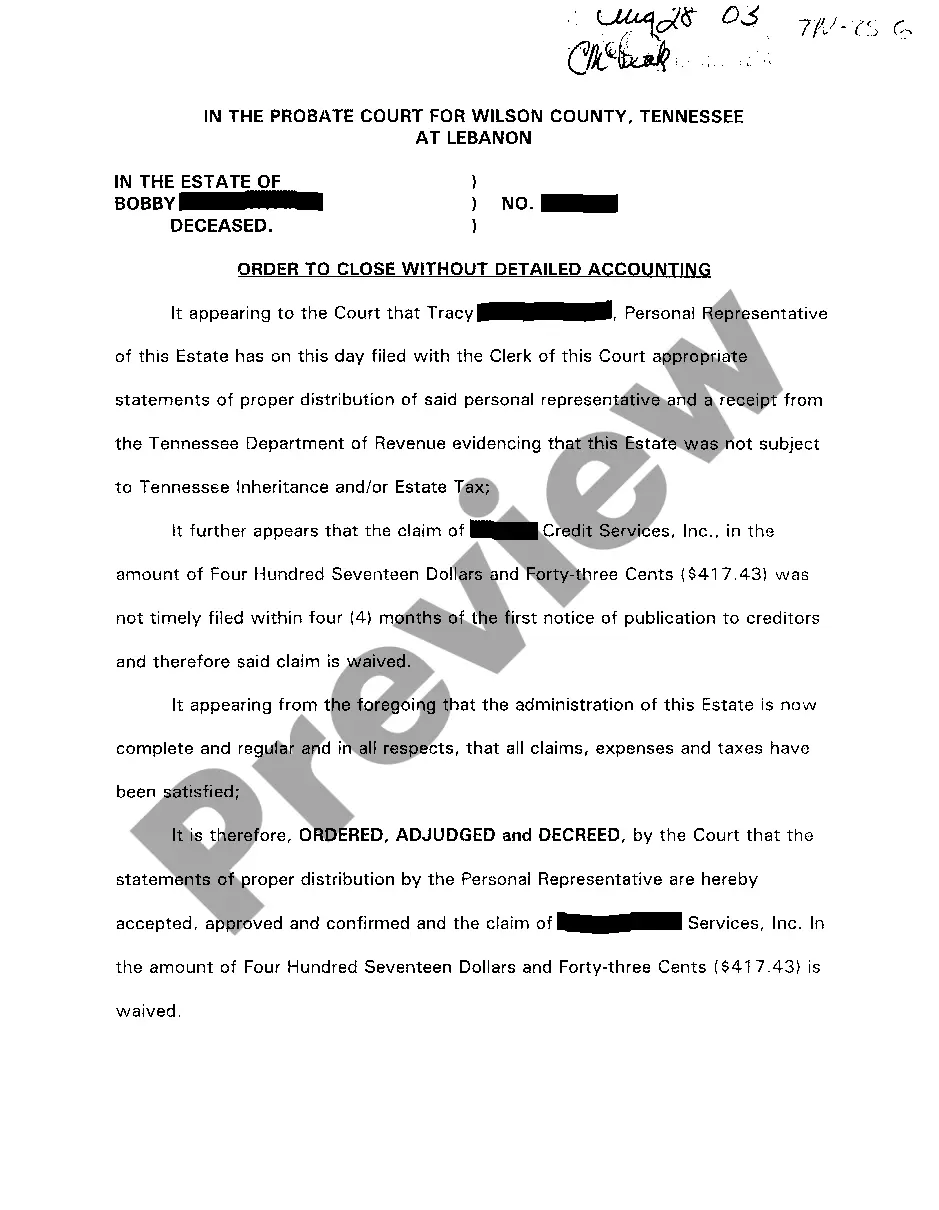

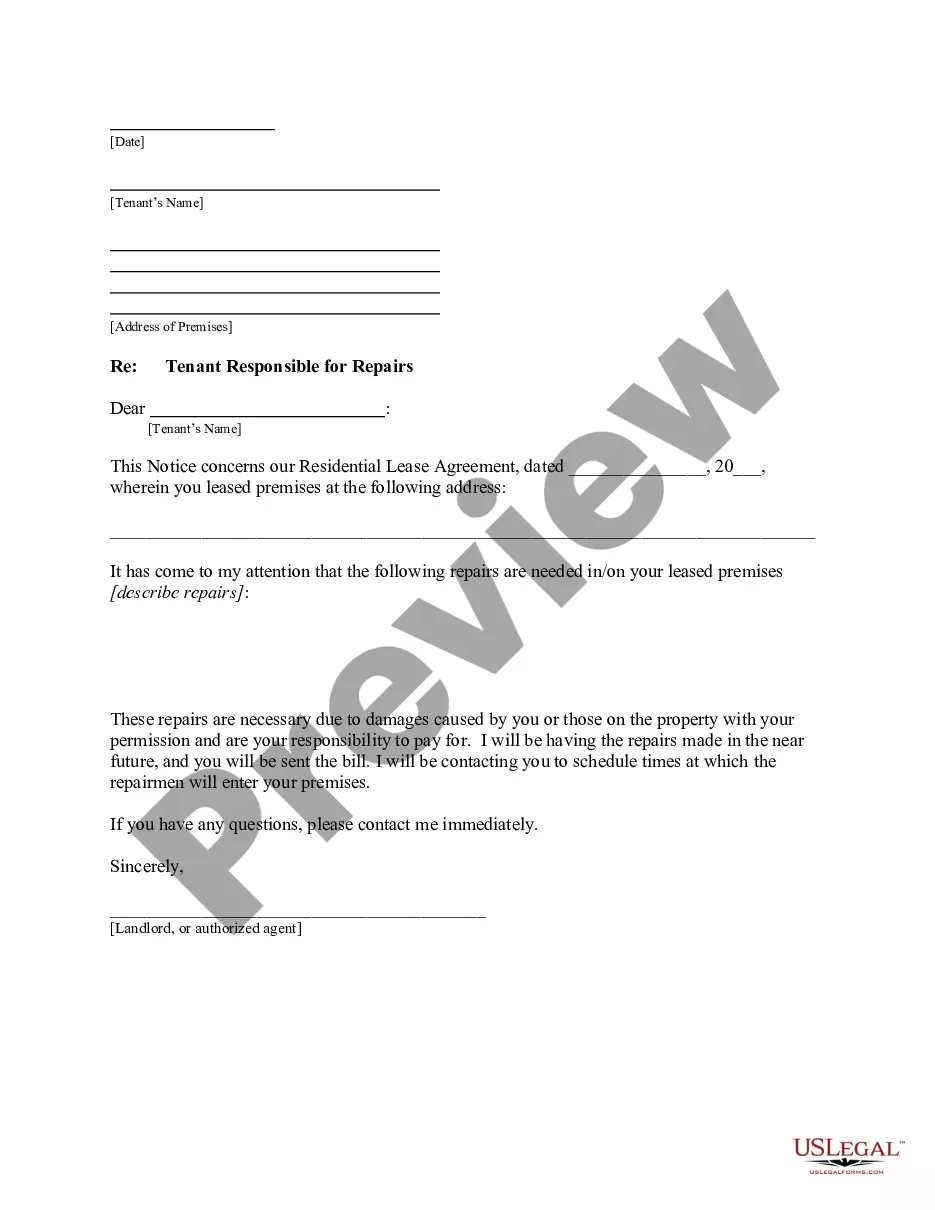

Memphis Tennessee Order to Close Without Detailed Accounting refers to a legal directive issued by the state authorities in Memphis, Tennessee, specifically in regard to businesses or organizations that are required to cease their operations without providing a thorough financial report. This order typically affects entities that are obligated to submit detailed accounting information as part of their regular operations or as a legal requirement. The Order to Close Without Detailed Accounting can target various types of establishments, including but not limited to restaurants, retail stores, manufacturing facilities, educational institutions, and non-profit organizations. Each of these entities is typically subject to specific regulations that outline their financial reporting obligations to ensure transparency, compliance, and accountability. This order may be issued under exceptional circumstances, such as during a public health crisis, natural disaster, or state of emergency, where the usual operating procedures are disrupted, and immediate closure of businesses is necessary for public safety or other reasons. In such cases, the authorities may prioritize action over exhaustive accounting documentation, allowing for a swift separation of businesses from their regular operations. Typically, this order exempts the affected businesses from the requirement to provide a detailed financial report, including profit and loss statements, balance sheets, cash flow statements, and other relevant accounting documents that outlines the financial performance and position of the entity. This exemption facilitates a prompt and efficient suspension of operations, ensuring that businesses can focus on implementing emergency measures or methodologies to tackle the situation at hand. It is important to note that while the Order to Close Without Detailed Accounting suspends the need for intricate financial reporting during the closure period, it does not absolve the entities from fulfilling their legal obligations eventually. Once the situation stabilizes, and operations resume to normalcy or a semblance of it, the affected businesses will likely be required to furnish the required accounting information to regulatory bodies or other relevant authorities. Overall, the Memphis Tennessee Order to Close Without Detailed Accounting caters to the urgent need for business closures in exceptional circumstances while acknowledging the challenges faced in providing the usual comprehensive financial reporting. This order helps streamline the closure process, enabling businesses to prioritize public safety or other necessary actions.

Memphis Tennessee Order To Close Without Detailed Accounting

Description

How to fill out Memphis Tennessee Order To Close Without Detailed Accounting?

No matter the social or professional status, filling out legal documents is an unfortunate necessity in today’s professional environment. Very often, it’s virtually impossible for someone without any law background to draft this sort of paperwork from scratch, mainly because of the convoluted terminology and legal subtleties they come with. This is where US Legal Forms can save the day. Our service offers a massive library with more than 85,000 ready-to-use state-specific documents that work for practically any legal case. US Legal Forms also is a great asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

Whether you need the Memphis Tennessee Order To Close Without Detailed Accounting or any other paperwork that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Memphis Tennessee Order To Close Without Detailed Accounting in minutes using our trustworthy service. In case you are presently a subscriber, you can proceed to log in to your account to download the appropriate form.

Nevertheless, if you are a novice to our platform, make sure to follow these steps before downloading the Memphis Tennessee Order To Close Without Detailed Accounting:

- Be sure the template you have found is suitable for your area considering that the regulations of one state or area do not work for another state or area.

- Review the form and read a short outline (if available) of scenarios the document can be used for.

- If the form you selected doesn’t meet your requirements, you can start again and look for the necessary form.

- Click Buy now and choose the subscription option you prefer the best.

- Access an account {using your login information or register for one from scratch.

- Choose the payment gateway and proceed to download the Memphis Tennessee Order To Close Without Detailed Accounting as soon as the payment is through.

You’re good to go! Now you can proceed to print out the form or complete it online. If you have any problems getting your purchased documents, you can easily find them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.