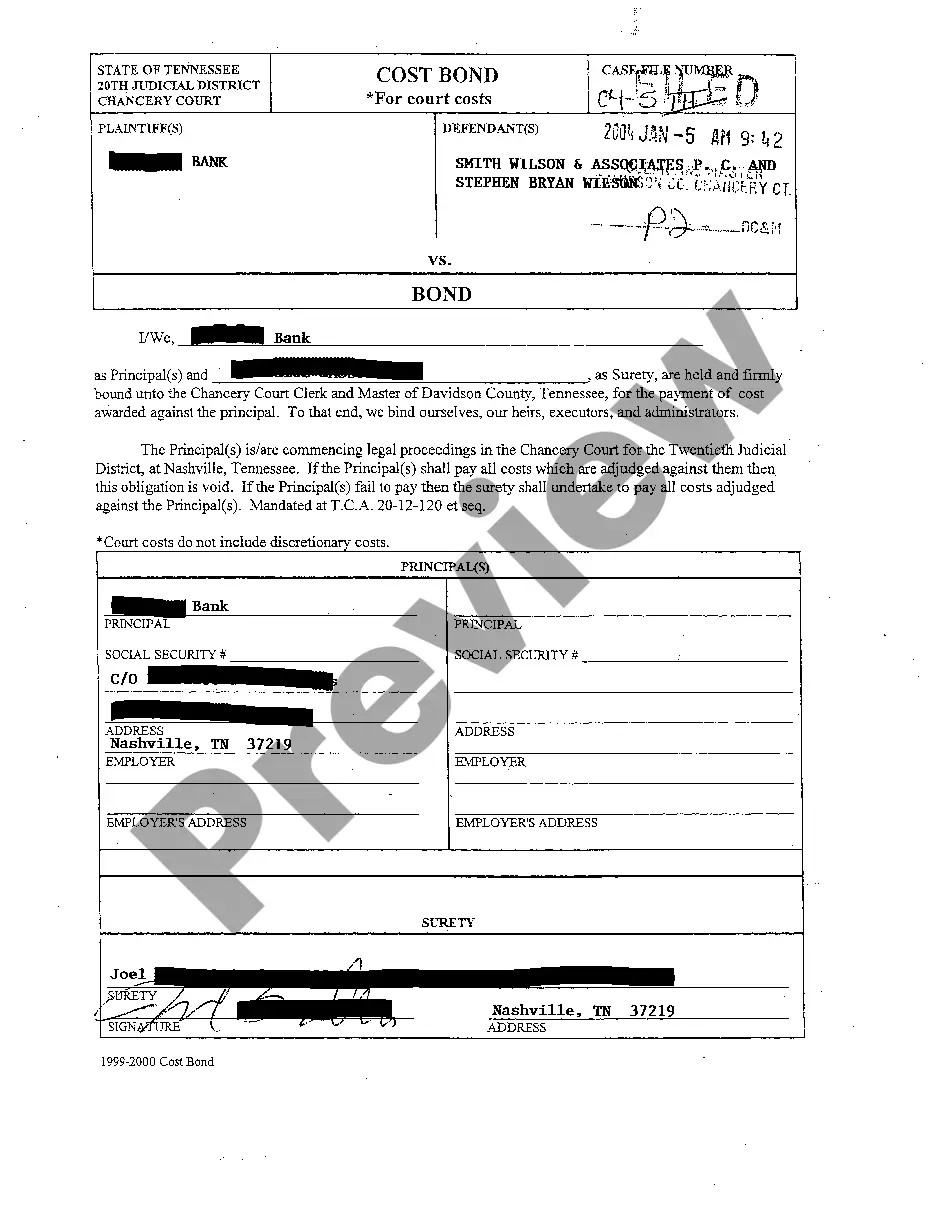

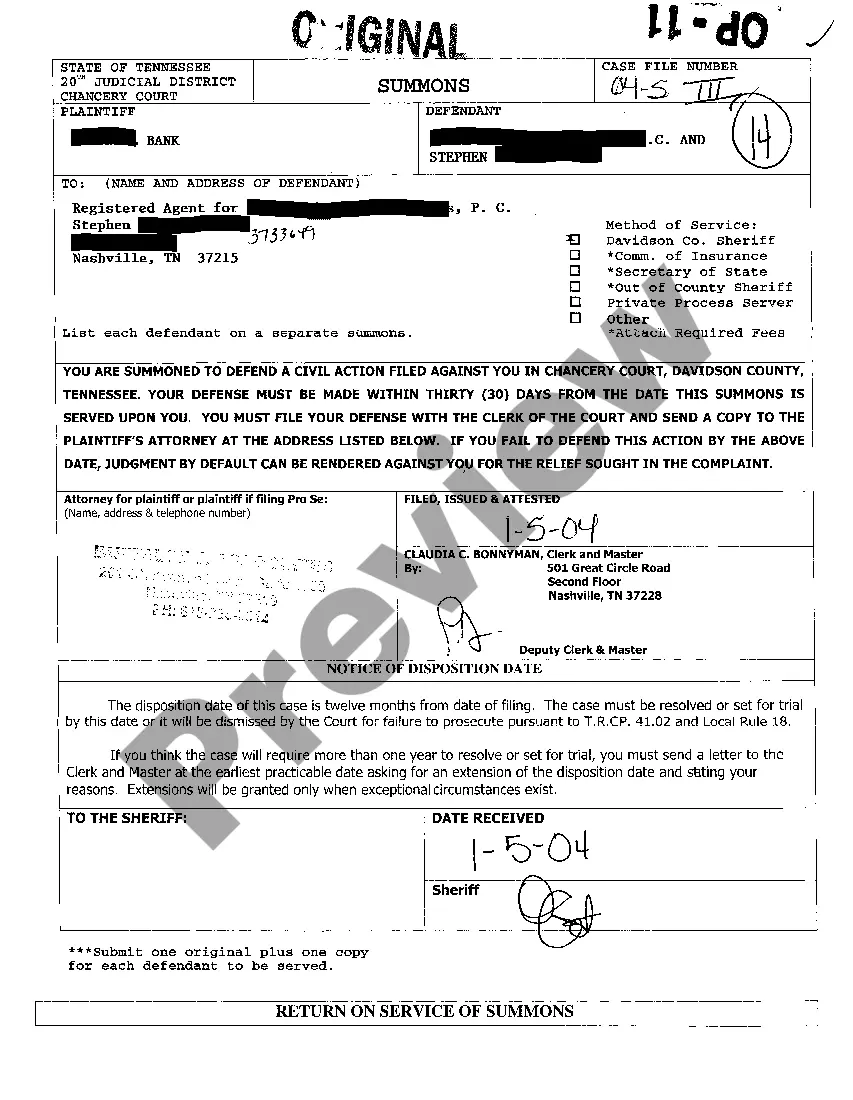

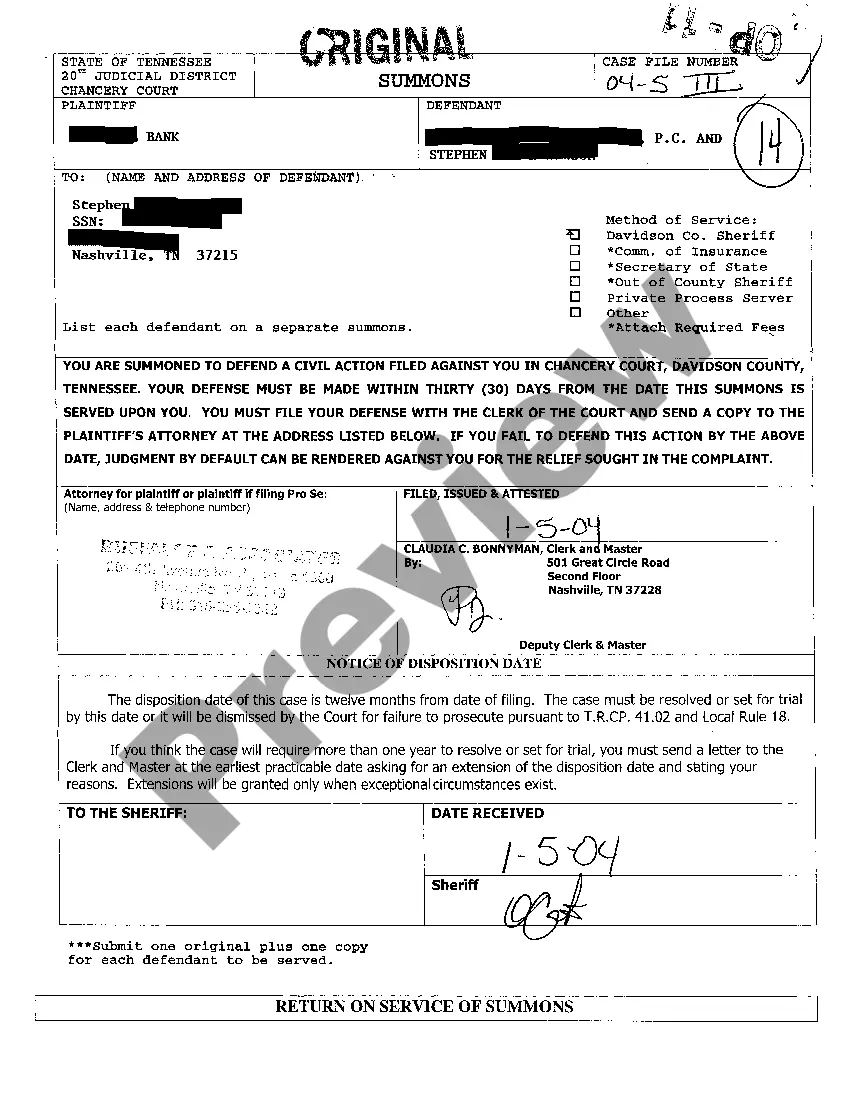

A Chattanooga Tennessee Cost Bond is a type of surety bond that serves as a guarantee for the payment of costs awarded against the principle. These costs may arise from legal proceedings, such as court fees, expert witness fees, and other expenses that the court deems necessary for the proceedings. The bond acts as a form of protection for the obliged, who can recover their costs if the principal fails to fulfill their financial obligations. There are different types of Chattanooga Tennessee Cost Bonds, depending on the specific requirements of the situation. Some common variations include: 1. Appeal Cost Bond: This bond is required when a party wishes to appeal a court decision. It ensures that the appealing party will pay any costs that may arise during the appeal process. 2. Plaintiff or Defendant Cost Bond: In certain cases, the court may require either the plaintiff or the defendant to post a cost bond. This bond guarantees that the party responsible for paying the costs will fulfill their obligations. 3. Cost Bond for Executors or Administrators: In probate or estate administration cases, the court may require the executor or administrator to post a cost bond. This bond ensures that the fiduciary will cover any costs incurred during the administration of the estate. Chattanooga Tennessee Cost Bonds are typically issued by insurance companies or surety bond providers. The bond amount is determined by the court based on the estimated costs of the case or the specific requirements outlined in the court order. When obtaining a cost bond, the principal will need to provide certain documentation and undergo a review process to determine their eligibility for bonding. It is important for individuals or businesses involved in legal proceedings in Chattanooga, Tennessee, to understand the specific requirements and obligations associated with cost bonds. Failure to obtain or maintain a cost bond may result in legal consequences, including potential delays or dismissal of the case. Consulting with an experienced attorney or surety bond professional is advisable to ensure compliance with relevant regulations.

Chattanooga Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal

Description

How to fill out Chattanooga Tennessee Cost Bond To Act As Surety For Payments Of Costs Awarded Against The Principal?

No matter what social or professional status, filling out law-related documents is an unfortunate necessity in today’s world. Very often, it’s practically impossible for someone without any legal education to draft such paperwork from scratch, mainly because of the convoluted jargon and legal nuances they come with. This is where US Legal Forms can save the day. Our platform offers a massive collection with more than 85,000 ready-to-use state-specific documents that work for practically any legal scenario. US Legal Forms also is an excellent resource for associates or legal counsels who want to save time utilizing our DYI forms.

No matter if you want the Chattanooga Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Chattanooga Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal in minutes employing our trusted platform. In case you are already an existing customer, you can go on and log in to your account to download the appropriate form.

Nevertheless, if you are new to our library, ensure that you follow these steps before obtaining the Chattanooga Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal:

- Ensure the template you have found is specific to your area considering that the rules of one state or county do not work for another state or county.

- Review the form and go through a quick outline (if provided) of cases the document can be used for.

- In case the one you picked doesn’t meet your needs, you can start again and search for the necessary document.

- Click Buy now and choose the subscription plan you prefer the best.

- utilizing your login information or register for one from scratch.

- Pick the payment method and proceed to download the Chattanooga Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal once the payment is completed.

You’re all set! Now you can go on and print the form or complete it online. In case you have any problems getting your purchased documents, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.