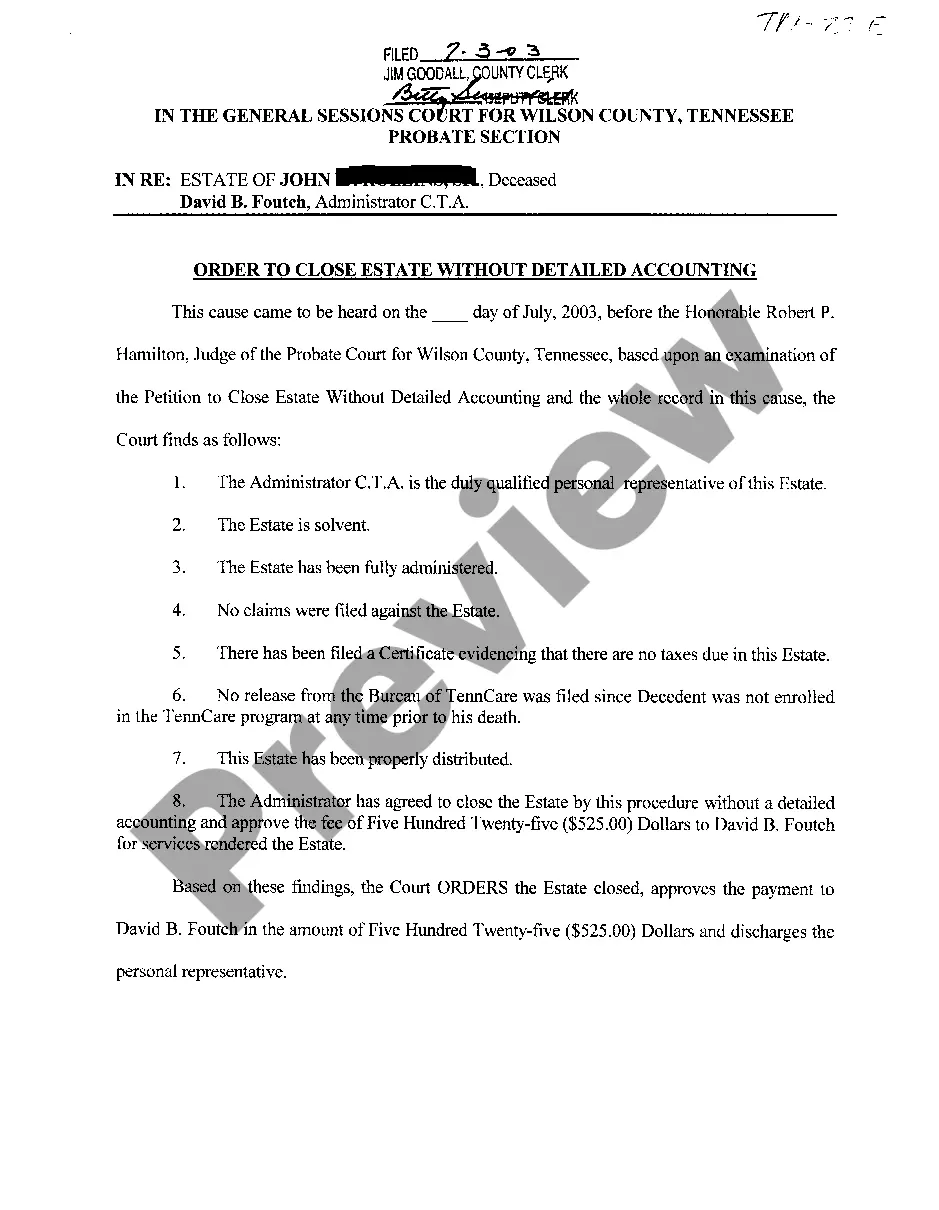

Title: Knoxville Tennessee Order to Close Estate Without Detailed Accounting: Explained Meta Description: Discover the different types of Knoxville Tennessee orders to close an estate without a detailed accounting. Learn the key steps involved in this process and understand how it applies to estate administration in Knoxville, Tennessee. Introduction: When it comes to estate administration, the Knoxville Tennessee Order to Close Estate Without Detailed Accounting is a legal proceeding that allows for the efficient closure of an estate without the need for a comprehensive and detailed financial account. In this article, we delve into the various types of Knoxville Tennessee Orders to Close Estate Without Detailed Accounting and provide a step-by-step overview of how this process works. Types of Knoxville Tennessee Orders to Close Estate Without Detailed Accounting: 1. Order Confirming Completion of Administration without Detailed Accounting: This order is typically utilized when the executor or administrator finishes the administration of an estate, demonstrating that all necessary steps have been taken and no detailed accounting is required. It is important for the executor to ensure that all beneficiaries receive their allotted shares before seeking this order. 2. Consent Order to Close Estate Without Detailed Accounting: This type of order is obtained when all interested parties, including beneficiaries and potential creditors, consent to the closing of an estate without the need for a detailed accounting. It is crucial to have all parties involved sign the consent order voluntarily. Steps involved in obtaining a Knoxville Tennessee Order to Close Estate Without Detailed Accounting: 1. Preparation and Filing of the Petition: The executor or administrator must draft a petition that states the intention to close the estate without a detailed accounting. This petition must include relevant details such as the deceased's name, the estate's value, and how the assets were distributed. Once prepared, the petition should be filed with the appropriate probate court in Knoxville, Tennessee. 2. Notification to Interested Parties: The executor/administrator must provide written notice to all interested parties, including beneficiaries and potential creditors, about the intention to close the estate without a detailed accounting. This notice should include information on how interested parties can contest or object to the closure. 3. Waiting Period: After the notification, there is typically a waiting period specified by Tennessee law during which creditors can file any claims against the estate. This waiting period varies depending on the circumstances, but it is generally around four months. 4. Consent and Agreement: If all interested parties, including creditors, beneficiaries, and potential beneficiaries, agree to the closure of the estate without a detailed accounting, a consent and agreement document must be prepared and signed by each party involved. This document serves as evidence of the parties' agreement to forgo a detailed accounting. 5. Presentation to Court: The petition, along with the consent and agreement document, should be presented to the probate court in Knoxville, Tennessee. The court will then review the documents and may schedule a hearing if deemed necessary. 6. Court Approval and Order: If the court finds that all legal requirements have been met and there are no objections or issues, it may approve the petition and issue an order to close the estate without a detailed accounting. Conclusion: The Knoxville Tennessee Order to Close Estate Without Detailed Accounting provides a streamlined process for closing an estate without the need for a detailed financial account. By following the appropriate steps, including preparing a petition, obtaining consent from interested parties, and presenting the agreement to the probate court, the executor or administrator can efficiently finalize the estate administration in Knoxville, Tennessee.

Knoxville Tennessee Order To Close Estate Without Detailed Accounting

Description

How to fill out Knoxville Tennessee Order To Close Estate Without Detailed Accounting?

No matter what social or professional status, filling out legal documents is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for someone with no law education to draft this sort of papers cfrom the ground up, mostly because of the convoluted jargon and legal nuances they involve. This is where US Legal Forms can save the day. Our platform offers a huge collection with over 85,000 ready-to-use state-specific documents that work for practically any legal scenario. US Legal Forms also serves as a great resource for associates or legal counsels who want to save time utilizing our DYI forms.

No matter if you need the Knoxville Tennessee Order To Close Estate Without Detailed Accounting or any other document that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Knoxville Tennessee Order To Close Estate Without Detailed Accounting in minutes using our trustworthy platform. If you are already a subscriber, you can proceed to log in to your account to get the appropriate form.

However, if you are new to our platform, make sure to follow these steps before obtaining the Knoxville Tennessee Order To Close Estate Without Detailed Accounting:

- Ensure the template you have found is specific to your area because the regulations of one state or county do not work for another state or county.

- Preview the form and read a quick description (if available) of scenarios the document can be used for.

- In case the form you picked doesn’t meet your requirements, you can start again and search for the needed document.

- Click Buy now and choose the subscription option that suits you the best.

- utilizing your credentials or create one from scratch.

- Choose the payment gateway and proceed to download the Knoxville Tennessee Order To Close Estate Without Detailed Accounting as soon as the payment is through.

You’re all set! Now you can proceed to print the form or fill it out online. In case you have any problems getting your purchased documents, you can quickly access them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.