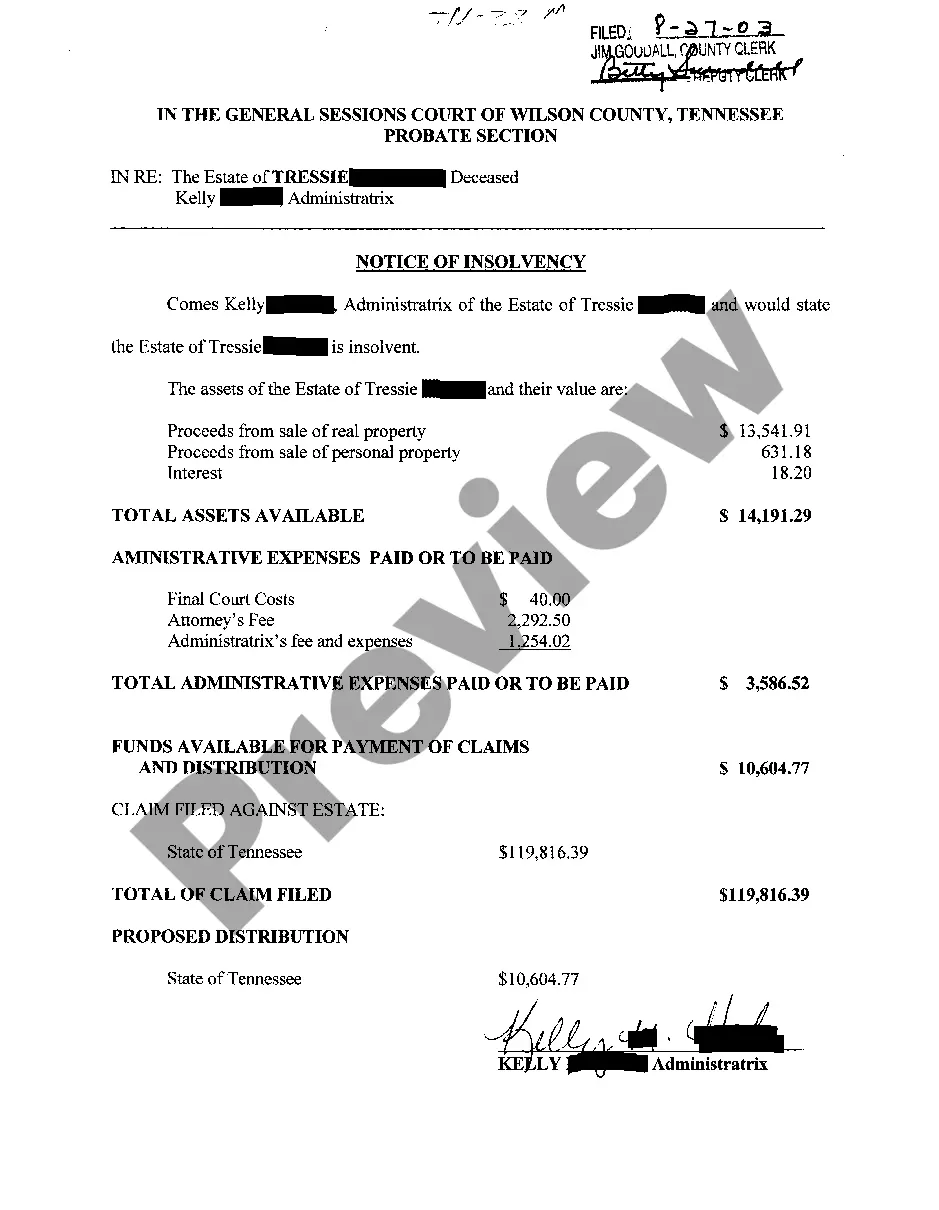

Chattanooga Tennessee Notice of Insolvency is a legal document that signifies an individual or company's inability to pay off their debts. This notice is filed when an individual or business reaches a financially distressed state and becomes insolvent. It serves as a formal declaration to creditors, informing them of the insolvent party's current financial situation. The Notice of Insolvency provides creditors with critical information regarding the debtor's financial standing and impending insolvency proceedings. It includes details about the debtor's assets, liabilities, outstanding debts, and any ongoing legal actions, such as bankruptcy proceedings. This document plays a crucial role in the insolvency process, as it marks the initiation of legal proceedings and provides transparency to all parties involved. In Chattanooga, Tennessee, there are primarily two types of Notice of Insolvency: personal and corporate. Personal insolvency notice refers to an individual's inability to meet their financial obligations, while corporate insolvency notice refers to a business entity's inability to repay its debts. When an individual files a personal insolvency notice, they are typically required to provide comprehensive details about their financial situation, including a list of assets, sources of income, outstanding debts, and any ongoing legal actions. These details assist creditors and insolvency professionals in assessing the individual's financial standing and determining the most suitable course of action to resolve the insolvency. On the other hand, a corporate insolvency notice involves submitting relevant financial information, such as the company's balance sheet, income statement, cash flow statement, as well as details of outstanding debts, creditor claims, pending litigation, and ongoing insolvency proceedings. This notice provides creditors with essential information required for making informed decisions regarding their claims against the insolvent company. Chattanooga Tennessee Notice of Insolvency is a significant document that establishes transparency and allows for an organized resolution process in situations where individuals or businesses are unable to pay off their debts. By filing this notice, debtors can proactively address their financial difficulties while creditors gain valuable insights into their claims and potential recovery options.

Chattanooga Tennessee Notice of Insolvency

Description

How to fill out Chattanooga Tennessee Notice Of Insolvency?

Locating verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Chattanooga Tennessee Notice of Insolvency becomes as quick and easy as ABC.

For everyone already familiar with our library and has used it before, obtaining the Chattanooga Tennessee Notice of Insolvency takes just a few clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a couple of additional actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make certain you’ve chosen the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to get the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Chattanooga Tennessee Notice of Insolvency. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!