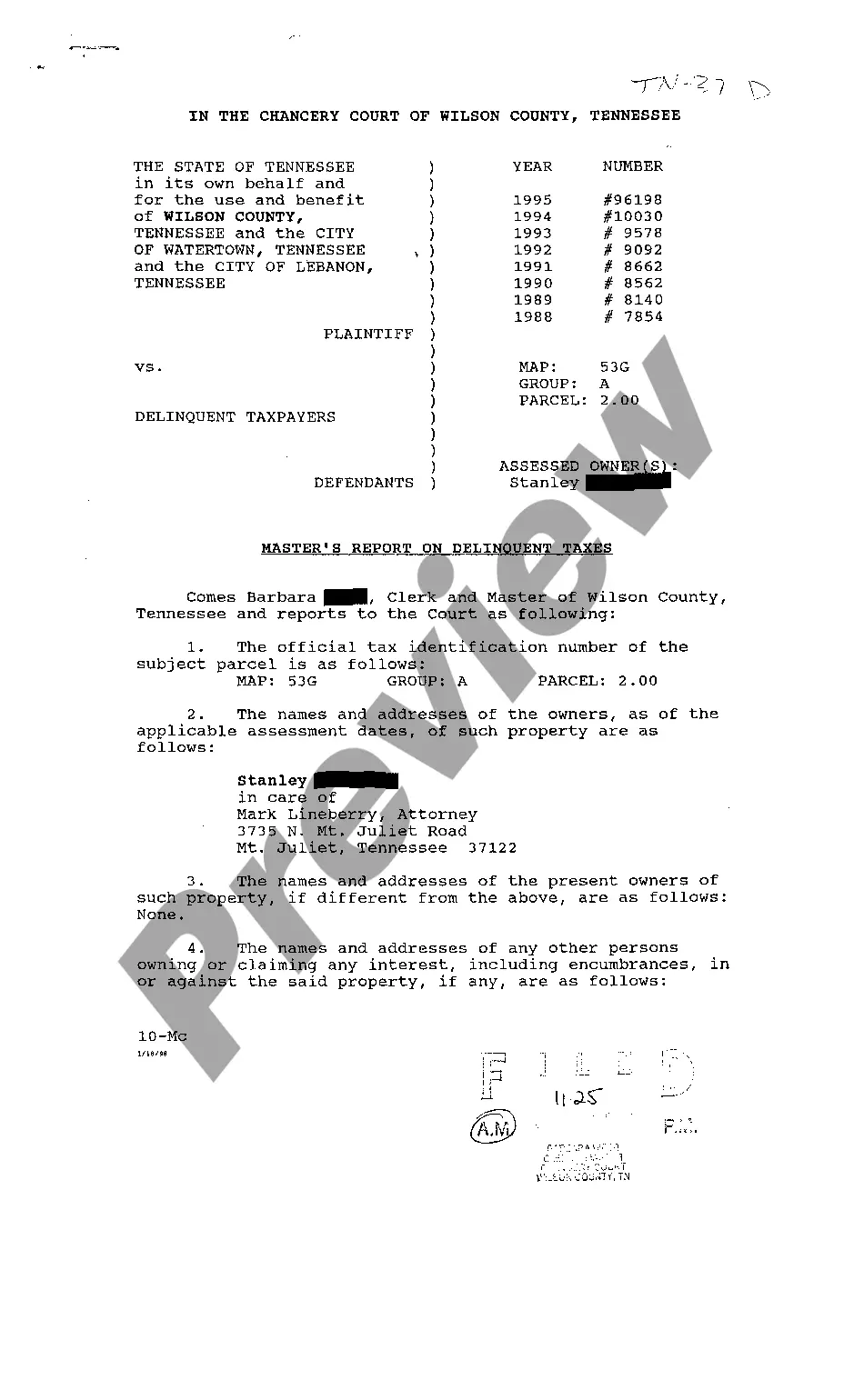

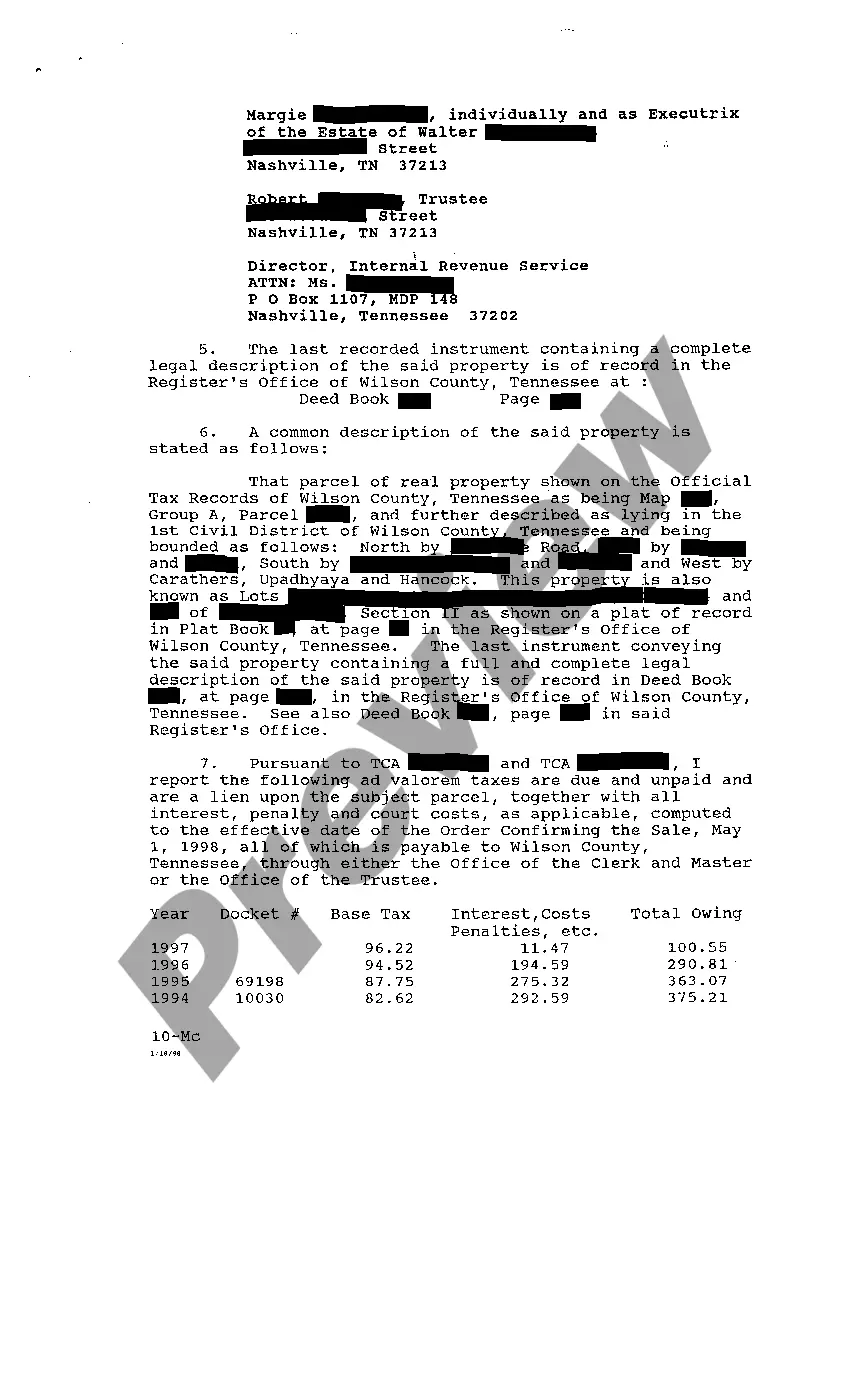

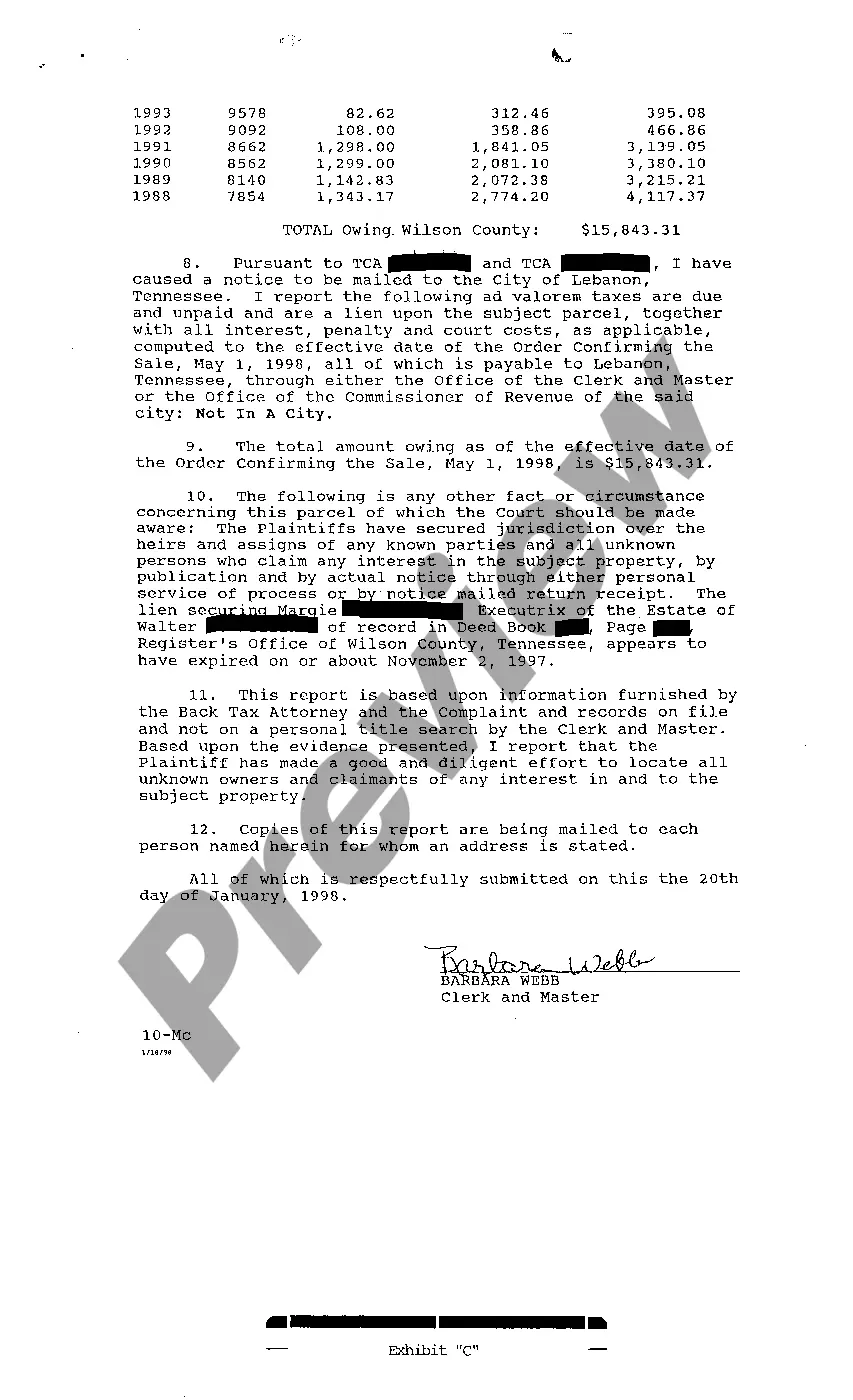

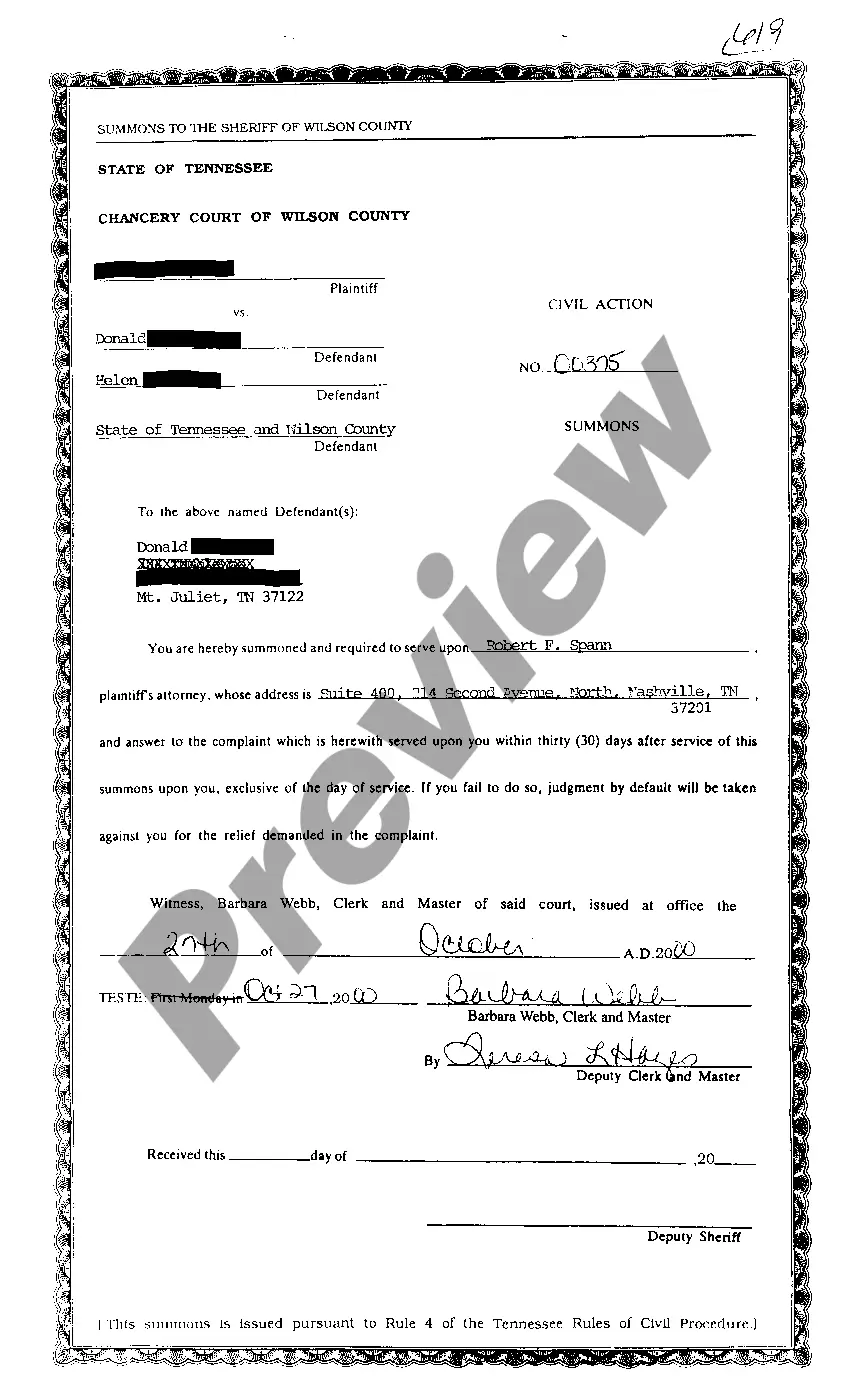

The Murfreesboro Tennessee Masters Report of Delinquent Taxes is an official document that showcases a comprehensive overview of unpaid taxes within the city of Murfreesboro, Tennessee. This report aims to provide an accurate summary of outstanding taxes, enabling authorities and interested individuals to track and manage the delinquent tax situation effectively. The Murfreesboro Tennessee Masters Report of Delinquent Taxes details various types of unpaid taxes, which typically include property taxes, sales taxes, business taxes, and personal income taxes. Each tax type is meticulously recorded and categorized in the report, providing a clear breakdown of the amount owed in each category. This report is an essential tool for local government agencies, real estate professionals, and concerned taxpayers as it presents a comprehensive list of properties, businesses, and individuals who have failed to fulfill their tax obligations. By identifying delinquent taxpayers, the report serves as a reliable resource for initiating collection efforts or legal actions to recover the unpaid taxes. Additionally, the Masters Report may encompass subdivisions such as residential, commercial, and industrial properties, offering a precise view of the specific sectors affected by delinquent taxes. This segregation enables authorities to prioritize actions based on the severity and impact of unpaid taxes within various segments of the city. Besides aiding in tax collection efforts, the Murfreesboro Tennessee Masters Report of Delinquent Taxes helps reduce the burden on responsible taxpayers who diligently fulfill their obligations. By identifying and addressing delinquent tax cases promptly, it ensures a fair and equitable distribution of the tax burden among all residents and businesses in Murfreesboro. Overall, the Murfreesboro Tennessee Masters Report of Delinquent Taxes is a vital resource for tracking, managing, and addressing unpaid taxes within the city. It plays a pivotal role in promoting tax compliance, safeguarding the financial stability of the community, and maintaining the provision of essential services funded by these taxes.

Murfreesboro Tennessee Masters Report of Delinquent Taxes

Description

How to fill out Murfreesboro Tennessee Masters Report Of Delinquent Taxes?

We always strive to minimize or avoid legal issues when dealing with nuanced law-related or financial affairs. To do so, we sign up for attorney solutions that, usually, are very expensive. However, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online collection of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without using services of legal counsel. We provide access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Murfreesboro Tennessee Masters Report of Delinquent Taxes or any other document easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it from within the My Forms tab.

The process is equally effortless if you’re unfamiliar with the website! You can create your account within minutes.

- Make sure to check if the Murfreesboro Tennessee Masters Report of Delinquent Taxes complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Murfreesboro Tennessee Masters Report of Delinquent Taxes would work for your case, you can select the subscription plan and make a payment.

- Then you can download the document in any suitable format.

For over 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!