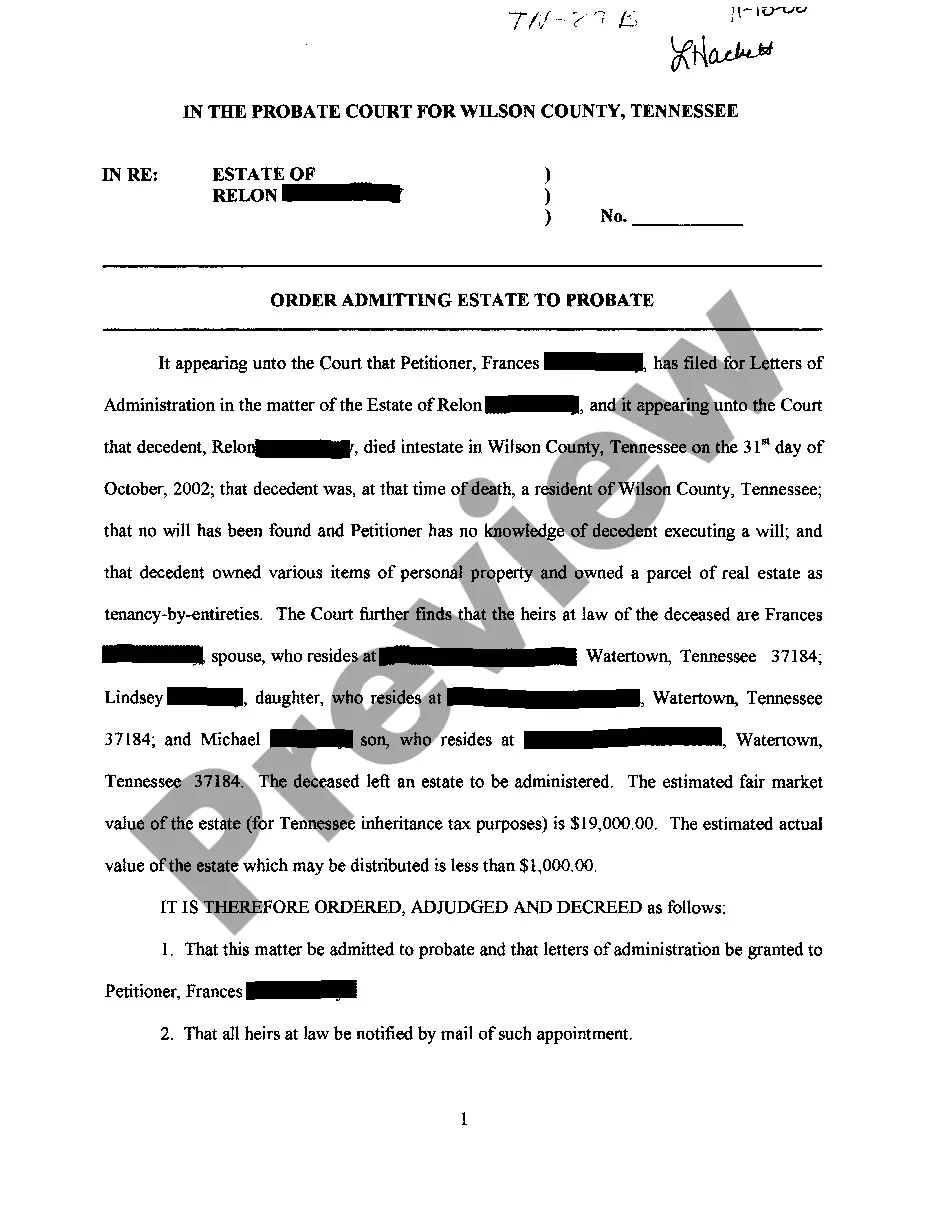

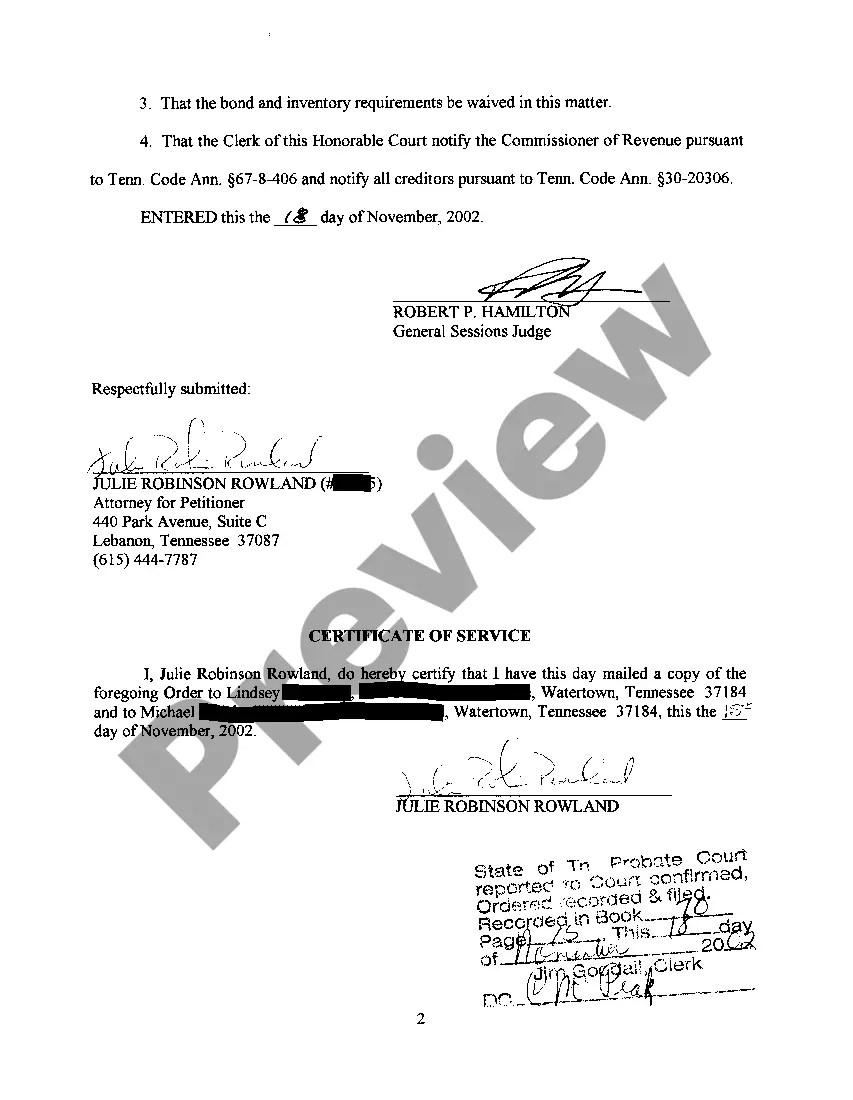

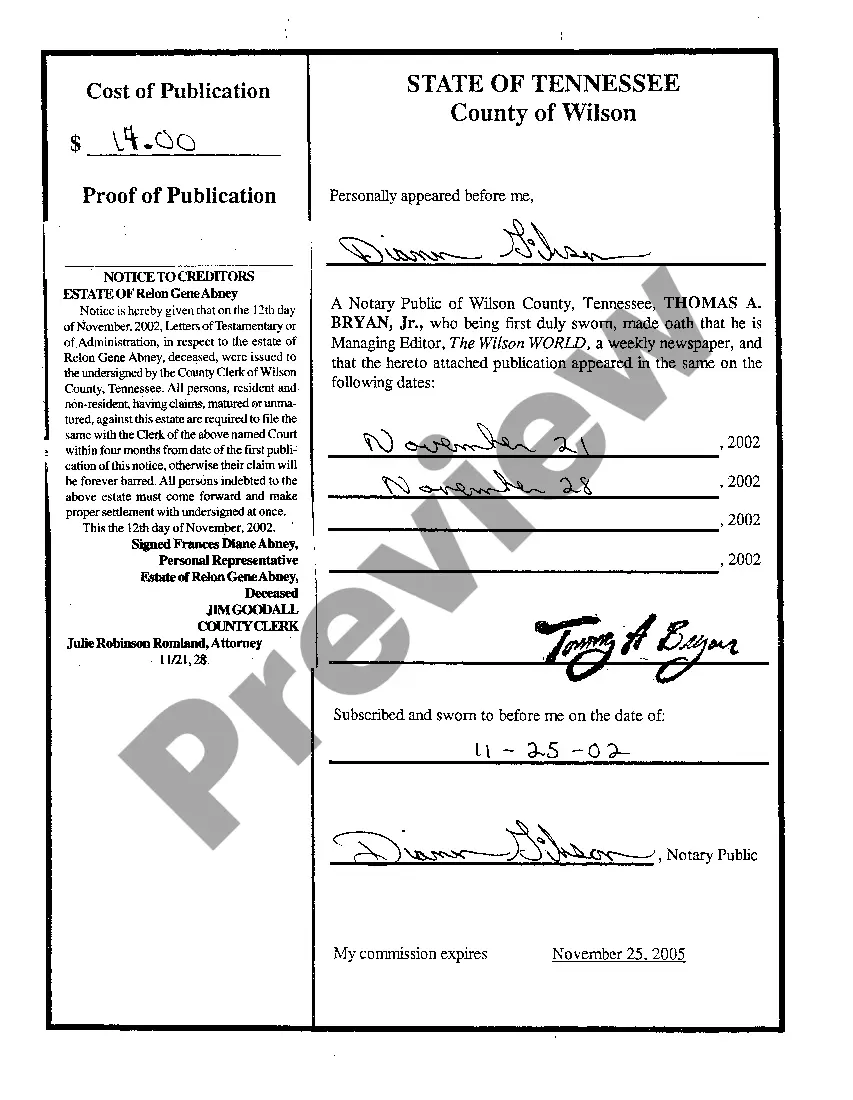

Title: Chattanooga Tennessee Order Admitting Estate to Probate: A Comprehensive Guide Introduction: Discover all you need to know about Chattanooga Tennessee Order Admitting Estate to Probate, a crucial legal procedure allowing the settlement and distribution of a deceased individual's assets. This article will delve into the probate process, its importance, and the different types of orders associated with this specific procedure in Chattanooga, Tennessee. 1. Understanding the Probate Process: — Probate: Probate refers to the legal process that validates a will, settles any outstanding debts or taxes, and organizes the distribution of assets after an individual's passing. — Executor/Administrator: The person responsible for managing the estate, ensuring proper distribution, and following the probate process as mandated by Tennessee law. — Assets: Any property, finances, or belongings that were owned by the deceased individual. — Beneficiaries: Individuals or organizations entitled to receive a share of the deceased person's assets. 2. Chattanooga Tennessee Order Admitting Estate to Probate: — Purpose and Importance: An Order Admitting Estate to Probate grants legal authority to the executor or administrator to handle the probate process, initiate asset appraisal procedures, address debts, and distribute assets to beneficiaries. — Filing the Order: Detailed steps involving drafting and filing the Order Admitting Estate to Probate with the appropriate probate court in Chattanooga, Tennessee. — Required Documents: A list of necessary documents to include when filing the Order, such as the original will, death certificate, inventory of assets, and any relevant supporting documents. 3. Types of Chattanooga Tennessee Orders Admitting Estate to Probate: — Order Admitting Will to Probate: This order is specifically associated with probating a will, validating its authenticity, and initiating the distribution process. — Order Admitting Estate to Probate (Intestate): Applied when someone passes away without leaving a valid will, appointing an administrator to manage and distribute the assets based on state laws. — Ancillary Probate Order: Relevant for individuals who had assets in multiple states, this order allows the appointment of an administrator to address assets solely located in Chattanooga, Tennessee. — Summary Administration Order: A streamlined probate process available for estates with limited assets and no outstanding debts, ensuring a more efficient distribution of assets. Conclusion: In Chattanooga, Tennessee, the Order Admitting Estate to Probate is a key legal document facilitating the probate process, acting as a starting point for asset assessment and distribution. Whether you need to probate a will, address an intestate estate, or manage assets located solely in Chattanooga, understanding the different types and procedures associated with the Order Admitting Estate to Probate is essential. Seek expert legal advice to navigate this intricate process with confidence and ensure a smooth settlement of the deceased individual's estate.

Chattanooga Tennessee Order Admitting Estate To Probate

Description

How to fill out Chattanooga Tennessee Order Admitting Estate To Probate?

If you are looking for a valid form, it’s difficult to choose a more convenient platform than the US Legal Forms website – probably the most considerable libraries on the internet. Here you can get thousands of templates for business and personal purposes by types and states, or key phrases. With our advanced search option, getting the newest Chattanooga Tennessee Order Admitting Estate To Probate is as elementary as 1-2-3. In addition, the relevance of each record is confirmed by a group of professional lawyers that on a regular basis review the templates on our website and update them in accordance with the latest state and county laws.

If you already know about our system and have a registered account, all you need to get the Chattanooga Tennessee Order Admitting Estate To Probate is to log in to your account and click the Download option.

If you utilize US Legal Forms for the first time, just follow the instructions below:

- Make sure you have found the form you need. Read its explanation and utilize the Preview function (if available) to see its content. If it doesn’t meet your requirements, use the Search field near the top of the screen to discover the appropriate file.

- Affirm your choice. Select the Buy now option. Next, select your preferred pricing plan and provide credentials to register an account.

- Make the financial transaction. Use your bank card or PayPal account to finish the registration procedure.

- Get the template. Choose the file format and save it to your system.

- Make changes. Fill out, modify, print, and sign the obtained Chattanooga Tennessee Order Admitting Estate To Probate.

Each and every template you save in your account has no expiration date and is yours forever. It is possible to access them via the My Forms menu, so if you need to receive an extra version for enhancing or printing, you can come back and export it again whenever you want.

Make use of the US Legal Forms professional library to gain access to the Chattanooga Tennessee Order Admitting Estate To Probate you were looking for and thousands of other professional and state-specific templates in a single place!