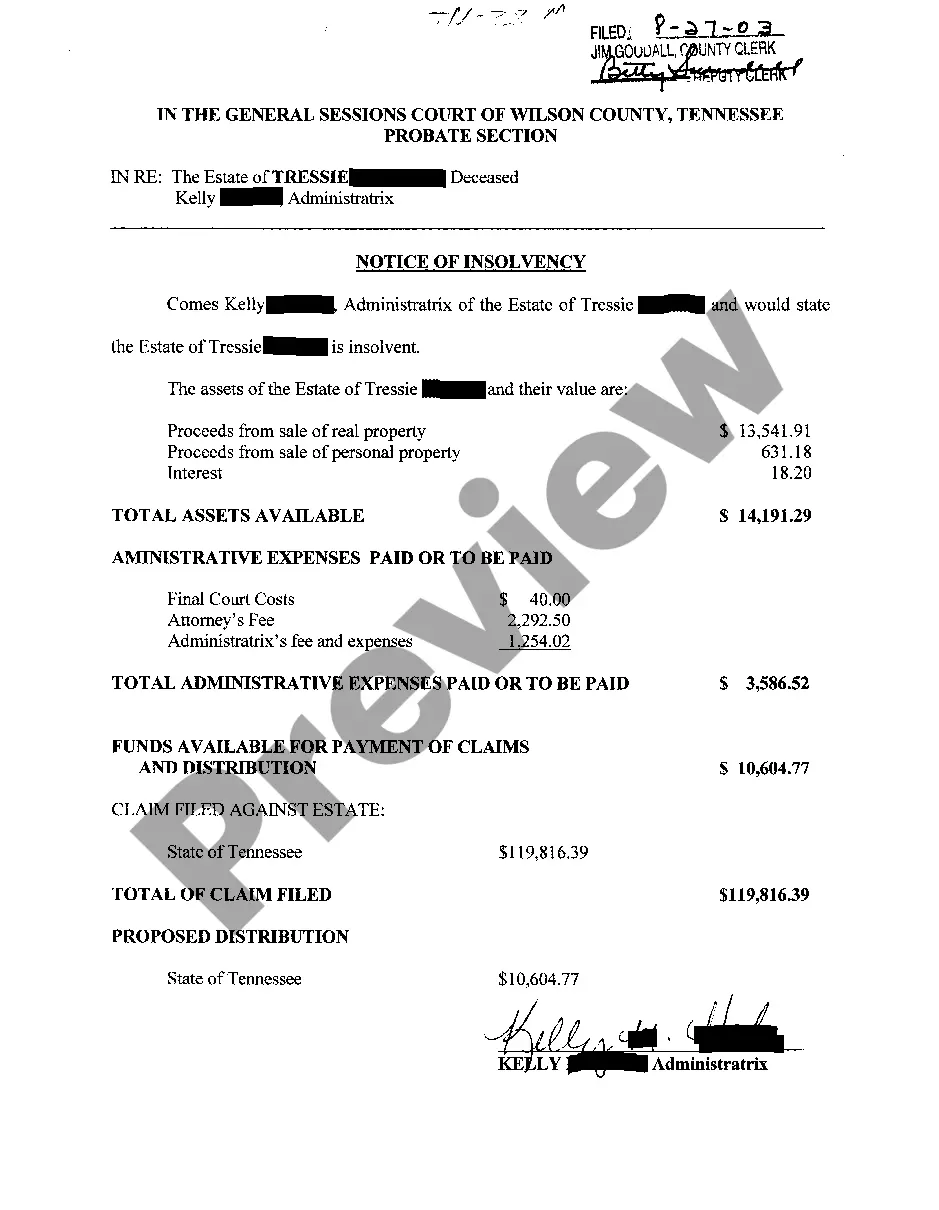

Nashville Tennessee Notice of Insolvency is a legal document that signifies the financial distress and inability of an individual or business entity to pay its debts. This notice is typically filed by a debtor who is seeking protection under bankruptcy laws. Keywords: Nashville Tennessee, Notice of Insolvency, legal document, financial distress, inability to pay debts, bankruptcy laws. There are various types of Nashville Tennessee Notice of Insolvency, which include: 1. Chapter 7 Bankruptcy: This type of notice is filed by individuals or businesses who seek to liquidate their assets to repay creditors. It is often known as "straight bankruptcy" as it allows debtors to discharge their debts and make a fresh start. 2. Chapter 13 Bankruptcy: Individuals who have a steady income, but struggle with debt payments may file a Chapter 13 Notice of Insolvency. It involves creating a repayment plan to creditors over an extended period of time, typically three to five years. 3. Chapter 11 Bankruptcy: Primarily used by businesses, this type of notice allows companies to reorganize their debts and continue operations while repaying creditors over time. It provides an opportunity for debtors to restructure their finances and regain stability. 4. Notice of Insolvency for Individuals: This notice is filed by individuals who do not qualify for Chapter 7 bankruptcy and have sufficient income to pay off their debts over time. It may be applicable to those who have significant assets or are above the income threshold required for Chapter 7. 5. Notice of Insolvency for Businesses: Filed by struggling businesses, this notice aims to address financial difficulties by reorganizing debts, negotiating with creditors, and potentially selling assets. It allows businesses a chance to regain profitability and continue operations. In conclusion, Nashville Tennessee Notice of Insolvency is a legal process that serves as a last resort for individuals and businesses struggling with insurmountable debt. Different types of notices cater to the unique circumstances, income levels, and specific goals of debtors seeking debt relief and financial restructuring.

Nashville Tennessee Notice of Insolvency

Description

How to fill out Nashville Tennessee Notice Of Insolvency?

Do you need a reliable and inexpensive legal forms supplier to get the Nashville Tennessee Notice of Insolvency? US Legal Forms is your go-to solution.

Whether you require a basic arrangement to set regulations for cohabitating with your partner or a package of documents to advance your divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t universal and framed based on the requirements of separate state and area.

To download the document, you need to log in account, locate the needed template, and hit the Download button next to it. Please remember that you can download your previously purchased document templates anytime in the My Forms tab.

Are you new to our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Nashville Tennessee Notice of Insolvency conforms to the laws of your state and local area.

- Read the form’s description (if available) to find out who and what the document is good for.

- Restart the search in case the template isn’t suitable for your specific situation.

Now you can register your account. Then select the subscription option and proceed to payment. As soon as the payment is completed, download the Nashville Tennessee Notice of Insolvency in any available format. You can get back to the website when you need and redownload the document free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about spending your valuable time researching legal papers online for good.