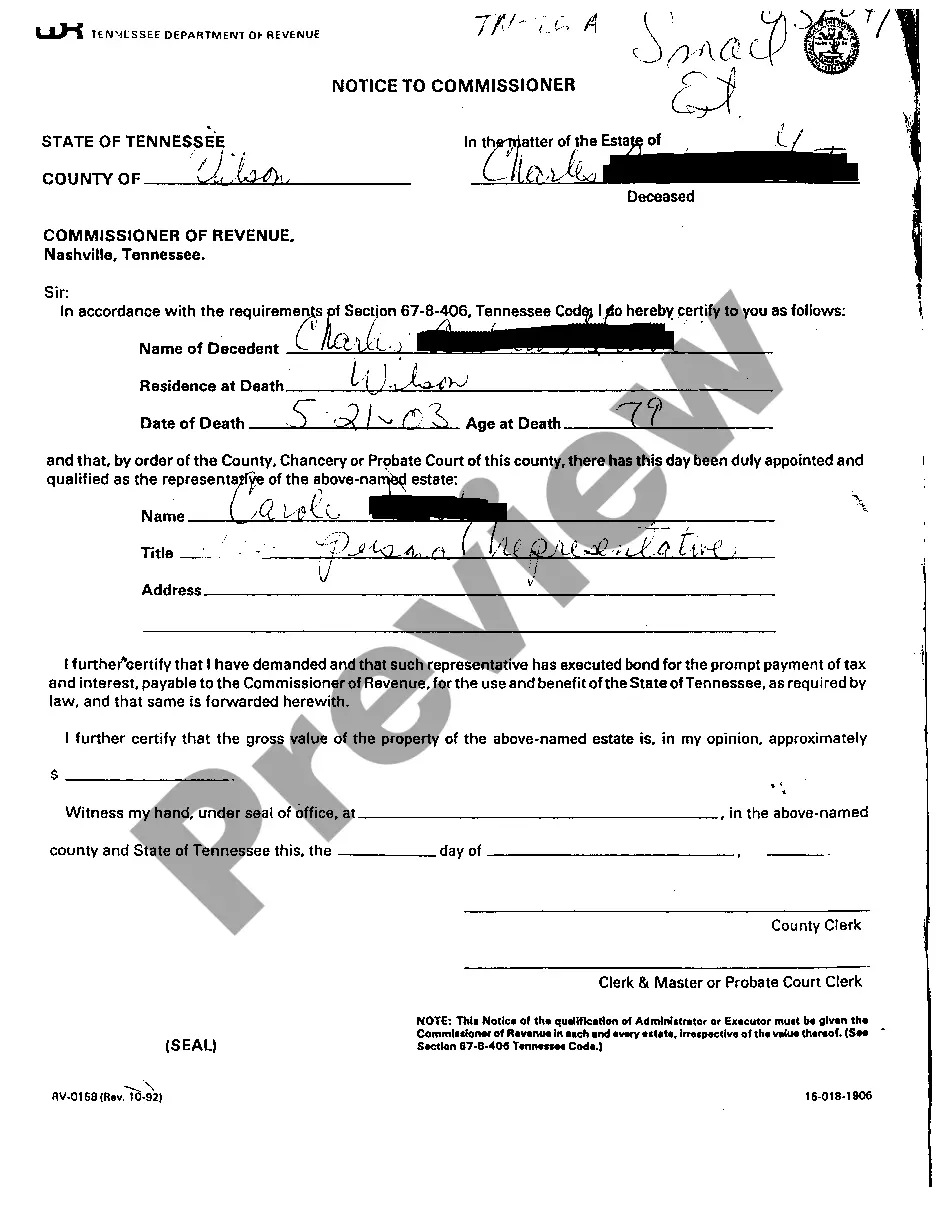

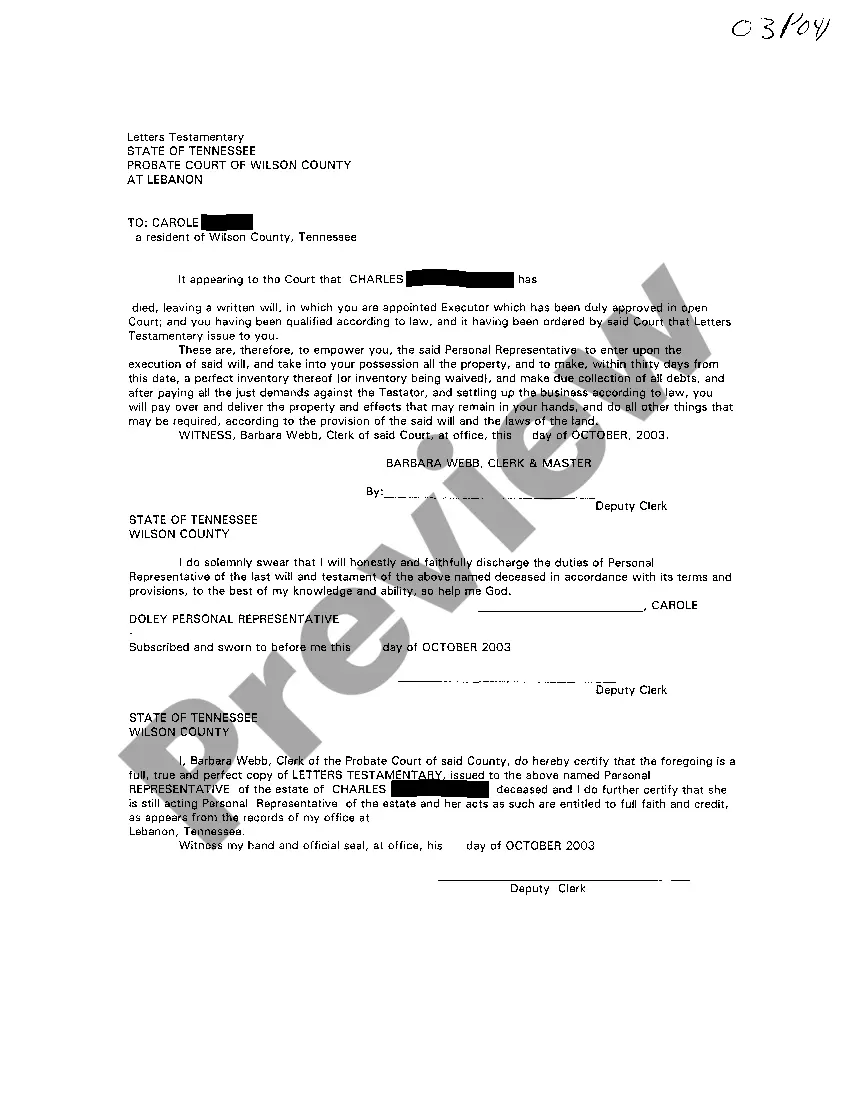

Chattanooga Tennessee Notice To Commissioner of Revenue That Will have Deceased is Being Probated: A Comprehensive Guide In Chattanooga, Tennessee, the process of probating a deceased individual's will is an essential legal procedure that ensures the proper distribution of assets and settlement of taxes owed to the Commissioner of Revenue. This detailed description aims to shed light on the various aspects of filing a Notice to Commissioner of Revenue That Will have Deceased is Being Probated in Chattanooga, Tennessee, while incorporating relevant keywords for a comprehensive understanding. 1. Purpose of Notice to Commissioner of Revenue That Will have Deceased is Being Probated: The primary goal of this notice is to inform the Commissioner of Revenue in Chattanooga, Tennessee, that a deceased individual's will is being probated. This allows the Commissioner's office to assess and collect any outstanding taxes owed by the deceased person or their estate. 2. Types of Chattanooga Tennessee Notices To Commissioner of Revenue That Will have Deceased is Being Probated: a. Standard Notice: This is the most common type of notice used to inform the Commissioner's office about the probate process and the deceased individual's will. b. Abbreviated Notice: In certain cases where the estate is smaller or does not meet specific thresholds, an abbreviated notice may be used. This streamlines the process while ensuring compliance with relevant regulations. 3. Required Information in the Notice: When filing a Notice to Commissioner of Revenue That Will have Deceased is Being Probated in Chattanooga, Tennessee, the following key details must be included: — Full legal name of the deceased individual — Datdeathat— - Executor or administrator's full name and contact information — A copy of the deceased persoWillieil— - Estate's estimated value, including all assets and property — Estimated tax liability, if any, that will be owed to the Commissioner of Revenue — The probate court's information where the will is being administered — Contact information of the attorney or legal representative handling the probate process 4. Submission Process: The notice, along with the required documents, must be submitted to the Commissioner of Revenue's office within a specified timeframe after the probate process begins. It is crucial to adhere to the applicable deadlines to avoid any penalties or delays. 5. Importance of Filing the Notice: Filing a Notice to Commissioner of Revenue That Will have Deceased is Being Probated is a legal requirement in Chattanooga, Tennessee. It ensures transparency in the probate process and facilitates the assessment and collection of any taxes owed to the Commissioner's office. Failure to file this notice may result in penalties, hindrance in settling the deceased person's tax obligations, and potential legal complications. 6. Key Keywords: — Chattanooga Tennessee Notice To Commissioner of Revenue — Deceased individuaWillieil— - Probate process — Estate administratio— - Tax liability - Executor or administrator — Probatfourur— - Legal representation - Compliance with regulations — Penalties and legal complication— - Transparency in asset distribution In conclusion, properly filing a Notice to Commissioner of Revenue That Will have Deceased is Being Probated in Chattanooga, Tennessee is a crucial step to ensure the efficient settlement of taxes and asset distribution. This comprehensive guide, incorporating relevant keywords, provides a clear understanding of the process's purpose, different types of notices, required information, submission process, and its significance. Remember to consult with a legal professional to navigate through the complexities of probate processes and tax obligations.

Chattanooga Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated

Description

How to fill out Chattanooga Tennessee Notice To Commissioner Of Revenue That Will Of Deceased Is Being Probated?

Take advantage of the US Legal Forms and obtain immediate access to any form template you require. Our beneficial platform with thousands of templates makes it easy to find and obtain almost any document sample you want. You are able to save, fill, and sign the Chattanooga Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated in just a matter of minutes instead of surfing the Net for many hours trying to find a proper template.

Utilizing our catalog is a great way to raise the safety of your record filing. Our experienced attorneys on a regular basis review all the records to ensure that the templates are appropriate for a particular region and compliant with new acts and regulations.

How can you obtain the Chattanooga Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated? If you already have a profile, just log in to the account. The Download option will appear on all the samples you view. Additionally, you can get all the previously saved files in the My Forms menu.

If you haven’t registered an account yet, follow the tips listed below:

- Open the page with the template you require. Ensure that it is the form you were hoping to find: verify its name and description, and use the Preview function if it is available. Otherwise, make use of the Search field to find the needed one.

- Launch the downloading procedure. Select Buy Now and choose the pricing plan you like. Then, sign up for an account and pay for your order with a credit card or PayPal.

- Export the file. Select the format to obtain the Chattanooga Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated and modify and fill, or sign it for your needs.

US Legal Forms is one of the most significant and trustworthy template libraries on the web. We are always happy to assist you in any legal process, even if it is just downloading the Chattanooga Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated.

Feel free to benefit from our platform and make your document experience as convenient as possible!