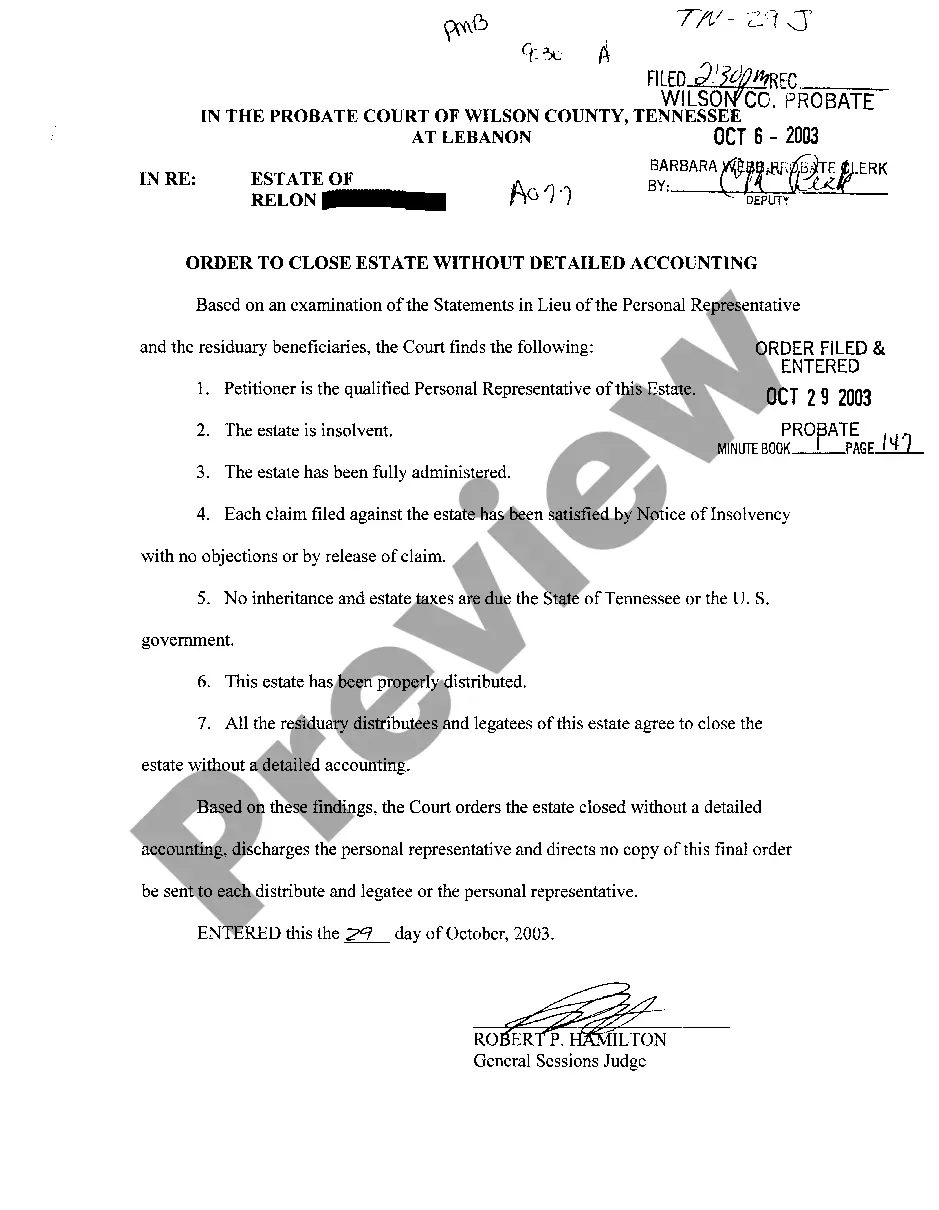

Title: The Clarksville Tennessee Order to Close Estate Without Detailed Accounting: A Comprehensive Overview Introduction: Understanding the intricacies of the Clarksville Tennessee Order to Close Estate Without Detailed Accounting is essential for anyone involved in administering an estate. This detailed description aims to outline the process, requirements, and various types of situations where this order becomes relevant. 1. Defining the Clarksville Tennessee Order to Close Estate Without Detailed Accounting: The Clarksville Tennessee Order to Close Estate Without Detailed Accounting is a legal provision that allows executors or administrators to settle an estate's final affairs and distribute assets without preparing a detailed accounting report. 2. Situations that may necessitate this order: a) Small estates: When the estate possesses a limited number of assets and debts, a detailed accounting may not be required. The exact monetary threshold may vary by jurisdiction. b) No disputes or unresolved claims: If all beneficiaries agree to waive a detailed accounting, and there are no legal claims against the estate, this order may be pursued. 3. Requirements to obtain the order: a) Petition filing: The executor or administrator must prepare and file a petition with the appropriate court, specifically requesting the Order to Close Estate Without Detailed Accounting. b) Notice to interested parties: All interested parties, such as beneficiaries and creditors, must be informed about the petition and given an opportunity to object. c) Demonstration of good faith and fairness: The petitioner must exhibit that the final distribution is being carried out impartially and without any fraudulent intent. 4. Benefits of the Order to Close Estate Without Detailed Accounting: a) Quicker settlement: Avoiding a detailed accounting process can potentially expedite the closing of an estate. b) Reduced costs: By forgoing a detailed accounting report, the estate can save on professional fees and expenses associated with the preparation of such reports. c) Simplicity: This order offers a simpler alternative for settling straightforward estates, eliminating unnecessary complications. Types of Clarksville Tennessee Order to Close Estate Without Detailed Accounting: 1. By Consent: A situation where all beneficiaries unanimously agree not to pursue a detailed accounting. 2. Small estate exemption: When the value of the estate falls below a certain threshold, allowing for a simplified process without a detailed accounting. Conclusion: Understanding the Clarksville Tennessee Order to Close Estate Without Detailed Accounting is crucial for executors and administrators when settling an estate. Its utilization can expedite distribution, reduce costs, and simplify the overall estate administration process, making it an advantageous option in certain situations.

Clarksville Tennessee Order To Close Estate Without Detailed Accounting

Description

How to fill out Clarksville Tennessee Order To Close Estate Without Detailed Accounting?

Regardless of social or professional status, filling out legal documents is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for a person without any legal background to create this sort of paperwork from scratch, mostly due to the convoluted terminology and legal subtleties they entail. This is where US Legal Forms comes to the rescue. Our platform offers a massive catalog with more than 85,000 ready-to-use state-specific documents that work for pretty much any legal situation. US Legal Forms also is a great asset for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

Whether you need the Clarksville Tennessee Order To Close Estate Without Detailed Accounting or any other paperwork that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Clarksville Tennessee Order To Close Estate Without Detailed Accounting in minutes using our trusted platform. In case you are already a subscriber, you can go ahead and log in to your account to get the needed form.

However, in case you are a novice to our library, make sure to follow these steps prior to obtaining the Clarksville Tennessee Order To Close Estate Without Detailed Accounting:

- Ensure the form you have found is good for your location because the rules of one state or county do not work for another state or county.

- Preview the form and read a short description (if available) of cases the document can be used for.

- In case the form you chosen doesn’t meet your needs, you can start over and search for the necessary document.

- Click Buy now and choose the subscription option you prefer the best.

- Log in to your account credentials or create one from scratch.

- Choose the payment gateway and proceed to download the Clarksville Tennessee Order To Close Estate Without Detailed Accounting as soon as the payment is completed.

You’re all set! Now you can go ahead and print out the form or complete it online. In case you have any issues getting your purchased documents, you can quickly access them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.

Form popularity

FAQ

While there is no strict deadline to close an estate, it's advisable to do so within one year. Delays can lead to complications or additional court requirements. A Clarksville Tennessee Order To Close Estate Without Detailed Accounting can be an efficient path to quick closure, especially when managing uncomplicated estates.

Closing an estate with no assets is possible and often straightforward. You may need to file a simple document in probate court stating there are no assets to distribute. Utilizing a Clarksville Tennessee Order To Close Estate Without Detailed Accounting can simplify the paperwork and ensure compliance with local regulations.

In Tennessee, you typically have four months from the date the estate is opened to file a claim against it. This window is crucial for ensuring that your claim is considered. If you’re navigating this process, an option like a Clarksville Tennessee Order To Close Estate Without Detailed Accounting can facilitate smoother transitions.

Yes, Tennessee law sets a reasonable timeframe for settling estates. While the law doesn't specify an exact deadline for all cases, it's recommended to complete the process within 12 months. Using a Clarksville Tennessee Order To Close Estate Without Detailed Accounting can help avoid delays and complications.

In general, you should aim to settle an estate within one year after the date of death. However, the exact timeframe can depend on specific circumstances. If you're considering a Clarksville Tennessee Order To Close Estate Without Detailed Accounting, this method can help streamline the process, especially if there are no complex issues to address.

Final expenses for an estate encompass costs incurred during the estate's management, such as funeral expenses, legal fees, and taxes. It’s important to document these expenses clearly as they will affect the overall estate value. Accurate tracking of final expenses ensures compliance with legal obligations and effective distribution of remaining assets. For assistance with these expenses, consider following procedures outlined in the Clarksville Tennessee Order To Close Estate Without Detailed Accounting.

Filling out an estate document requires you to provide accurate details about the deceased's assets, liabilities, and any transactions made. You will need to include names, addresses, and values to ensure everything is transparent for probate purposes. To assist you, platforms like US Legal Forms offer user-friendly templates that cater specifically to the Clarksville Tennessee Order To Close Estate Without Detailed Accounting.

To conduct final estate accounting, compile all financial data to create a clear picture of the estate's financial situation. Begin with assets, then list any debts and administrative costs, ensuring accurate totals for all entries. It may help to create a spreadsheet for organization. Moreover, the Clarksville Tennessee Order To Close Estate Without Detailed Accounting provides reliable templates and guidance that can simplify this procedure.

Preparing a final accounting for an estate involves calculating all income and expenses from the estate's inception to its final settlement. Start by reviewing bank statements and financial documents, documenting each transaction in a systematic manner. It's essential to track any distributions made to beneficiaries. For a thorough guide, check out resources related to the Clarksville Tennessee Order To Close Estate Without Detailed Accounting.

To prepare final accounting, begin by gathering all financial records relevant to the estate. This includes income statements, bills, and receipts for each asset or liability. Once you have gathered this information, categorize each entry to present a clear overview. If you're unsure how to structure this, consider using the Clarksville Tennessee Order To Close Estate Without Detailed Accounting, which simplifies this process.