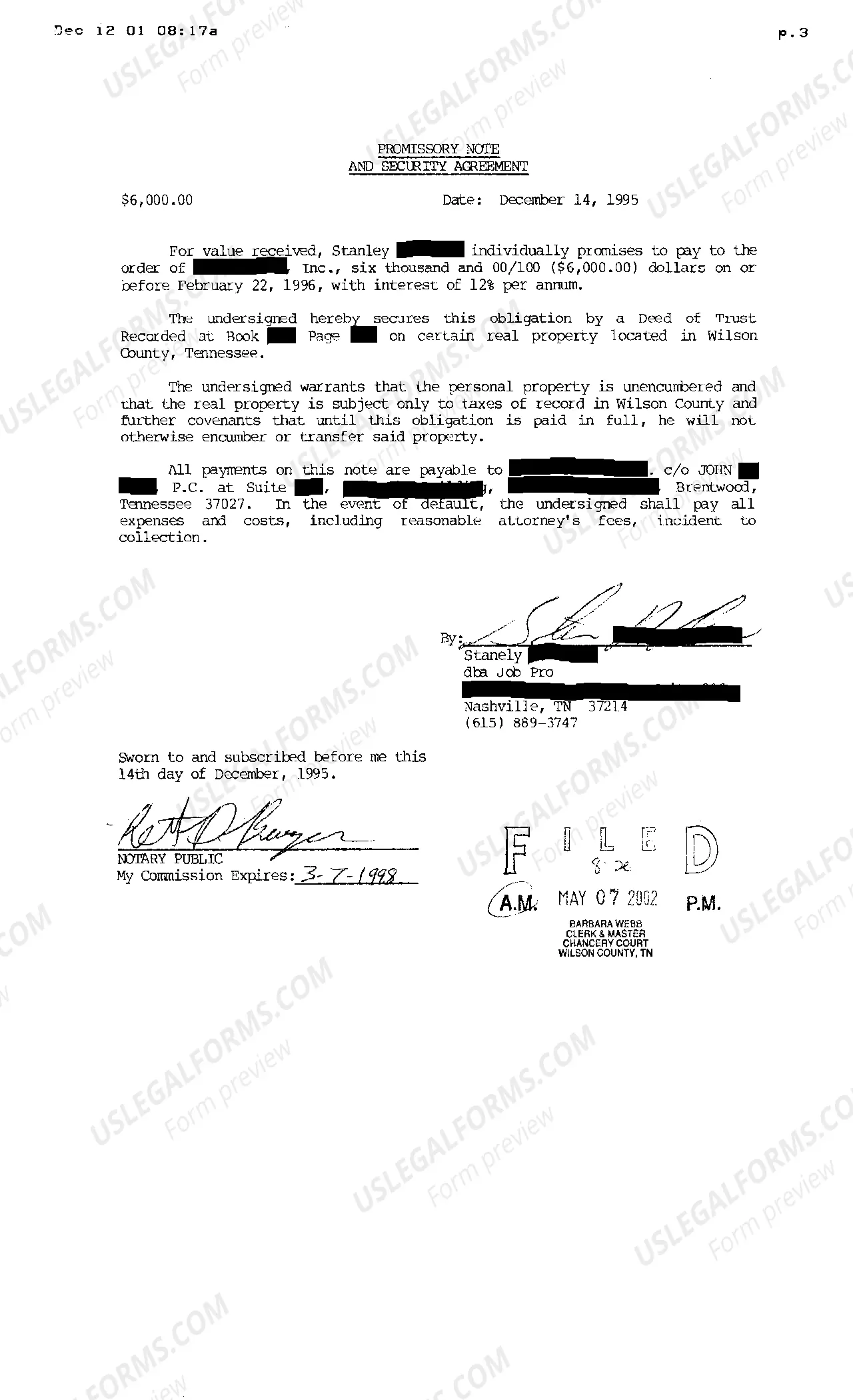

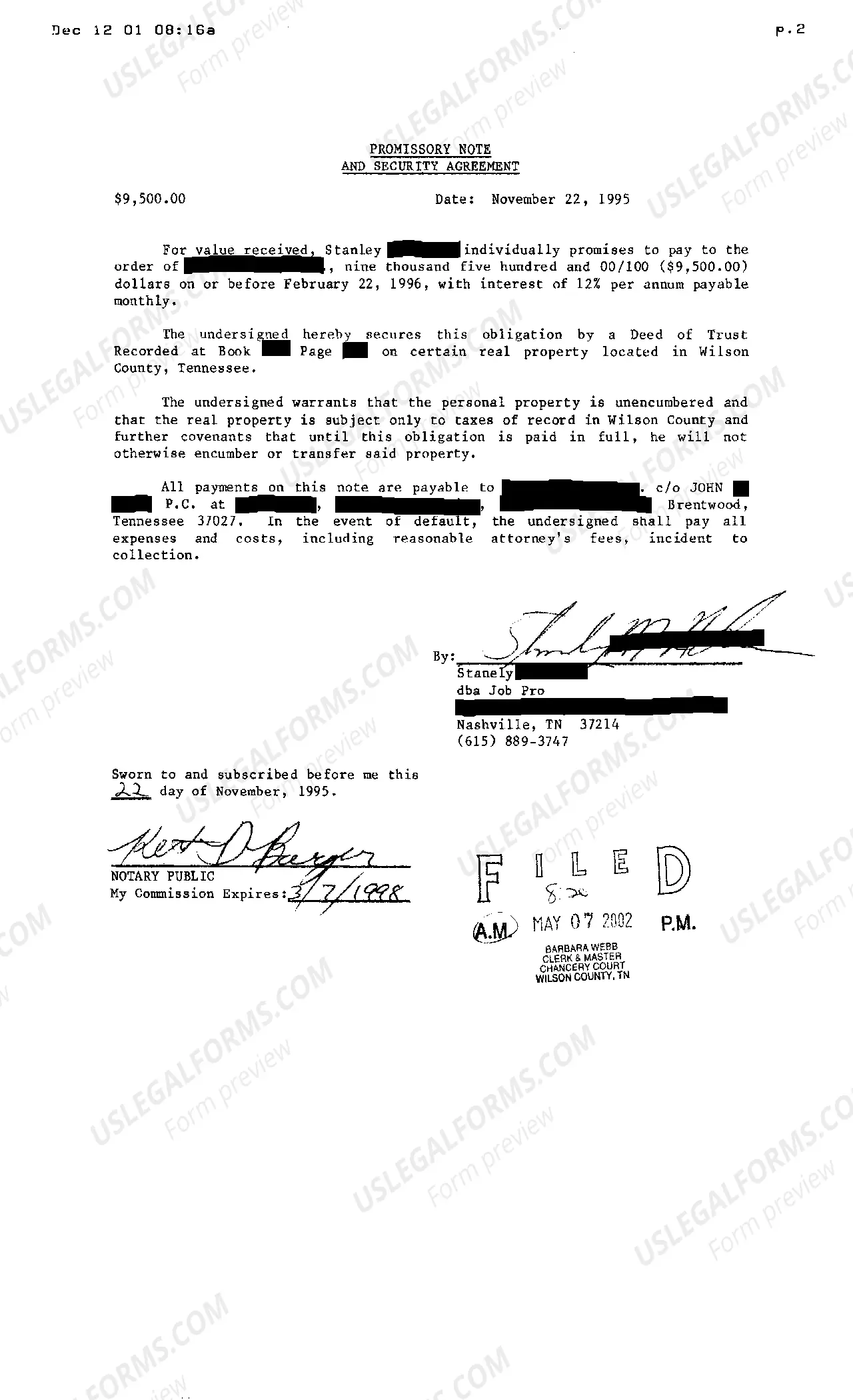

Memphis, Tennessee issues on appeal to set aside a tax sale refer to legal matters related to challenging the legitimacy or validity of a tax sale in Memphis, Tennessee. These issues arise when property owners or interested parties file an appeal in court seeking to have a tax sale declared void or canceled. The purpose is to protect the rights of property owners and ensure that the tax sale was conducted in accordance with the law. There may be various types of Memphis, Tennessee issues on appeal to set aside tax sale, including: 1. Procedural Irregularities: This refers to situations where there are violations or irregularities in the process of conducting a tax sale. It could include improper notice to the property owner, failure to follow proper auction procedures, or other procedural errors. 2. Lack of Sufficient Notice: Property owners have the right to receive adequate notice about the pending tax sale. If it can be demonstrated that the property owner did not receive proper notice or was not given a reasonable opportunity to pay delinquent taxes before the sale, the appeal may be successful. 3. Error in Tax Assessment: This occurs when there is an error in assessing taxes or determining the amount owed. If the property owner can prove that the tax assessment was incorrect, resulting in an inflated tax amount, they may appeal to set aside the tax sale. 4. Failure to Follow Statutory Requirements: Tax sales must comply with specific statutory requirements, and any failure to follow these requirements may lead to an appeal. This could include failure to follow proper procedures for conducting the sale, failure to provide required documentation, or failure to notify all interested parties. 5. Lack of Justification for the Sale: Property owners may argue that the tax sale was unwarranted, and there was now just cause for the sale. This could include situations where the property owner had already paid the taxes before the sale, or where there were mitigating circumstances that should have prevented the sale. To initiate the appeal process, property owners or interested parties typically file a petition or motion in the appropriate court, detailing the issues and requesting that the tax sale be set aside. The court then reviews the evidence presented and weighs the merits of the case. The outcome of the appeal will depend on the specific circumstances and evidence provided by the parties involved.

Memphis Tennessee Issues On Appeal To Set Aside Tax Sale

Description

How to fill out Memphis Tennessee Issues On Appeal To Set Aside Tax Sale?

Utilize the US Legal Forms and gain immediate access to any document you need.

Our helpful website, featuring a vast array of document templates, enables you to locate and acquire nearly any document sample you require.

You can save, complete, and sign the Memphis Tennessee Issues On Appeal To Set Aside Tax Sale in just a few minutes instead of spending hours online searching for the correct template.

Using our catalog is an excellent approach to enhance the security of your document submissions.

The Download button will be visible on all the documents you review.

Furthermore, you can retrieve all your previously saved files in the My documents menu.

- Our skilled attorneys routinely assess all the documents to ensure that the forms are applicable to a specific state and comply with the latest laws and regulations.

- How can you access the Memphis Tennessee Issues On Appeal To Set Aside Tax Sale.

- If you have a subscription, simply Log Into your account.

Form popularity

FAQ

Delinquent tax properties are sold only by public auction and will not be sold over the counter. The Clerk & Master's Office does not issue Tax Certificates. Credit Cards are not accepted. Purchase of the properties will not be financed through the Clerk & Master's Office; payment must be made in full.

Tennessee is a redeemable deed state, which is a bit of a hybrid of a tax lien and tax deed. At a redeemable deed auction you're bidding on the deed to the property, like you would at a tax deed sale, but, as in a tax lien state, you don't get immediate possession of the property.

The delinquent taxpayer may pay the Clerk and Master the amount owed any time before the sale and the lawsuit will be dismissed. Once the tax sale is scheduled, the costs of preparation and publication attach as additional costs to the properties scheduled. These fees cannot be waived.

Tennessee is a redeemable deed state, which is a bit of a hybrid of a tax lien and tax deed. At a redeemable deed auction you're bidding on the deed to the property, like you would at a tax deed sale, but, as in a tax lien state, you don't get immediate possession of the property.

Properties purchased in a tax sale may be redeemed by the previous owner, the heirs of the previous owner, or lien holders and assignees. An order confirming the tax sale is entered into the court records within 45 business days of the sale date. Once the order is complete, the property is eligible for redemption.

All states have laws that allow the local government to sell a home through a tax sale process to collect delinquent taxes. Accordingly, in Tennessee, your property can be sold at a tax sale to pay off the delinquent tax bill.

The delinquent taxpayer may pay the Clerk and Master the amount owed any time before the sale and the lawsuit will be dismissed. Once the tax sale is scheduled, the costs of preparation and publication attach as additional costs to the properties scheduled. These fees cannot be waived.

It depends, under certain circumstances a party's payment of property taxes can create a rebuttable presumption that the party has title, or ownership, to the property in question. These requirements are addressed in Tennessee Code Annotated §§ 28-2-109 & 110.

§2410(b)). The Tennessee Legislature passed changes to the redemption law January 2016. The new law allows shorter redemption period based on the number of years a property has been delinquent....Redemption Period. Years of DelinquencyRedemption Period8 years or more90 daysVacant and abandoned30 days2 more rows