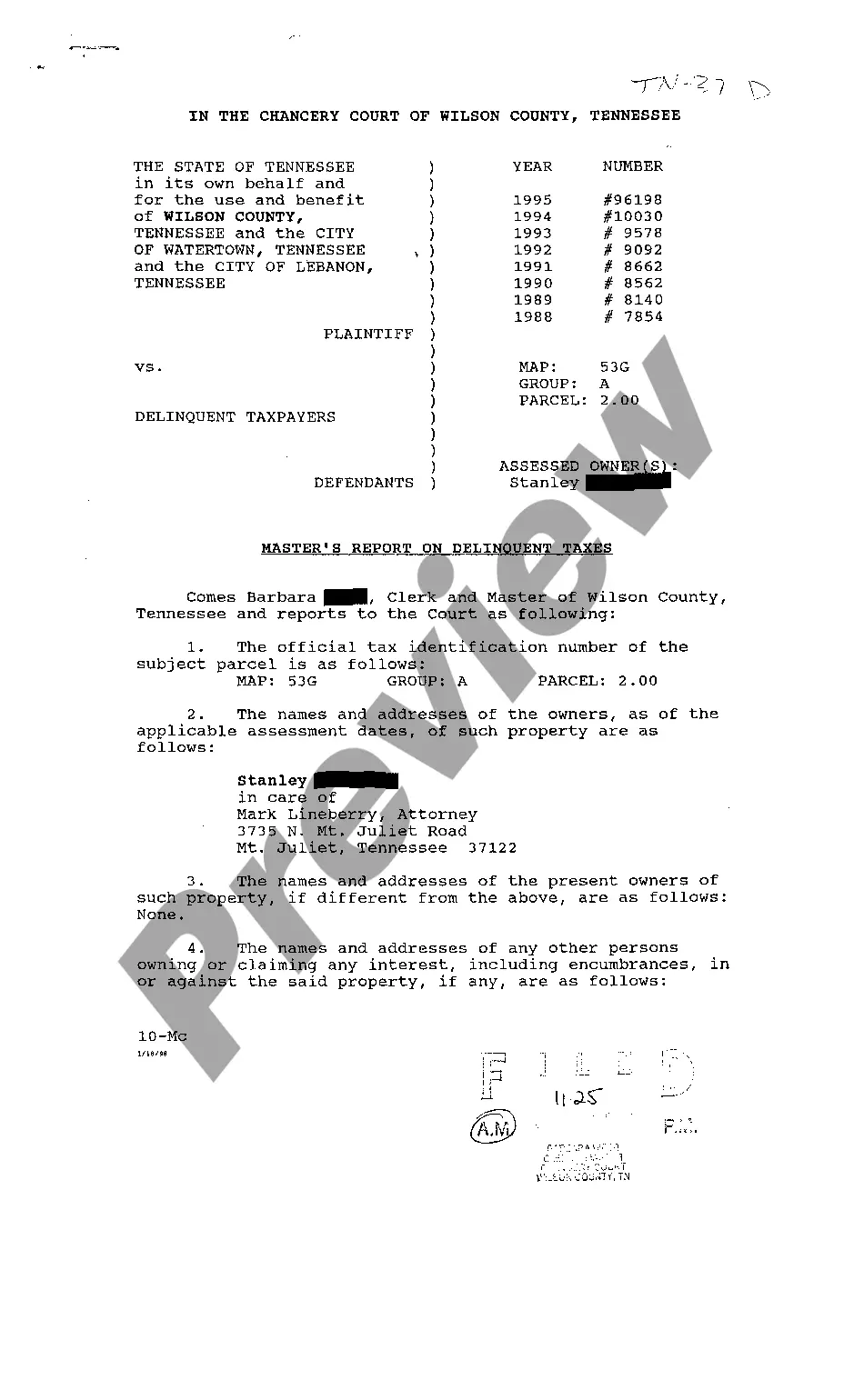

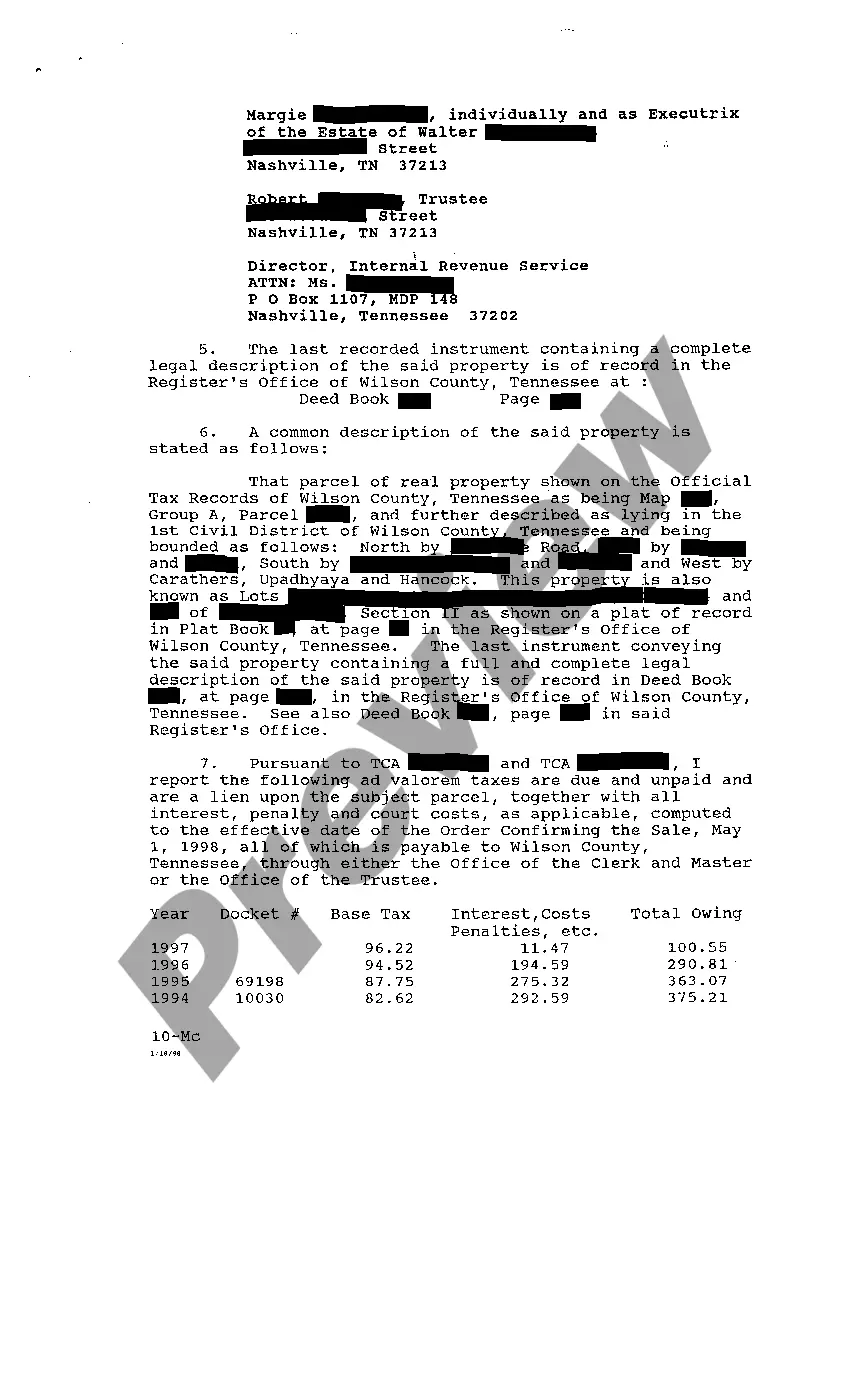

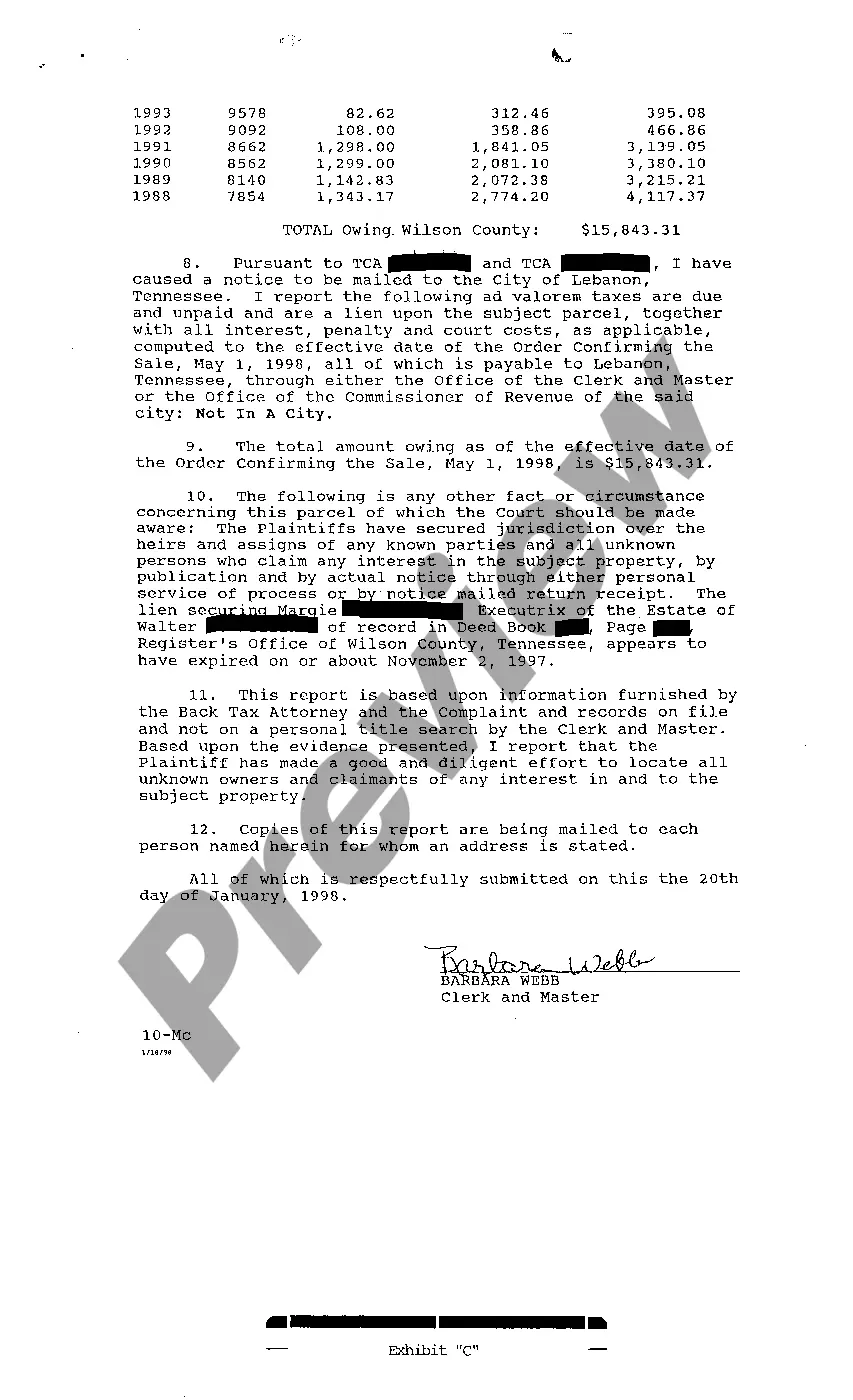

The Knoxville Tennessee Masters Report of Delinquent Taxes is a comprehensive document that provides detailed information regarding unpaid property taxes in Knoxville, Tennessee. It serves as an essential resource for homeowners, real estate investors, and local authorities who need to stay informed about outstanding tax obligations in the area. The report contains an extensive list of properties within Knoxville that have accumulated delinquent taxes. It includes relevant details such as the property address, owner's name, tax year(s) for which payments are overdue, and the outstanding amount owed. By referencing this report, individuals can readily identify properties that are at risk of foreclosure or sale due to unpaid taxes. This vital document plays a central role in upholding the financial integrity of Knoxville's tax system. Municipal authorities rely on the Masters Report of Delinquent Taxes to monitor and manage the collection of unpaid property taxes. It enables them to take necessary actions to recover the outstanding amounts, such as initiating legal proceedings or auctioning the properties to satisfy the debts. Moreover, the Knoxville Tennessee Masters Report of Delinquent Taxes is not limited to a single type or category. Instead, it covers all properties, including residential, commercial, and industrial, that have fallen behind on their tax payments. This ensures that the report encompasses a diverse range of real estate assets, catering to the various stakeholders interested in Knoxville's tax records. Real estate investors can leverage the information within this report to identify potential investment opportunities. By examining the properties listed with delinquent taxes, investors can determine which properties might be available for purchase at reduced prices. Acquiring such properties can yield substantial returns, as long as investors navigate the necessary legal procedures for property acquisition and tax settlement. Homeowners can also benefit from the Knoxville Tennessee Masters Report of Delinquent Taxes. By regularly reviewing the report, they can ensure their properties are not mistakenly listed or subject to incorrect tax obligations. Additionally, homeowners can use the report to identify neighboring properties that may be experiencing financial difficulties, potentially impacting the value or desirability of their own homes. Overall, the Knoxville Tennessee Masters Report of Delinquent Taxes is an invaluable tool for keeping track of outstanding property tax obligations within Knoxville. Its comprehensive nature covers various property types and provides crucial information for individuals, investors, and authorities to make informed decisions regarding tax collection and property ownership in the city.

Knoxville Tennessee Masters Report of Delinquent Taxes

Description

How to fill out Knoxville Tennessee Masters Report Of Delinquent Taxes?

Are you looking for a reliable and inexpensive legal forms supplier to buy the Knoxville Tennessee Masters Report of Delinquent Taxes? US Legal Forms is your go-to solution.

Whether you need a basic arrangement to set regulations for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and framed in accordance with the requirements of separate state and county.

To download the document, you need to log in account, locate the required template, and click the Download button next to it. Please keep in mind that you can download your previously purchased document templates anytime from the My Forms tab.

Is the first time you visit our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Knoxville Tennessee Masters Report of Delinquent Taxes conforms to the laws of your state and local area.

- Read the form’s details (if available) to find out who and what the document is intended for.

- Start the search over if the template isn’t good for your specific scenario.

Now you can register your account. Then choose the subscription option and proceed to payment. Once the payment is done, download the Knoxville Tennessee Masters Report of Delinquent Taxes in any available file format. You can return to the website at any time and redownload the document free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about wasting hours learning about legal papers online once and for all.