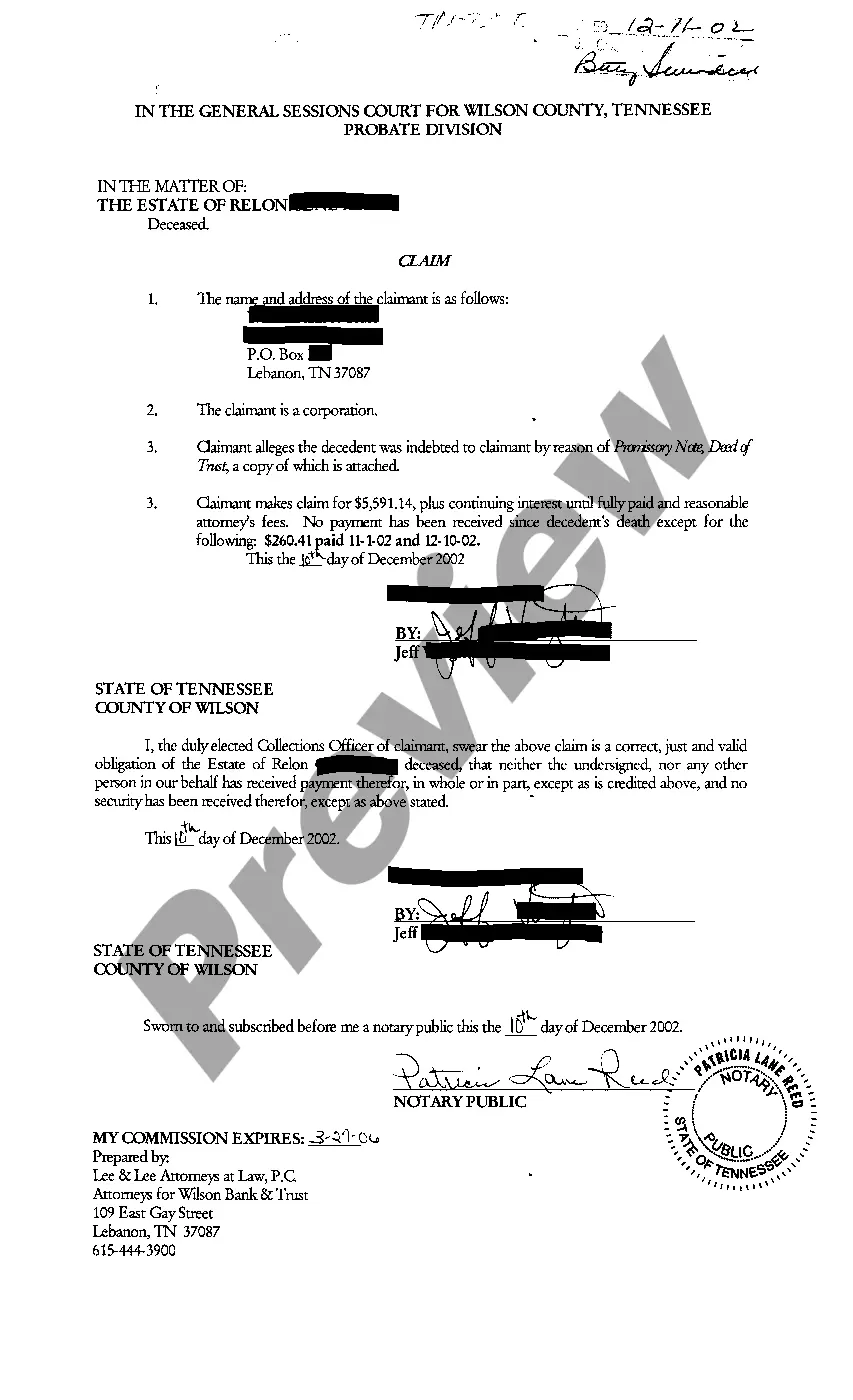

Clarksville Tennessee Claim Against Estate A Clarksville Tennessee claim against an estate refers to a legal process where an individual asserts their right to receive assets or monetary compensation from someone's estate who has passed away. It may occur when a person believes they are entitled to provisions outlined in a will or inheritance, but haven't received what they believe is rightfully theirs. There are different types of Clarksville Tennessee Claim Against Estate, including: 1. Will Contest: This claim may arise when an individual believes that the deceased's will is invalid due to issues such as lack of mental capacity, undue influence, fraud, or improper execution. Contesting a will involves presenting evidence in court to support the claim. 2. Distribution Disputes: These claims may occur when beneficiaries disagree about how the estate's assets should be divided among them. It may involve disputes over the valuation of assets, unequal distribution, or breach of fiduciary duty by the executor or personal representative. 3. Creditor Claims: In some cases, the deceased may leave behind debts that need to be settled before the estate can be distributed to beneficiaries. Creditors can file claims against the estate to recover the owed amounts, and these claims must be addressed during the probate process. 4. Estate Mismanagement: This claim arises when a beneficiary believes that the executor or personal representative of the estate has mismanaged its assets, resulting in financial loss or improper distribution. It may involve allegations of negligence, fraud, or conflicts of interest. 5. Fraudulent Transfers: If a deceased individual transferred assets to others with the intention to defraud legitimate creditors or beneficiaries, a claim can be made to challenge the validity of these transactions and recover the assets for the estate. 6. Breach of Fiduciary Duty: Executors or personal representatives have a legal obligation to act in the best interest of the estate and its beneficiaries. If they fail to fulfill their fiduciary duties, such as misappropriating assets, self-dealing, or failing to communicate with beneficiaries, a claim can be filed against them. 7. Inheritance Tax Disputes: Inheritance taxes may be levied by the state of Tennessee on certain estates. Disputes may arise regarding the proper calculation of taxes or the validity of certain exemptions or deductions claimed. Navigating a Clarksville Tennessee claim against an estate can be complex and requires a thorough understanding of state laws and regulations. It is advisable to seek the services of an experienced probate attorney who specializes in estate litigation to protect one's rights and ensure a fair resolution.

Clarksville Tennessee Claim Against Estate

Description

How to fill out Clarksville Tennessee Claim Against Estate?

If you are looking for a relevant form, it’s extremely hard to choose a better service than the US Legal Forms website – probably the most considerable online libraries. Here you can find thousands of templates for company and individual purposes by types and regions, or keywords. With the advanced search feature, finding the newest Clarksville Tennessee Claim Against Estate is as elementary as 1-2-3. Additionally, the relevance of every file is confirmed by a team of expert lawyers that on a regular basis check the templates on our website and revise them based on the newest state and county regulations.

If you already know about our platform and have a registered account, all you need to get the Clarksville Tennessee Claim Against Estate is to log in to your profile and click the Download option.

If you utilize US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have opened the sample you need. Read its explanation and make use of the Preview function (if available) to explore its content. If it doesn’t meet your requirements, utilize the Search option at the top of the screen to discover the appropriate file.

- Confirm your selection. Choose the Buy now option. Following that, select the preferred subscription plan and provide credentials to register an account.

- Make the transaction. Utilize your credit card or PayPal account to finish the registration procedure.

- Obtain the form. Indicate the format and download it on your device.

- Make changes. Fill out, modify, print, and sign the acquired Clarksville Tennessee Claim Against Estate.

Every form you save in your profile does not have an expiry date and is yours permanently. It is possible to gain access to them via the My Forms menu, so if you need to receive an extra version for enhancing or creating a hard copy, feel free to come back and download it once more anytime.

Make use of the US Legal Forms professional library to get access to the Clarksville Tennessee Claim Against Estate you were looking for and thousands of other professional and state-specific templates on one platform!