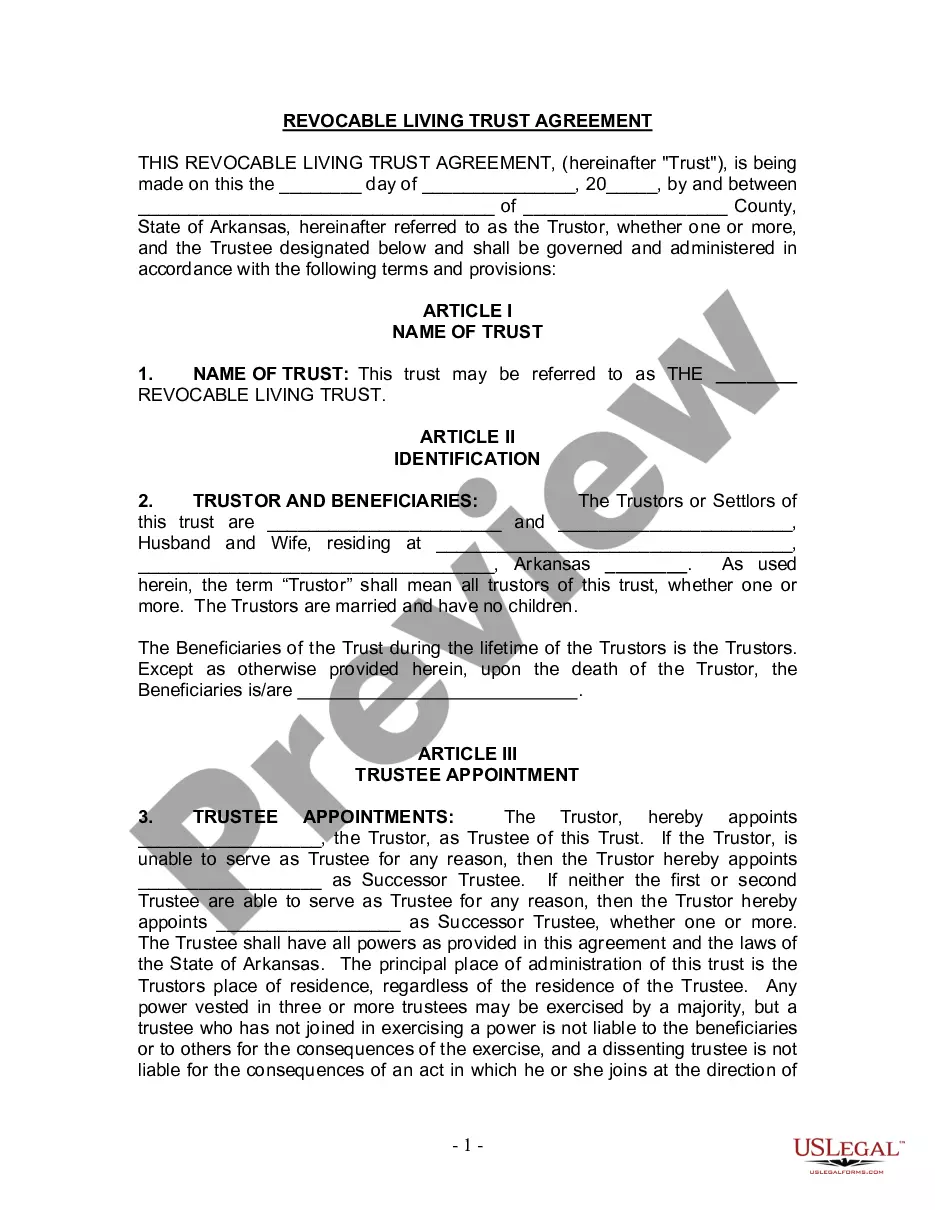

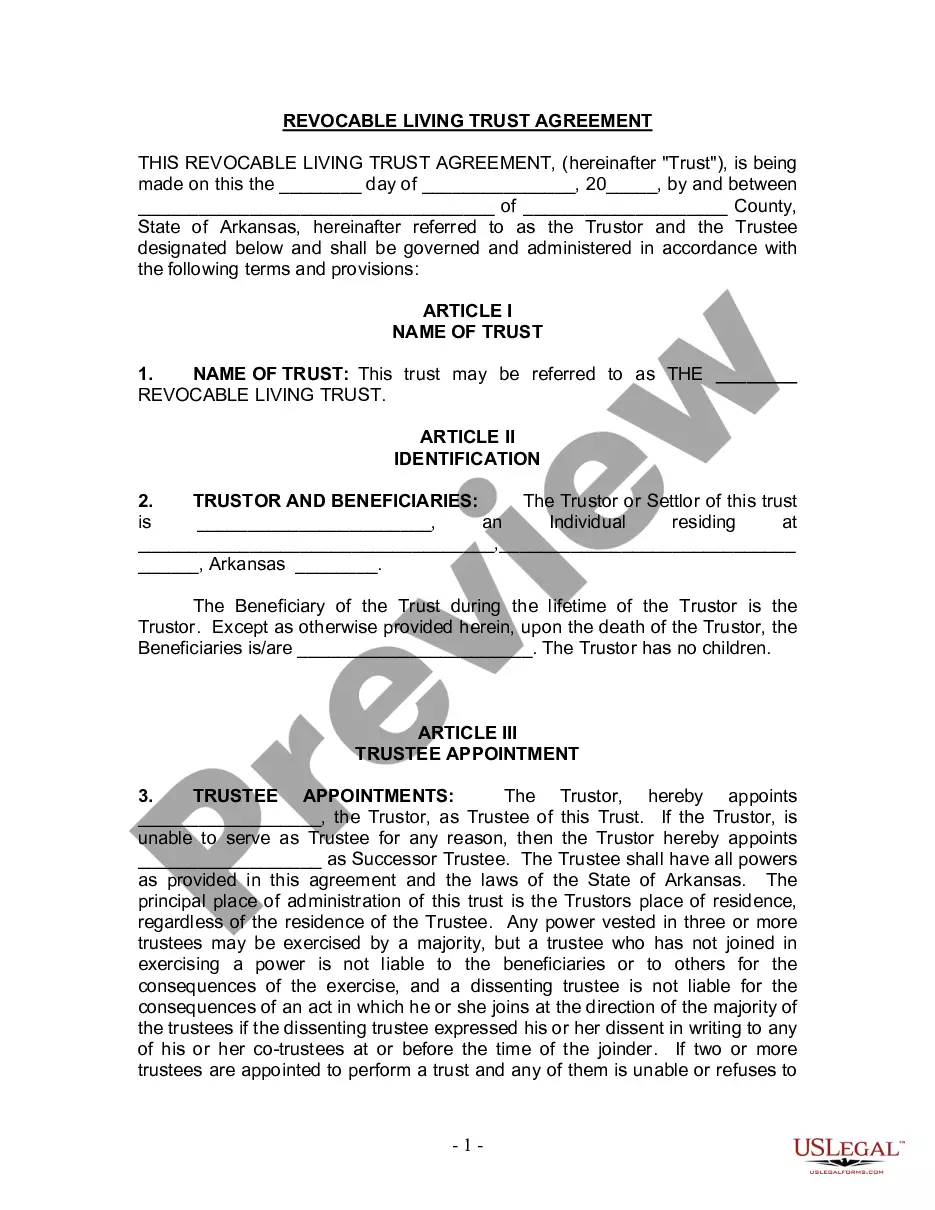

Title: Nashville Tennessee Petition to Set Aside Tax Sale: A Comprehensive Overview of the Process Keywords: Nashville Tennessee Petition, Set Aside Tax Sale, Tax Delinquency, Property Redemption, Legal Petition, Property Owner Rights Introduction: The Nashville Tennessee Petition to Set Aside Tax Sale is a legal process utilized by property owners who seek to invalidate a tax sale due to specific circumstances. This detailed guide aims to explore the different types of Nashville Tennessee Petitions to Set Aside Tax Sales and provide a comprehensive understanding of the process involved. 1. Overview of Tax Sale: Tax sale refers to the public auction of properties with unpaid property taxes. The local tax authorities sell these properties to recover the outstanding tax debts. However, under certain circumstances, property owners can file a petition to set aside or overturn the tax sale. 2. Types of Nashville Tennessee Petitions to Set Aside Tax Sale: a. Inadequate Notice Petition: Property owners may file this type of petition when they argue that they did not receive proper notice regarding their property's tax delinquency and impending sale. b. Irregularities in the Sale Process Petition: This petition focuses on pointing out any legal irregularities or errors in the tax sale process, such as procedural mistakes or violations. c. Constitutional Violation Petition: Property owners may utilize this type of petition when they believe that the tax sale process violated their constitutional rights, such as due process or equal protection under the law. 3. Grounds for Filing a Petition: To successfully petition for a tax sale set aside in Nashville, Tennessee, property owners must provide substantial evidence supporting one or more of the following grounds: a. Failure to provide proper notice of tax delinquency and sale. b. Failure to follow statutory requirements or procedural rules during the tax sale. c. Lack of fair market value achieved during the tax sale. 4. Initiation and Filing Procedure: Property owners wishing to set aside a tax sale in Nashville, Tennessee, must adhere to specific procedures: a. Consultation: Seeking legal counsel or guidance from an experienced attorney specializing in property law and tax sales is highly recommended. b. Drafting the Petition: The property owner or their attorney will draft a formal petition outlining the grounds for setting aside the tax sale. c. Filing the Petition: The completed petition, along with any required supporting documents, must be filed with the appropriate court within the specified time frame, typically within 30-90 days after the tax sale. 5. The Judicial Process: Once the petition is submitted, the court will examine the substance of the petition, the evidence provided, and consider the arguments made by both parties. The court will make a decision based on the merits of the case and the applicable laws. 6. Potential Outcomes: Upon successful petitioning and the court's decision to set aside the tax sale, the property owner may regain ownership of their property, subject to any necessary redemption procedures or payment of outstanding property tax debts. Conclusion: The Nashville Tennessee Petition to Set Aside Tax Sale is a legal recourse available to property owners seeking to challenge a tax sale. Understanding the different types of petitions, the grounds for filing, and the necessary procedures can empower property owners to protect their rights and potentially regain ownership of their properties. Seeking expert legal advice throughout this process is crucial to maximize the chances of a favorable outcome.

Nashville Tennessee Petition To Set Aside Tax Sale

Description

How to fill out Nashville Tennessee Petition To Set Aside Tax Sale?

Benefit from the US Legal Forms and get instant access to any form you require. Our beneficial platform with a large number of templates makes it easy to find and get virtually any document sample you will need. You are able to save, fill, and sign the Nashville Tennessee Petition To Set Aside Tax Sale in just a matter of minutes instead of browsing the web for several hours seeking the right template.

Using our catalog is a wonderful strategy to increase the safety of your form filing. Our experienced lawyers regularly check all the documents to make sure that the forms are appropriate for a particular region and compliant with new laws and regulations.

How can you get the Nashville Tennessee Petition To Set Aside Tax Sale? If you have a profile, just log in to the account. The Download option will be enabled on all the samples you look at. Furthermore, you can find all the previously saved records in the My Forms menu.

If you don’t have a profile yet, follow the instructions listed below:

- Find the form you require. Ensure that it is the template you were looking for: verify its headline and description, and utilize the Preview feature when it is available. Otherwise, utilize the Search field to look for the appropriate one.

- Launch the downloading process. Select Buy Now and select the pricing plan you like. Then, create an account and pay for your order using a credit card or PayPal.

- Save the document. Indicate the format to obtain the Nashville Tennessee Petition To Set Aside Tax Sale and revise and fill, or sign it for your needs.

US Legal Forms is among the most extensive and reliable document libraries on the internet. We are always ready to assist you in virtually any legal case, even if it is just downloading the Nashville Tennessee Petition To Set Aside Tax Sale.

Feel free to benefit from our form catalog and make your document experience as efficient as possible!