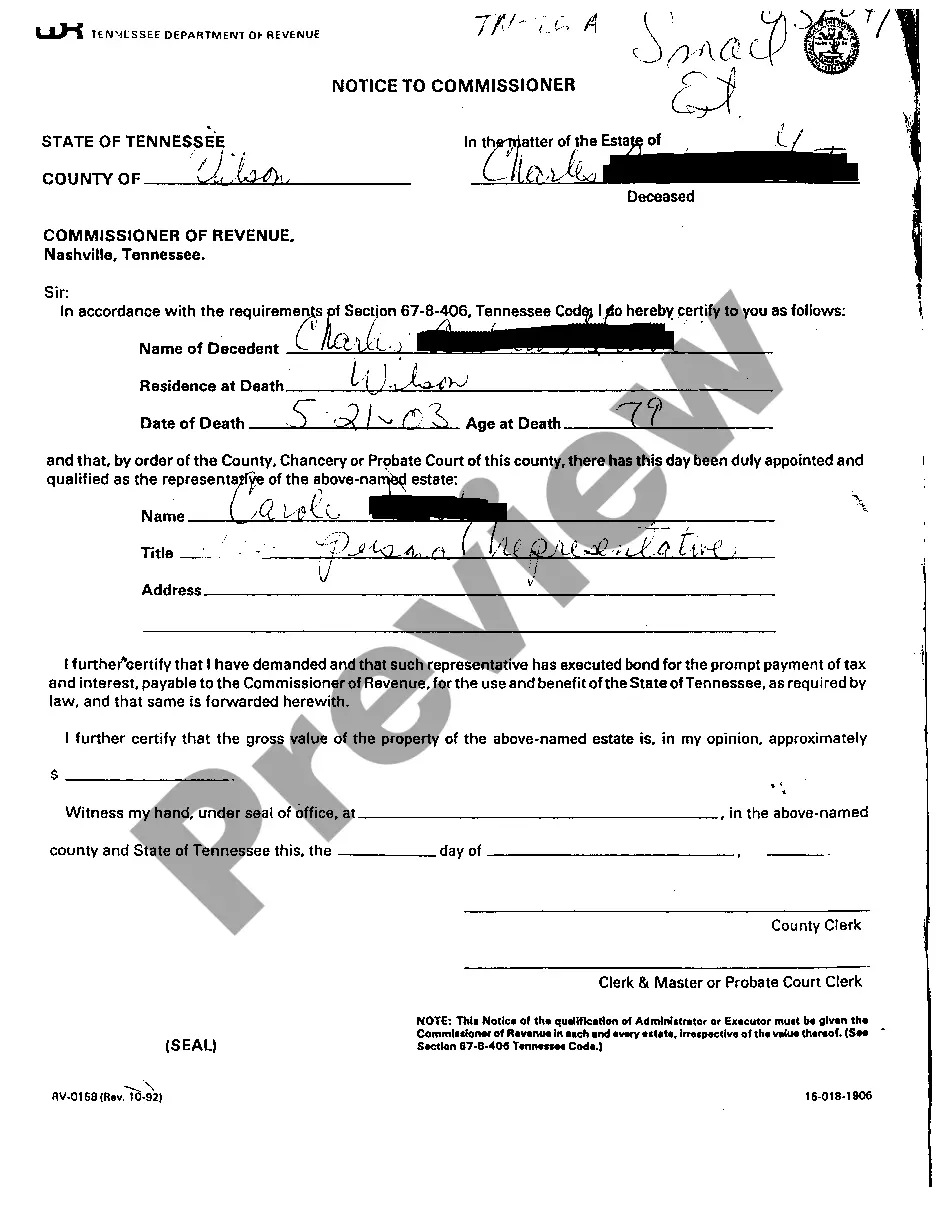

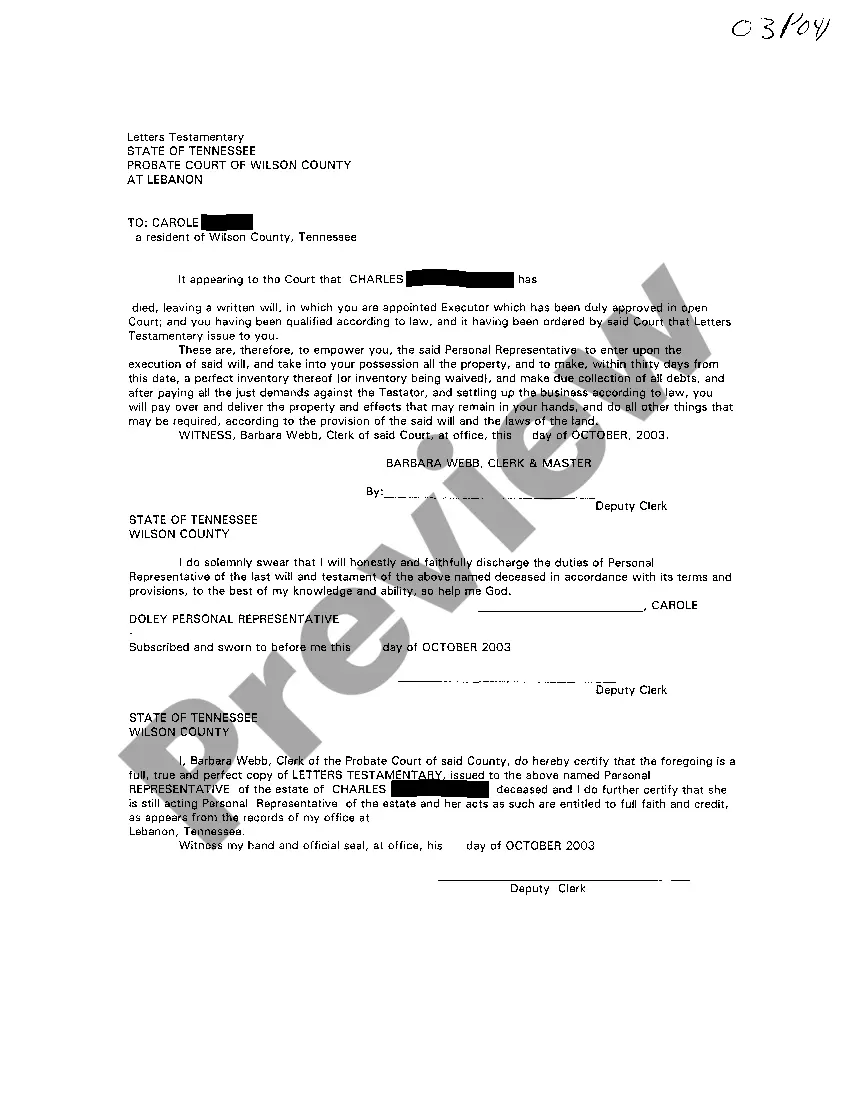

Title: Clarksville Tennessee Notice to Commissioner of Revenue: Probating the Will of a Deceased Individual Keyword: Clarksville Tennessee, Notice to Commissioner of Revenue, Probating, Will, Deceased Introduction: In Clarksville, Tennessee, it is essential to inform the Commissioner of Revenue when the will of a deceased individual is being probated. By filing the appropriate notice, the executor or administrator ensures that the estate's tax affairs are appropriately handled. This comprehensive guide will outline the process, requirements, and importance of a Clarksville Tennessee Notice to the Commissioner of Revenue, highlighting any additional types of notices that may be relevant. Types of Clarksville Tennessee Notice to Commissioner of Revenue for Probate: 1. Initial Notice to Commissioner of Revenue: The initial notice is typically filed by the executor or administrator of the estate within a specified period of time after the deceased's passing. This notice serves to inform the Commissioner of Revenue that the probate process has commenced and the estate's tax matters will be addressed. 2. Notice of Estate Inventory and Valuation: Once the executor or administrator has completed the inventory and valuation of the estate's assets, it is necessary to provide an updated report to the Commissioner of Revenue. This notice ensures accurate tax assessment based on the estate's value. 3. Notice of Estate Distribution: After all debts, taxes, and administration expenses have been paid, the estate's assets are distributed to beneficiaries. It is crucial to notify the Commissioner of Revenue about the forthcoming distribution to ensure compliance and address any potential tax implications. 4. Notice of Estate Closure: Once the probate process is complete, and the estate administration has concluded, a notice of estate closure is filed with the Commissioner of Revenue. This notice confirms the finalization of the probate proceedings and notifies the Commissioner that no further action is required. Importance of Clarksville Tennessee Notice to Commissioner of Revenue: 1. Compliance with Tax Laws: Filing a notice with the Commissioner of Revenue ensures compliance with Clarksville, Tennessee tax laws. It allows the Commissioner to monitor and evaluate the estate's tax obligations accurately. 2. Preventing Penalties and Fines: By promptly notifying the Commissioner of Revenue, potential penalties or fines resulting from delayed or incomplete tax reporting can be avoided. Complying with the notice requirements showcases responsible estate management. 3. Efficient Tax Evaluation: Notifying the Commissioner of Revenue about the probate process allows for an accurate evaluation of the estate's tax liability. It ensures that the estate's assets are assessed correctly based on their value, facilitating a fair and efficient tax assessment. 4. Facilitating Communication: The Clarksville Tennessee Notice to Commissioner of Revenue encourages communication between the executor/administrator and the Commissioner's office, establishing a transparent relationship. Any queries or concerns regarding estate taxes can be effectively addressed, ensuring a smooth probate process. Conclusion: Filing a Clarksville Tennessee Notice to Commissioner of Revenue when probating the will of a deceased individual plays a vital role in managing the estate's tax affairs. Ensuring compliance, avoiding penalties, and facilitating efficient tax evaluation are just some reasons why it is imperative to adhere to the notice requirements. By providing the necessary information promptly, the executor or administrator contributes to a smooth and transparent probate process in Clarksville, Tennessee.

Clarksville Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated

Description

How to fill out Clarksville Tennessee Notice To Commissioner Of Revenue That Will Of Deceased Is Being Probated?

Benefit from the US Legal Forms and have immediate access to any form template you require. Our useful platform with a huge number of documents allows you to find and obtain almost any document sample you want. You can export, complete, and sign the Clarksville Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated in a matter of minutes instead of surfing the Net for several hours looking for the right template.

Using our library is an excellent strategy to improve the safety of your record filing. Our experienced legal professionals on a regular basis check all the documents to make certain that the templates are relevant for a particular region and compliant with new laws and polices.

How can you get the Clarksville Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated? If you have a profile, just log in to the account. The Download button will be enabled on all the documents you look at. Additionally, you can get all the earlier saved files in the My Forms menu.

If you haven’t registered an account yet, stick to the tips listed below:

- Find the form you require. Make sure that it is the form you were hoping to find: verify its headline and description, and take take advantage of the Preview function if it is available. Otherwise, utilize the Search field to look for the appropriate one.

- Start the downloading process. Click Buy Now and select the pricing plan you prefer. Then, create an account and pay for your order using a credit card or PayPal.

- Download the document. Choose the format to obtain the Clarksville Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated and change and complete, or sign it for your needs.

US Legal Forms is probably the most considerable and reliable form libraries on the web. We are always ready to assist you in virtually any legal procedure, even if it is just downloading the Clarksville Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated.

Feel free to take full advantage of our platform and make your document experience as efficient as possible!

Form popularity

FAQ

Executors in Tennessee have a timeline of up to one year to distribute funds to beneficiaries, but this can vary based on the estate's intricacies and any outstanding debts. It’s important for executors to carefully manage the process and keep beneficiaries updated. Delays may occur if there are disputes or if further documentation is needed. To ensure compliance with the distribution timeline, reviewing the Clarksville Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated can be instrumental.

Once probate is granted in Tennessee, funds are generally released after all estate debts and taxes have been settled. This process can take several months, depending on the estate's complexity. Executors must be diligent in managing the estate's finances to ensure a smooth distribution process. Understanding the steps outlined in the Clarksville Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated will help clarify these obligations.

While there isn't a strict deadline for starting the probate process in Tennessee, it is advisable to initiate it within four years of the decedent's death. Delaying probate can complicate matters and potentially impact the distribution of assets. Executors should act promptly to fulfill their duties. To ensure compliance with necessary legal steps, including the Clarksville Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated can provide significant guidance.

Yes, probate records are generally public in Tennessee. This means anyone can access these records, offering transparency in the probate process. Individuals interested in examining these records often do so for various reasons, such as confirming the validity of a will or understanding the distribution of assets. For a clear understanding, reviewing the Clarksville Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated can also be beneficial.

In Tennessee, the statute of limitations for filing a probate case is typically four years from the date of death. However, if the estate is known to be insolvent, it is wise to initiate probate sooner. Delaying the process can complicate matters and potentially affect your rights as a beneficiary. To better understand these timelines, consider reviewing the Clarksville Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated.

Tennessee law allows executors up to one year to distribute the assets of an estate, although this timeline may vary based on the specifics of the estate. Executors should communicate openly with beneficiaries and keep them informed about any potential delays. Additionally, all claims against the estate must be resolved before assets can be distributed. Utilizing resources like the Clarksville Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated can help executors navigate their responsibilities efficiently.

In Tennessee, once the probate process is initiated, the distribution of funds typically occurs after all debts and taxes are settled. Generally, executors can distribute funds to beneficiaries within six months to a year, depending on the complexity of the estate. It is crucial for executors to adhere to the legal requirements for notifying all interested parties. Therefore, understanding the Clarksville Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated is vital.

In Tennessee, an executor generally has about 6 months to finalize the estate settlement after receiving the Clarksville Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated. However, complexities in the estate can extend this timeline. Timely communication with beneficiaries and efficient management can help to ensure that the process runs smoothly. Utilizing professional services can also facilitate an efficient settlement.

In Tennessee, certain assets may be exempt from probate. These typically include life insurance policies, retirement accounts, and property held in joint tenancy. Moreover, you may find that some small estates can be settled without formal probate through alternative procedures. Understanding these exceptions can ease the process for those involved in a Clarksville Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated.

Most wills in Tennessee must be probated to ensure legal recognition and implement the deceased’s wishes effectively. This process allows for the proper handling of debts, distribution of assets, and resolution of any disputes. Filing the Clarksville Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated is an important step in this process, serving as a notification to the court and interested parties.