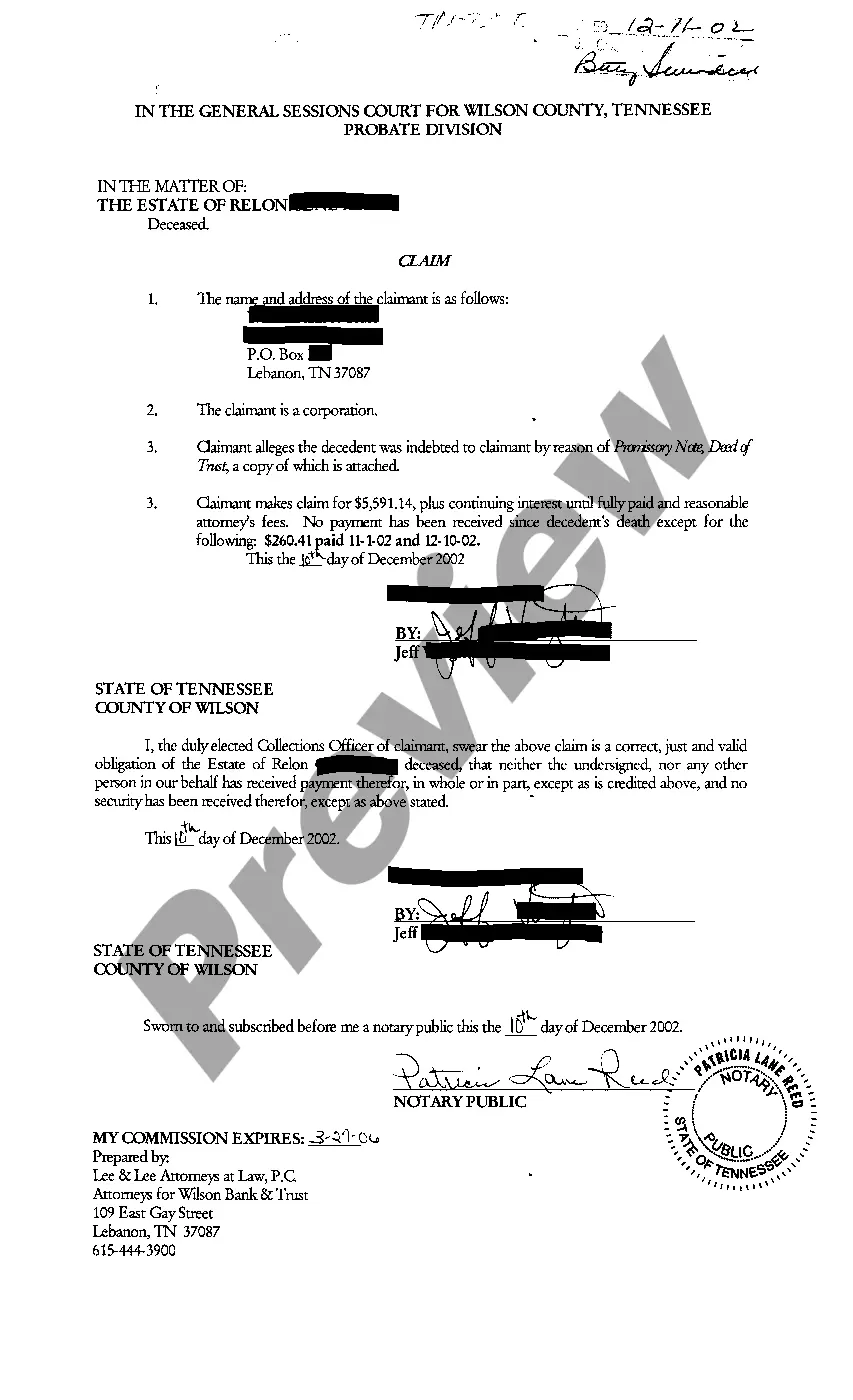

Nashville Tennessee Claim Against Estate, also referred to as Estate Administered Matters, involves legal processes related to the settlement of a deceased person's estate in Nashville, Tennessee. This claim allows individuals or entities to assert their rights or contest various aspects of the estate's administration. There are several types of claims against an estate in Nashville, Tennessee: 1. Creditor Claims: Any person or entity owed money by the deceased can file a claim against the estate to seek repayment. These claims may include outstanding debts, loans, medical bills, or any other financial obligation. 2. Beneficiary Claims: Beneficiaries designated in a will or trust document may file a claim against the estate if they believe they were wrongfully excluded or if they feel they are entitled to a larger portion of the assets. 3. Spousal Elective Share Claims: In Tennessee, a surviving spouse has the right to claim an elective share of the deceased spouse's estate, even if they were not included in the will. This claim ensures that the surviving spouse receives a fair share of the estate assets. 4. Will Contest: Any interested party, such as a family member or beneficiary, can challenge the validity of a will. They may claim that the will was executed under duress, fraud, undue influence, or that the deceased lacked testamentary capacity at the time of its creation. 5. Breach of Fiduciary Duty Claims: If an executor, administrator, or trustee fails to fulfill their fiduciary duties, beneficiaries or interested parties can file claims alleging mismanagement, embezzlement, fraud, or any other misconduct relating to the administration of the estate. 6. Disputes over Asset Distribution: Contentions may arise between beneficiaries or interested parties regarding the distribution or valuation of specific assets within the estate. These disputes can lead to claims against the estate, seeking resolution or reallocation of such assets. 7. Tax Liability Claims: The estate may owe certain state and federal taxes, including income taxes, estate taxes, or inheritance taxes. Claims against the estate can be filed to address any disputed tax liabilities or to assert the appropriate tax treatment of estate assets. In Nashville, Tennessee, these different types of claims against an estate are handled through the probate court system. It is essential for claimants to seek legal advice and assistance from experienced estate litigation attorneys who can navigate the complex legal procedures and protect their rights during the estate administration and settlement process.

Nashville Tennessee Claim Against Estate

Description

How to fill out Nashville Tennessee Claim Against Estate?

Take advantage of the US Legal Forms and obtain instant access to any form you require. Our useful platform with a large number of templates makes it easy to find and obtain almost any document sample you want. You can save, fill, and sign the Nashville Tennessee Claim Against Estate in a couple of minutes instead of browsing the web for hours searching for an appropriate template.

Utilizing our catalog is a great way to raise the safety of your record submissions. Our professional attorneys on a regular basis review all the documents to make sure that the forms are relevant for a particular region and compliant with new acts and regulations.

How do you obtain the Nashville Tennessee Claim Against Estate? If you have a profile, just log in to the account. The Download button will be enabled on all the samples you look at. Additionally, you can find all the earlier saved files in the My Forms menu.

If you don’t have a profile yet, stick to the tips below:

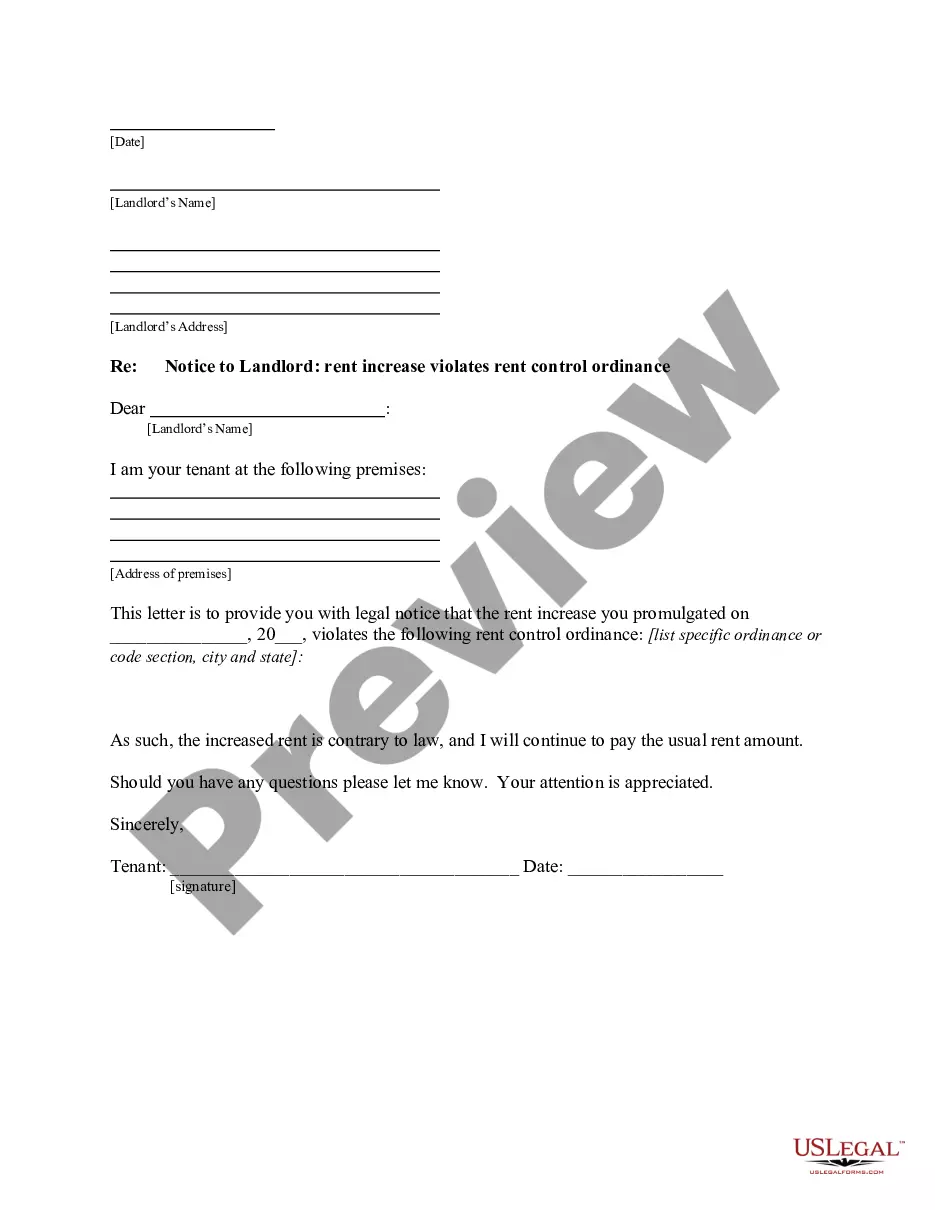

- Find the template you require. Ensure that it is the form you were seeking: verify its title and description, and take take advantage of the Preview feature if it is available. Otherwise, make use of the Search field to look for the appropriate one.

- Start the saving procedure. Select Buy Now and select the pricing plan you like. Then, sign up for an account and pay for your order utilizing a credit card or PayPal.

- Save the file. Indicate the format to get the Nashville Tennessee Claim Against Estate and change and fill, or sign it for your needs.

US Legal Forms is among the most extensive and reliable form libraries on the web. Our company is always ready to help you in virtually any legal case, even if it is just downloading the Nashville Tennessee Claim Against Estate.

Feel free to take advantage of our form catalog and make your document experience as efficient as possible!