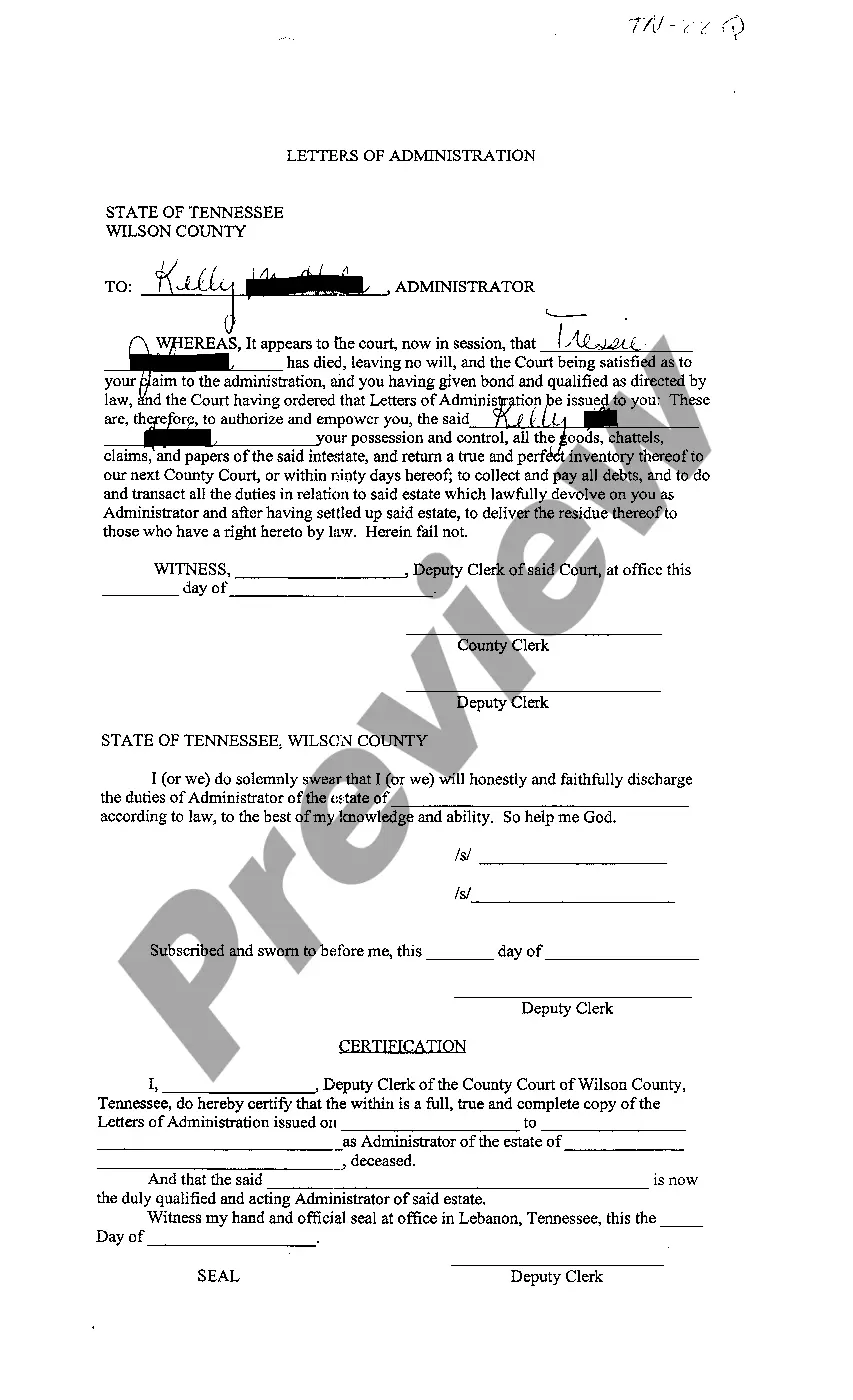

Memphis Tennessee Letters of Administration refer to a legal document issued by the Probate Court in Memphis, Tennessee, granting authority to an individual or entity to manage and distribute the assets of a deceased person's estate. When a person passes away without leaving a valid will or an executor named in their will, the court appoints an administrator to handle the estate settlement process. This appointed administrator ensures that the deceased person's debts are settled and their assets are distributed to the rightful heirs in accordance with Tennessee state laws. There are two main types of Memphis Tennessee Letters of Administration: formal and informal. 1. Formal Letters of Administration: This type is required when there is a contested or complex estate. It involves a court hearing where interested parties may object to the appointment of a particular individual as an administrator. The court reviews evidence and hears arguments before issuing formal letters to the selected administrator. 2. Informal Letters of Administration: This type is typically used when the estate settlement process is straightforward, uncontested, and there is broad consensus among the interested parties. The interested party petitions the court to be appointed as the administrator, and upon review of the petition, the court may issue informal letters without the need for a formal hearing. The Memphis Tennessee Letters of Administration grant several powers and responsibilities to the appointed administrator, including: 1. Inventory and Appraisal: The administrator must identify all the assets of the deceased person and determine their value. This includes real estate, personal property, financial accounts, investments, and any other form of assets. 2. Debt Settlement: The administrator is responsible for locating and notifying all potential creditors of the deceased person. They must review and assess claims made against the estate and ensure that debts are paid from the available assets. 3. Asset Distribution: Once all the debts, taxes, and expenses are settled, the administrator distributes the remaining assets to the lawful heirs according to Tennessee intestate succession laws (if there is no will) or the instructions outlined in the will. 4. Estate Accounting: The administrator must maintain accurate and detailed records of all transactions and activities related to the estate. This includes income, expenses, distributions, and any other financial transactions. It is important to note that the responsibilities of the administrator can vary depending on the complexity of the estate and any specific instructions provided in the deceased person's will. The Letters of Administration empower the chosen individual or entity to carry out these duties legally and efficiently, ensuring a fair and orderly distribution of the deceased person's assets.

Memphis Tennessee Letters of Administration refer to a legal document issued by the Probate Court in Memphis, Tennessee, granting authority to an individual or entity to manage and distribute the assets of a deceased person's estate. When a person passes away without leaving a valid will or an executor named in their will, the court appoints an administrator to handle the estate settlement process. This appointed administrator ensures that the deceased person's debts are settled and their assets are distributed to the rightful heirs in accordance with Tennessee state laws. There are two main types of Memphis Tennessee Letters of Administration: formal and informal. 1. Formal Letters of Administration: This type is required when there is a contested or complex estate. It involves a court hearing where interested parties may object to the appointment of a particular individual as an administrator. The court reviews evidence and hears arguments before issuing formal letters to the selected administrator. 2. Informal Letters of Administration: This type is typically used when the estate settlement process is straightforward, uncontested, and there is broad consensus among the interested parties. The interested party petitions the court to be appointed as the administrator, and upon review of the petition, the court may issue informal letters without the need for a formal hearing. The Memphis Tennessee Letters of Administration grant several powers and responsibilities to the appointed administrator, including: 1. Inventory and Appraisal: The administrator must identify all the assets of the deceased person and determine their value. This includes real estate, personal property, financial accounts, investments, and any other form of assets. 2. Debt Settlement: The administrator is responsible for locating and notifying all potential creditors of the deceased person. They must review and assess claims made against the estate and ensure that debts are paid from the available assets. 3. Asset Distribution: Once all the debts, taxes, and expenses are settled, the administrator distributes the remaining assets to the lawful heirs according to Tennessee intestate succession laws (if there is no will) or the instructions outlined in the will. 4. Estate Accounting: The administrator must maintain accurate and detailed records of all transactions and activities related to the estate. This includes income, expenses, distributions, and any other financial transactions. It is important to note that the responsibilities of the administrator can vary depending on the complexity of the estate and any specific instructions provided in the deceased person's will. The Letters of Administration empower the chosen individual or entity to carry out these duties legally and efficiently, ensuring a fair and orderly distribution of the deceased person's assets.