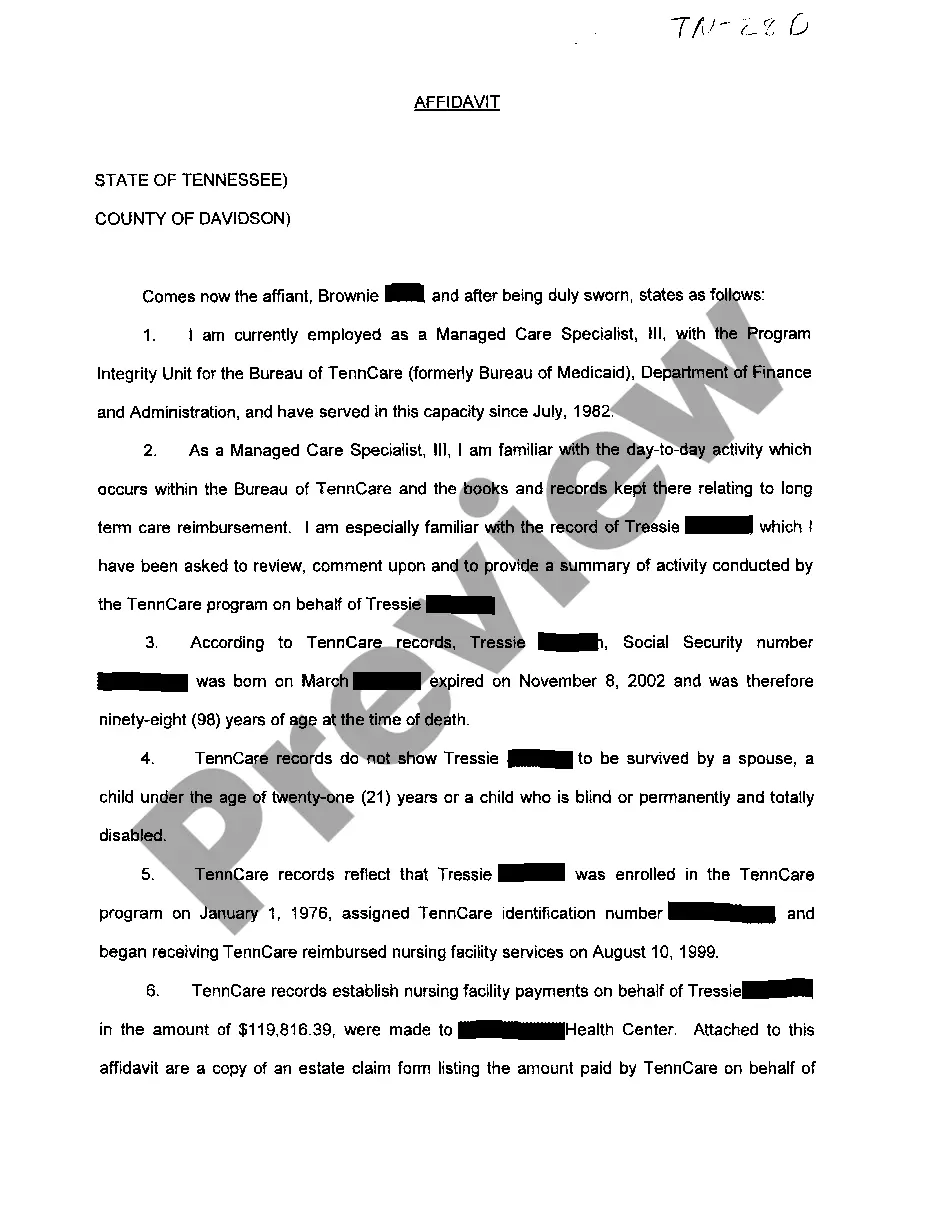

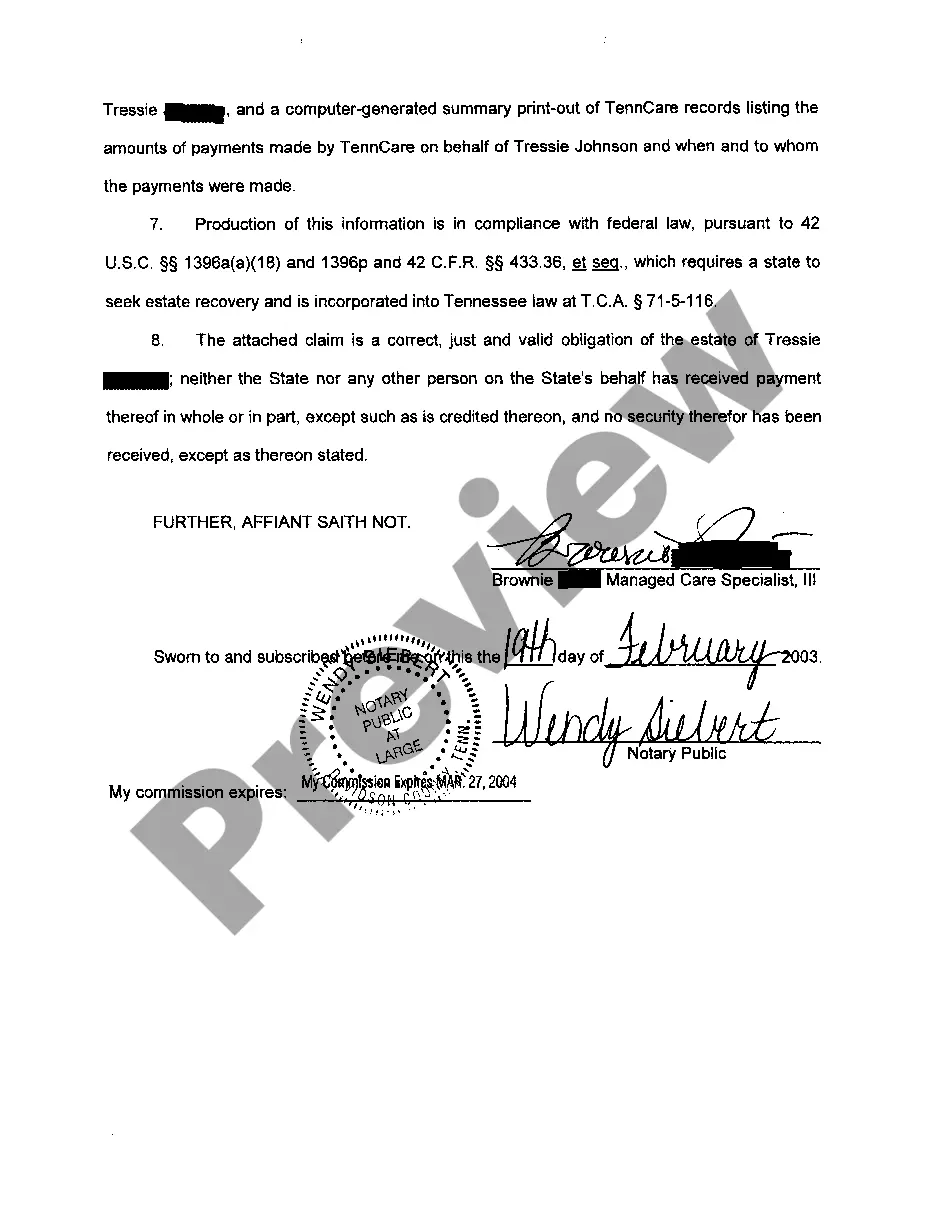

The Memphis Tennessee Affidavit pertaining to business records and billing is a legal document that attests to the accuracy, completeness, and authenticity of financial records and invoices associated with a business. This affidavit plays a crucial role in various legal proceedings such as insurance claims, tax audits, disputes, or any situation where the veracity of business records is being questioned or challenged. There are several types of Memphis Tennessee Affidavits regarding business records and billing, each serving a different purpose: 1. Affidavit of Business Records: This type of affidavit is used to verify the accuracy and integrity of business records, including but not limited to financial statements, ledgers, income statements, balance sheets, purchase orders, sales records, and employee payroll records. It confirms that these records have been well-maintained, are in proper order, and have not been tampered with. 2. Affidavit of Invoices: This affidavit specifically focuses on the accuracy and legitimacy of billing and invoicing records. It assures that invoices have been issued correctly, including accurate product or service descriptions, quantities, prices, and applicable taxes. Additionally, it confirms that all invoices have been issued in accordance with relevant laws, regulations, and contractual agreements. 3. Affidavit of Accounts Receivable: This affidavit provides verification of the outstanding amounts owed to a business by its customers or clients. It confirms the accuracy of the accounts receivable ledger, detailing the specific debts, their origins, and their current balances. It also certifies that all due diligence has been conducted to collect these debts and that they are genuinely owed. 4. Affidavit of Purchase Orders: This affidavit is concerned with purchase order records, ensuring their accuracy, completeness, and adherence to the terms and conditions set forth in the agreements. It affirms that purchase orders have been duly authorized, contain accurate product or service descriptions, quantities, prices, delivery dates, and any other applicable terms. 5. Affidavit of Inventory Records: This type of affidavit focuses on the accuracy, completeness, and integrity of a business's inventory records. It confirms that proper inventory management systems are in place, accurately reflecting the quantity, quality, and value of all stock items. It also attests that regular audits have been conducted to reconcile physical stock with recorded inventory levels. In conclusion, the Memphis Tennessee Affidavits regarding business records and billing are an essential legal tool that helps establish the credibility of financial documentation. These affidavits come in various forms, addressing specific aspects of business records such as general records, invoices, accounts receivable, purchase orders, and inventory. Their purpose is to provide assurances that the records are accurate, complete, and reliable in order to protect the interests of the businesses involved and maintain the integrity of legal proceedings.

The Memphis Tennessee Affidavit pertaining to business records and billing is a legal document that attests to the accuracy, completeness, and authenticity of financial records and invoices associated with a business. This affidavit plays a crucial role in various legal proceedings such as insurance claims, tax audits, disputes, or any situation where the veracity of business records is being questioned or challenged. There are several types of Memphis Tennessee Affidavits regarding business records and billing, each serving a different purpose: 1. Affidavit of Business Records: This type of affidavit is used to verify the accuracy and integrity of business records, including but not limited to financial statements, ledgers, income statements, balance sheets, purchase orders, sales records, and employee payroll records. It confirms that these records have been well-maintained, are in proper order, and have not been tampered with. 2. Affidavit of Invoices: This affidavit specifically focuses on the accuracy and legitimacy of billing and invoicing records. It assures that invoices have been issued correctly, including accurate product or service descriptions, quantities, prices, and applicable taxes. Additionally, it confirms that all invoices have been issued in accordance with relevant laws, regulations, and contractual agreements. 3. Affidavit of Accounts Receivable: This affidavit provides verification of the outstanding amounts owed to a business by its customers or clients. It confirms the accuracy of the accounts receivable ledger, detailing the specific debts, their origins, and their current balances. It also certifies that all due diligence has been conducted to collect these debts and that they are genuinely owed. 4. Affidavit of Purchase Orders: This affidavit is concerned with purchase order records, ensuring their accuracy, completeness, and adherence to the terms and conditions set forth in the agreements. It affirms that purchase orders have been duly authorized, contain accurate product or service descriptions, quantities, prices, delivery dates, and any other applicable terms. 5. Affidavit of Inventory Records: This type of affidavit focuses on the accuracy, completeness, and integrity of a business's inventory records. It confirms that proper inventory management systems are in place, accurately reflecting the quantity, quality, and value of all stock items. It also attests that regular audits have been conducted to reconcile physical stock with recorded inventory levels. In conclusion, the Memphis Tennessee Affidavits regarding business records and billing are an essential legal tool that helps establish the credibility of financial documentation. These affidavits come in various forms, addressing specific aspects of business records such as general records, invoices, accounts receivable, purchase orders, and inventory. Their purpose is to provide assurances that the records are accurate, complete, and reliable in order to protect the interests of the businesses involved and maintain the integrity of legal proceedings.