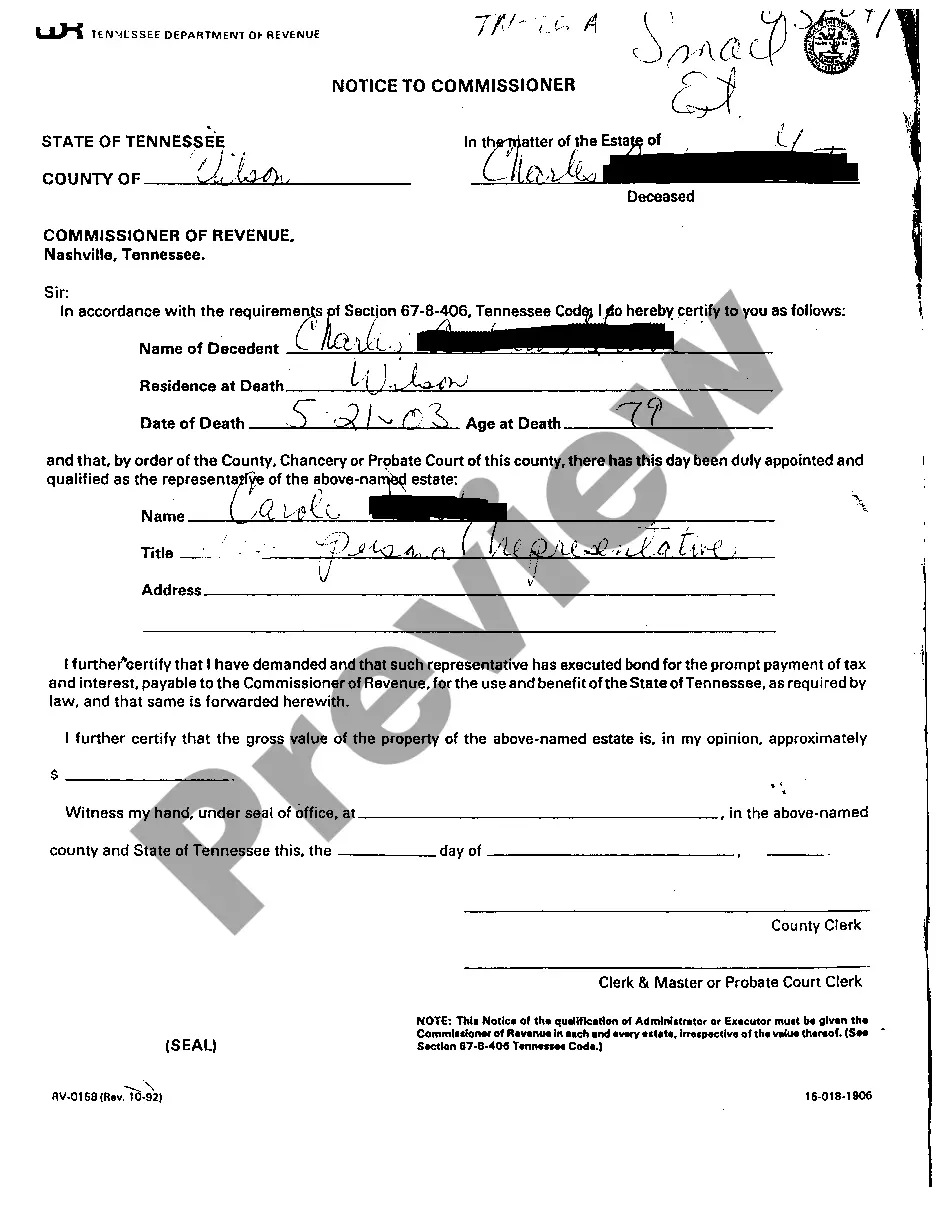

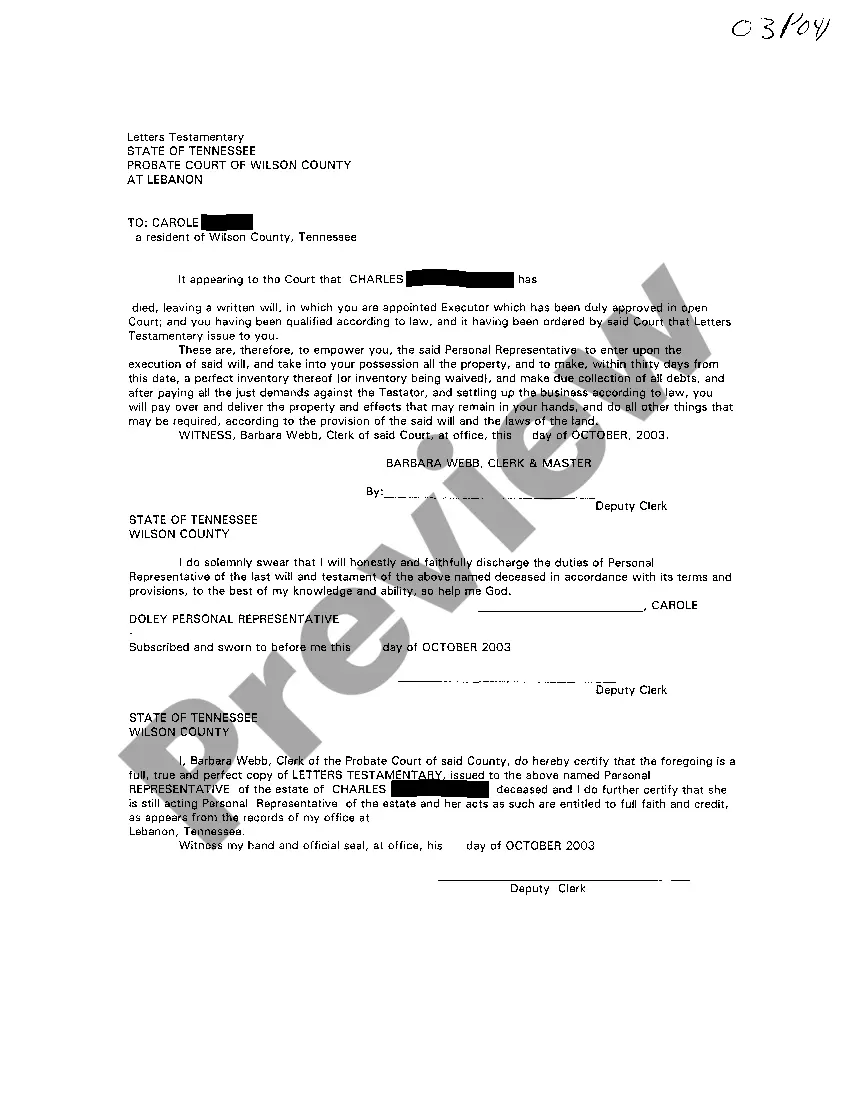

Title: Murfreesboro Tennessee Notice to Commissioner of Revenue: Probate Process for the Will of a Deceased keyword: Murfreesboro Tennessee, Notice to Commissioner of Revenue, probate process, will have deceased, probate forms, probate court, estate administration, taxable estate, estate assets Description: In Murfreesboro, Tennessee, when a person passes away, their estate must go through a legal process known as probate. As part of this process, a specific form, called the Notice to Commissioner of Revenue, needs to be filed to inform the local Commissioner of Revenue about the initiation of probate proceedings. This notice plays a vital role in ensuring the proper administration of the deceased's estate and fulfilling any tax obligations that may arise. The Notice to Commissioner of Revenue informs the respective government authorities that the deceased's will is being probated and allows them to evaluate and assess the taxable estate accurately. By submitting this notice, the personal representative or executor of the estate can establish open lines of communication with the Commissioner's office to facilitate the smooth progression of the probate process. There are several variations or situations regarding the Notice to Commissioner of Revenue that may apply, including: 1. Notice to Commissioner of Revenue for Standard Probate Process: — This refers to the regular probate process where an individual's will is being probated, and the estate's assets need to be accounted for tax purposes. 2. Notice to Commissioner of Revenue for High-Value or Complex Estate: — In cases where the deceased's estate is substantial or comprises intricate financial matters, an enhanced version of the notice is often required. This ensures that all relevant information is appropriately disclosed, enabling the efficient allocation of taxes and estate administration. 3. Notice to Commissioner of Revenue for Expedited Probate Process: — When circumstances demand a more expedited probate process, such as imminent tax deadlines or urgent estate matters, a modified notice may be used to promptly notify the Commissioner's office of the ongoing probate proceedings. 4. Notice to Commissioner of Revenue for Estate with Significant Tax Implications: — In situations where a deceased person's estate has substantial tax implications, whether due to high-value assets, complex financial structures, or potential tax disputes, a specialized notice may be submitted. This enables the Commissioner of Revenue to allocate appropriate resources and provide necessary guidance throughout the probate process. Submitting the Notice to Commissioner of Revenue is a critical step in fulfilling your responsibilities as a personal representative or executor in Murfreesboro, Tennessee. It helps ensure proper compliance with tax regulations and facilitates an efficient probate process. Please note that specific forms and procedures may vary depending on Murfreesboro's local laws and regulations. It is essential to consult with professionals, such as attorneys or tax advisors, to obtain accurate legal advice tailored to your specific situation. Remember to follow all local guidelines and provide accurate and detailed information when completing the Notice to Commissioner of Revenue to prevent any delays or legal complications during the probate process in Murfreesboro, Tennessee.

Murfreesboro Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated

Description

How to fill out Murfreesboro Tennessee Notice To Commissioner Of Revenue That Will Of Deceased Is Being Probated?

If you are looking for a valid form template, it’s extremely hard to choose a more convenient place than the US Legal Forms site – probably the most comprehensive online libraries. Here you can get thousands of form samples for company and individual purposes by categories and regions, or key phrases. Using our high-quality search feature, finding the most recent Murfreesboro Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated is as elementary as 1-2-3. Additionally, the relevance of every record is proved by a team of expert lawyers that regularly review the templates on our platform and update them according to the latest state and county demands.

If you already know about our platform and have an account, all you should do to receive the Murfreesboro Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated is to log in to your user profile and click the Download option.

If you make use of US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have opened the sample you need. Look at its explanation and use the Preview feature to explore its content. If it doesn’t suit your needs, utilize the Search field near the top of the screen to find the needed file.

- Confirm your choice. Select the Buy now option. Next, select the preferred pricing plan and provide credentials to sign up for an account.

- Process the transaction. Use your bank card or PayPal account to finish the registration procedure.

- Obtain the form. Indicate the format and save it to your system.

- Make adjustments. Fill out, edit, print, and sign the acquired Murfreesboro Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated.

Every form you save in your user profile has no expiration date and is yours permanently. You can easily access them using the My Forms menu, so if you need to have an extra copy for editing or creating a hard copy, you can come back and export it once again whenever you want.

Make use of the US Legal Forms professional collection to get access to the Murfreesboro Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated you were looking for and thousands of other professional and state-specific templates on a single website!