A Memphis Tennessee Petition to Set Aside Tax Sale is a legal document filed with the court by property owners or interested parties seeking to revoke or cancel a tax sale on a particular property. This petition is used when the property owner believes that certain legal requirements were not followed during the tax sale process, resulting in an unfair sale or a violation of the property owner's rights. Keywords: Memphis Tennessee, Petition to Set Aside Tax Sale, tax sale, property owners, interested parties, legal document, court, revoke, cancel, tax sale process, unfair sale, violation, property owner's rights. There are several types of Memphis Tennessee Petitions to Set Aside Tax Sale, including: 1. Administrative Errors: These petitions are filed when the tax sale was conducted with incorrect information or errors in the administrative process. It may involve mistakes in the property identification, delinquency amounts, or owners' information. 2. Lack of Proper Notice: This type of petition is filed if the property owner claims that they did not receive proper notice of the impending tax sale. The notice requirements include notifying the property owner of their unpaid taxes, the sale date, and other relevant details. If the property owner is not properly notified, they may argue that the tax sale should be invalidated. 3. Inadequate Redemption Period: In some cases, property owners may argue that the redemption period (the time given to pay the delinquent taxes and redeem the property) was insufficient or violated Tennessee state law. This can be a ground for petitioning to set aside the tax sale. 4. Procedural Irregularities: This type of petition is used when the property owner believes that there were procedural irregularities in the tax sale process that affected their rights. Examples include improper advertising, failure to follow legal requirements, or failure to conduct the sale in an open and fair manner. 5. Fraud or Misrepresentation: This petition is filed when the property owner alleges fraud or misrepresentation by the taxing authority or any other party involved in the tax sale. This can include cases where false information was provided or deliberate misrepresentation occurred during the sale. Regardless of the type of petition filed, the burden of proof will generally be on the party seeking to set aside the tax sale. They will be required to provide evidence supporting their claims and demonstrate that there were substantial legal defects or violations that warrant the cancellation or revocation of the sale. In conclusion, a Memphis Tennessee Petition to Set Aside Tax Sale is a legal recourse available to property owners or interested parties who believe that a tax sale was conducted improperly or unlawfully. By filing this petition, they can seek the court's intervention to reverse the sale and protect their property rights.

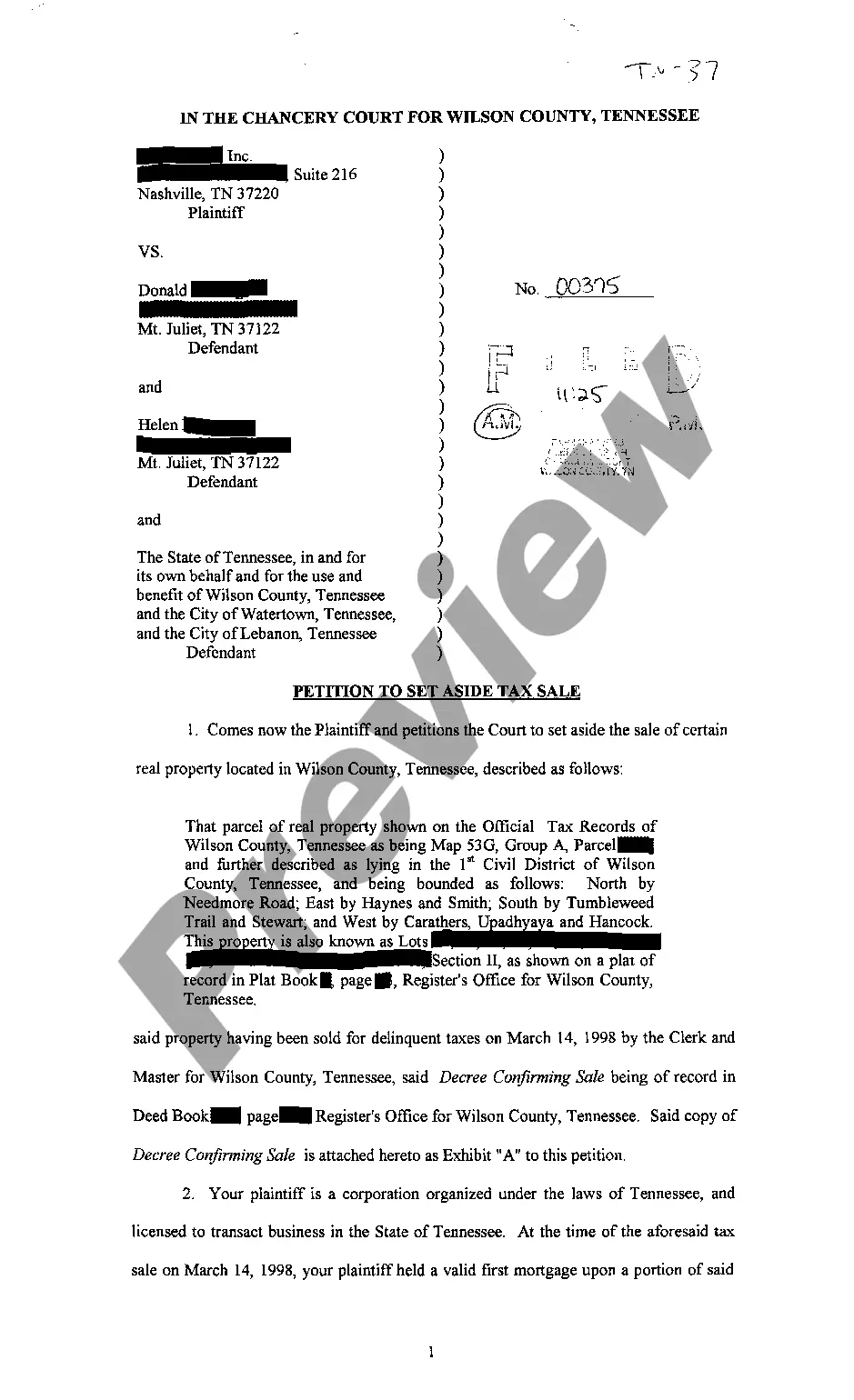

Memphis Tennessee Petition To Set Aside Tax Sale

Description

How to fill out Memphis Tennessee Petition To Set Aside Tax Sale?

Do you need a reliable and inexpensive legal forms provider to get the Memphis Tennessee Petition To Set Aside Tax Sale? US Legal Forms is your go-to option.

Whether you require a basic agreement to set regulations for cohabitating with your partner or a set of documents to advance your divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and framed in accordance with the requirements of particular state and county.

To download the document, you need to log in account, locate the required template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates anytime in the My Forms tab.

Is the first time you visit our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Memphis Tennessee Petition To Set Aside Tax Sale conforms to the laws of your state and local area.

- Read the form’s description (if provided) to learn who and what the document is intended for.

- Restart the search if the template isn’t suitable for your specific scenario.

Now you can create your account. Then select the subscription option and proceed to payment. As soon as the payment is done, download the Memphis Tennessee Petition To Set Aside Tax Sale in any provided format. You can get back to the website when you need and redownload the document free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about wasting hours learning about legal paperwork online once and for all.