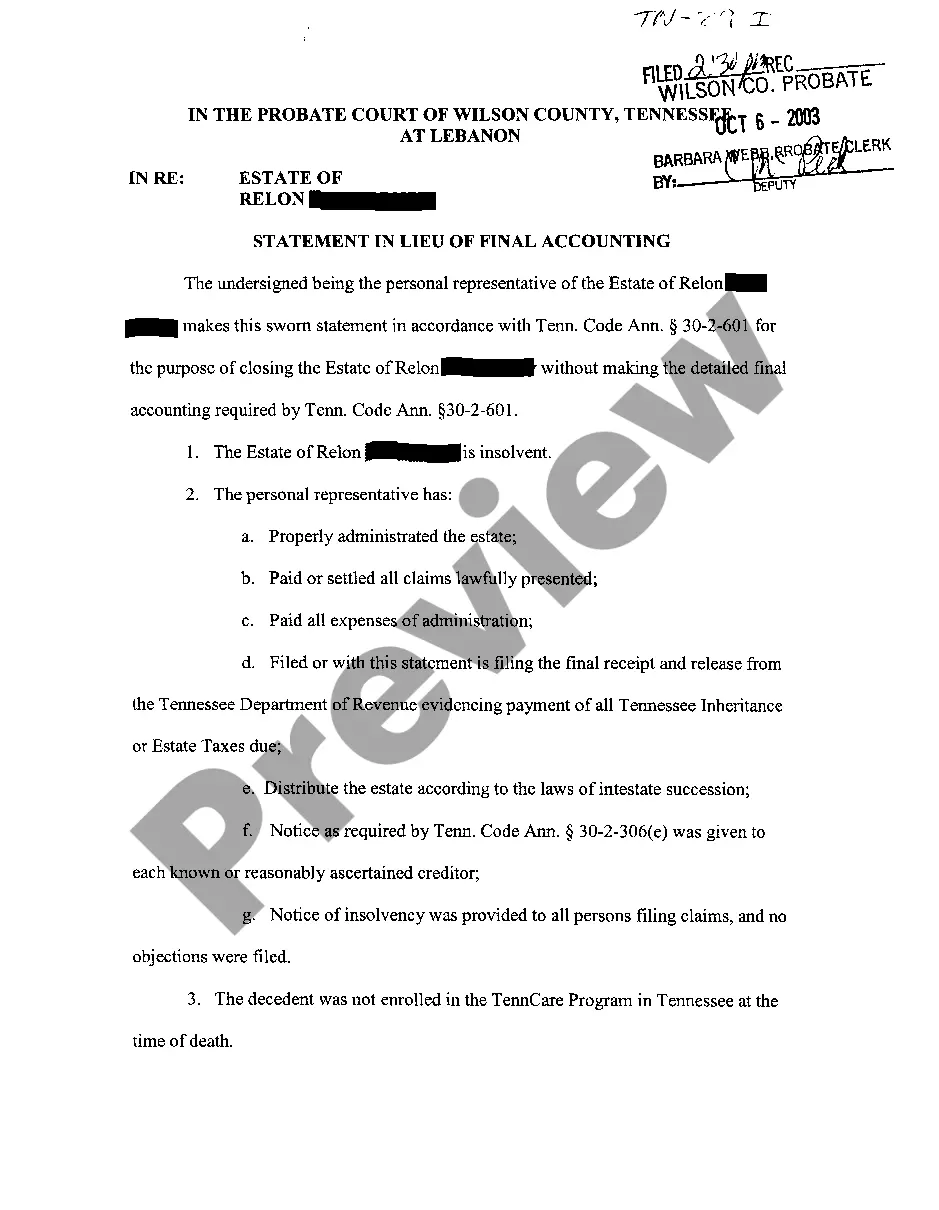

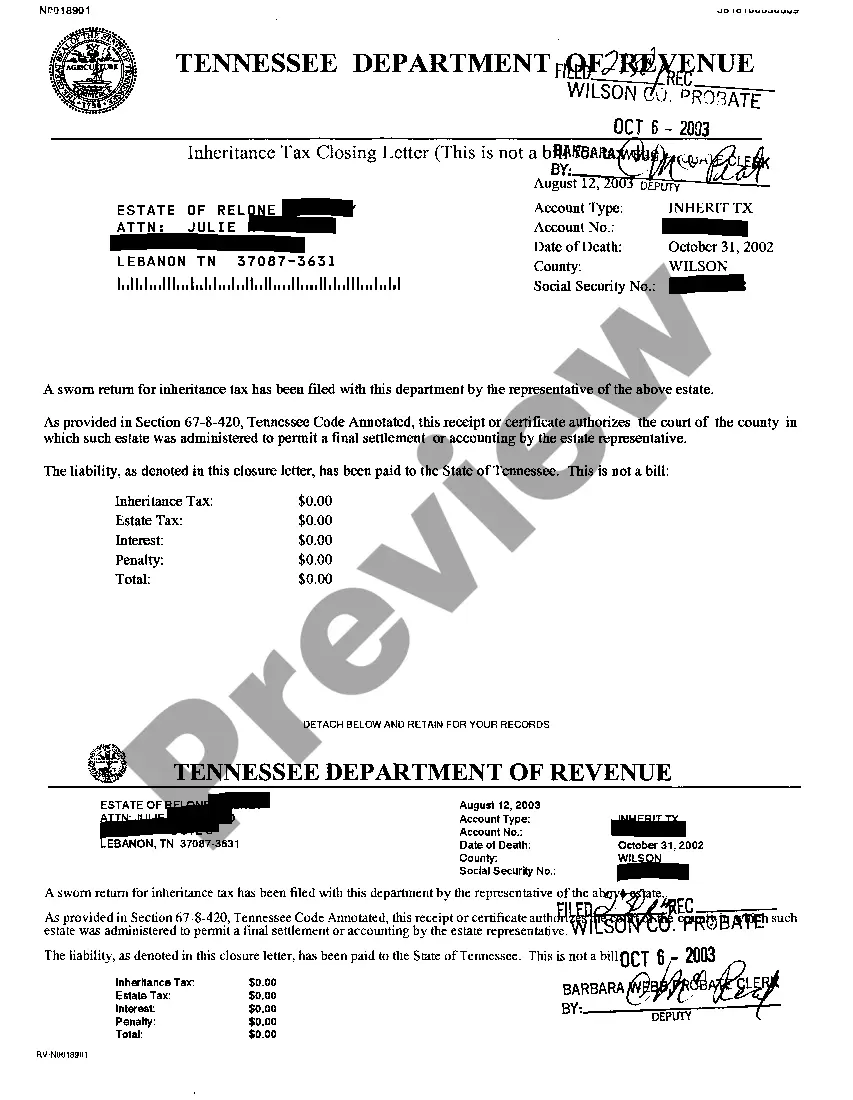

The Chattanooga Tennessee Statement In Lieu of Final Accounting is a legal document that serves as an alternative to a final accounting report typically required in the probate process. It provides a comprehensive summary of an estate's financial transactions and distributions, allowing for a simplified approach to estate administration. This statement is particularly significant when dealing with smaller estates or situations where a traditional final accounting may be overly burdensome or time-consuming. By electing to file a Statement In Lieu of Final Accounting, individuals or executors can efficiently settle an estate, saving valuable time and resources. Keywords: Chattanooga Tennessee, Statement In Lieu of Final Accounting, legal document, probate process, estate administration, financial transactions, distributions, simplified approach, smaller estates, traditional final accounting, executors, settle estate, time-consuming, resources. Different Types of Chattanooga Tennessee Statement In Lieu of Final Accounting: 1. Individual Statement In Lieu of Final Accounting: This type relates to a single individual who wishes to administer their estate without the need for a traditional final accounting. It is commonly used when the estate value is relatively small or when the deceased has specifically chosen this alternative method. 2. Executor's Statement In Lieu of Final Accounting: Executors, who are appointed to manage and distribute the assets of an estate, may file this type of statement if they believe it is a more appropriate and efficient way to settle the estate. It requires the executor to provide a comprehensive overview of the estate's financial activities and distributions. 3. Joint Statement In Lieu of Final Accounting: This category refers to situations where multiple beneficiaries or co-executors collectively choose to file a Statement In Lieu of Final Accounting. This type allows for simplified estate administration by consolidating financial information and streamlining the distribution process. 4. Small Estate Statement In Lieu of Final Accounting: In cases where the estate's value falls below a specific threshold defined by Tennessee law, individuals or executors may file this type of statement. It is designed to simplify the probate process for estates of minimal value, minimizing administrative burden and costs. Keywords: Chattanooga Tennessee, Statement In Lieu of Final Accounting, individual, executor, joint, small estate, estate value, beneficiaries, co-executors, simplified administration, financial activities, distribution process, probate process, administrative burden, costs.

Chattanooga Tennessee Statement In Lieu of Final Accounting

Description

How to fill out Chattanooga Tennessee Statement In Lieu Of Final Accounting?

We always strive to reduce or avoid legal damage when dealing with nuanced legal or financial affairs. To do so, we sign up for legal solutions that, as a rule, are extremely costly. However, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based library of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of a lawyer. We provide access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Chattanooga Tennessee Statement In Lieu of Final Accounting or any other document quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again in the My Forms tab.

The process is equally easy if you’re unfamiliar with the website! You can create your account in a matter of minutes.

- Make sure to check if the Chattanooga Tennessee Statement In Lieu of Final Accounting complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Chattanooga Tennessee Statement In Lieu of Final Accounting is suitable for your case, you can select the subscription option and proceed to payment.

- Then you can download the form in any available file format.

For over 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!