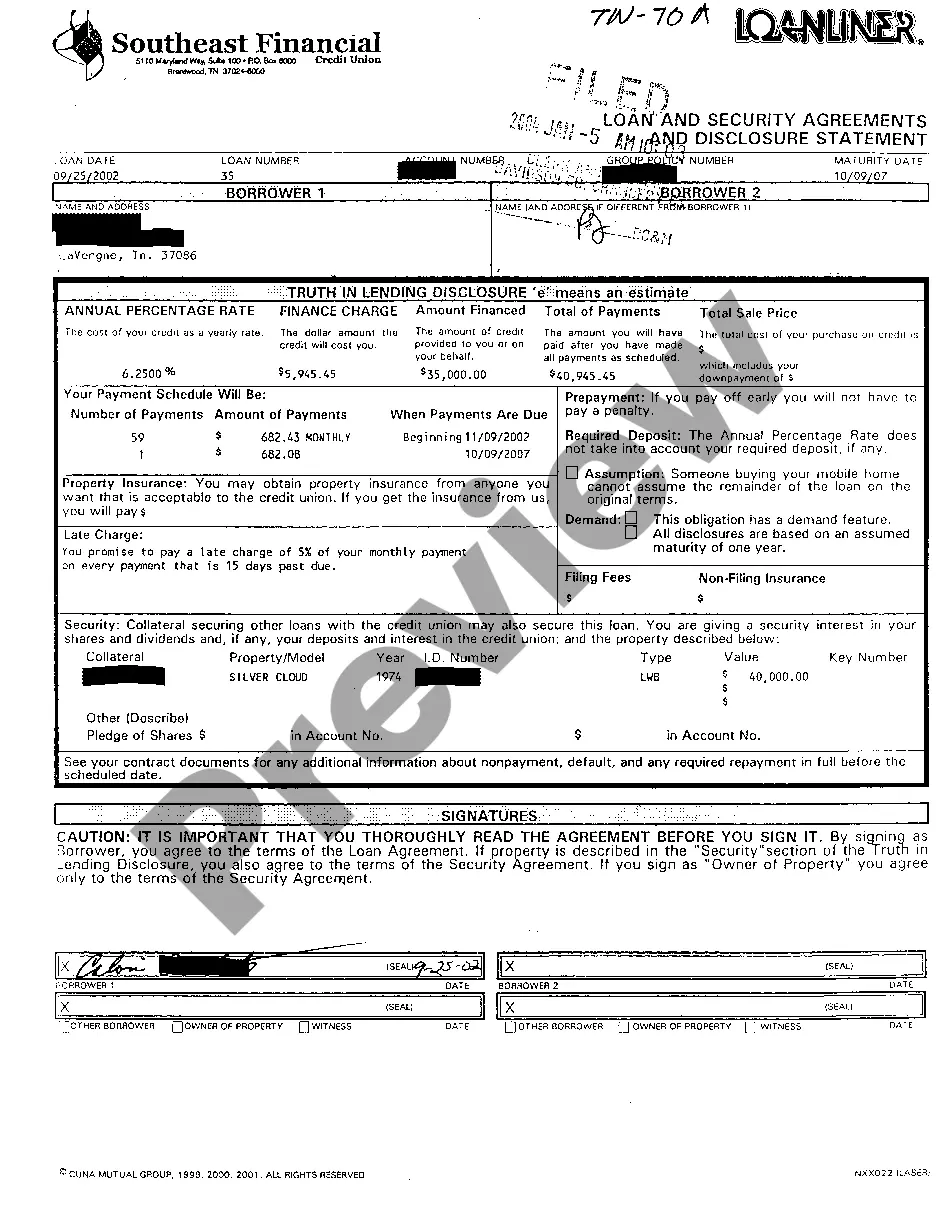

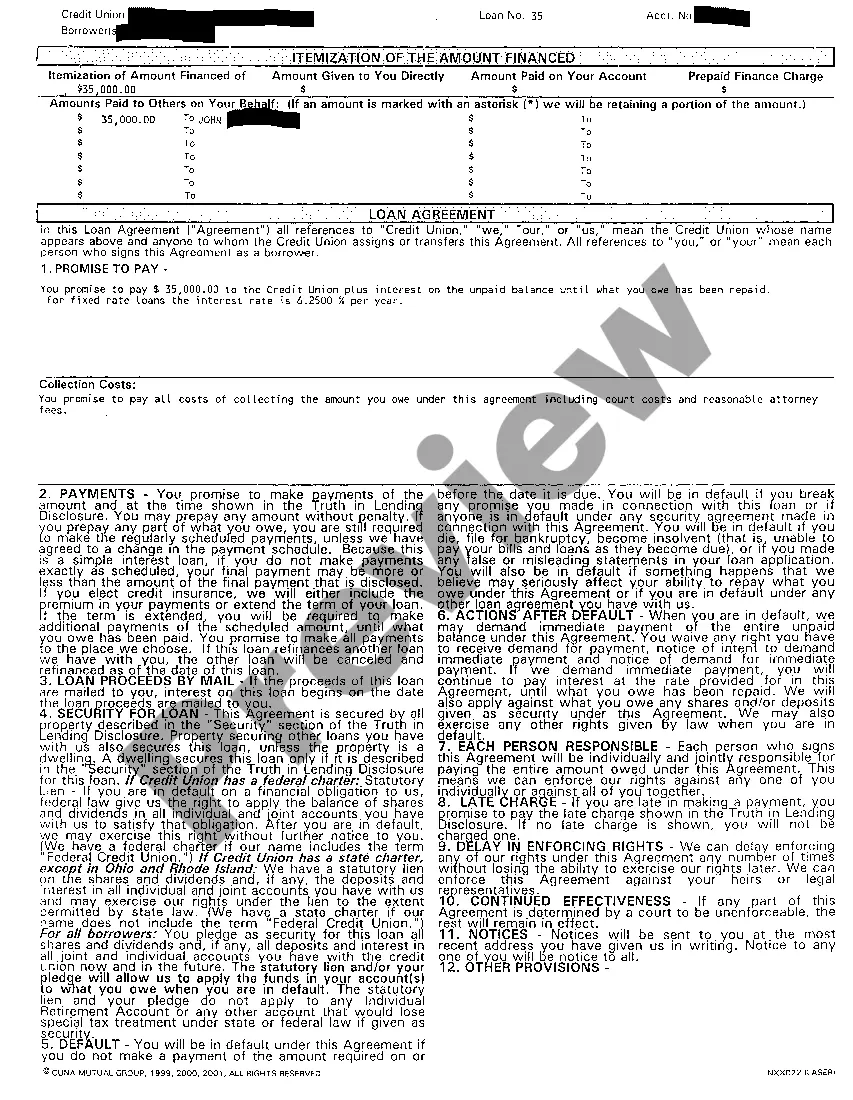

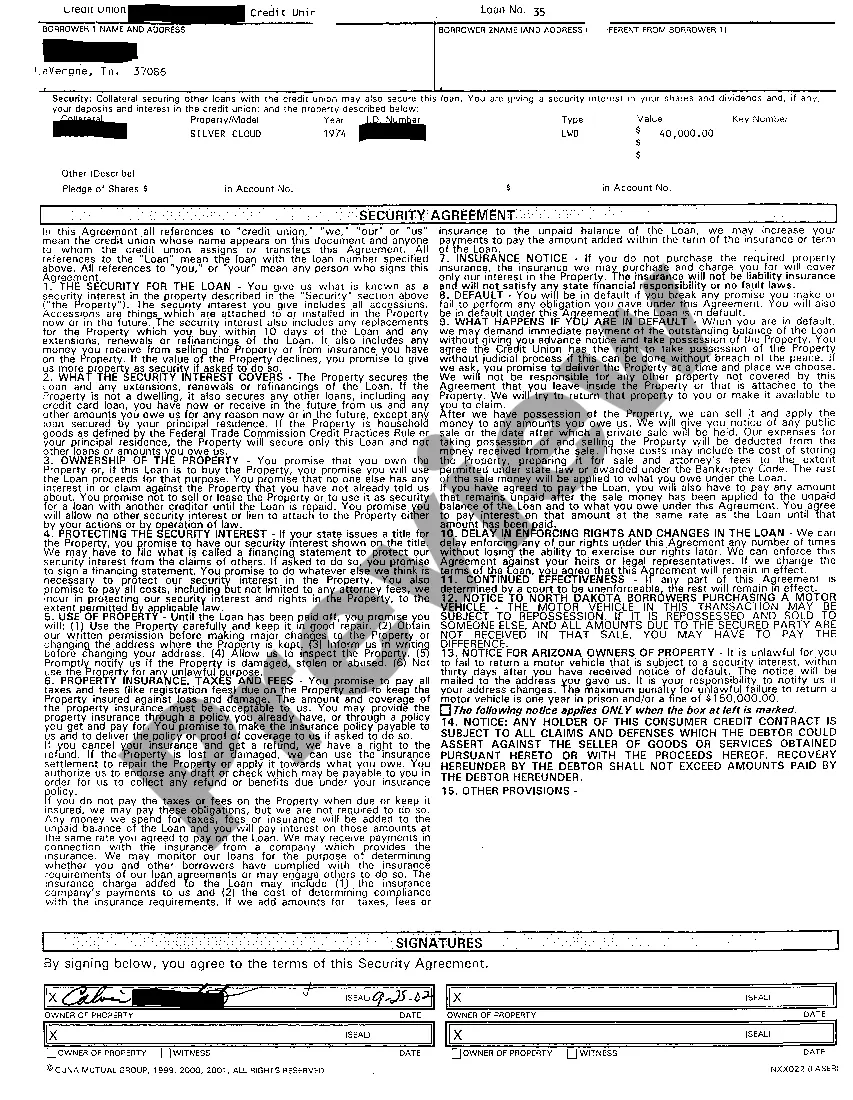

The Chattanooga Tennessee Loan and Security Agreement is a legally binding contract that outlines the terms and conditions of a loan between a lender and a borrower in the city of Chattanooga, Tennessee. This agreement establishes the obligations and responsibilities of both parties, ensuring a transparent and smooth transaction. In essence, the loan agreement serves as a protective measure for both the lender and the borrower. The lender provides a specified amount of money or assets to the borrower, with the understanding that it will be repaid according to the agreed-upon terms. Additionally, the borrower pledges collateral as security to guarantee the repayment of the loan. There are several types of loan and security agreements available in Chattanooga, Tennessee, depending on the nature of the loan and the collateral involved: 1. Real Estate Loan and Security Agreement: This type of agreement is commonly used when the loan is secured by real estate property, such as a mortgage or a home equity loan. It establishes the terms of repayment and the rights and responsibilities of both the lender and borrower in case of default. 2. Business Loan and Security Agreement: When a business seeks financial assistance, a business loan and security agreement come into play. This agreement outlines the specific terms of the loan, including interest rates, repayment schedules, and collateral, such as business assets or accounts receivable, offered as security. 3. Personal Loan and Security Agreement: In cases where an individual borrower requires funds, a personal loan and security agreement is created. This agreement details the loan amount, interest rate, repayment period, and any collateral provided as security, such as personal property or vehicles. 4. Equipment Loan and Security Agreement: When a loan is obtained to finance equipment, machinery, or vehicles, an equipment loan and security agreement is utilized. This agreement specifies the terms of the loan, such as the repayment schedule and any assets provided as collateral. Chattanooga Tennessee Loan and Security Agreements are designed to protect the interests of both parties involved in the lending process. It is crucial for borrowers to carefully review and understand the terms outlined in the agreement before signing to ensure full compliance and avoid any potential legal consequences. Similarly, lenders depend on these agreements to enforce their rights to repayment and secure their investment in case of default.

Chattanooga Tennessee Loan And Security Agreement

State:

Tennessee

City:

Chattanooga

Control #:

TN-CN-70-01

Format:

PDF

Instant download

This form is available by subscription

Description

A03 Loan And Security Agreement

The Chattanooga Tennessee Loan and Security Agreement is a legally binding contract that outlines the terms and conditions of a loan between a lender and a borrower in the city of Chattanooga, Tennessee. This agreement establishes the obligations and responsibilities of both parties, ensuring a transparent and smooth transaction. In essence, the loan agreement serves as a protective measure for both the lender and the borrower. The lender provides a specified amount of money or assets to the borrower, with the understanding that it will be repaid according to the agreed-upon terms. Additionally, the borrower pledges collateral as security to guarantee the repayment of the loan. There are several types of loan and security agreements available in Chattanooga, Tennessee, depending on the nature of the loan and the collateral involved: 1. Real Estate Loan and Security Agreement: This type of agreement is commonly used when the loan is secured by real estate property, such as a mortgage or a home equity loan. It establishes the terms of repayment and the rights and responsibilities of both the lender and borrower in case of default. 2. Business Loan and Security Agreement: When a business seeks financial assistance, a business loan and security agreement come into play. This agreement outlines the specific terms of the loan, including interest rates, repayment schedules, and collateral, such as business assets or accounts receivable, offered as security. 3. Personal Loan and Security Agreement: In cases where an individual borrower requires funds, a personal loan and security agreement is created. This agreement details the loan amount, interest rate, repayment period, and any collateral provided as security, such as personal property or vehicles. 4. Equipment Loan and Security Agreement: When a loan is obtained to finance equipment, machinery, or vehicles, an equipment loan and security agreement is utilized. This agreement specifies the terms of the loan, such as the repayment schedule and any assets provided as collateral. Chattanooga Tennessee Loan and Security Agreements are designed to protect the interests of both parties involved in the lending process. It is crucial for borrowers to carefully review and understand the terms outlined in the agreement before signing to ensure full compliance and avoid any potential legal consequences. Similarly, lenders depend on these agreements to enforce their rights to repayment and secure their investment in case of default.

Free preview

How to fill out Chattanooga Tennessee Loan And Security Agreement?

If you’ve already utilized our service before, log in to your account and download the Chattanooga Tennessee Loan And Security Agreement on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Ensure you’ve found the right document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Chattanooga Tennessee Loan And Security Agreement. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional needs!