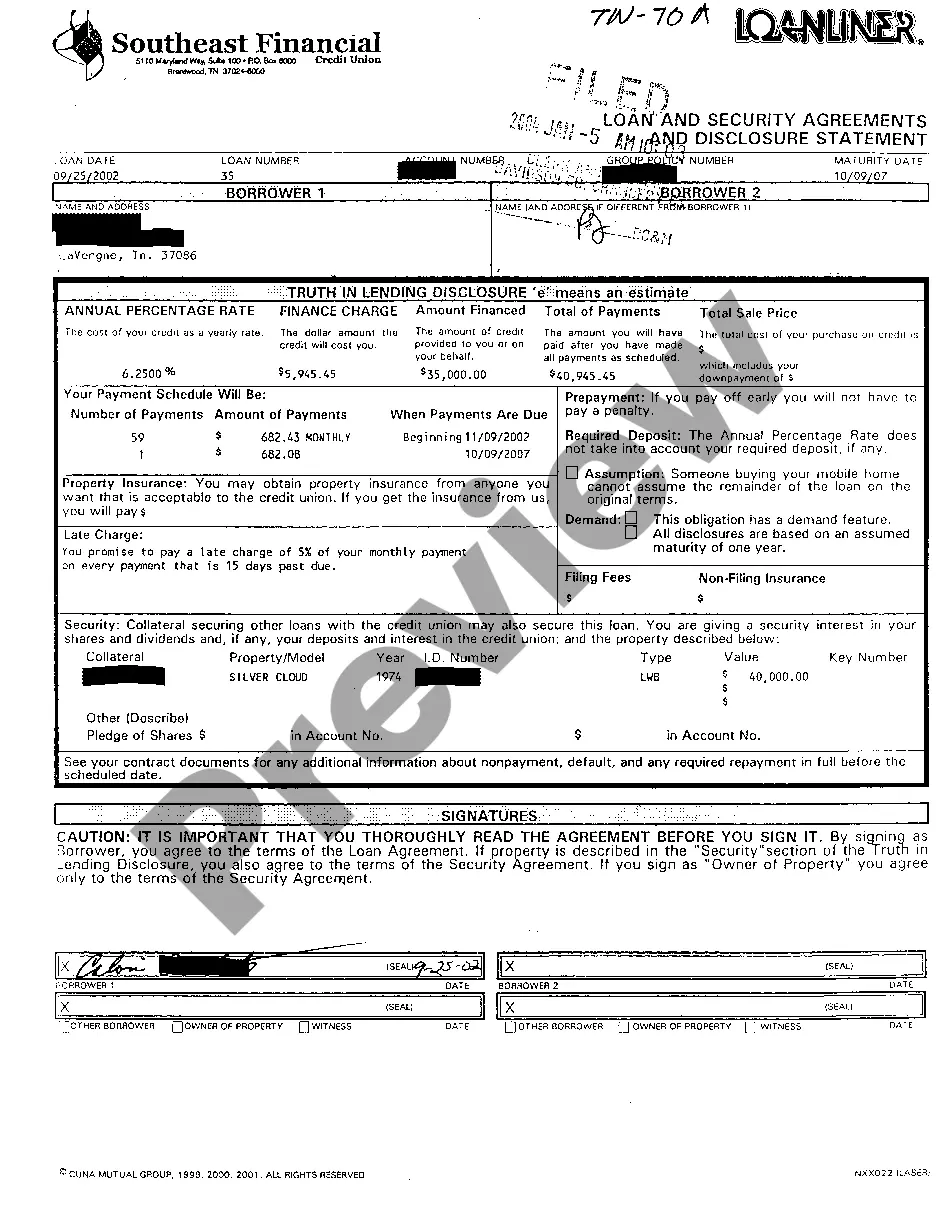

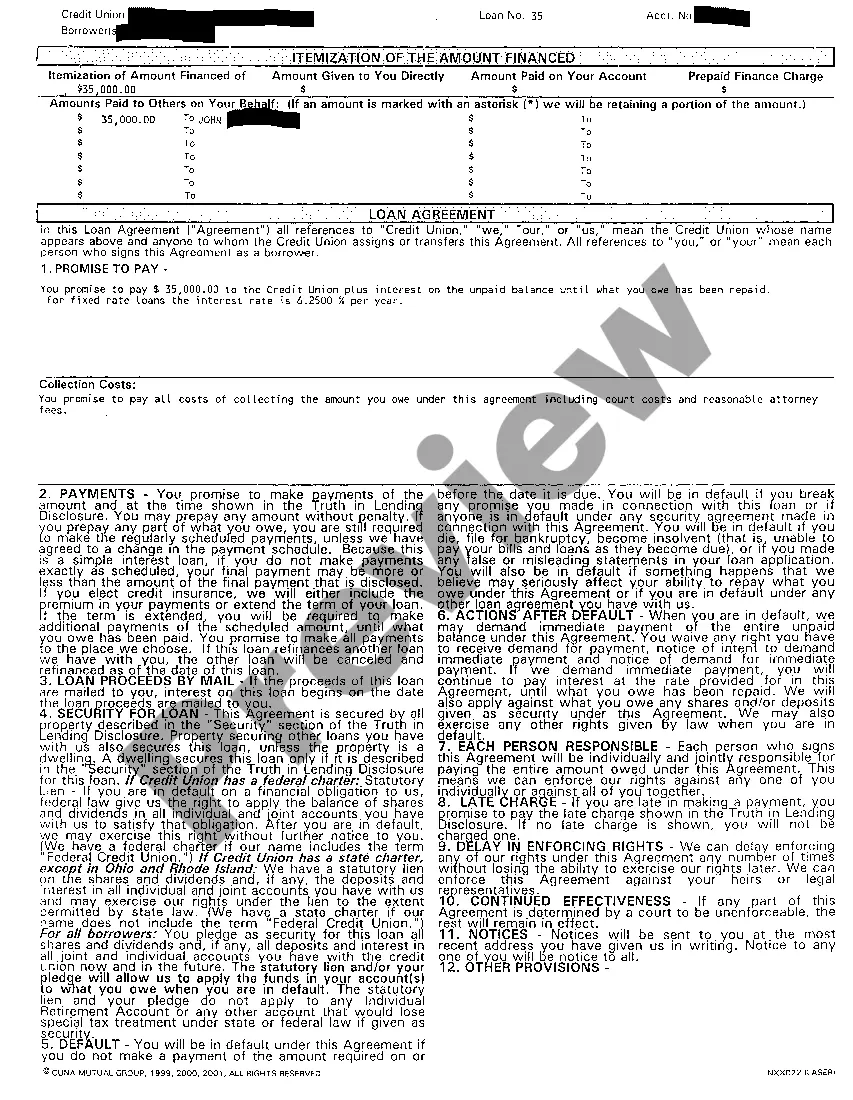

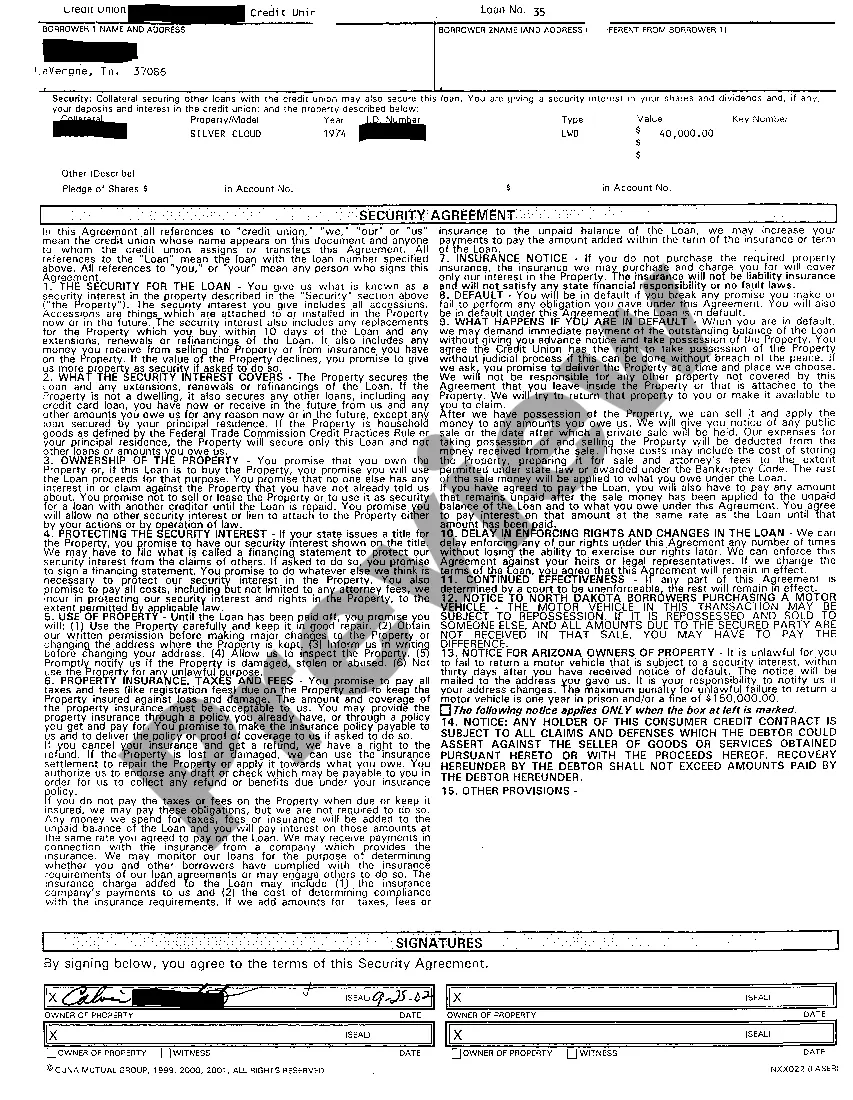

Title: Knoxville Tennessee Loan And Security Agreement: A Comprehensive Overview Description: In Knoxville, Tennessee, a Loan and Security Agreement is a legally binding document that outlines the terms, conditions, and responsibilities associated with a loan transaction. This agreement serves as a crucial tool in safeguarding the interests of both the lender and the borrower. Throughout this article, we will provide a detailed description of the Knoxville Tennessee Loan and Security Agreement, covering its purpose, key components, and potential variations. Keywords: Knoxville Tennessee Loan And Security Agreement, Loan Agreement in Knoxville, Tennessee, Security Agreement in Knoxville, TN, Loan and Security Agreement types in Knoxville, Tennessee. 1. Purpose of a Knoxville Tennessee Loan and Security Agreement: A Knoxville Tennessee Loan and Security Agreement serves as a legal contract that governs the lending of funds and sets the terms and conditions of repayment between the lender (typically a financial institution) and the borrower. This agreement ensures that both parties understand their rights and obligations, minimizing potential disputes or misunderstandings. 2. Key Components of a Knoxville Tennessee Loan and Security Agreement: a) Loan Terms: This section outlines the specifics of the loan, including the principal amount, interest rate, repayment schedule, penalties, and any additional fees associated with the loan in Knoxville, Tennessee. b) Collateral: A vital element of the agreement, the collateral serves as security for the loan. It defines the assets the borrower pledges to secure the loan in case of default. c) Default and Remedies: This segment highlights the consequences of default, such as the lender's right to seize and sell collateral or pursue legal action to recover the outstanding debt. It also mentions potential remedies available to the borrower to rectify the default. d) Representations and Warranties: This section covers any statements or assurances made by both parties regarding their financial stability, legal authority, and compliance with all applicable laws and regulations. e) Governing Law and Jurisdiction: Indicates the laws and regulations that govern the agreement and determines the jurisdiction where any legal disputes will be resolved. f) Miscellaneous Provisions: Includes clauses covering prevailing party attorney fees, amendments and modifications, notices, and waivers. 3. Types of Knoxville Tennessee Loan and Security Agreements: a) Real Estate Loan and Security Agreement: This type of agreement is specific to loans secured by real estate properties, such as mortgages or construction loans. b) Business Loan and Security Agreement: Pertaining to loans provided to businesses, this agreement outlines the financial arrangements, repayment terms, and collateral related to commercial loans. c) Personal Loan and Security Agreement: Applicable to individual borrowers, this agreement governs personal loans, including auto loans, student loans, or personal lines of credit. In conclusion, a Knoxville Tennessee Loan and Security Agreement is a critical legal document that protects the rights and obligations of both borrowers and lenders in various loan scenarios. By understanding the purpose, key components, and different types of agreements, individuals and organizations can navigate the loan process with confidence and ensure compliance with applicable laws.

Knoxville Tennessee Loan And Security Agreement

Description

How to fill out Knoxville Tennessee Loan And Security Agreement?

Are you looking for a trustworthy and inexpensive legal forms supplier to buy the Knoxville Tennessee Loan And Security Agreement? US Legal Forms is your go-to solution.

No matter if you require a simple arrangement to set rules for cohabitating with your partner or a set of documents to move your divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and frameworked based on the requirements of particular state and area.

To download the document, you need to log in account, find the needed template, and click the Download button next to it. Please remember that you can download your previously purchased form templates at any time in the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Knoxville Tennessee Loan And Security Agreement conforms to the laws of your state and local area.

- Go through the form’s description (if provided) to learn who and what the document is good for.

- Start the search over if the template isn’t good for your legal scenario.

Now you can create your account. Then select the subscription option and proceed to payment. As soon as the payment is completed, download the Knoxville Tennessee Loan And Security Agreement in any provided format. You can return to the website at any time and redownload the document free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about wasting hours researching legal paperwork online once and for all.