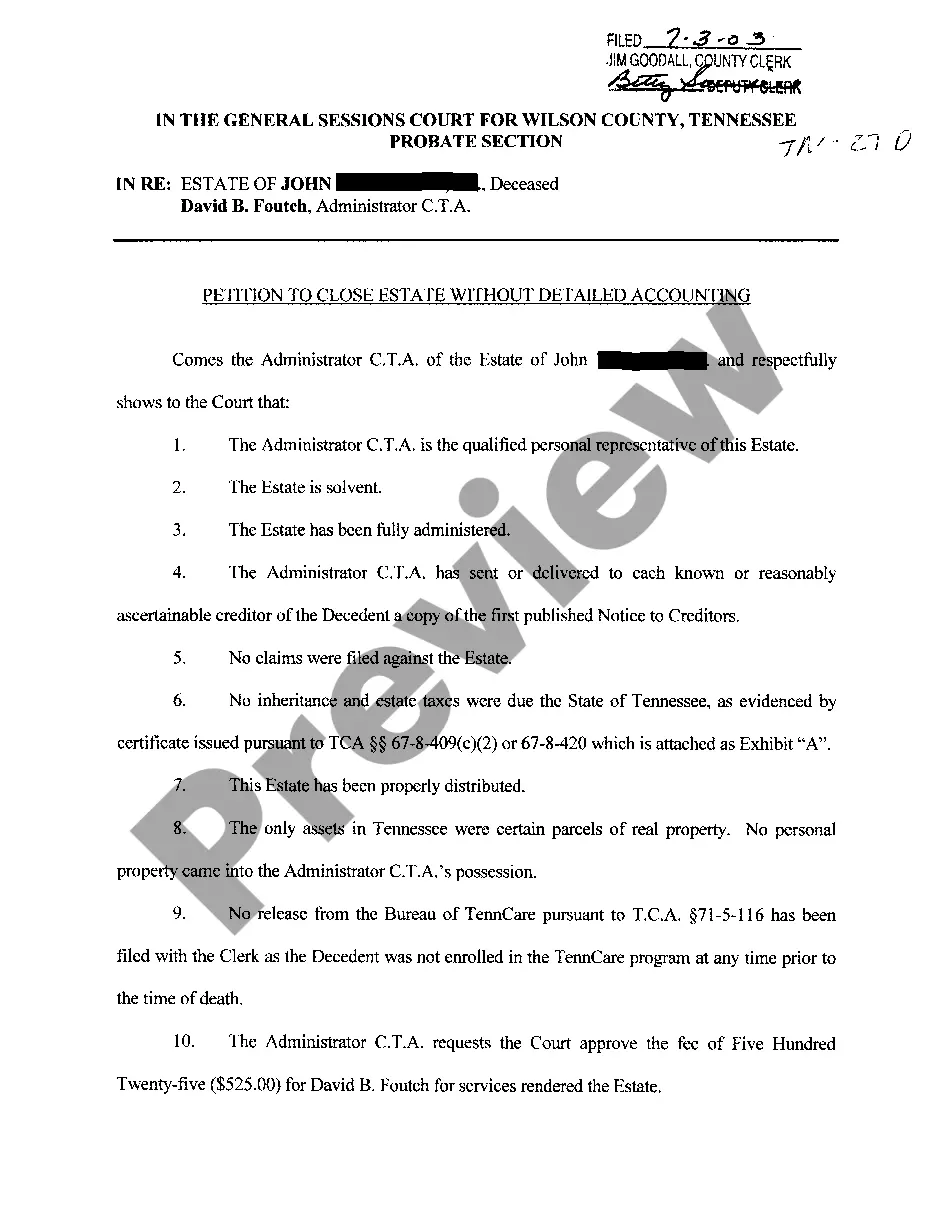

Memphis Tennessee Petition To Close Estate Without Detailed Accounting

Description

How to fill out Tennessee Petition To Close Estate Without Detailed Accounting?

Obtaining verified templates tailored to your local regulations can be difficult unless you utilize the US Legal Forms database.

This online collection includes over 85,000 legal documents for both personal and professional requirements as well as a variety of real-world situations.

All paperwork is accurately organized by usage area and jurisdiction, making it quick and straightforward to locate the Memphis Tennessee Petition To Close Estate Without Detailed Accounting.

Maintaining documentation organized and compliant with legal standards is crucial. Take advantage of the US Legal Forms library to have essential document templates for any requirements just at your fingertips!

- Review the Preview mode and document description.

- Ensure you have selected the correct one that satisfies your needs and fully aligns with your local jurisdiction standards.

- Look for an alternative template, if necessary.

- If you notice any discrepancies, use the Search tab above to find the appropriate one. If it meets your criteria, proceed to the following step.

- Finalize the purchase.

Form popularity

FAQ

According to the Kentucky Revised Statutes 395.010, it must be completed within 10 years after the person's death. However, it is better to file soon after the person's death and to complete the probate process as quickly as possible.

Protect Yourself as Executor When Facing Estate Litigation Make sure you follow the written wishes of the deceased.Share information with anyone involved in the estate.Document everything that you do for the estate.

Can a personal representative be a beneficiary of a will? Yes. A personal representative can also be a named beneficiary in the decedent's will. For example, in a family with four siblings, one of the siblings or even the spouse may act as a personal representative.

Generally, in Tennessee, probate can take anywhere from six months to a year. However, the process can take longer if there is a dispute over the deceased person's will or any unusual assets or debts involved.

Settling an Estate in Tennessee File a petition with the court to open probate. The court appoints an Executor of Estate of Personal Representative. The Executor of the Estate notifies the heirs and publishes notice of probate for creditors.

Fiduciary Services Failing to make sure that transferable assets that were bequeathed to heirs are indeed transferred correctly. Cancelling mortgage bonds in favour of the deceased when it is prejudicial to do so. Giving one-sided advice/instructions to a client, especially in the case of the massing of estates.

Starting from the date of death, the executors have 12 months before they have to start distributing the estate. This allows time to gather information on the estate and check for potential claims. The executors have no obligation to distribute the estate before the end of the year.

Probate in Tennessee commonly takes six months to a year. It may take longer if there is a court fight over the will (which is rare) or unusual assets or debts that complicate matters.

The executor has 60 days to start the process by submitting an inventory of the estate's assets, notifying heirs and creditors and asking the state's tax authorities and the Medicaid agency, TennCare, for a release of any claims.