Title: Exploring Different Types of Chattanooga Tennessee Complaints Regarding Sales, Use, Liquor, and Business Taxes Introduction: Chattanooga, Tennessee, is a vibrant city known for its beautiful scenery, thriving business community, and lively atmosphere. Like any other city, it also witnesses occasional complaints related to sales, use, liquor, and business taxes. In this article, we delve into various aspects of these complaints, their implications, and the significance of pertinent keywords. 1. Sales Tax Complaints: Sales tax plays a crucial role in funding local infrastructure and services. However, disagreements or issues can arise, leading to complaints. Some common themes include: a) Overcharging: Complaints alleging businesses overcharge customers by falsely increasing the sales tax on products or services. b) Incorrect Application: Instances where businesses incorrectly apply sales tax, leading to incorrect calculations or excess charges. c) Exemptions or Discounts: Situations where eligible exemptions or discounts are not correctly applied during sales transactions, resulting in customer dissatisfaction or financial burdens. Key keywords: Chattanooga sales tax issues, overcharging complaints, incorrect sales tax application, exemption and discount problems. 2. Use Tax Complaints: While sales tax is levied on the sale of goods or services, use tax is applicable on purchases made outside Tennessee but utilized within the state. Common use tax complaints include: a) Non-registered Businesses: Complaints regarding out-of-state businesses that fail to remit use tax to Chattanooga when selling products or services in the city. b) Use Tax Evasion: Instances where individuals or businesses intentionally evade use tax by not reporting out-of-state purchases, resulting in unfair competition. c) Incorrect Calculations: Complaints arising from incorrect use tax calculations made by businesses, leading to discrepancies and inconveniences for customers. Key keywords: Chattanooga use tax issues, unregistered businesses, use tax evasion, incorrect use tax calculations. 3. Liquor Tax Complaints: Liquor tax is an essential revenue source for Chattanooga, making complaints in this domain crucial to maintain transparency and compliance. Frequent liquor tax complaints include: a) Overcharging: Allegations of businesses overcharging customers by inflating the liquor tax component of their bills. b) Reporting Inaccuracies: Complaints relating to businesses inaccurately reporting or underreporting liquor sales, therefore misleading tax authorities and affecting revenue collection. c) Lack of Transparency: Concerns regarding the transparency of liquor tax calculations and how the funds are allocated and utilized. Key keywords: Chattanooga liquor tax issues, overcharging complaints, inaccurate reporting, lack of transparency in liquor tax calculations. 4. Business Tax Complaints: Business tax covers various aspects, such as licensing, permits, and assessments, and may give rise to different types of complaints, including: a) Licensing Delays: Complaints arising due to delays or complications in obtaining or renewing required business licenses, affecting business operations. b) Assessment Disputes: Complaints filed by businesses disagreeing with the assessed value of their properties for tax purposes, placing undue financial burdens on them. c) Tax Audit Issues: Instances where businesses experience discrepancies or disagreement with the findings of tax audits conducted by local authorities. Key keywords: Chattanooga business tax issues, licensing delays, assessment disputes, tax audit problems. Conclusion: Chattanooga, Tennessee, witnesses various complaints related to sales, use, liquor, and business taxes. Understanding the key issues within each category enables both businesses and authorities to work towards fair and efficient tax systems. By addressing these complaints promptly and striving for transparency, Chattanooga can foster a thriving business environment and ensure the welfare of its residents.

Chattanooga Tennessee Complaint regarding sales, use, liquor, business taxes

Description

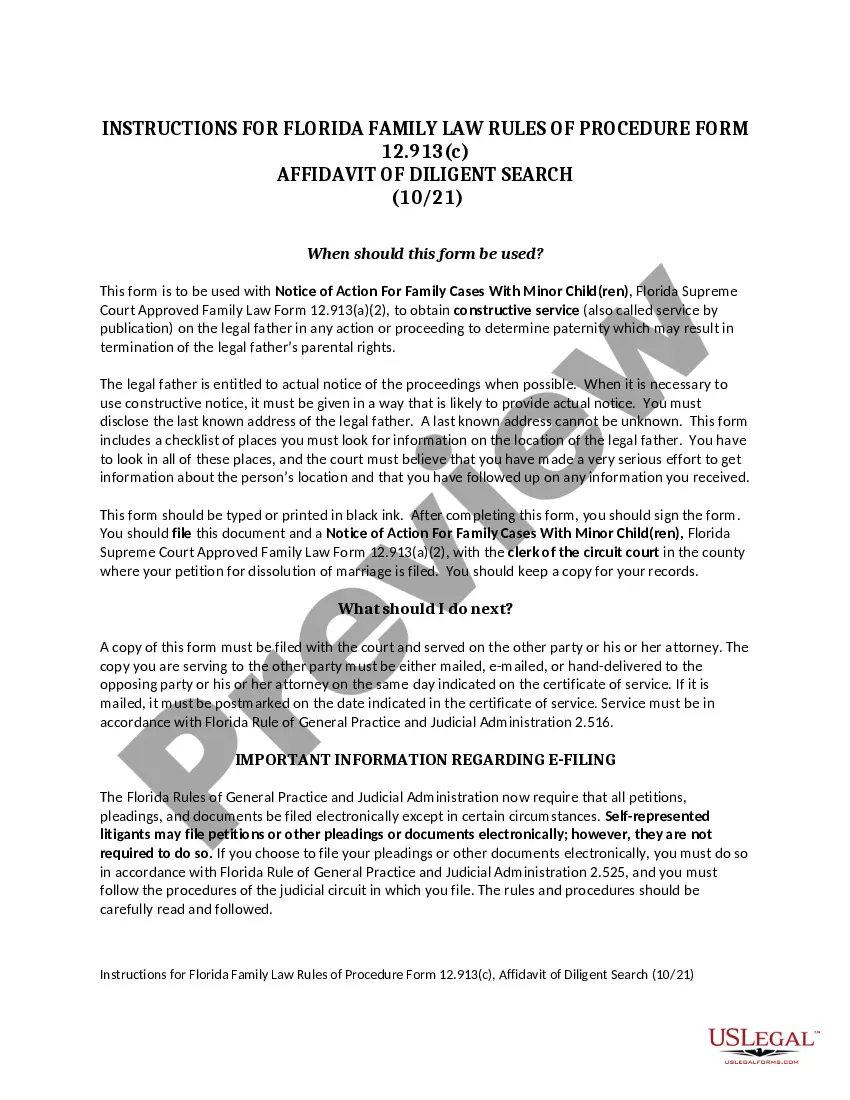

How to fill out Chattanooga Tennessee Complaint Regarding Sales, Use, Liquor, Business Taxes?

Are you seeking a dependable and cost-effective provider of legal forms to obtain the Chattanooga Tennessee Complaint about sales, use, liquor, and business taxes? US Legal Forms is your top option.

Whether you require a straightforward agreement to establish regulations for living together with your partner or a collection of documents to facilitate your separation or divorce through the courts, we have you covered. Our platform offers over 85,000 modern legal document templates for both personal and business purposes. All the templates we provide are not one-size-fits-all and are tailored to meet the specifications of different states and counties.

To acquire the form, you must Log Into your account, locate the necessary form, and click the Download button adjacent to it. Please remember that you can retrieve your previously purchased document templates at any time from the My documents section.

Is this your first visit to our website? No problem. You can create an account in just a few minutes, but before doing so, ensure that you.

Now, you can register your account. Then, select the subscription option and proceed with the payment. Once the payment has been finalized, download the Chattanooga Tennessee Complaint concerning sales, use, liquor, and business taxes in any provided file format. You can revisit the website at any time and redownload the form at no additional charge.

Finding up-to-date legal documents has never been simpler. Try US Legal Forms today and stop wasting your precious time searching for legal papers online once and for all.

- Verify that the Chattanooga Tennessee Complaint concerning sales, use, liquor, and business taxes aligns with the laws of your state and community.

- Review the details of the form (if available) to determine who it is intended for and what it covers.

- Restart the search if the form does not suit your legal situation.

Form popularity

FAQ

To file a complaint against an attorney in Tennessee, you should contact the Board of Professional Responsibility. They handle matters concerning ethical violations and can guide you through the complaint process. If your complaint involves issues related to a Chattanooga Tennessee Complaint regarding sales, use, liquor, business taxes, providing clear details will help them assess your case. Make sure to gather any supporting documents you have.

The Tennessee Consumer Protection Act safeguards consumers against unfair or deceptive business practices. This law provides a framework for addressing issues such as a Chattanooga Tennessee Complaint regarding sales, use, liquor, business taxes, and other unlawful actions by businesses. It allows consumers to seek relief, which can include financial compensation and the ability to report violations. Understanding this act can empower you as a consumer.

Filing a complaint against a local business in Tennessee begins with identifying the right regulatory agency or local department that oversees such matters. If your complaint concerns a Chattanooga Tennessee Complaint regarding sales, use, liquor, business taxes, the Department of Revenue may be involved. Typically, you'll need to complete a form and provide evidence of your claims. Keeping copies of all communications is also essential.

To file a complaint in Tennessee, determine the appropriate agency to handle your specific issue. If it pertains to a Chattanooga Tennessee Complaint regarding sales, use, liquor, business taxes, you might want to reach out to local authorities or the Department of Revenue. Follow their specific filing procedures, which often include submitting necessary documentation. Be clear and detailed to help expedite your complaint.

You can contact the Attorney General in Tennessee by visiting their official website, where they provide a variety of contact options. You may also call their office directly for assistance. If your issue relates to a Chattanooga Tennessee Complaint regarding sales, use, liquor, business taxes, they can provide guidance on how to proceed. Make sure to have relevant details ready to help facilitate your conversation.

To send a complaint to a company, start by determining the best method of communication, such as email or a contact form on their website. Clearly outline your Chattanooga Tennessee Complaint regarding sales, use, liquor, business taxes, including specific details and any relevant documentation. Make sure to keep a copy of your complaint for your records. Following up after a few days can help ensure your complaint is being addressed.

In Chattanooga, Tennessee, the liquor tax typically includes a combination of state and local taxes. The rates can vary based on the type of liquor and the specific categories defined by law. If you are facing a Chattanooga Tennessee Complaint regarding sales, use, liquor, business taxes, it’s crucial to stay informed about these tax rates to ensure compliance. For guidance and reliable information, check out the resources available on US Legal Forms.

Vendors in Tennessee can retain a percentage of the sales and use tax they collect. This compensation helps cover their administrative costs associated with collecting and remitting the tax. If you have a Chattanooga Tennessee Complaint regarding sales, use, liquor, business taxes, understanding this retention can help clarify your tax responsibilities. For further assistance, consider using the US Legal Forms platform to access resources on vendor compensation.

The Tennessee Alcoholic Beverage Commission regulates the manufacture, distribution, and sale of alcoholic beverages in the state. This includes licensing establishments, enforcing laws, and ensuring that sellers comply with state regulations. For those in Chattanooga, knowing these regulations can safeguard against poor practices. If you encounter issues, you can submit a Chattanooga Tennessee Complaint regarding sales, use, liquor, business taxes for resolution.

The Tennessee Alcoholic Beverage Commission (TABC) oversees the regulation of alcohol sales, distribution, and enforcement of laws pertaining to alcoholic beverages. This commission ensures compliance with state laws and has the authority to grant licenses for alcohol sales. If you have concerns about a business's compliance in Chattanooga, consider voicing your issues through a Chattanooga Tennessee Complaint regarding sales, use, liquor, business taxes.