Title: Understanding the Chattanooga Tennessee Petition To Set Aside Tax Sale: Types and Detailed Description Introduction: The Chattanooga Tennessee Petition To Set Aside Tax Sale (also known as Tax Sale Redemption Petition) provides property owners with an opportunity to appeal or challenge a tax sale that has occurred on their property due to failure to pay property taxes. This article aims to offer a comprehensive insight into this legal process, highlighting its different types and providing a detailed description for each. 1. Overview of the Chattanooga Tennessee Petition To Set Aside Tax Sale: The Chattanooga Tennessee Petition To Set Aside Tax Sale is a legal avenue available to property owners to potentially reverse or invalidate a tax sale. This means that if a property has been sold at a public auction due to unpaid property taxes, the property owner can file a petition to set aside the sale and regain ownership of their property. 2. Types of Chattanooga Tennessee Petition To Set Aside Tax Sale: a. Redemption Petition: This type of petition typically occurs within a specified redemption period determined by state law. Property owners can redeem their property by paying the outstanding tax amount along with any additional fees or costs incurred during the tax sale. The redemption period can vary, so it is essential to consult state regulations or legal advice for specific details. b. Invalidity Petition: In cases where the tax sale was conducted improperly or violated the property owner's rights, an invalidity petition can be filed. This petition seeks to void the tax sale on legal grounds such as improper notice, irregular auction procedures, or failure to adhere to statutory requirements. c. Hardship Petition: A hardship petition is filed when property owners can demonstrate significant financial hardship that prevented them from paying property taxes on time. This petition requests the court to set aside the tax sale based on compassionate grounds, taking into consideration the property owner's circumstances. 3. Detailed Description of the Chattanooga Tennessee Petition To Set Aside Tax Sale Process: a. Filing the Petition: To initiate the process, property owners or their legal representatives must file a petition stating the reasons for setting aside the tax sale. The petition should include proper identification of the property in question, evidence of compliance with notification requirements, and any supporting documentation to substantiate the claim. b. Notice to Interested Parties: Upon filing the petition, the property owner must comply with the legal requirement of serving notice to all interested parties, such as the tax sale purchaser, taxing authorities, and any other parties with a potential interest in the property. c. Court Hearing: After the notice period, a court hearing will be scheduled, where the property owner presents their case and argues for why the tax sale should be set aside. It is crucial to provide compelling evidence and legal arguments, highlighting any irregularities or undue hardships faced. d. Court Ruling and Potential Outcomes: The court will evaluate all presented evidence and arguments before making a decision. If the petition is successful, the court may order the tax sale to be set aside, allowing the property owner to regain ownership. However, in cases where the petition is denied, the tax sale remains valid and the property owner may need to explore other legal options, such as seeking monetary compensation. Conclusion: Understanding the Chattanooga Tennessee Petition To Set Aside Tax Sale is vital for property owners who have experienced a tax sale and wish to regain ownership. By comprehending the different types and the detailed description of the process, individuals can take appropriate steps to navigate the legal system and potentially set aside the tax sale. It is advised to consult with legal professionals for personalized guidance in pursuing this petition.

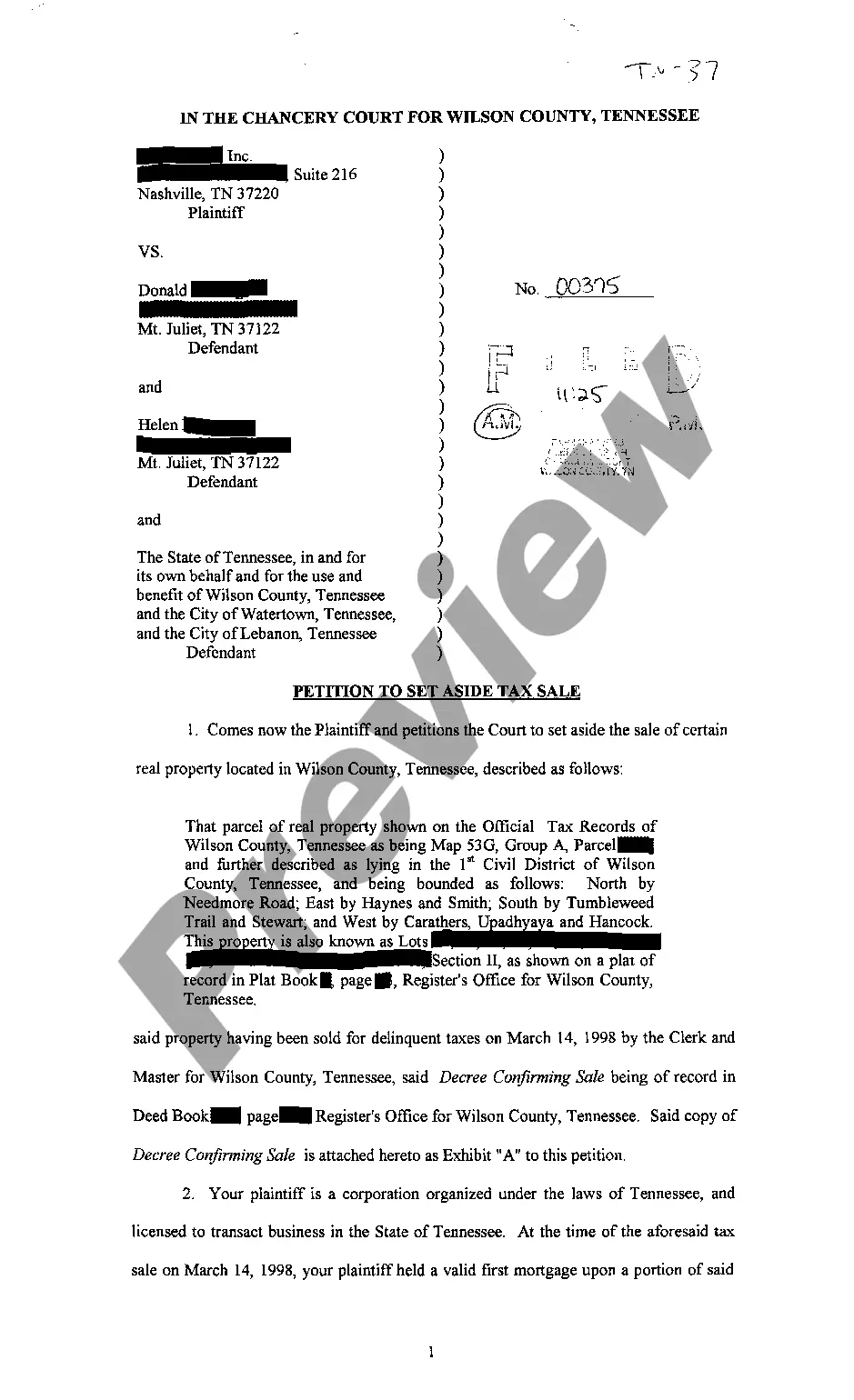

Chattanooga Tennessee Petition To Set Aside Tax Sale

Description

How to fill out Chattanooga Tennessee Petition To Set Aside Tax Sale?

Are you looking for a trustworthy and inexpensive legal forms provider to get the Chattanooga Tennessee Petition To Set Aside Tax Sale? US Legal Forms is your go-to solution.

Whether you require a simple arrangement to set rules for cohabitating with your partner or a set of documents to advance your divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and frameworked based on the requirements of separate state and area.

To download the document, you need to log in account, locate the required form, and click the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time from the My Forms tab.

Are you new to our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Chattanooga Tennessee Petition To Set Aside Tax Sale conforms to the regulations of your state and local area.

- Read the form’s details (if available) to find out who and what the document is intended for.

- Start the search over in case the form isn’t good for your legal scenario.

Now you can register your account. Then select the subscription option and proceed to payment. Once the payment is done, download the Chattanooga Tennessee Petition To Set Aside Tax Sale in any available file format. You can get back to the website when you need and redownload the document without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about spending hours learning about legal paperwork online once and for all.