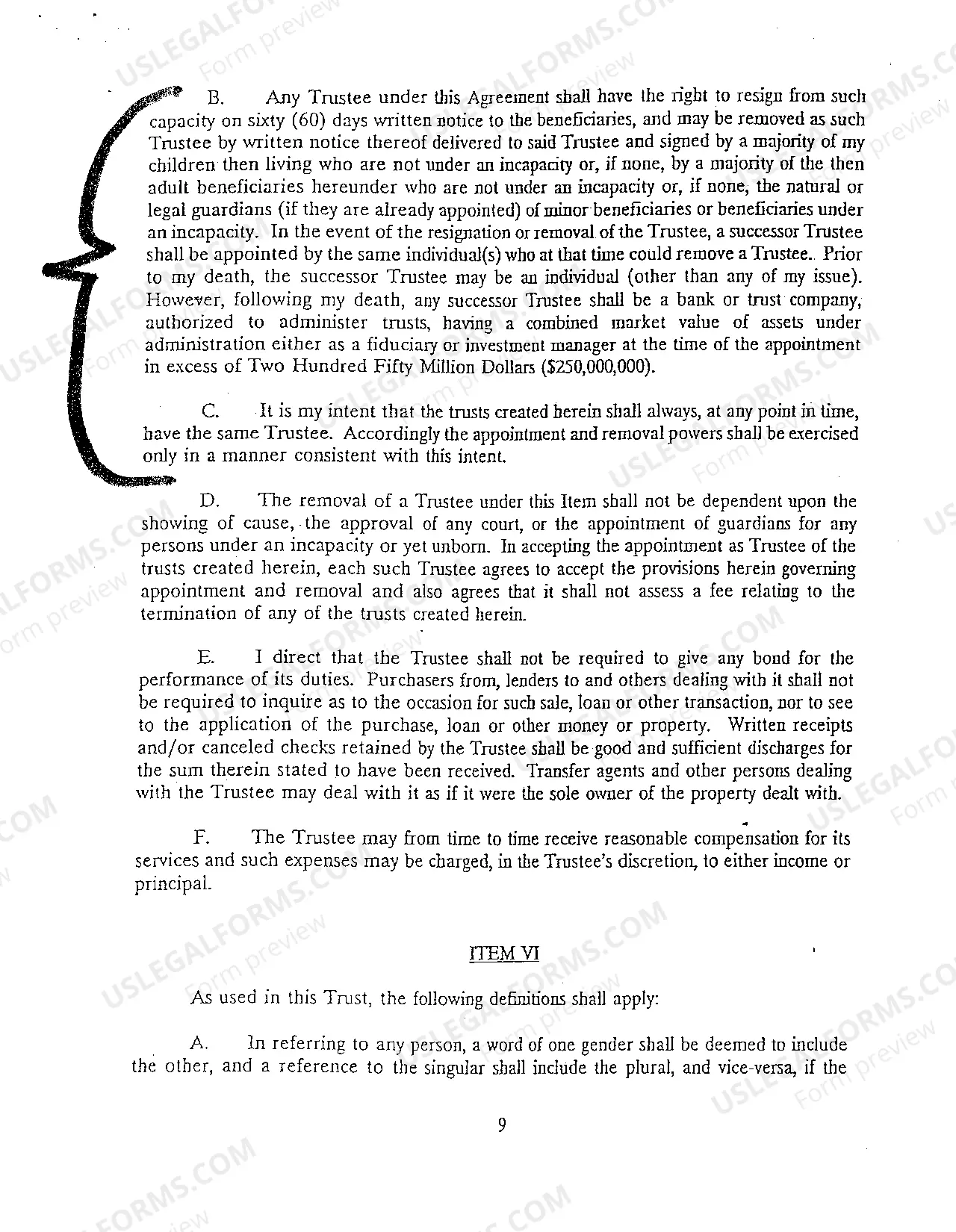

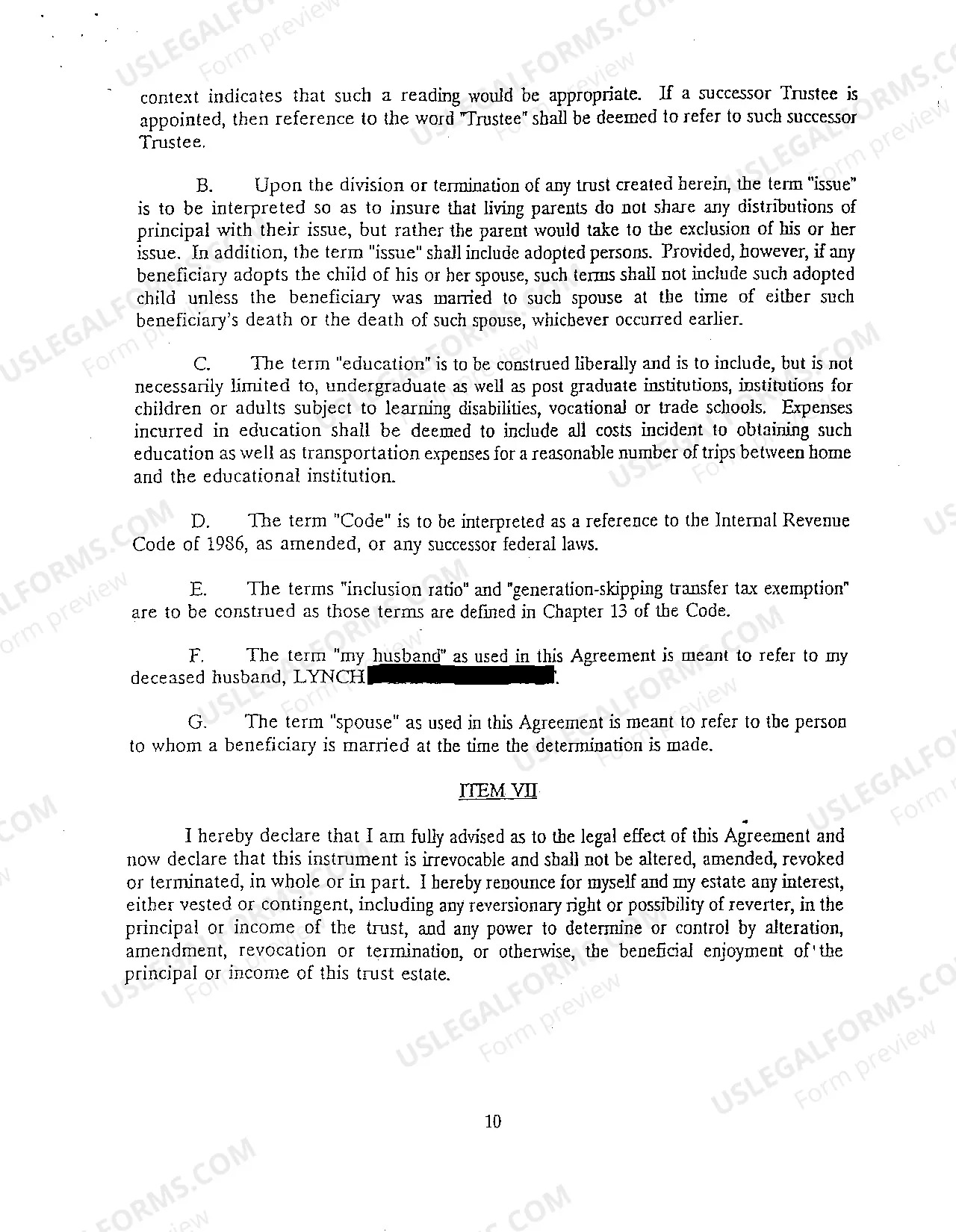

The Memphis Tennessee Trust Agreement is a legally binding document that outlines the terms and conditions of a trust established in Memphis, Tennessee. It is typically created by a settler who wishes to transfer their assets to a trustee for the benefit of beneficiaries. The main purpose of a trust agreement is to protect and manage assets while ensuring they are distributed according to the settler's wishes. It provides specific instructions on how the trustee should handle the assets, when and how distributions should be made to beneficiaries, and any conditions or restrictions that apply. There are several types of trust agreements that can be established in Memphis, Tennessee. Some common types include: 1. Revocable Trust Agreement: This type of trust agreement allows the settler to retain control and make changes or revoke the trust during their lifetime. It offers flexibility, privacy, and avoids probate. 2. Irrevocable Trust Agreement: In contrast to a revocable trust, an irrevocable trust agreement cannot be modified or terminated without the consent of the beneficiaries. Once established, the settler relinquishes ownership and control of the assets, providing potential estate tax benefits. 3. Testamentary Trust Agreement: This trust agreement takes effect upon the death of the settler, as outlined in their will. It allows for the distribution of assets to beneficiaries according to the settler's instructions, often providing support or managing assets for minor or incapacitated beneficiaries. 4. Special Needs Trust Agreement: This type of trust agreement is designed to provide for the long-term care and needs of individuals with disabilities or special needs. It ensures that beneficiaries can receive supplemental assistance without compromising their eligibility for government benefits. 5. Charitable Trust Agreement: This trust agreement is established to fulfill specific charitable purposes. Assets are transferred to a charitable organization or foundation and managed for the benefit of a chosen cause or community. It is important for the settler to work with an experienced attorney specializing in estate planning in Memphis, Tennessee, to draft and properly execute the trust agreement. Compliance with state laws and regulations is crucial to ensure the validity and effectiveness of the trust.

Memphis Tennessee Trust Agreement

Description

How to fill out Memphis Tennessee Trust Agreement?

Are you seeking a trustworthy and affordable supplier of legal forms to purchase the Memphis Tennessee Trust Agreement? US Legal Forms is your preferred option.

Whether you require a simple agreement to establish guidelines for living together with your partner or a compilation of documents for processing your separation or divorce in court, we have you covered.

Our website features over 85,000 current legal document templates for personal and business purposes. All the templates we provide access to are not generic and tailored specifically to the needs of various states and counties.

To obtain the document, you must Log In to your account, locate the required form, and click the Download button adjacent to it.

If the form is not appropriate for your legal circumstances, restart your search.

Now you can create your account, choose the subscription option, and continue to payment. After the payment is processed, download the Memphis Tennessee Trust Agreement in any available format. You can return to the website at any point and re-download the document without any additional costs.

- Please remember that you can retrieve your previously purchased form templates at any time in the My documents tab.

- Are you unfamiliar with our platform? No problem.

- You can set up an account within minutes, but before proceeding, ensure you do the following.

- Verify that the Memphis Tennessee Trust Agreement complies with the laws of your state and locality.

- Review the form's description (if available) to understand who and what the document is designed for.

Form popularity

FAQ

The beneficiary can (where there is one beneficiary or if there are several beneficiaries and all of them agree) direct the trustee to transfer the trust property to him (if there are several beneficiaries to all of them) or to such other person as the beneficiary (or the beneficiaries may desire).

A Tennessee living trust is an estate planning tool that lets you maintain the use of your assets while placing ownership of them in a trust. After your death, they are passed to beneficiaries of your choice. A living trust in Tennessee is created by the grantor, the person transferring assets into the trust.

Tennessee has not adopted the Uniform Probate Code. So if your property is worth more than $50,000, a living trust will enable your heirs to avoid the state's lengthy probate period ? and legal costs. Living trusts do cost money, though, so you should weigh the benefits with the outlay of $1,000 or more.

A trust is not public record. A will is always made public record when it is probated. No one need know what assets are in your trust, who your beneficiaries are, or when the assets are distributed.

Key estate planning documents that might be impacted include trusts, wills, living wills, and durable or healthcare power of attorney. All of these legal documents require the signatory, witnesses, and notary to be physically present in order to execute the document.

Common Types of Trusts Inter vivos trusts or living trusts: created and active during the lifetime of the grantor. Testamentary trusts: trusts formed after the death of the grantor. Revocable trusts: can be changed or revoked entirely by the grantor.

Drawbacks of a living trust The most significant disadvantages of trusts include costs of set and administration. Trusts have a complex structure and intricate formation and termination procedures. The trustor hands over control of their assets to trustees.

The Cons. While there are many benefits to putting your home in a trust, there are also a few disadvantages. For one, establishing a trust is time-consuming and can be expensive. The person establishing the trust must file additional legal paperwork and pay corresponding legal fees.

To transfer personal items to a trust, you or your attorney will list them on a property schedule that is referenced by and attached to the trust. However, note that it is more common to keep these assets just in your name and distribute them under your will than place them in a trust.

How to Create a Living Trust in Tennessee Identify what should go into the trust.Choose the appropriate type of living trust.Next, choose your trustee, who will manage the trust.Now create a trust agreement.Then sign the trust document in front of a notary public. Finally, transfer your property into the trust.

More info

Once the paperwork is completed, the beneficiary can claim the account assets themselves and the Trustee will have no role in the decedent's estate. However, if there is no will, the next step will be to determine the assets in the account. Once the account holder dies, the Trustee will continue with the estate management on behalf of the beneficiary, even though there is no surviving trustee. Some people decide that the best thing is to set up an account before death, and then the beneficiary should transfer the funds there as they are needed. This is a good plan to consider when the beneficiary has little money, and you are not worried about the account not being fully funded after they die. It may be advantageous to keep the trust company for the rest of a deceased person's life so that they have a place to keep their assets, and there will be no chance of someone else claiming their assets.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.