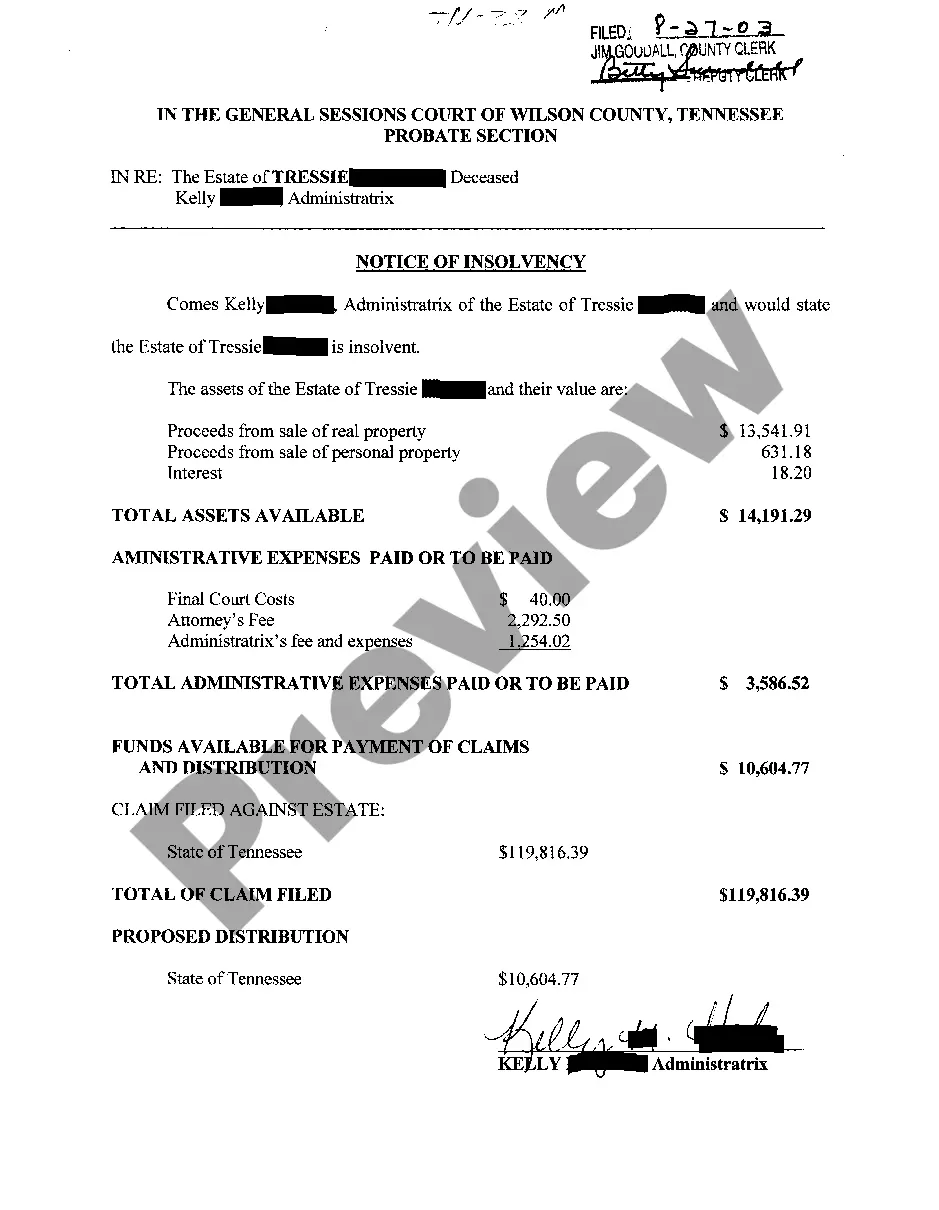

Title: Knoxville Tennessee Notice of Insolvency: Understanding the Process and its Types Introduction: In Knoxville, Tennessee, individuals and businesses facing insurmountable debt may utilize the legal process of filing a Notice of Insolvency. This important step signifies the official acknowledgment of an entity's inability to repay creditors. This article aims to provide a detailed description of Knoxville Tennessee Notice of Insolvency, highlighting its purpose, procedures, and potential types. 1. Purpose of Knoxville Tennessee Notice of Insolvency: The Knoxville Tennessee Notice of Insolvency serves as a formal declaration by debtors that they are unable to meet their financial obligations. The main objective behind this notice is to initiate a legal process that protects the debtor from aggressive creditor actions and allows for the fair distribution of assets. 2. Process of Filing the Notice of Insolvency: a. Consultation with Legal Professionals: Before filing the Notice of Insolvency, debtors are advised to seek legal counsel to understand their rights, obligations, and potential alternatives. An experienced attorney can guide them through the entire process and ensure compliance with relevant laws and regulations. b. Compilation of Necessary Documentation: To file the Notice of Insolvency, debtors must compile an assortment of essential documents, including financial records, asset and liability statements, contracts, leases, and pertinent legal forms. Thorough documentation is crucial for an accurate assessment of the debtor's financial state. c. Filing the Petition and Notice: Once all the necessary documentation is gathered, debtors must file their Notice of Insolvency petition with the appropriate court. This officially commences the insolvency process, placing an automatic stay on creditor actions and granting the debtor breathing room. d. Creditor Notification and Claim Filing: After the Notice of Insolvency is filed, an order is issued to inform all involved creditors about the situation. Creditors are given a specified period to submit claims for the debts owed by the debtor. These claims are later evaluated, and a distribution plan is established based on the debtor's available assets. 3. Types of Knoxville Tennessee Notice of Insolvency: While the process of filing a Notice of Insolvency generally follows a similar pattern, there are distinct types of insolvency proceedings, including: a. Chapter 7 Bankruptcy: This type involves the liquidation of non-exempt assets to repay creditors. Debtors with primarily consumer debts typically pursue Chapter 7 bankruptcy. b. Chapter 11 Bankruptcy: Primarily designed for businesses, Chapter 11 bankruptcy allows the debtor to reorganize their finances and develop a repayment plan while continuing their operations. c. Chapter 13 Bankruptcy: Ideal for individuals with regular income, Chapter 13 bankruptcy involves the creation of a manageable debt repayment plan spanning three to five years. Debtors can retain their assets and repay creditors according to the proposed plan. Conclusion: The Knoxville Tennessee Notice of Insolvency serves as a gateway for individuals and businesses to navigate their way out of overwhelming debt burdens. By understanding its purpose, procedures, and different types, individuals can make informed decisions and seek appropriate legal assistance when facing financial distress in Knoxville, Tennessee. It is important to consult with professionals to tailor the process according to individual circumstances and ensure a smoother path towards financial stability.

Knoxville Tennessee Notice of Insolvency

Description

How to fill out Knoxville Tennessee Notice Of Insolvency?

Are you looking for a trustworthy and inexpensive legal forms supplier to get the Knoxville Tennessee Notice of Insolvency? US Legal Forms is your go-to option.

No matter if you need a simple agreement to set rules for cohabitating with your partner or a set of documents to move your divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and framed in accordance with the requirements of particular state and county.

To download the form, you need to log in account, locate the needed template, and click the Download button next to it. Please remember that you can download your previously purchased form templates anytime from the My Forms tab.

Are you new to our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Knoxville Tennessee Notice of Insolvency conforms to the laws of your state and local area.

- Read the form’s details (if available) to find out who and what the form is good for.

- Start the search over in case the template isn’t suitable for your legal situation.

Now you can create your account. Then pick the subscription plan and proceed to payment. Once the payment is completed, download the Knoxville Tennessee Notice of Insolvency in any available file format. You can get back to the website when you need and redownload the form free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about wasting your valuable time learning about legal paperwork online for good.