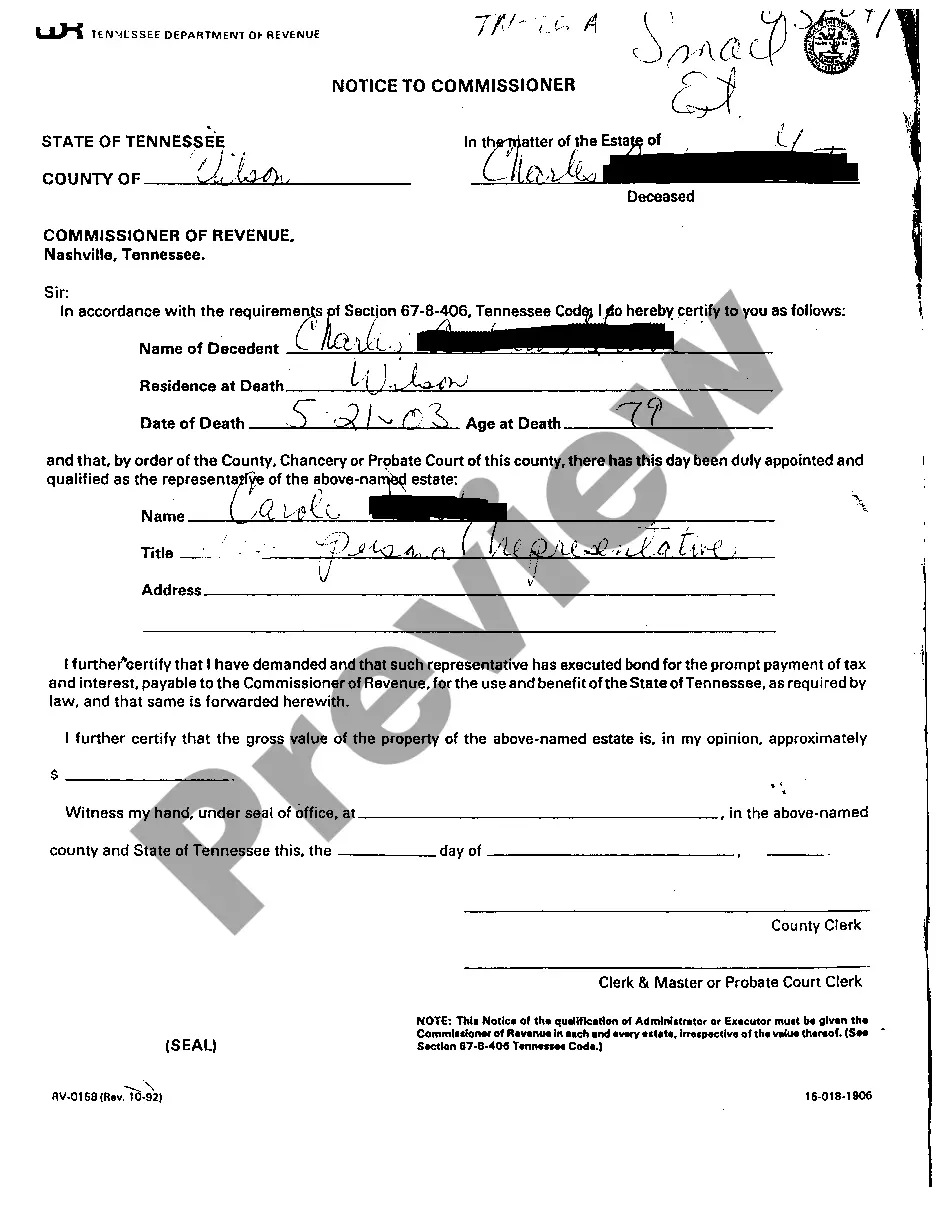

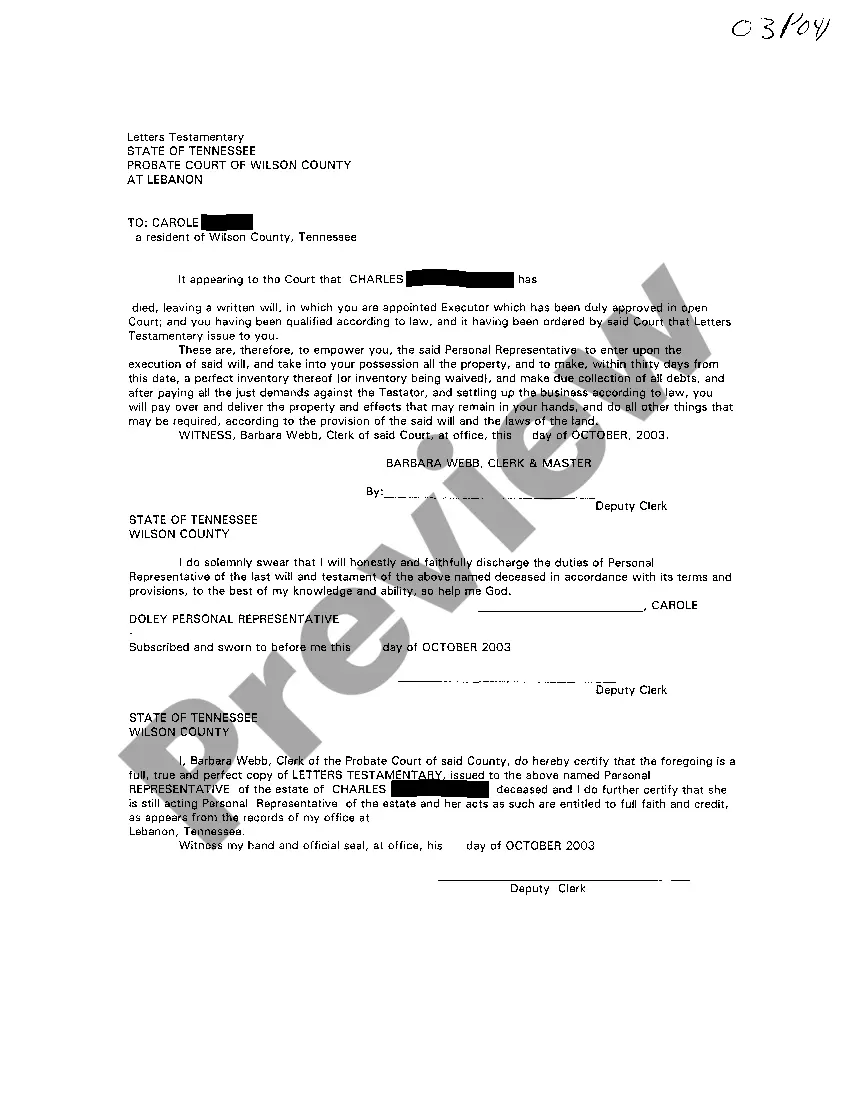

Title: Nashville Tennessee Notice to Commissioner of Revenue That Will have Deceased is Being Probated Introduction: In Nashville, Tennessee, when the will of a deceased individual is being probated, it is crucial to notify the Commissioner of Revenue. This notice serves to inform the Commissioner about the probate process and allows them to assess any estate taxes or potential tax liabilities associated with the deceased's assets. Let's delve into the details of this essential communication. Keywords: Nashville Tennessee, notice to Commissioner of Revenue, will, probated, deceased, estate taxes, tax liabilities. 1. Overview of the Notice to Commissioner of Revenue: The notice to the Commissioner of Revenue is a legal requirement in Nashville, Tennessee, in situations where the will of a deceased individual is being probated. It notifies the Commissioner about the probate process and involves an assessment of any potential tax obligations associated with the estate. 2. Importance of Notifying the Commissioner of Revenue: By sending the notice, executors or administrators of the estate fulfill their duty to inform the Commissioner about the ongoing probate proceedings. This allows the Commissioner to determine if any estate taxes need to be paid or if there are any tax liabilities. 3. Contents and Format of the Notice: The notice to the Commissioner of Revenue should include information such as the deceased person's name, date of death, details of the probated will, and any relevant documentation. It should be submitted in a prescribed format, typically as a written document. 4. Different Types of Nashville Tennessee Notice to Commissioner of Revenue That Will have Deceased is Being Probated: a. Regular Notice: This is the standard notice that estate executors or administrators file with the Commissioner of Revenue, complying with the necessary guidelines and requirements. b. Expedited Notice: In certain urgent cases, an expedited notice may be submitted to the Commissioner to hasten the assessment of estate taxes or tax liabilities. c. Notice for Complicated Estates: In instances where the estate is complex, involving multiple beneficiaries or intricate tax matters, an in-depth notice may be required, providing comprehensive details to assist the Commissioner in accurately assessing the estate's tax obligations. 5. Deadline for Filing the Notice: The notice to the Commissioner of Revenue should be filed within a specific timeframe after the deceased individual's passing or the initiation of the probate process. It is crucial to adhere to this deadline to avoid any penalties or legal issues. Conclusion: The Nashville Tennessee Notice to Commissioner of Revenue is an essential step in the probate process, ensuring that appropriate tax obligations associated with a deceased individual's assets are assessed and fulfilled. By accurately completing and submitting this notice, executors or administrators fulfill their duty to inform the Commissioner, facilitating a smooth and compliant probate procedure. Keywords: Nashville Tennessee, notice to Commissioner of Revenue, will, probated, deceased, estate taxes, tax liabilities, probate process, executors, administrators, legal requirement, filing deadline.

Nashville Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated

State:

Tennessee

City:

Nashville

Control #:

TN-CN-26-01

Format:

PDF

Instant download

This form is available by subscription

Description

A02 Notice To Commissioner of Revenue That Will of Deceased is Being Probated

Title: Nashville Tennessee Notice to Commissioner of Revenue That Will have Deceased is Being Probated Introduction: In Nashville, Tennessee, when the will of a deceased individual is being probated, it is crucial to notify the Commissioner of Revenue. This notice serves to inform the Commissioner about the probate process and allows them to assess any estate taxes or potential tax liabilities associated with the deceased's assets. Let's delve into the details of this essential communication. Keywords: Nashville Tennessee, notice to Commissioner of Revenue, will, probated, deceased, estate taxes, tax liabilities. 1. Overview of the Notice to Commissioner of Revenue: The notice to the Commissioner of Revenue is a legal requirement in Nashville, Tennessee, in situations where the will of a deceased individual is being probated. It notifies the Commissioner about the probate process and involves an assessment of any potential tax obligations associated with the estate. 2. Importance of Notifying the Commissioner of Revenue: By sending the notice, executors or administrators of the estate fulfill their duty to inform the Commissioner about the ongoing probate proceedings. This allows the Commissioner to determine if any estate taxes need to be paid or if there are any tax liabilities. 3. Contents and Format of the Notice: The notice to the Commissioner of Revenue should include information such as the deceased person's name, date of death, details of the probated will, and any relevant documentation. It should be submitted in a prescribed format, typically as a written document. 4. Different Types of Nashville Tennessee Notice to Commissioner of Revenue That Will have Deceased is Being Probated: a. Regular Notice: This is the standard notice that estate executors or administrators file with the Commissioner of Revenue, complying with the necessary guidelines and requirements. b. Expedited Notice: In certain urgent cases, an expedited notice may be submitted to the Commissioner to hasten the assessment of estate taxes or tax liabilities. c. Notice for Complicated Estates: In instances where the estate is complex, involving multiple beneficiaries or intricate tax matters, an in-depth notice may be required, providing comprehensive details to assist the Commissioner in accurately assessing the estate's tax obligations. 5. Deadline for Filing the Notice: The notice to the Commissioner of Revenue should be filed within a specific timeframe after the deceased individual's passing or the initiation of the probate process. It is crucial to adhere to this deadline to avoid any penalties or legal issues. Conclusion: The Nashville Tennessee Notice to Commissioner of Revenue is an essential step in the probate process, ensuring that appropriate tax obligations associated with a deceased individual's assets are assessed and fulfilled. By accurately completing and submitting this notice, executors or administrators fulfill their duty to inform the Commissioner, facilitating a smooth and compliant probate procedure. Keywords: Nashville Tennessee, notice to Commissioner of Revenue, will, probated, deceased, estate taxes, tax liabilities, probate process, executors, administrators, legal requirement, filing deadline.

Free preview

How to fill out Nashville Tennessee Notice To Commissioner Of Revenue That Will Of Deceased Is Being Probated?

If you’ve already used our service before, log in to your account and download the Nashville Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Make certain you’ve found an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Nashville Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!