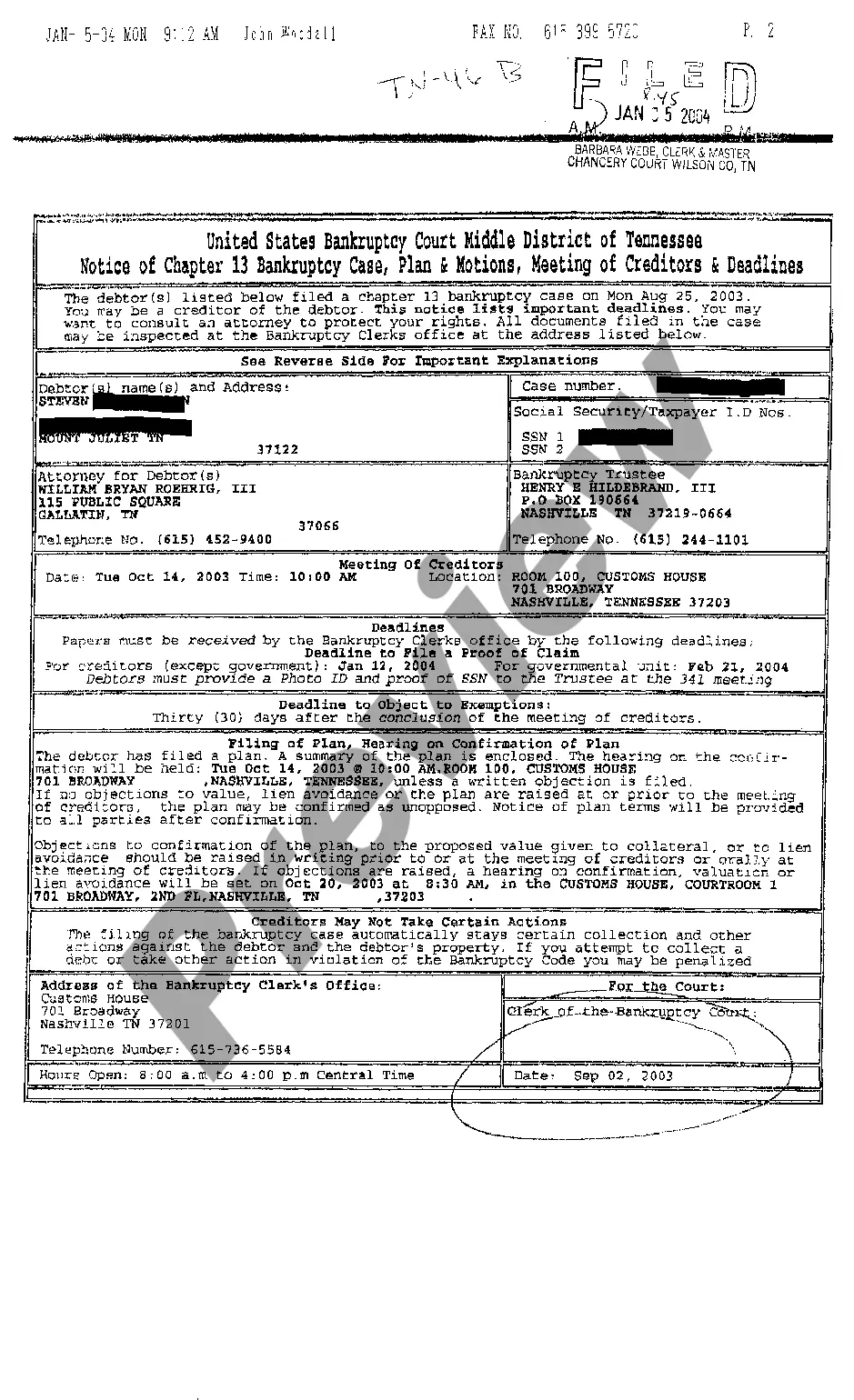

The Chattanooga US Bankruptcy Court Middle District of Tennessee is a federal court located in Chattanooga, Tennessee. It is one of the four divisions that make up the Middle District of Tennessee bankruptcy court system, with the other divisions being Nashville, Columbia, and Cookeville. As part of the United States Bankruptcy Court for the Middle District of Tennessee, the Chattanooga court holds jurisdiction over bankruptcy cases filed within its designated area. The Chattanooga US Bankruptcy Court Middle District of Tennessee plays a crucial role in the bankruptcy process, ensuring the fair and equitable resolution of debtor-creditor disputes. Its jurisdiction covers several counties in southeastern Tennessee, including Bedsore, Bradley, Franklin, Hamilton, Marion, McMinn, Mags, Polk, Rhea, and Sequatchie. Individuals and businesses residing or conducting business within the boundaries of the Chattanooga Division can file various types of bankruptcy cases with the court. These bankruptcy cases include Chapter 7, Chapter 11, and Chapter 13 bankruptcies. Each chapter serves distinct purposes and is tailored to meet different needs of debtors. Chapter 7 bankruptcy is commonly referred to as "liquidation bankruptcy" and is available to individuals, partnerships, or corporations. It involves the sale of a debtor's non-exempt assets by a court-appointed trustee to pay off outstanding debts. Chapter 7 bankruptcy grants individuals and businesses a fresh start by eliminating most unsecured debts. Chapter 11 bankruptcy is primarily designed for businesses, allowing them to reorganize their debts and continue operating while formulating a repayment plan. This type of bankruptcy gives businesses the opportunity to renegotiate contracts, leases, and other financial obligations with the aim of returning to profitability. Chapter 13 bankruptcy is often known as the "wage earner's plan" and is available to individuals with regular income. It enables debtors to develop a plan to repay a portion or all their debts over a specific period, usually three to five years. Chapter 13 bankruptcy is particularly beneficial for individuals seeking to save their homes from foreclosure or catch up on delinquent mortgage payments. The Chattanooga US Bankruptcy Court Middle District of Tennessee ensures that all bankruptcy cases are handled fairly and efficiently. It provides a platform for debtors to present their financial circumstances, negotiate with creditors, and find appropriate solutions to their financial struggles. The court also maintains records of bankruptcy cases, provides legal resources and assistance to litigants, and manages the overall bankruptcy process. In summary, the Chattanooga US Bankruptcy Court Middle District of Tennessee is a vital institution that oversees bankruptcy cases in its jurisdiction. By offering different types of bankruptcy relief such as Chapter 7, Chapter 11, and Chapter 13, it plays a critical role in assisting individuals and businesses facing financial adversity to obtain a fresh start and work towards a brighter financial future.

Chattanooga US Bankruptcy Court Middle District of Tennessee

Description

How to fill out Chattanooga US Bankruptcy Court Middle District Of Tennessee?

If you are searching for a relevant form template, it’s difficult to find a better service than the US Legal Forms website – one of the most considerable libraries on the internet. Here you can get a large number of form samples for company and personal purposes by categories and regions, or keywords. With our high-quality search function, getting the most recent Chattanooga US Bankruptcy Court Middle District of Tennessee is as elementary as 1-2-3. Moreover, the relevance of each document is confirmed by a group of professional lawyers that on a regular basis review the templates on our platform and revise them based on the latest state and county regulations.

If you already know about our system and have an account, all you should do to receive the Chattanooga US Bankruptcy Court Middle District of Tennessee is to log in to your account and click the Download button.

If you make use of US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have discovered the form you need. Look at its description and utilize the Preview feature (if available) to explore its content. If it doesn’t meet your requirements, utilize the Search option near the top of the screen to find the needed record.

- Affirm your choice. Select the Buy now button. Following that, select the preferred subscription plan and provide credentials to sign up for an account.

- Process the purchase. Use your bank card or PayPal account to finish the registration procedure.

- Get the template. Pick the format and download it on your device.

- Make adjustments. Fill out, revise, print, and sign the acquired Chattanooga US Bankruptcy Court Middle District of Tennessee.

Every template you add to your account does not have an expiry date and is yours forever. You always have the ability to gain access to them via the My Forms menu, so if you need to have an extra copy for enhancing or creating a hard copy, you may come back and download it again at any moment.

Make use of the US Legal Forms professional collection to get access to the Chattanooga US Bankruptcy Court Middle District of Tennessee you were seeking and a large number of other professional and state-specific templates in a single place!