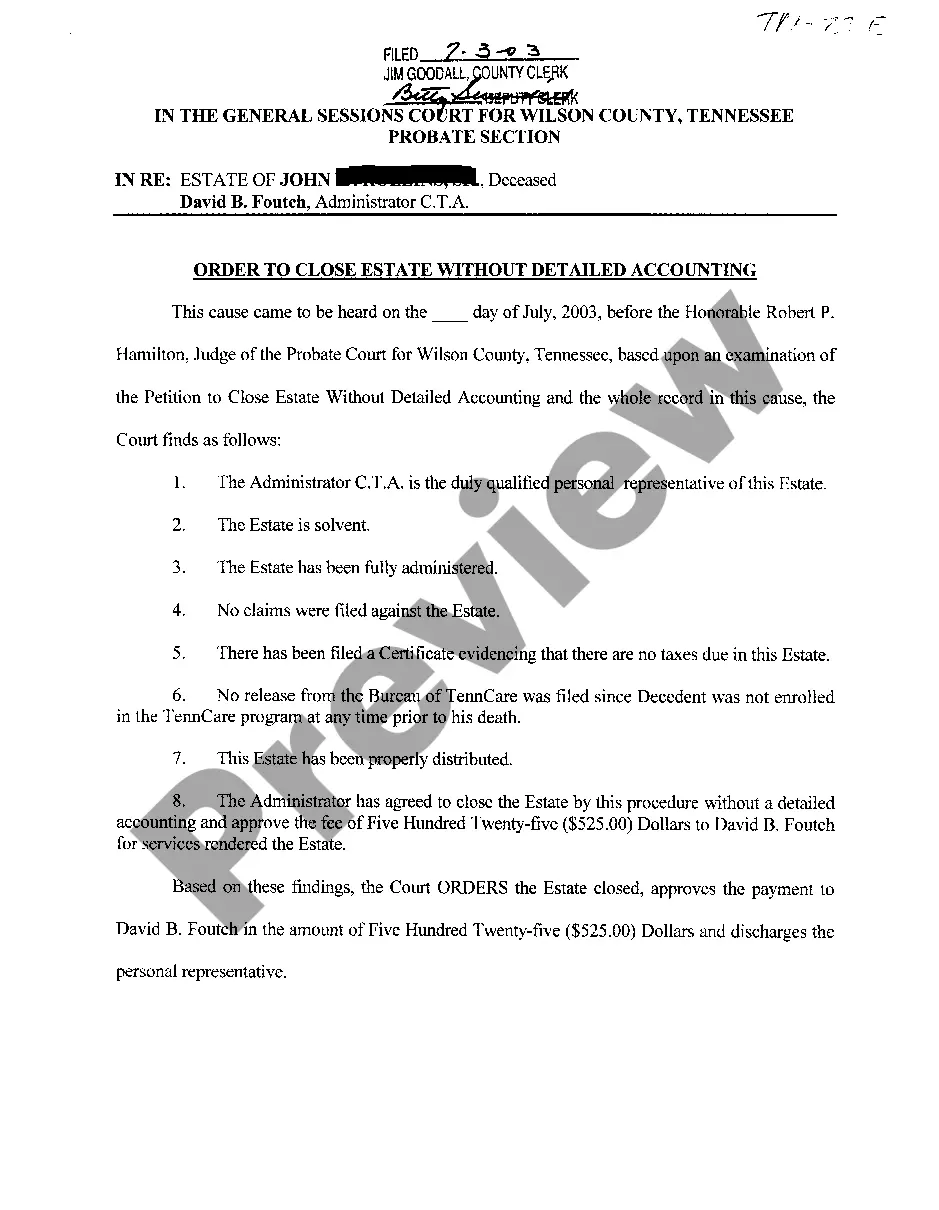

Nashville Tennessee Order to Close Estate without Detailed Accounting: Understanding the Process and Requirements When administering an estate in Nashville, Tennessee, there may be situations where it becomes necessary to seek an order to close the estate without providing a detailed accounting. This order simplifies the estate closing process, allowing the executor or personal representative to conclude the estate administration swiftly, saving time and resources. This article will shed light on the requirements, procedures, and variations of this order in Nashville, Tennessee. What is an Order to Close Estate Without Detailed Accounting? An Order to Close Estate Without Detailed Accounting is a court-issued document that relieves the executor/personal representative from the obligation of filing a comprehensive accounting of the estate's financial transactions. Typically, a detailed accounting includes records of assets, liabilities, income, expenses, distributions, and any other financial activities involved in estate administration. However, in certain cases, such as when the estate is straightforward and uncontested, this requirement may be waived. Requirements for obtaining an Order to Close Estate Without Detailed Accounting in Nashville, Tennessee: 1. Simplicity of the estate: The estate must be relatively uncomplicated, with minimal or no complexities such as multiple properties, substantial debts, disputes among beneficiaries, or ongoing lawsuits involving the estate. 2. Agreement among beneficiaries: All beneficiaries and interested parties must reach a consensus and agree to waive the detailed accounting. If any objections are raised, the court may require a full accounting instead. 3. Compliance with state laws: The executor/personal representative must comply with all relevant Tennessee probate laws and court procedures regarding the estate administration process. Types of Nashville Tennessee Order to Close Estate Without Detailed Accounting: 1. Small Estate Affidavit: In cases where the total value of the estate falls below a certain threshold (typically determined by state law), the executor may apply for a Small Estate Affidavit. This form eliminates the need for detailed accounting, providing a simplified process to close the estate. 2. Summary Administration: Summary Administration allows for the closure of the estate without a detailed accounting when the value of the estate's assets falls within a specific range set by Tennessee law. This form of closure is typically applicable when the value is relatively low or the estate qualifies under specific circumstances. 3. Consent of Heirs or Beneficiaries: If all heirs or beneficiaries unanimously agree to waive the detailed accounting, the executor/personal representative can seek consent from them, which can then be affirmatively presented to the court as an Order to Close Estate Without Detailed Accounting. Closing Thoughts: Navigating the process of obtaining a Nashville Tennessee Order to Close Estate Without Detailed Accounting requires a comprehensive understanding of the specific requirements, guidelines, and alternatives available. It is recommended to consult with an experienced probate attorney who can guide you through the estate administration process, ensuring compliance with the necessary legal procedures while efficiently bringing the estate to a close.

Nashville Tennessee Order To Close Estate Without Detailed Accounting

Description

How to fill out Nashville Tennessee Order To Close Estate Without Detailed Accounting?

We consistently endeavor to reduce or avert legal harm when managing intricate law-related or financial issues.

To achieve this, we enroll in legal services that are typically very costly.

Nevertheless, not every legal challenge is so intricate; many of them can be handled independently.

US Legal Forms is an online repository of modern DIY legal documents encompassing everything from wills and power of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button next to it. If you happen to misplace the form, you can always download it again in the My documents tab. The process is equally straightforward if you’re new to the platform! You can establish your account in minutes. Ensure to verify if the Nashville Tennessee Order To Close Estate Without Detailed Accounting complies with your state and area laws and regulations. Additionally, it is vital that you review the form’s outline (if offered), and if you notice any inconsistencies with what you were originally seeking, look for an alternative form. Once you confirm that the Nashville Tennessee Order To Close Estate Without Detailed Accounting is suitable for your situation, you can select a subscription plan and proceed to payment. You may then download the form in any available file format. For over 24 years in the market, we’ve assisted millions of individuals by providing ready-to-customize and current legal forms. Take advantage of US Legal Forms now to conserve time and resources!

- Our library enables you to take charge of your affairs without needing to consult a lawyer.

- We offer access to legal document templates that are not always publicly accessible.

- Our templates are tailored to specific states and regions, significantly simplifying the search process.

- Utilize US Legal Forms whenever you need to locate and download the Nashville Tennessee Order To Close Estate Without Detailed Accounting or any other document swiftly and securely.

Form popularity

Interesting Questions

More info

Colliers International expands to Nashville, Tennessee. A Release says your estate does not owe Tenner any money. A child who does not live in the parent's home and is receiving support from the other parent, but not pursuant to a court order. Simply put the hand‛ icon, in Acrobat Reader, on the space to be filled in, Click once and start typing. Colliers International expands to Nashville, Tennessee. A Release says your estate does not owe Tenner any money.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.