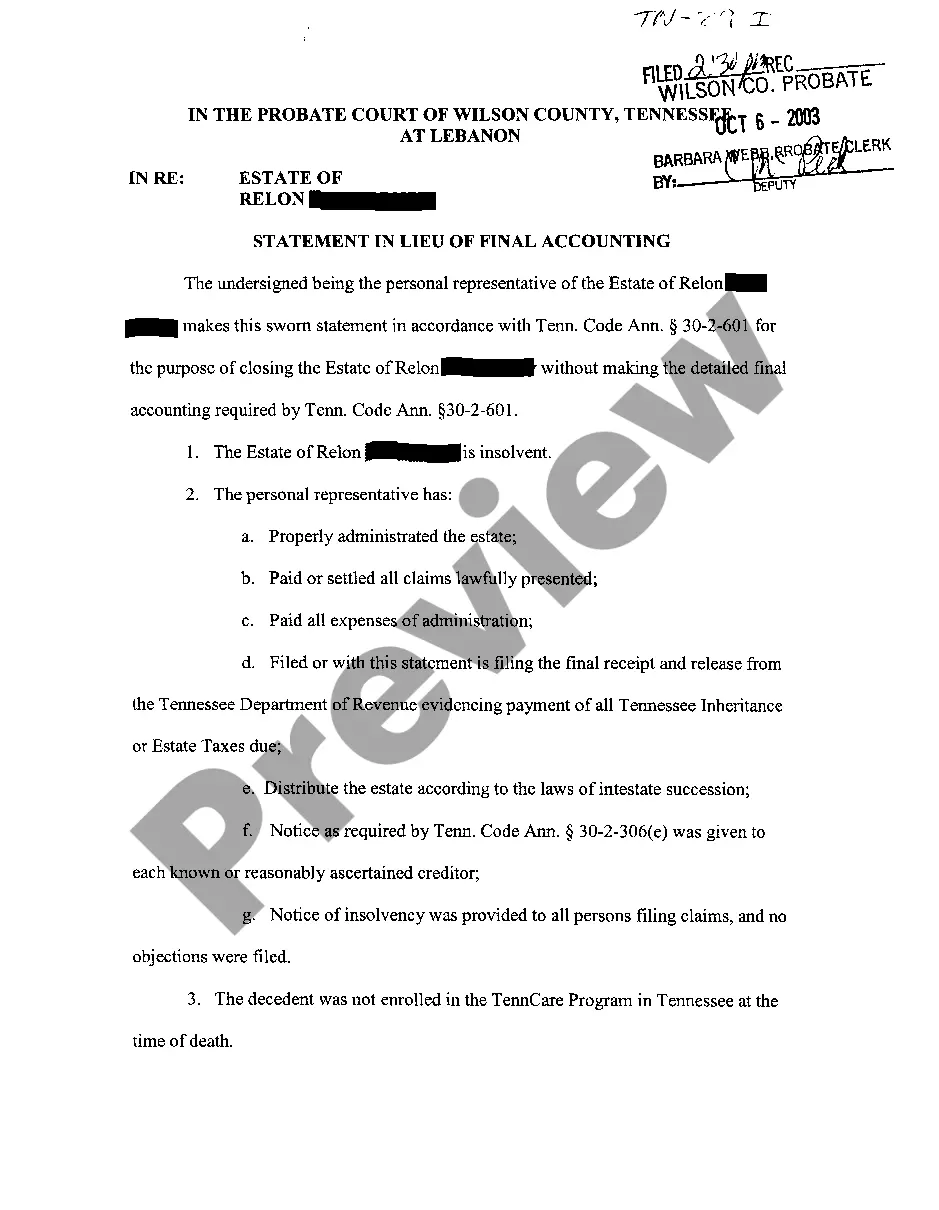

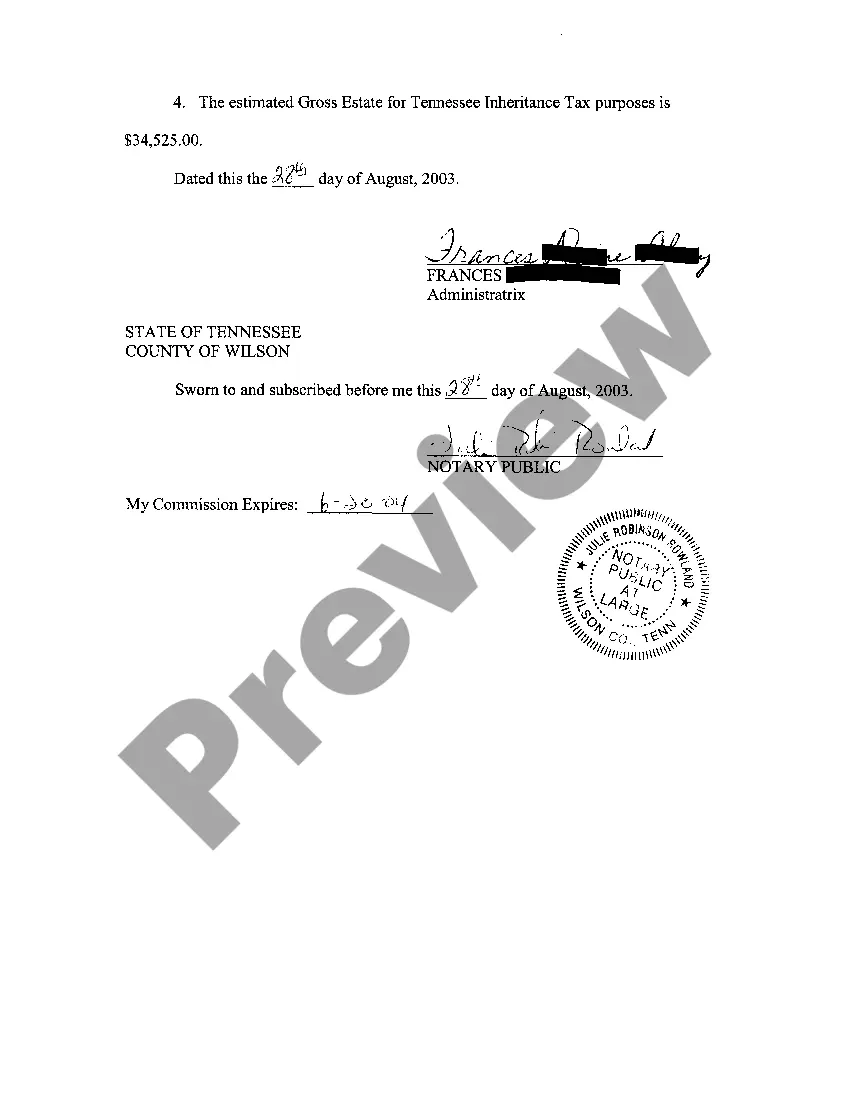

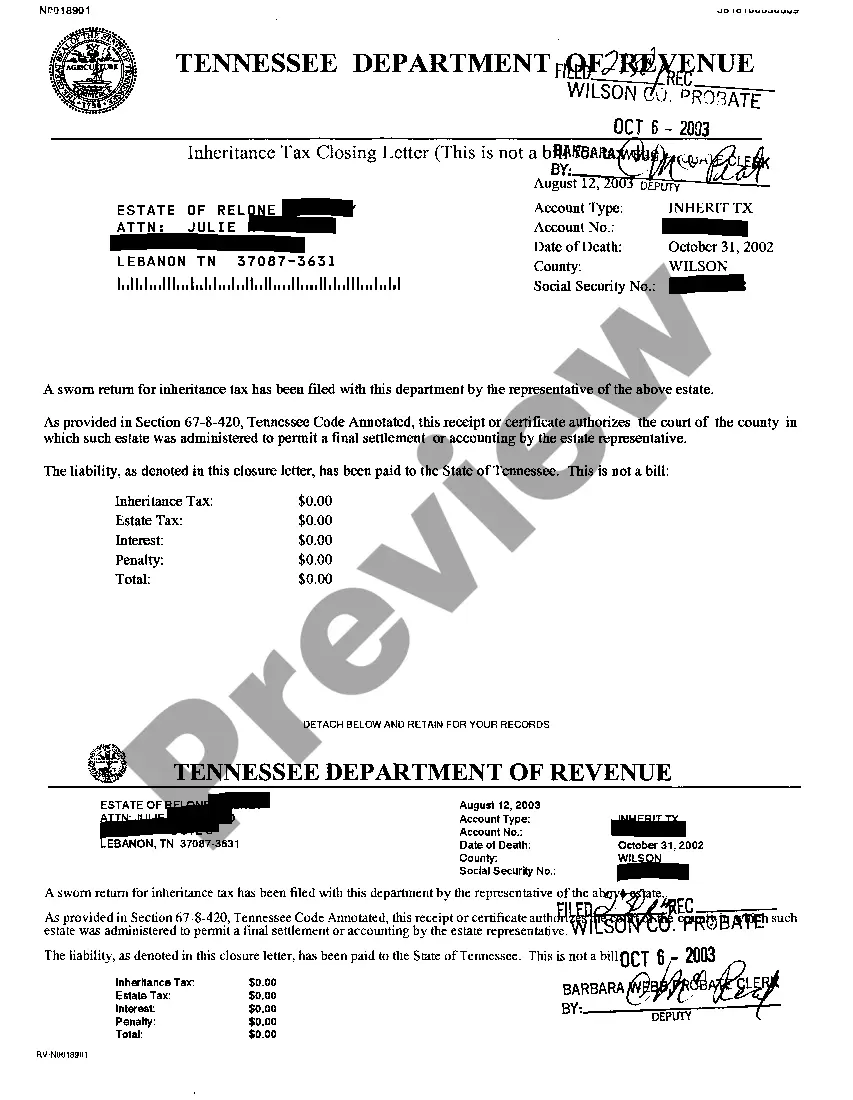

In Memphis, Tennessee, a Statement In Lieu of Final Accounting refers to a legal document that can be filed in certain circumstances, typically for small estates or when a formal probate administration is not required. This statement allows for the efficient distribution of assets and the settling of the decedent's estate without going through the entire probate process. The purpose of a Statement In Lieu of Final Accounting is to provide a detailed overview of the assets and debts of the deceased individual, as well as any additional relevant information that may be required by the court. It serves as a substitute for a formal final accounting that is typically prepared in an extensive probate administration. However, it is important to note that this statement is not applicable in all situations, and the specific criteria for eligibility may differ depending on the jurisdiction. By filing a Statement In Lieu of Final Accounting, the executor or personal representative of the estate can present a summary of all the decedent's assets, such as bank accounts, investments, properties, and personal belongings, as well as any outstanding debts or liabilities. Additionally, the statement should include information about the distribution of these assets to the beneficiaries, if applicable. This simplified alternative to a full accounting is designed to save time and resources, particularly when the estate involves minimal assets or the distribution is straightforward. It provides an expedited method for closing the estate, granting the necessary approvals, and ensuring that the beneficiaries receive their designated shares. In Memphis, Tennessee, there are no distinct types of Statements In Lieu of Final Accounting, as the concept refers to a standardized process for settling smaller estates or those with minimal complexities. However, it's important to consult with an attorney or a legal expert familiar with local laws to determine if this option is appropriate for a specific estate.

Memphis Tennessee Statement In Lieu of Final Accounting

State:

Tennessee

City:

Memphis

Control #:

TN-CN-29-09

Format:

PDF

Instant download

This form is available by subscription

Description

A10 Statement In Lieu of Final Accounting

In Memphis, Tennessee, a Statement In Lieu of Final Accounting refers to a legal document that can be filed in certain circumstances, typically for small estates or when a formal probate administration is not required. This statement allows for the efficient distribution of assets and the settling of the decedent's estate without going through the entire probate process. The purpose of a Statement In Lieu of Final Accounting is to provide a detailed overview of the assets and debts of the deceased individual, as well as any additional relevant information that may be required by the court. It serves as a substitute for a formal final accounting that is typically prepared in an extensive probate administration. However, it is important to note that this statement is not applicable in all situations, and the specific criteria for eligibility may differ depending on the jurisdiction. By filing a Statement In Lieu of Final Accounting, the executor or personal representative of the estate can present a summary of all the decedent's assets, such as bank accounts, investments, properties, and personal belongings, as well as any outstanding debts or liabilities. Additionally, the statement should include information about the distribution of these assets to the beneficiaries, if applicable. This simplified alternative to a full accounting is designed to save time and resources, particularly when the estate involves minimal assets or the distribution is straightforward. It provides an expedited method for closing the estate, granting the necessary approvals, and ensuring that the beneficiaries receive their designated shares. In Memphis, Tennessee, there are no distinct types of Statements In Lieu of Final Accounting, as the concept refers to a standardized process for settling smaller estates or those with minimal complexities. However, it's important to consult with an attorney or a legal expert familiar with local laws to determine if this option is appropriate for a specific estate.

Free preview

How to fill out Memphis Tennessee Statement In Lieu Of Final Accounting?

If you’ve already used our service before, log in to your account and save the Memphis Tennessee Statement In Lieu of Final Accounting on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your file:

- Make sure you’ve located a suitable document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Memphis Tennessee Statement In Lieu of Final Accounting. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!