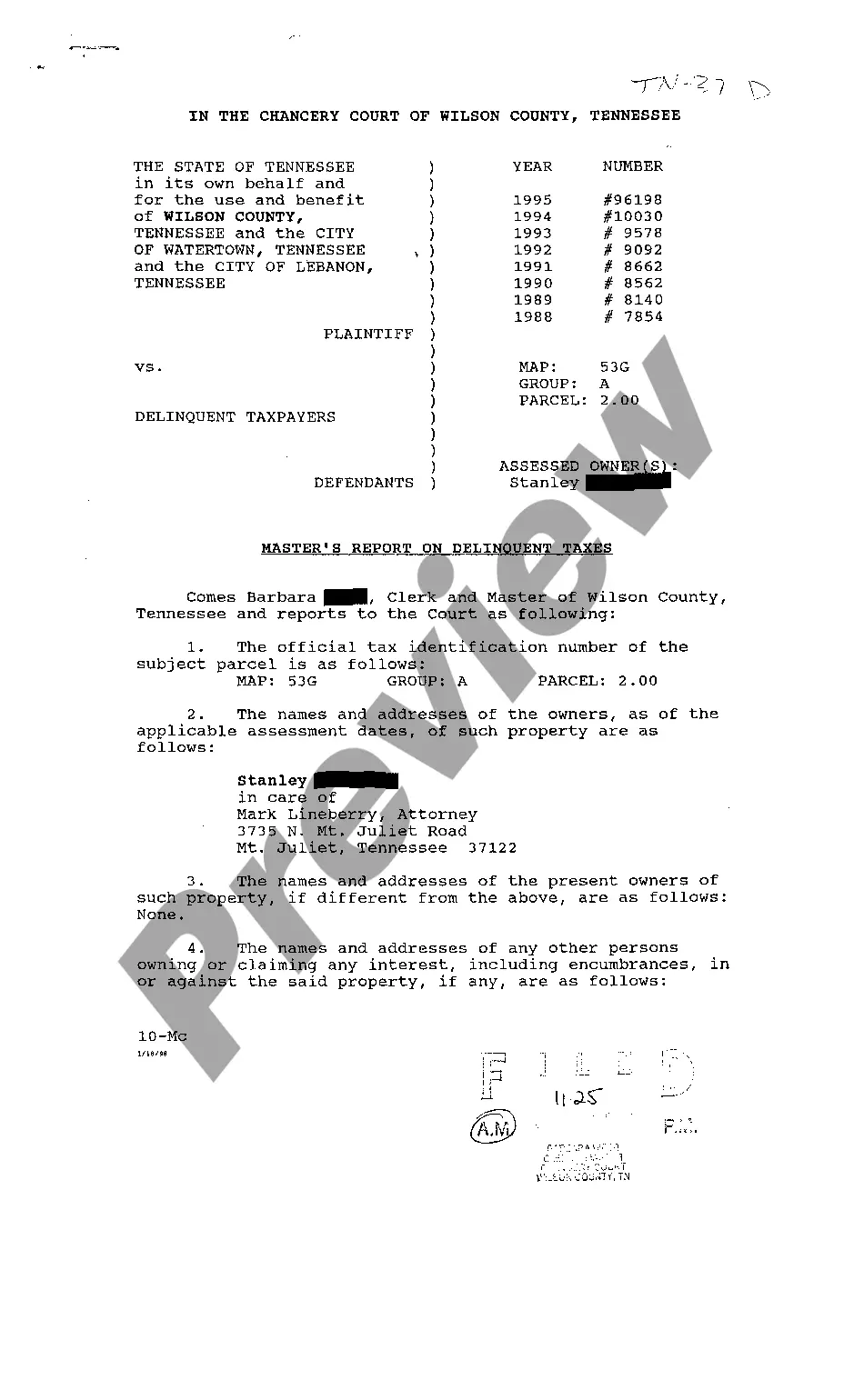

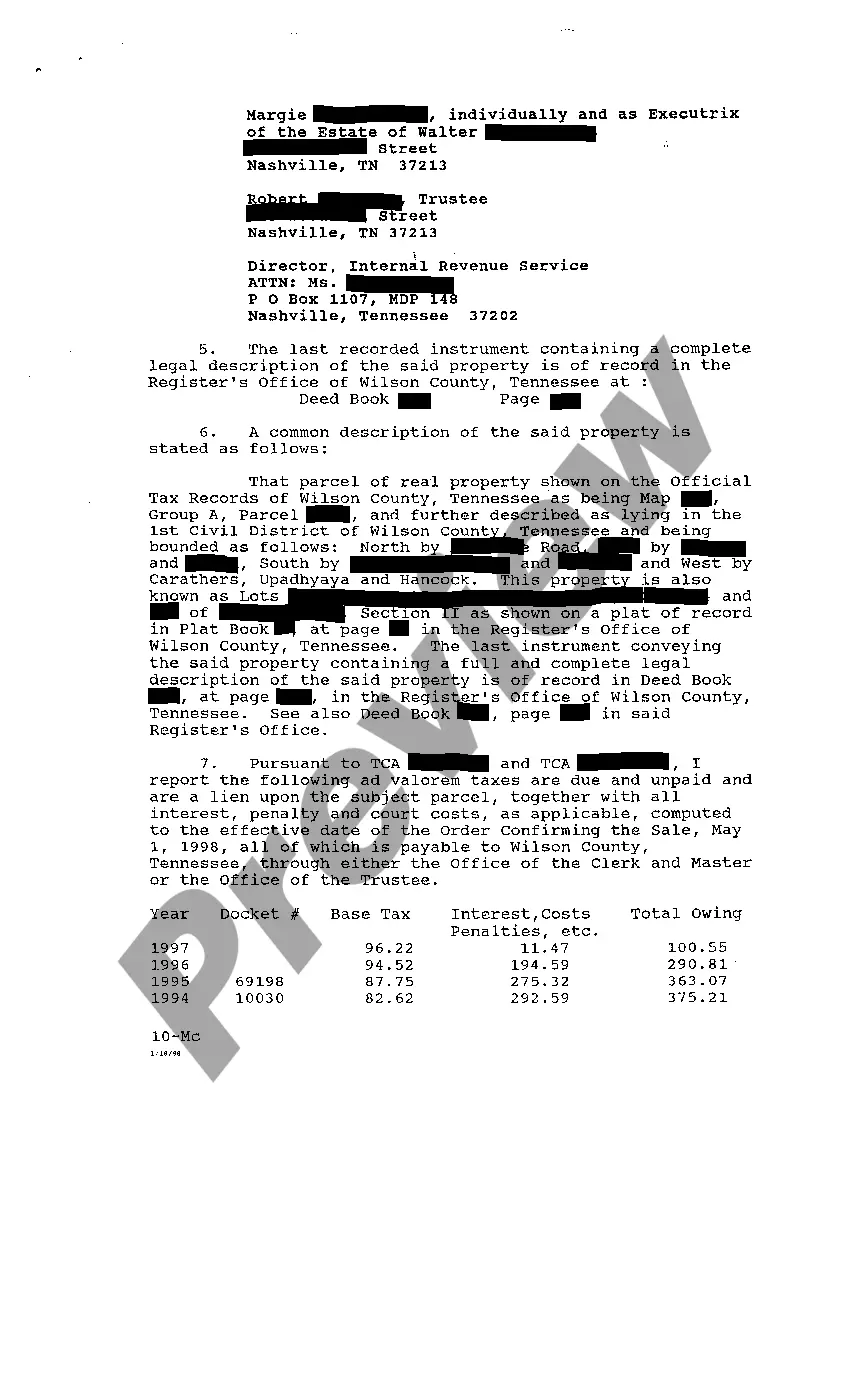

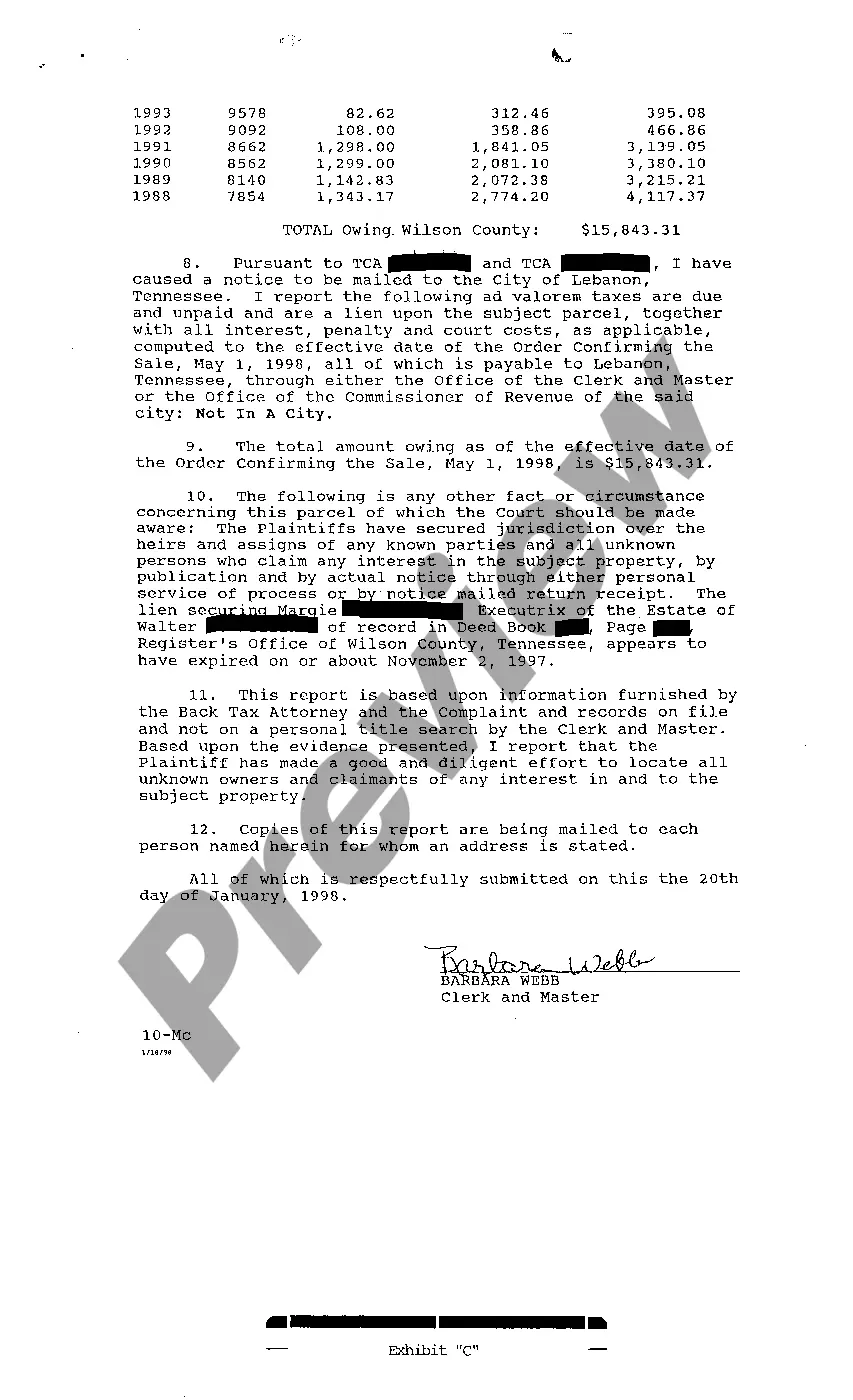

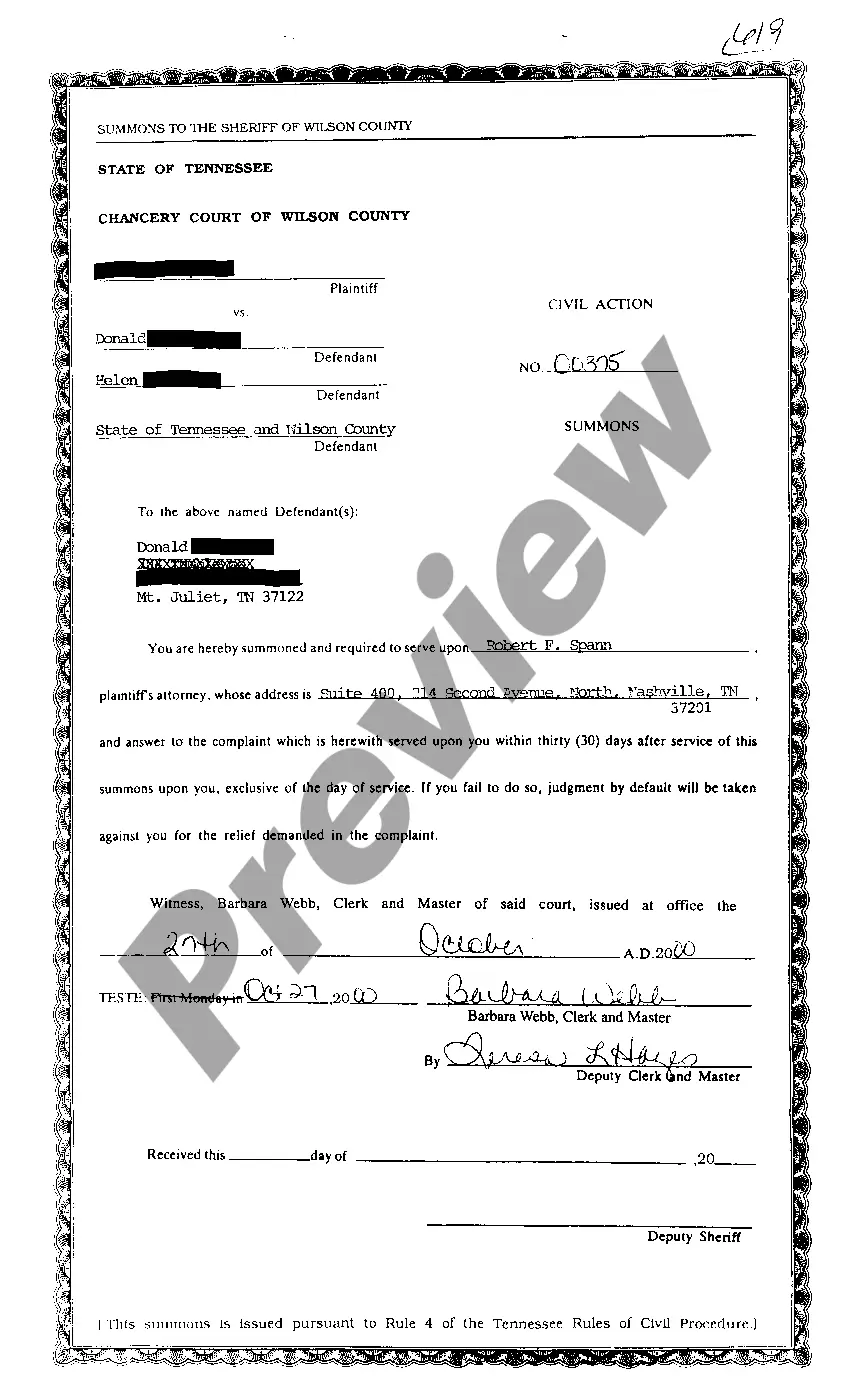

The Nashville Tennessee Masters Report of Delinquent Taxes is a comprehensive document that lists all outstanding unpaid taxes within the city. This report serves as a vital tool for both individuals and businesses to stay informed about their financial responsibilities and avoid potential legal consequences. The report includes detailed information about various types of delinquent taxes in Nashville, providing valuable insights to taxpayers and tax professionals alike. The types of delinquent taxes mentioned in the report may include property taxes, sales taxes, business taxes, and income taxes. 1. Property Taxes: The Nashville Tennessee Masters Report of Delinquent Taxes covers overdue property taxes on residential, commercial, and industrial properties. It provides information on the property owner, the delinquent amount, the date of delinquency, and any penalties or interest accrued. 2. Sales Taxes: This portion of the report highlights unpaid sales taxes owed by businesses operating within Nashville. It outlines the business name, the outstanding sales tax amount, and the duration of delinquency. 3. Business Taxes: For businesses operating in Nashville, the report includes details about unpaid business taxes. It enables local businesses to understand their outstanding liabilities and take necessary actions to reconcile their tax obligations promptly. 4. Income Taxes: The Nashville Tennessee Masters Report of Delinquent Taxes might also shed light on unpaid income taxes owed by individuals residing in the city. It outlines the taxpayer's name, the delinquent tax amount, and the number of years in arrears. By accessing the Nashville Tennessee Masters Report of Delinquent Taxes, individuals, businesses, and tax professionals can identify and address any outstanding tax-related issues. This report acts as a valuable resource for understanding the scope of delinquent taxes in Nashville, enabling taxpayers to resolve their obligations, avoid legal ramifications, and maintain good standing with the tax authorities. Keywords: Nashville, Tennessee, Masters Report, Delinquent Taxes, property taxes, residential, commercial, industrial properties, sales taxes, business taxes, income taxes, outstanding liabilities, penalties, interest, overdue, taxpayer, legal consequences, financial responsibilities

Nashville Tennessee Masters Report of Delinquent Taxes

Description

How to fill out Nashville Tennessee Masters Report Of Delinquent Taxes?

If you are looking for a valid form template, it’s extremely hard to find a more convenient place than the US Legal Forms website – probably the most comprehensive libraries on the web. With this library, you can find a huge number of document samples for company and individual purposes by categories and states, or keywords. With the high-quality search feature, discovering the most recent Nashville Tennessee Masters Report of Delinquent Taxes is as easy as 1-2-3. Moreover, the relevance of each and every file is proved by a group of expert attorneys that regularly review the templates on our platform and revise them based on the newest state and county demands.

If you already know about our system and have a registered account, all you should do to get the Nashville Tennessee Masters Report of Delinquent Taxes is to log in to your user profile and click the Download option.

If you utilize US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have opened the sample you need. Check its explanation and use the Preview feature to check its content. If it doesn’t suit your needs, use the Search field near the top of the screen to discover the needed record.

- Confirm your choice. Select the Buy now option. Next, pick the preferred subscription plan and provide credentials to register an account.

- Make the financial transaction. Use your bank card or PayPal account to complete the registration procedure.

- Get the form. Pick the format and download it on your device.

- Make adjustments. Fill out, revise, print, and sign the obtained Nashville Tennessee Masters Report of Delinquent Taxes.

Every form you save in your user profile does not have an expiry date and is yours forever. You can easily access them using the My Forms menu, so if you need to get an extra version for modifying or printing, you may come back and save it again anytime.

Take advantage of the US Legal Forms professional collection to get access to the Nashville Tennessee Masters Report of Delinquent Taxes you were seeking and a huge number of other professional and state-specific templates on one website!