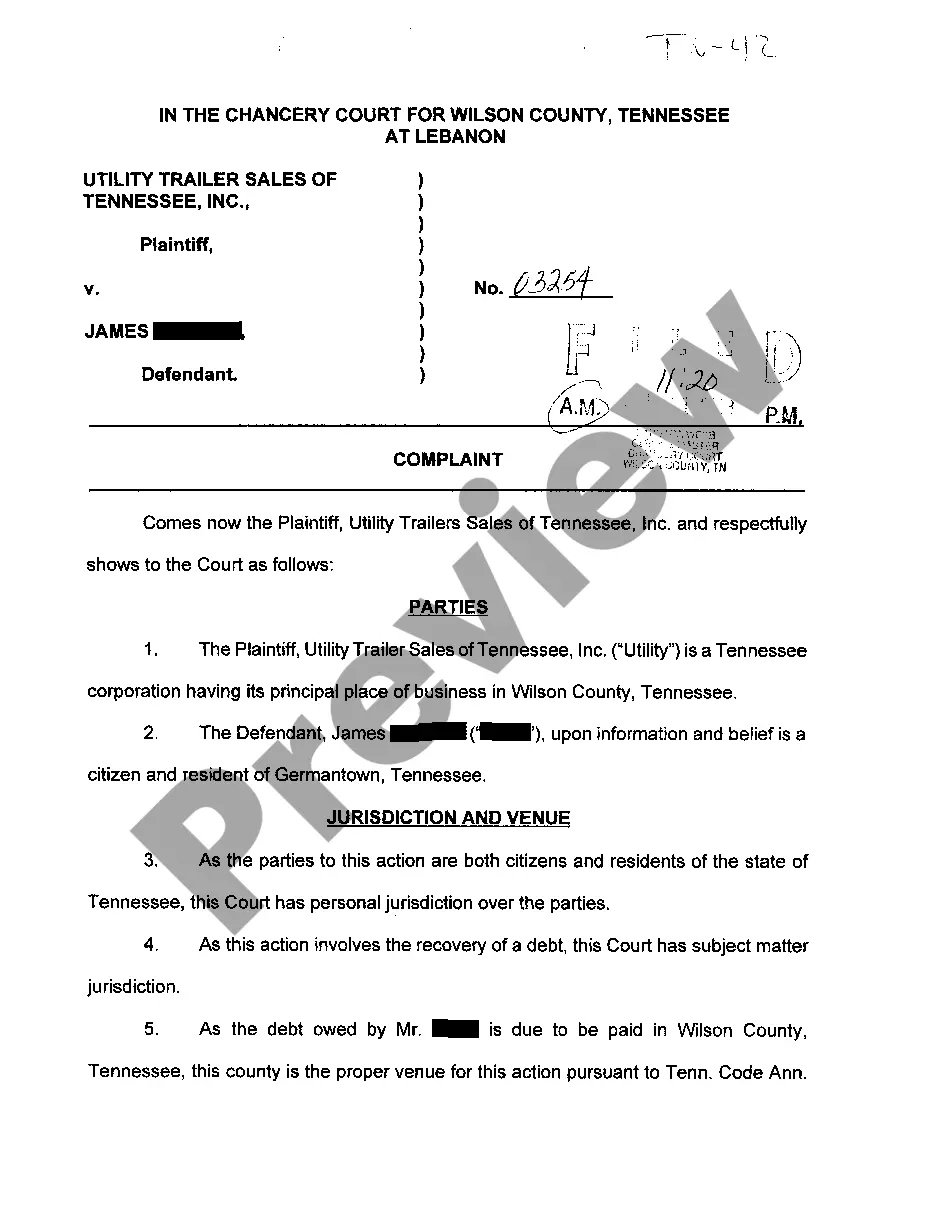

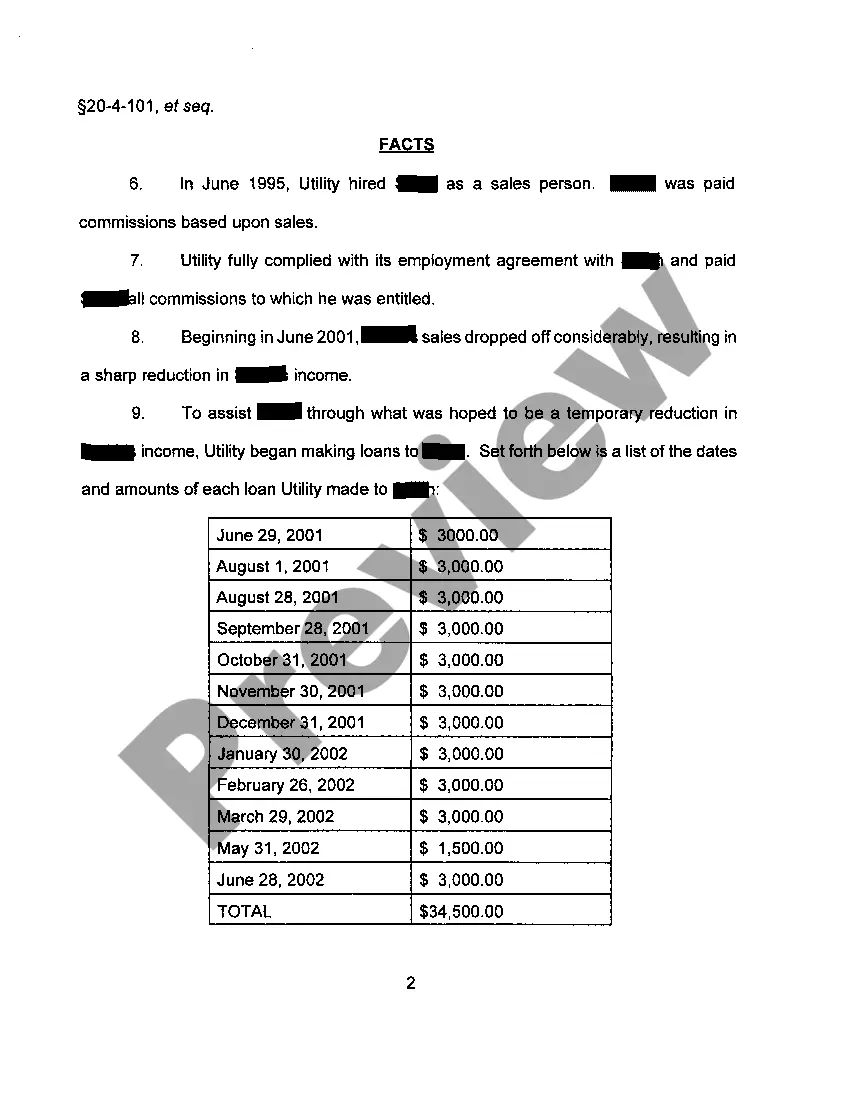

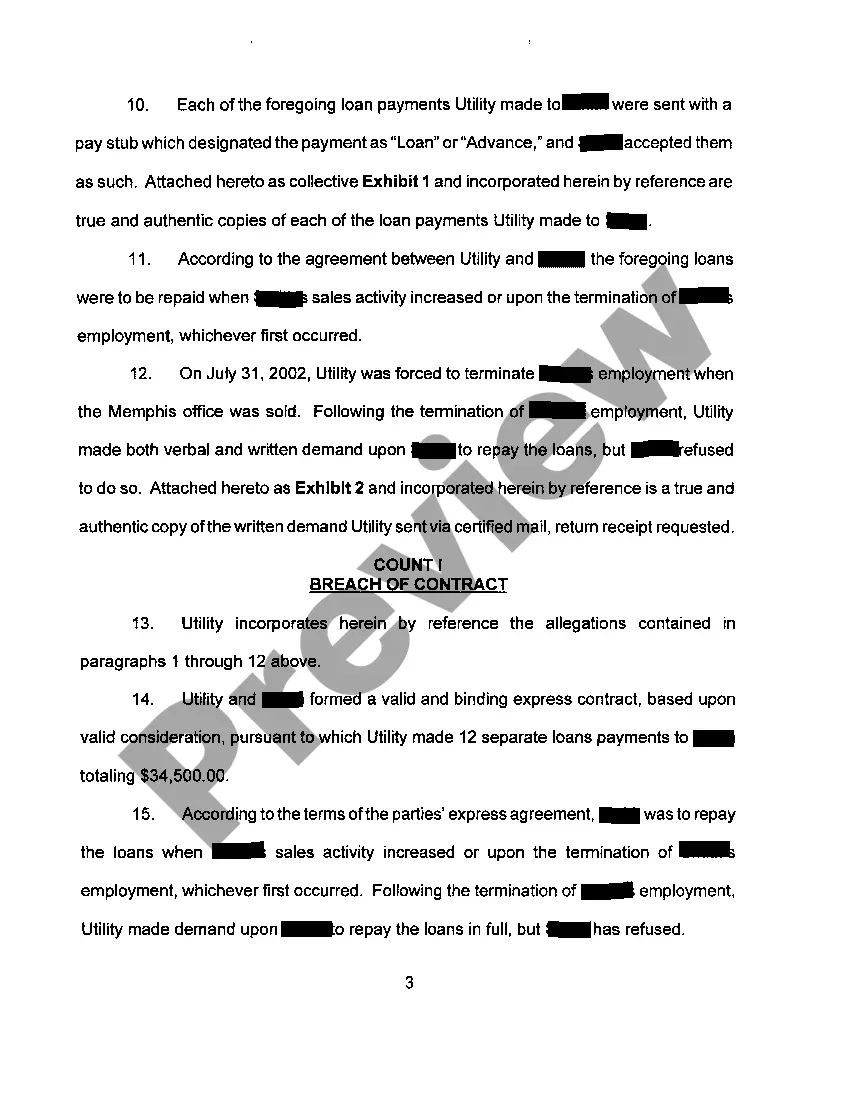

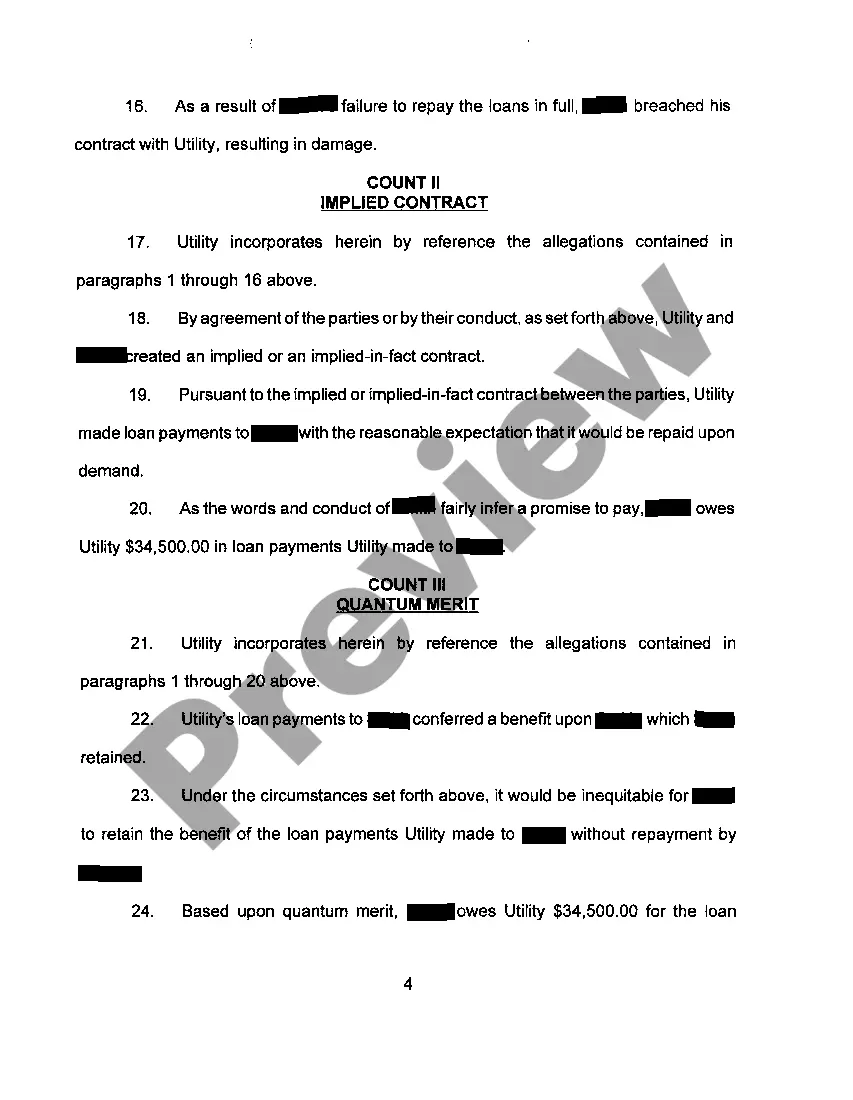

Title: Clarksville Tennessee Complaint for Demand for Payment: A Comprehensive Overview Introduction: In Clarksville, Tennessee, a Complaint for Demand for Payment serves as a legal tool utilized by individuals or businesses seeking to recover outstanding debts from debtors who have not fulfilled their obligations. This detailed description provides a comprehensive overview of the various types and procedures surrounding the Clarksville Tennessee Complaint for Demand for Payment. Types of Clarksville Tennessee Complaint for Demand for Payment: 1. Consumer Debt Complaint: This type of complaint is filed by businesses to demand payment from individual consumers who owe them money for goods or services provided. 2. Business Debt Complaint: Businesses can file a complaint to recover outstanding debt from other businesses or institutions. This category covers unpaid invoices, loans, or any other financial obligations owed by a business entity. 3. Medical Debt Complaint: Medical providers often utilize this complaint to recover unpaid medical bills from patients who have not satisfied their financial responsibilities. Key Components of Clarksville Tennessee Complaint for Demand for Payment: 1. Plaintiffs' Information: The complaint begins with the plaintiff's details, including their name, address, contact information, and legal representation (if applicable). 2. Defendants' Information: The complaint also includes the debtors' information, including their name, address, and any available contact details. 3. Statement of the Debt: This section outlines the specifics of the debt, such as the amount owed, the date it became due, and any pertinent details regarding the nature of the debt. 4. Basis for the Claim: The complaint must establish a legal basis for the demand, often by outlining the original agreement, contract terms, or an itemized invoice that supports the debt claim. 5. Demand for Payment: This section clearly articulates the plaintiff's demand for payment and includes a specific date by which the debtor must settle the debt to avoid legal action. 6. Legal Consequences: It is crucial to outline the potential legal consequences in case of non-compliance, such as initiating a lawsuit, obtaining a judgment, or pursuing further collection efforts. 7. Certification: The complaint needs to be signed by the plaintiff or their authorized representative, verifying the accuracy of the information provided. Conclusion: The Clarksville Tennessee Complaint for Demand for Payment is an instrumental legal document used to formally demand payment for outstanding debts in Clarksville, Tennessee. Whether it concerns consumer debt, business debt, or medical debt, the complaint serves as a crucial step in the debt collection process, clearly communicating the consequences of non-payment to the debtors. It is essential to consult with a legal professional to ensure the accuracy and adherence to the specific laws and regulations applicable in Clarksville, Tennessee.

Clarksville Tennessee Complaint for Demand for Payment

Category:

State:

Tennessee

City:

Clarksville

Control #:

TN-CN-42

Format:

PDF

Instant download

This form is available by subscription

Description

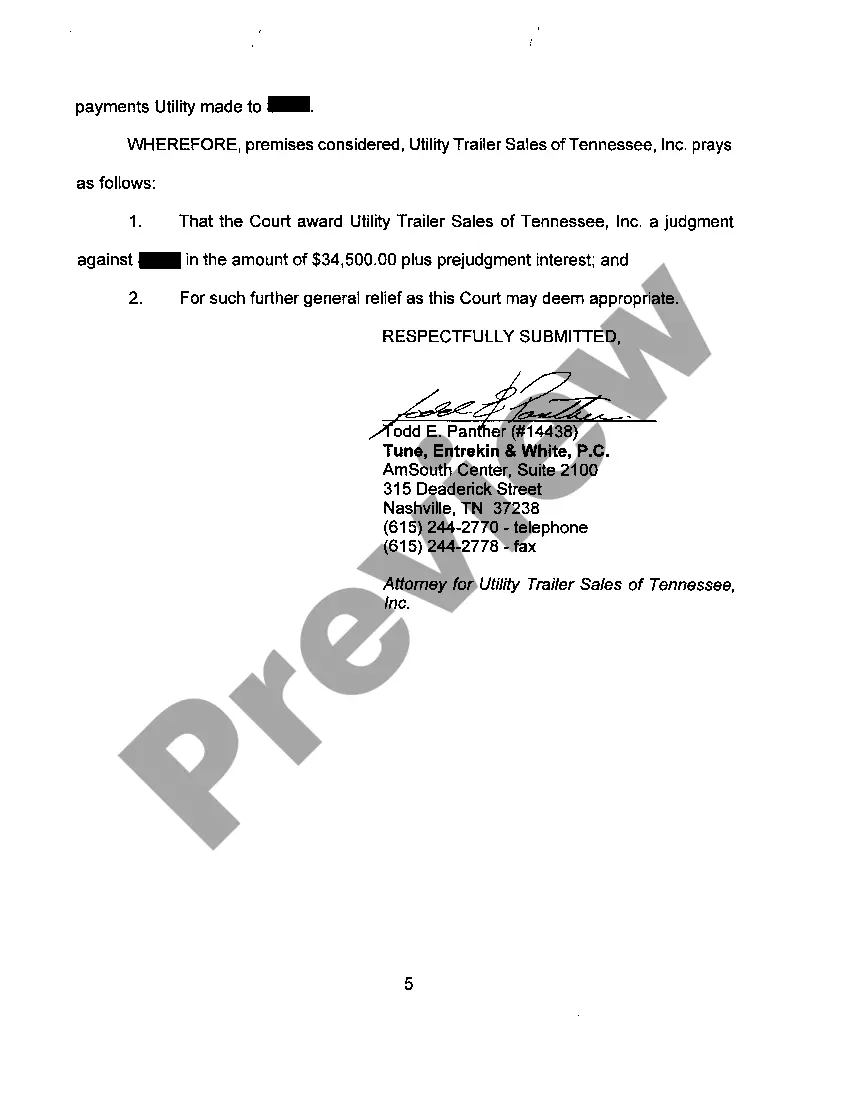

A01 Complaint for Demand for Payment

Title: Clarksville Tennessee Complaint for Demand for Payment: A Comprehensive Overview Introduction: In Clarksville, Tennessee, a Complaint for Demand for Payment serves as a legal tool utilized by individuals or businesses seeking to recover outstanding debts from debtors who have not fulfilled their obligations. This detailed description provides a comprehensive overview of the various types and procedures surrounding the Clarksville Tennessee Complaint for Demand for Payment. Types of Clarksville Tennessee Complaint for Demand for Payment: 1. Consumer Debt Complaint: This type of complaint is filed by businesses to demand payment from individual consumers who owe them money for goods or services provided. 2. Business Debt Complaint: Businesses can file a complaint to recover outstanding debt from other businesses or institutions. This category covers unpaid invoices, loans, or any other financial obligations owed by a business entity. 3. Medical Debt Complaint: Medical providers often utilize this complaint to recover unpaid medical bills from patients who have not satisfied their financial responsibilities. Key Components of Clarksville Tennessee Complaint for Demand for Payment: 1. Plaintiffs' Information: The complaint begins with the plaintiff's details, including their name, address, contact information, and legal representation (if applicable). 2. Defendants' Information: The complaint also includes the debtors' information, including their name, address, and any available contact details. 3. Statement of the Debt: This section outlines the specifics of the debt, such as the amount owed, the date it became due, and any pertinent details regarding the nature of the debt. 4. Basis for the Claim: The complaint must establish a legal basis for the demand, often by outlining the original agreement, contract terms, or an itemized invoice that supports the debt claim. 5. Demand for Payment: This section clearly articulates the plaintiff's demand for payment and includes a specific date by which the debtor must settle the debt to avoid legal action. 6. Legal Consequences: It is crucial to outline the potential legal consequences in case of non-compliance, such as initiating a lawsuit, obtaining a judgment, or pursuing further collection efforts. 7. Certification: The complaint needs to be signed by the plaintiff or their authorized representative, verifying the accuracy of the information provided. Conclusion: The Clarksville Tennessee Complaint for Demand for Payment is an instrumental legal document used to formally demand payment for outstanding debts in Clarksville, Tennessee. Whether it concerns consumer debt, business debt, or medical debt, the complaint serves as a crucial step in the debt collection process, clearly communicating the consequences of non-payment to the debtors. It is essential to consult with a legal professional to ensure the accuracy and adherence to the specific laws and regulations applicable in Clarksville, Tennessee.

Free preview

How to fill out Clarksville Tennessee Complaint For Demand For Payment?

If you’ve already utilized our service before, log in to your account and download the Clarksville Tennessee Complaint for Demand for Payment on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your document:

- Make sure you’ve found an appropriate document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to find the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Clarksville Tennessee Complaint for Demand for Payment. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!