Title: Understanding Murfreesboro Tennessee Order To Close Without Detailed Accounting: Key Information and Types Explained Introduction: In Murfreesboro, Tennessee, the Order To Close Without Detailed Accounting serves as an important legal tool used by authorities to close businesses temporarily or permanently due to violations or non-compliance with financial reporting regulations. This article aims to provide a detailed description of the order, its significance, and potential types that may be issued in Murfreesboro, Tennessee. Keywords: Murfreesboro Tennessee, Order To Close Without Detailed Accounting, businesses, violations, non-compliance, financial reporting regulations. 1. What is the Murfreesboro Tennessee Order To Close Without Detailed Accounting? The Order To Close Without Detailed Accounting is a legal instrument employed by Murfreesboro, Tennessee authorities when businesses fail to adhere to financial reporting regulations. It essentially mandates the temporary or permanent closure of a non-compliant business until proper financial accounting practices are implemented. 2. Significance of the Order: The Order To Close Without Detailed Accounting plays a crucial role in regulating businesses and maintaining financial transparency in Murfreesboro, Tennessee. It aims to protect consumers, ensure fair business practices, and prevent fraudulent activities. 3. Potential Types of Orders To Close Without Detailed Accounting in Murfreesboro, Tennessee: a) Temporary Closure Order: This type of order is issued when a business is found in violation of financial reporting regulations but has the potential to rectify the issue within a specified timeframe. b) Permanent Closure Order: In extreme cases of repeated or severe violations, authorities may issue a permanent closure order. This order signifies the closure of the non-compliant business without the possibility of reopening. 4. Reasons for Issuing the Order: a) Non-compliance with Financial Reporting Standards: Failure to maintain accurate and transparent financial records, as mandated by Murfreesboro, Tennessee regulations, can lead to the issuance of the order. b) Fraudulent Practices: Businesses engaged in fraudulent activities such as embezzlement, money laundering, or misappropriation of funds may face the order as a consequence. c) Persisting Violations: If a business has repeatedly violated financial reporting regulations despite prior warnings or corrective measures, an order to close without detailed accounting may be issued. 5. Consequences of the Order: a) Suspension of Business Operations: Upon receiving the order, the affected business is required to halt all operations until the financial reporting concerns are adequately addressed or rectified. b) Fines and Penalties: Non-compliant businesses may face financial penalties, depending on the severity of the violations and duration of non-compliance, in addition to the order to close. c) Reputational Damage: A business that receives the order may suffer reputational damage due to negative publicity and potential loss of trust among consumers, partners, and stakeholders. Conclusion: The Murfreesboro Tennessee Order To Close Without Detailed Accounting is a significant mechanism employed by authorities to ensure compliance with financial reporting regulations. It serves as a critical deterrent against fraudulent practices while promoting transparency and fairness in the local business environment. Businesses must adhere to financial reporting requirements to avoid potential closure and associated consequences.

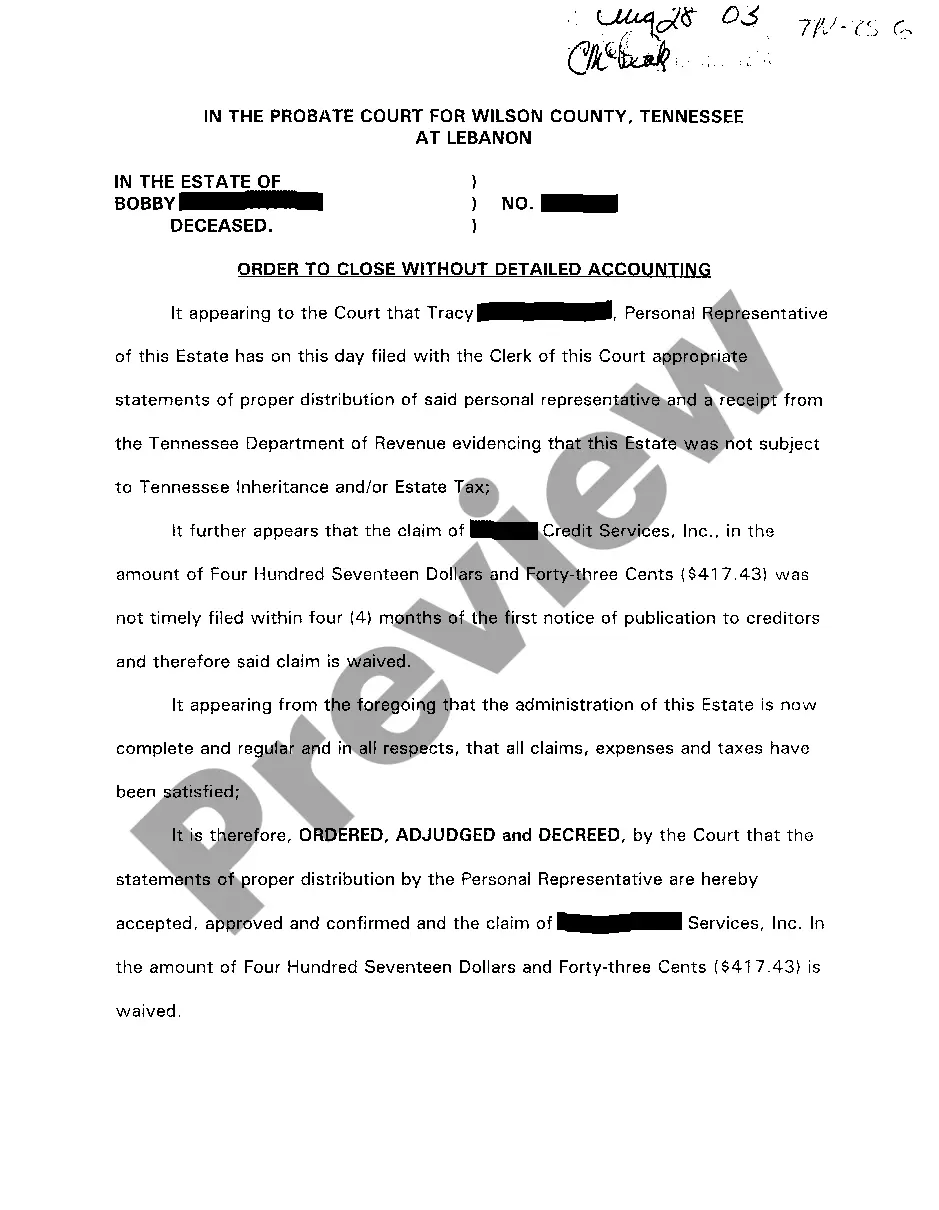

Murfreesboro Tennessee Order To Close Without Detailed Accounting

Description

How to fill out Murfreesboro Tennessee Order To Close Without Detailed Accounting?

If you are searching for a relevant form template, it’s difficult to find a better place than the US Legal Forms website – one of the most extensive online libraries. With this library, you can find thousands of templates for organization and personal purposes by types and states, or keywords. Using our advanced search feature, getting the most up-to-date Murfreesboro Tennessee Order To Close Without Detailed Accounting is as elementary as 1-2-3. In addition, the relevance of each and every document is confirmed by a team of expert lawyers that regularly review the templates on our platform and revise them in accordance with the latest state and county requirements.

If you already know about our platform and have an account, all you need to get the Murfreesboro Tennessee Order To Close Without Detailed Accounting is to log in to your profile and click the Download button.

If you use US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have chosen the form you require. Read its information and use the Preview option (if available) to see its content. If it doesn’t meet your needs, utilize the Search option near the top of the screen to find the appropriate file.

- Affirm your decision. Click the Buy now button. Next, pick your preferred pricing plan and provide credentials to sign up for an account.

- Make the financial transaction. Utilize your credit card or PayPal account to finish the registration procedure.

- Get the form. Pick the file format and save it to your system.

- Make changes. Fill out, edit, print, and sign the obtained Murfreesboro Tennessee Order To Close Without Detailed Accounting.

Every single form you save in your profile has no expiration date and is yours forever. It is possible to access them via the My Forms menu, so if you need to receive an extra copy for modifying or creating a hard copy, you may return and export it once again whenever you want.

Make use of the US Legal Forms professional library to gain access to the Murfreesboro Tennessee Order To Close Without Detailed Accounting you were seeking and thousands of other professional and state-specific samples in one place!