Chattanooga Tennessee Joiner In Petition By Entrust Bank: Detailed Description and Types The Chattanooga Tennessee Joiner In Petition By Entrust Bank refers to a legal action initiated by Entrust Bank in Chattanooga, Tennessee. This petition is a legal document filed with a court that outlines the bank's claims against a certain individual or entity in the Chattanooga area. The purpose of the petition is to seek a resolution or collect outstanding debts owed to Entrust Bank. Entrust Bank, a prominent financial institution, has a long-standing presence in Chattanooga, Tennessee. With its extensive range of banking services, the bank serves both individual customers and businesses in the area. It takes legal action through the Joiner In Petition process when it encounters situations where customers fail to fulfill their financial obligations. The Chattanooga Tennessee Joiner In Petition provides Entrust Bank the opportunity to present evidence, arguments, and claims against the opposing party. The bank may allege default on loans, unpaid credit card bills, failure to meet mortgage payments, or violation of the terms agreed upon for financial transactions. It is important to note that the specifics of each petition vary based on the circumstances and the parties involved. The types of Chattanooga Tennessee Joiner In Petition filings by Entrust Bank can vary depending on the nature of the issue. Some possible categories of petitions that Entrust Bank may file in Chattanooga, Tennessee include: 1. Debt Collection Petition: This type of petition is filed when a customer fails to repay the debt they owe to the bank. Entrust Bank seeks legal intervention to recover the outstanding debt through a court judgment. 2. Foreclosure Petition: In cases where a customer has defaulted on mortgage payments, Entrust Bank may file a foreclosure petition. This asserts the bank's right to take possession of the property secured by the mortgage in order to recover the amount owed. 3. Breach of Contract Petition: If Entrust Bank believes that a customer has violated the terms and conditions of a written agreement, such as a loan agreement or credit card agreement, they may file a breach of contract petition. This legal action is taken to enforce the terms of the contract and seek appropriate remedies. 4. Dispute Resolution Petition: Sometimes, disagreements arise between Entrust Bank and its customers regarding financial matters. In such cases, the bank may file a dispute resolution petition seeking court intervention to resolve the issue in a fair and lawful manner. It is important to consult legal professionals or professionals in the banking industry for accurate and up-to-date information about Chattanooga Tennessee Joiner In Petition By Entrust Bank. Each case is unique, and specific details and requirements may apply depending on the situation at hand.

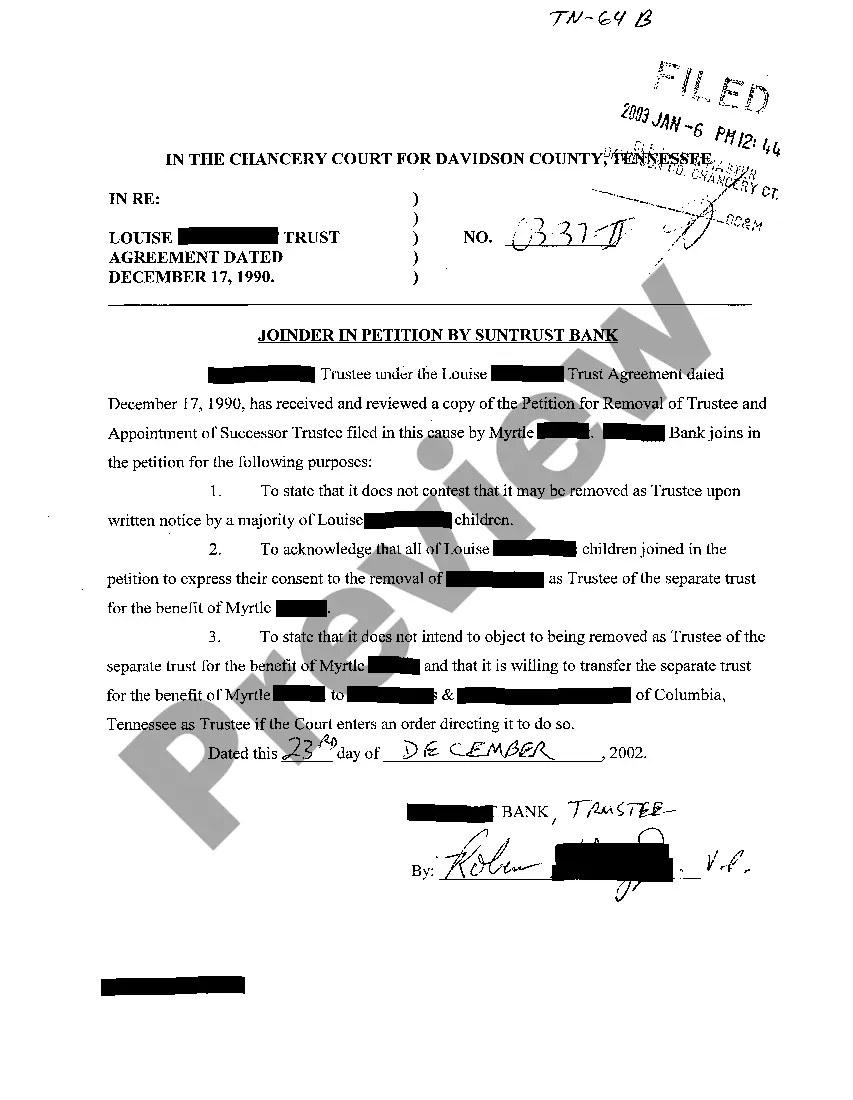

Chattanooga Tennessee Joiner In Petition By SunTrust Bank

Description

How to fill out Chattanooga Tennessee Joiner In Petition By SunTrust Bank?

If you are looking for a valid form template, it’s impossible to find a more convenient platform than the US Legal Forms site – one of the most comprehensive libraries on the web. Here you can find a huge number of templates for business and individual purposes by categories and regions, or key phrases. With the high-quality search option, getting the newest Chattanooga Tennessee Joiner In Petition By SunTrust Bank is as elementary as 1-2-3. In addition, the relevance of each and every record is confirmed by a group of skilled attorneys that regularly check the templates on our platform and revise them based on the newest state and county requirements.

If you already know about our platform and have an account, all you need to get the Chattanooga Tennessee Joiner In Petition By SunTrust Bank is to log in to your profile and click the Download button.

If you utilize US Legal Forms for the first time, just follow the instructions below:

- Make sure you have chosen the form you require. Check its explanation and utilize the Preview option to explore its content. If it doesn’t meet your requirements, utilize the Search option at the top of the screen to find the proper document.

- Affirm your choice. Choose the Buy now button. After that, select your preferred pricing plan and provide credentials to sign up for an account.

- Process the financial transaction. Utilize your bank card or PayPal account to finish the registration procedure.

- Receive the form. Pick the format and save it to your system.

- Make changes. Fill out, edit, print, and sign the acquired Chattanooga Tennessee Joiner In Petition By SunTrust Bank.

Each form you add to your profile does not have an expiry date and is yours permanently. It is possible to gain access to them via the My Forms menu, so if you need to have an additional duplicate for enhancing or creating a hard copy, feel free to return and save it once again anytime.

Take advantage of the US Legal Forms professional collection to get access to the Chattanooga Tennessee Joiner In Petition By SunTrust Bank you were looking for and a huge number of other professional and state-specific templates on one website!