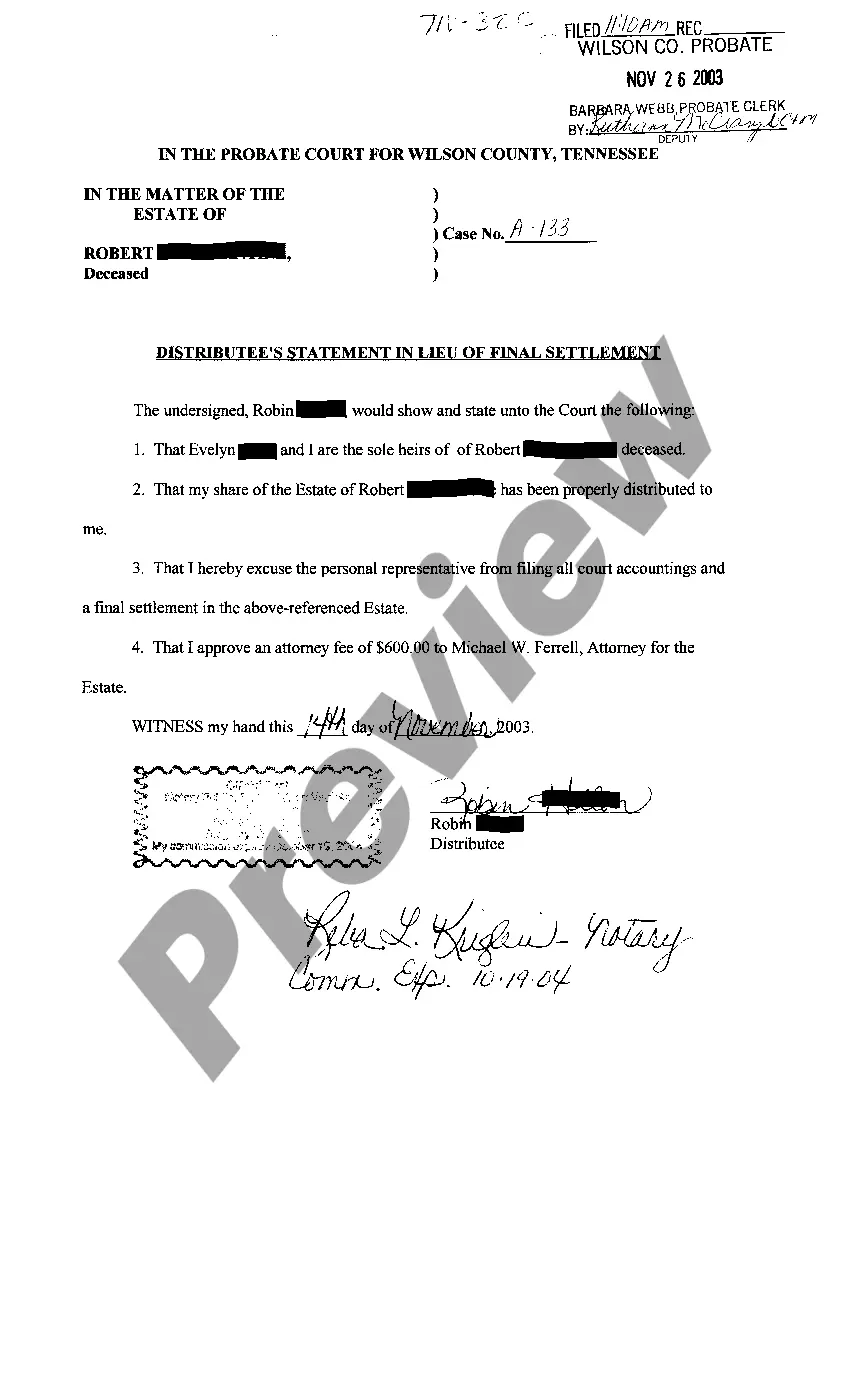

In Clarksville, Tennessee, a Distribute Statement In Lieu of Final Settlement is a legal document used in certain circumstances to clarify the settlement of trust or estate matters. This statement serves as an alternative to a Final Settlement, providing a comprehensive breakdown of how assets, debts, and distributions are allocated among beneficiaries or heirs. One type of Clarksville Tennessee Distribute Statement In Lieu of Final Settlement is the trust distribution statement. This document outlines the distribution of assets from a trust to the beneficiaries, including real estate, investments, cash, and personal property. It ensures that each beneficiary receives their designated share while accounting for any outstanding debts or taxes. Another type is the estate distribution statement, which specifically addresses the distribution of assets from an estate after someone's passing. This statement provides a transparent overview of how the deceased's property, bank accounts, investments, and other assets are divided among the heirs as per the provisions of the will or state laws of intestacy. Important keywords to consider while discussing the Clarksville Tennessee Distribute Statement In Lieu of Final Settlement could include: 1. Trust settlement: This refers to the process of closing a trust and distributing assets to beneficiaries according to the terms of the trust agreement. 2. Estate settlement: It involves winding up an estate's affairs after someone's death, ensuring the proper distribution of assets among the designated heirs. 3. Beneficiaries: Individuals or entities designated to receive a portion of the trust or estate's assets. 4. Assets: Any property, investments, or funds included in the trust or estate. 5. Debts: Outstanding obligations, such as mortgages, loans, or unpaid taxes, that need to be settled before distribution. 6. Taxes: Applicable taxes, such as estate taxes or inheritance taxes, which might affect the final distribution to beneficiaries. 7. Probate: The legal process of validating a will, assessing assets, paying debts, and distributing the remaining property to heirs. 8. Intestate: When someone passes away without a valid will, the state's laws of intestacy govern the distribution of their estate. 9. Personal representative: An individual appointed to administer the affairs of a testate estate or the executor in an intestate estate. In summary, the Distribute Statement In Lieu of Final Settlement in Clarksville, Tennessee, is an important legal document used to ensure a transparent and fair distribution of assets to beneficiaries or heirs. Whether for a trust or estate, this statement provides a comprehensive breakdown of how assets are distributed and debts settled.

Clarksville Tennessee Distribute Statement In Lieu of Final Settlement

Description

How to fill out Clarksville Tennessee Distribute Statement In Lieu Of Final Settlement?

Regardless of social or professional status, filling out legal forms is an unfortunate necessity in today’s professional environment. Too often, it’s practically impossible for someone with no legal background to create such paperwork cfrom the ground up, mainly because of the convoluted jargon and legal nuances they come with. This is where US Legal Forms can save the day. Our service provides a massive collection with over 85,000 ready-to-use state-specific forms that work for almost any legal case. US Legal Forms also is a great resource for associates or legal counsels who want to save time utilizing our DYI forms.

No matter if you require the Clarksville Tennessee Distribute Statement In Lieu of Final Settlement or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Clarksville Tennessee Distribute Statement In Lieu of Final Settlement quickly employing our reliable service. If you are presently a subscriber, you can go ahead and log in to your account to download the needed form.

However, in case you are unfamiliar with our library, make sure to follow these steps before obtaining the Clarksville Tennessee Distribute Statement In Lieu of Final Settlement:

- Ensure the form you have chosen is suitable for your area since the regulations of one state or county do not work for another state or county.

- Review the document and read a brief outline (if provided) of scenarios the document can be used for.

- In case the form you selected doesn’t meet your needs, you can start again and look for the necessary form.

- Click Buy now and pick the subscription plan that suits you the best.

- utilizing your credentials or register for one from scratch.

- Select the payment method and proceed to download the Clarksville Tennessee Distribute Statement In Lieu of Final Settlement as soon as the payment is done.

You’re good to go! Now you can go ahead and print the document or fill it out online. In case you have any issues getting your purchased forms, you can easily access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.