Chattanooga Tennessee Claim Based on Judgment refers to a legal process in which a person or entity seeks to enforce or collect on a judgment that has been previously awarded by a court in Chattanooga, Tennessee. It occurs when a party who has obtained a judgment in their favor wishes to obtain the awarded financial damages or other remedies from the party against whom the judgment was rendered. In the context of legal proceedings, a judgment refers to the final ruling made by a court in a lawsuit after considering all relevant evidence and arguments presented by both parties involved. Once a judgment is obtained, the successful party becomes the judgment creditor, while the opposing party becomes the judgment debtor. The judgment creditor can then pursue various methods to collect the awarded amount, and this process is known as the enforcement of judgment. There are different types of Chattanooga Tennessee Claim Based on Judgments, which may include: 1. Monetary Judgments: These involve cases where the judgment creditor seeks to collect a specific sum of money awarded by the court. This could be for various reasons, such as unpaid debts, breach of contract, or damages resulting from personal injury or property disputes. 2. Property Liens: In some instances, a judgment creditor may opt to place a lien on the judgment debtor's property. This can prevent the debtor from selling, transferring, or refinancing the property until the judgment is satisfied. The creditor may then proceed to execute on the lien and force the sale of the property to obtain the awarded amount. 3. Wage Garnishment: When a judgment debtor fails to pay the awarded amount voluntarily, the judgment creditor may seek a wage garnishment. This allows a portion of the debtor's wages to be withheld by their employer and redirected to the creditor until the judgment is fully satisfied. 4. Bank Account Levies: In cases where the judgment debtor has sufficient funds in a bank account, the judgment creditor may obtain a court order to freeze or seize those funds. This process is known as a bank account levy and enables the creditor to collect the judgment amount directly from the debtor's bank account. 5. Third-Party Examinations: To identify additional assets or income sources of the judgment debtor, a judgment creditor may conduct third-party examinations. This involves requesting financial information about the debtor from banks, employers, or other relevant entities, which can aid in the collection process. It is important to note that the specific procedures and regulations governing Chattanooga Tennessee Claim Based on Judgment may vary, so it is crucial for individuals or entities involved to consult with a qualified attorney who specializes in civil litigation and judgment enforcement in Chattanooga, Tennessee.

Chattanooga Tennessee Claim Based On Judgment

State:

Tennessee

City:

Chattanooga

Control #:

TN-CN-29-06

Format:

PDF

Instant download

This form is available by subscription

Description

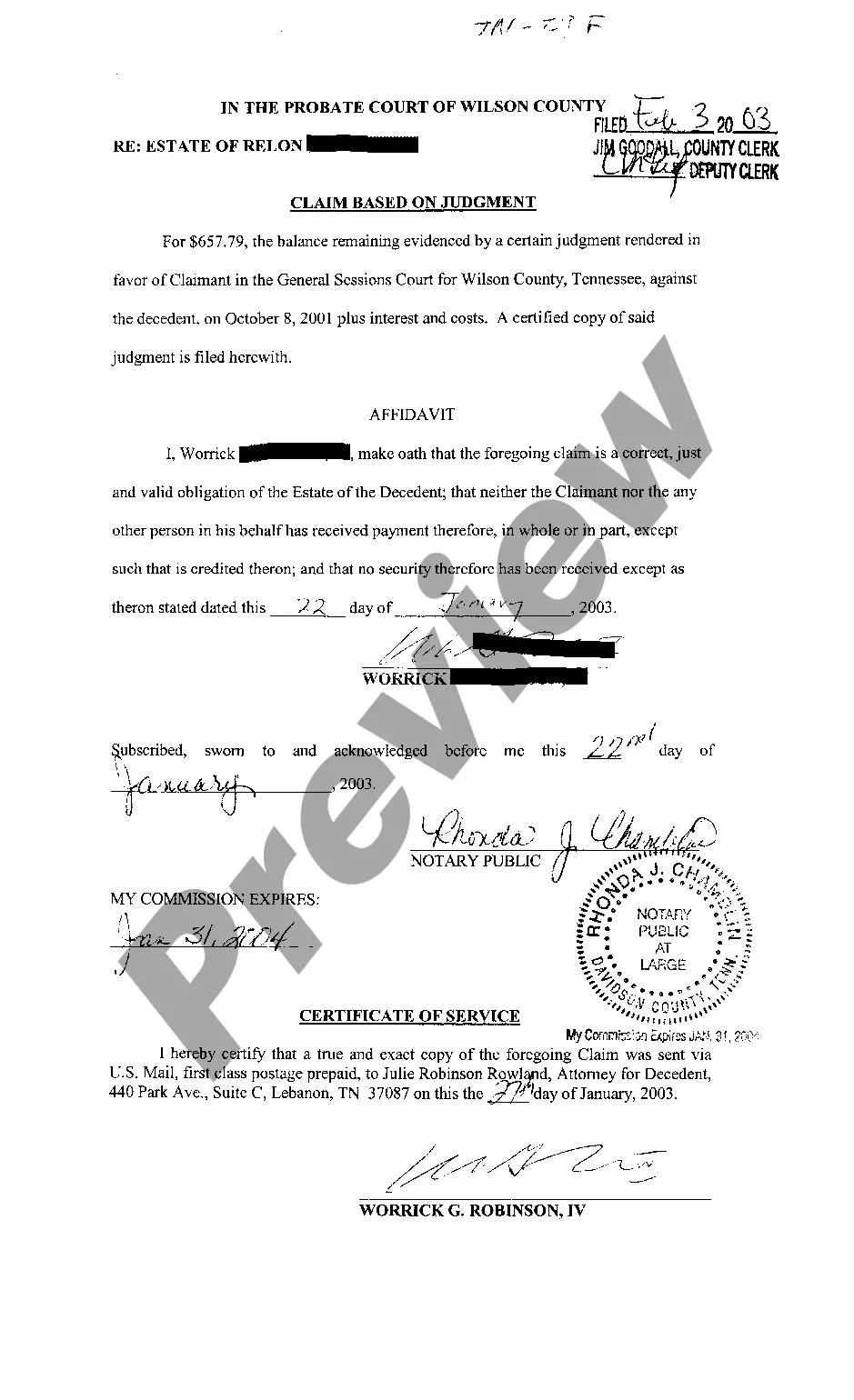

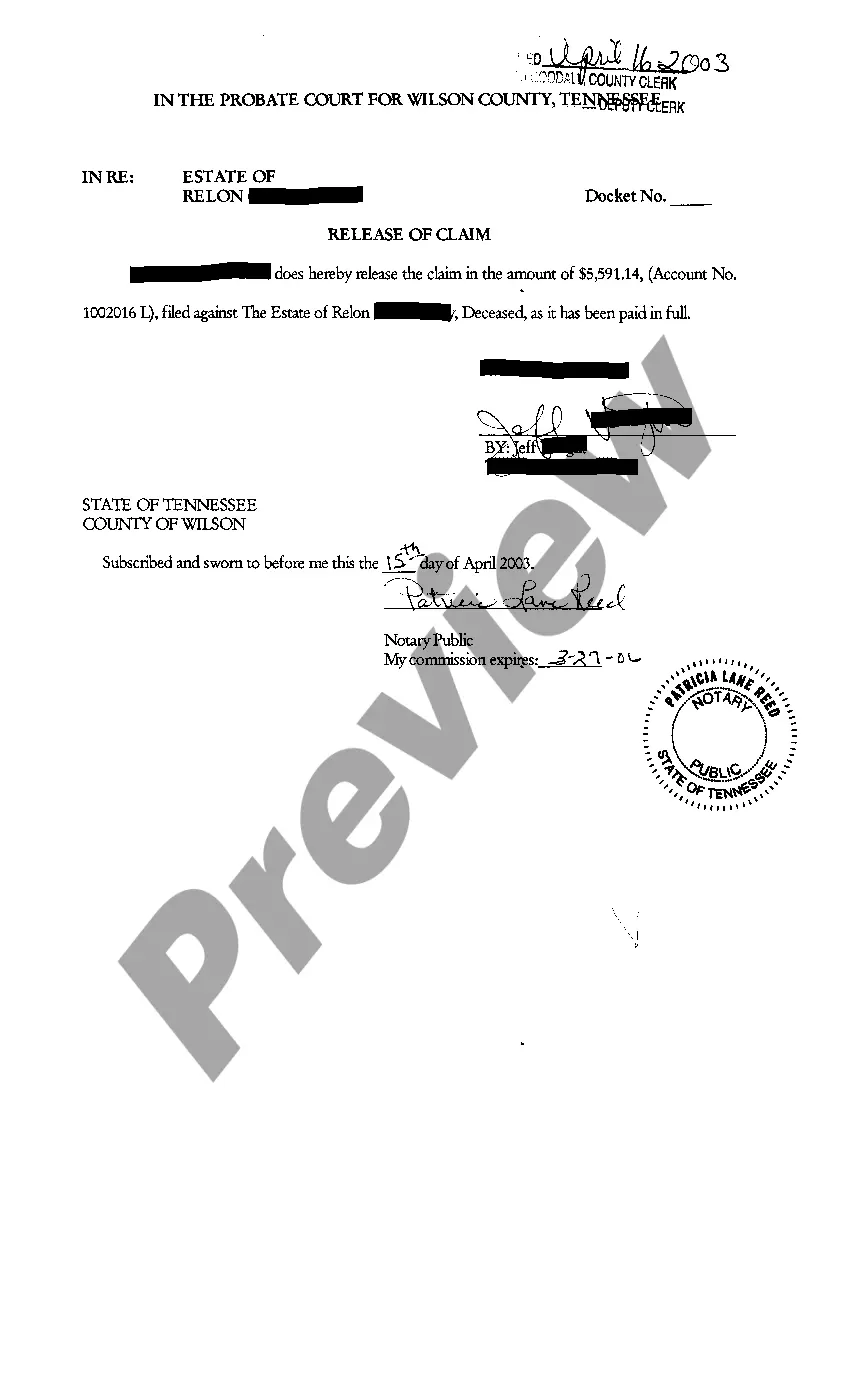

A07 Claim Based On Judgment

Chattanooga Tennessee Claim Based on Judgment refers to a legal process in which a person or entity seeks to enforce or collect on a judgment that has been previously awarded by a court in Chattanooga, Tennessee. It occurs when a party who has obtained a judgment in their favor wishes to obtain the awarded financial damages or other remedies from the party against whom the judgment was rendered. In the context of legal proceedings, a judgment refers to the final ruling made by a court in a lawsuit after considering all relevant evidence and arguments presented by both parties involved. Once a judgment is obtained, the successful party becomes the judgment creditor, while the opposing party becomes the judgment debtor. The judgment creditor can then pursue various methods to collect the awarded amount, and this process is known as the enforcement of judgment. There are different types of Chattanooga Tennessee Claim Based on Judgments, which may include: 1. Monetary Judgments: These involve cases where the judgment creditor seeks to collect a specific sum of money awarded by the court. This could be for various reasons, such as unpaid debts, breach of contract, or damages resulting from personal injury or property disputes. 2. Property Liens: In some instances, a judgment creditor may opt to place a lien on the judgment debtor's property. This can prevent the debtor from selling, transferring, or refinancing the property until the judgment is satisfied. The creditor may then proceed to execute on the lien and force the sale of the property to obtain the awarded amount. 3. Wage Garnishment: When a judgment debtor fails to pay the awarded amount voluntarily, the judgment creditor may seek a wage garnishment. This allows a portion of the debtor's wages to be withheld by their employer and redirected to the creditor until the judgment is fully satisfied. 4. Bank Account Levies: In cases where the judgment debtor has sufficient funds in a bank account, the judgment creditor may obtain a court order to freeze or seize those funds. This process is known as a bank account levy and enables the creditor to collect the judgment amount directly from the debtor's bank account. 5. Third-Party Examinations: To identify additional assets or income sources of the judgment debtor, a judgment creditor may conduct third-party examinations. This involves requesting financial information about the debtor from banks, employers, or other relevant entities, which can aid in the collection process. It is important to note that the specific procedures and regulations governing Chattanooga Tennessee Claim Based on Judgment may vary, so it is crucial for individuals or entities involved to consult with a qualified attorney who specializes in civil litigation and judgment enforcement in Chattanooga, Tennessee.

Free preview

How to fill out Chattanooga Tennessee Claim Based On Judgment?

If you’ve already used our service before, log in to your account and download the Chattanooga Tennessee Claim Based On Judgment on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your file:

- Make certain you’ve found a suitable document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Chattanooga Tennessee Claim Based On Judgment. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional needs!