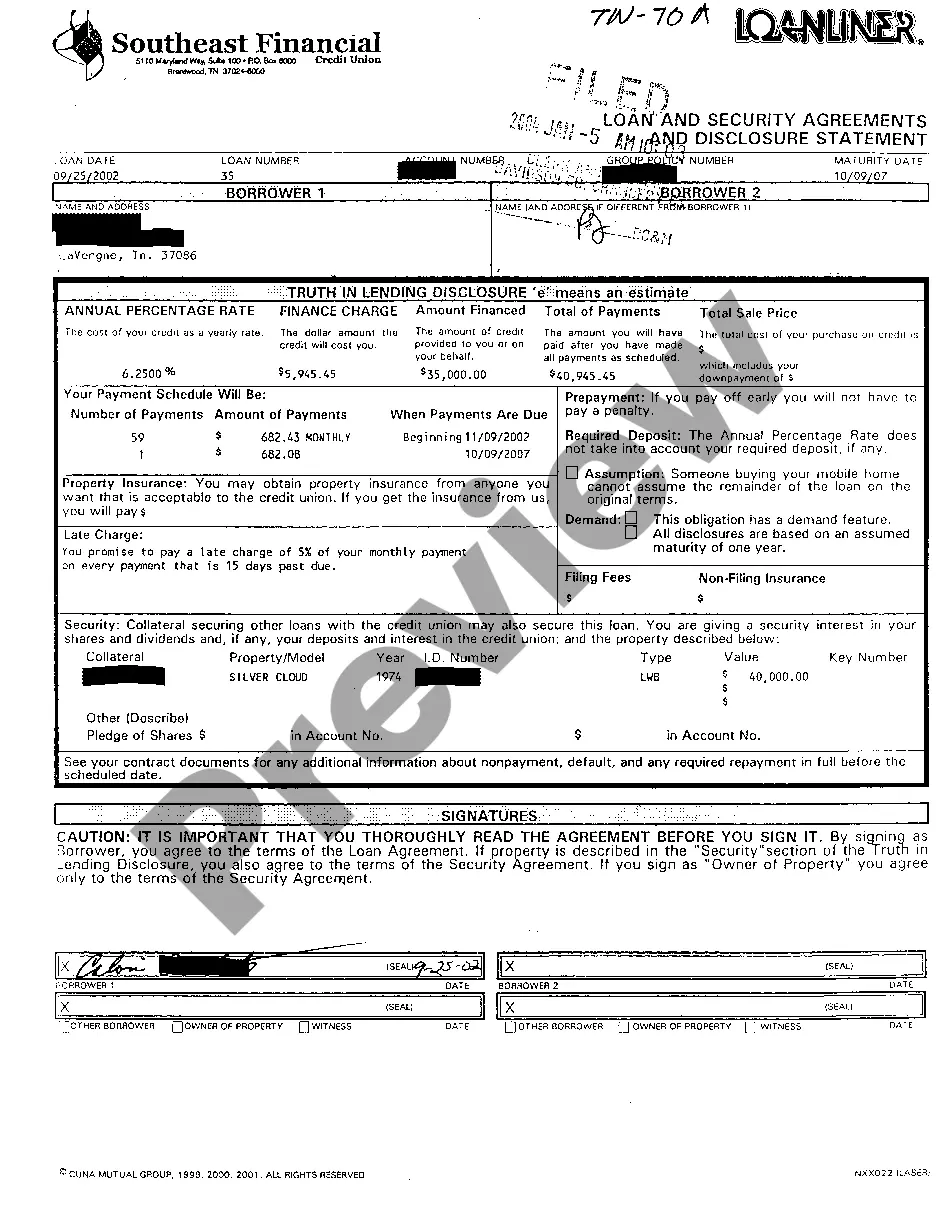

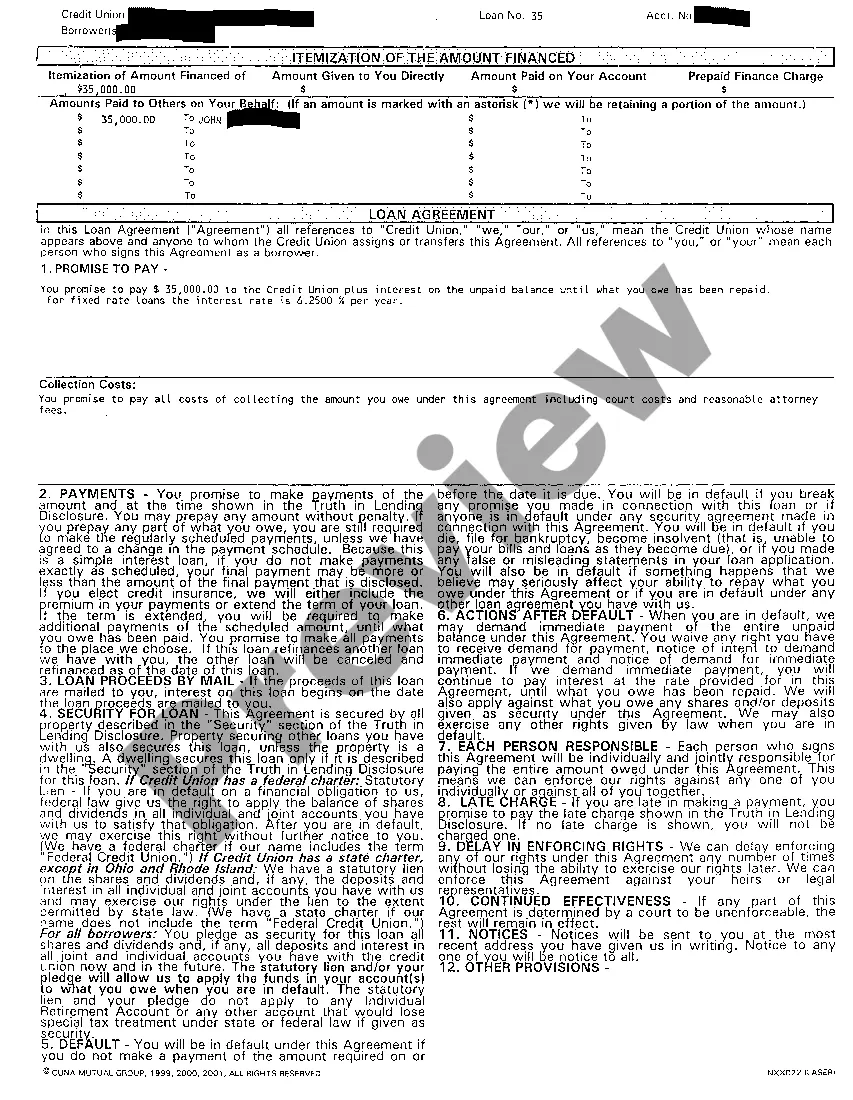

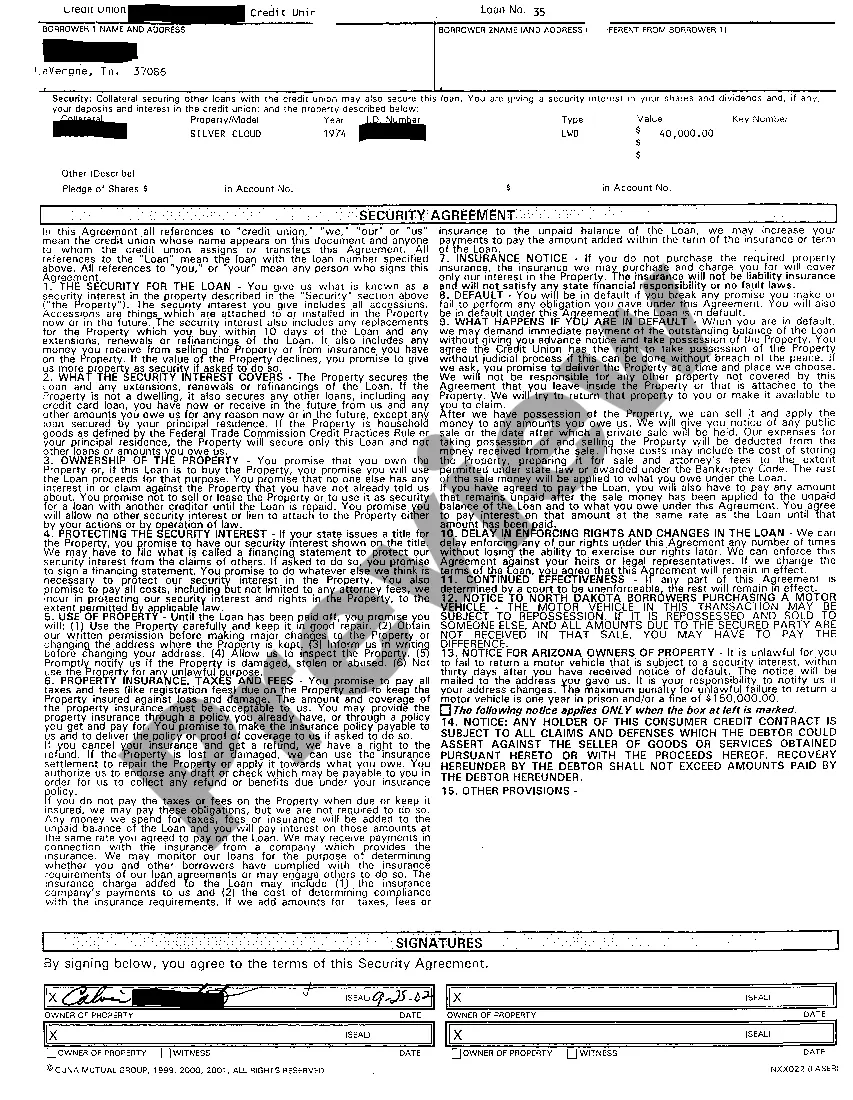

Murfreesboro Tennessee Loan and Security Agreement is a legal contract between a lender and a borrower that outlines the terms and conditions of a loan, as well as the collateral provided by the borrower to secure the loan. This agreement provides protection to the lender in case of default or non-payment by the borrower. Murfreesboro, Tennessee, being a vibrant city known for its economic growth and business opportunities, has various types of Loan and Security Agreements catering to different financial needs and industries. One of the common types of Loan and Security Agreements in Murfreesboro, Tennessee, is the Mortgage Loan Agreement. This type of agreement is typically used in real estate transactions where the borrower uses the property as collateral for the loan. The agreement details the loan amount, interest rate, loan term, and the agreed-upon repayment schedule. In case of default, the lender has the right to foreclose the property and sell it to recover the outstanding debt. Another type of Loan and Security Agreement in Murfreesboro, Tennessee, is the Business Loan Agreement. This agreement is relevant for entrepreneurs and business owners who require funding for their operations, expansion, or other related purposes. The agreement outlines the loan amount, interest rate, repayment schedule, and any specific conditions or covenants that the borrower must adhere to. Collateral, such as business assets or personal guarantees, is often required to secure the loan. Furthermore, Murfreesboro, Tennessee, also offers specific Loan and Security Agreements tailored to the needs of individuals such as Auto Loan Agreement and Personal Loan Agreement. An Auto Loan Agreement is used when an individual seeks financial assistance to purchase a vehicle, with the vehicle itself serving as collateral. On the other hand, a Personal Loan Agreement caters to individual financial requirements, ranging from debt consolidation to unexpected expenses. Collateral or a personal guarantee may be required depending on the borrower's creditworthiness. In summary, Murfreesboro Tennessee Loan and Security Agreement is a legal contract that assists lenders and borrowers in formalizing their financial relationships. It plays a crucial role in defining the loan terms, repayment conditions, and collateral requirements. The various types of agreements available in Murfreesboro, Tennessee, include Mortgage Loan Agreements, Business Loan Agreements, Auto Loan Agreements, and Personal Loan Agreements, among others. These agreements provide clear guidelines and protection for both parties involved in the borrowing and lending process.

Murfreesboro Tennessee Loan And Security Agreement

Description

How to fill out Murfreesboro Tennessee Loan And Security Agreement?

No matter the social or professional status, filling out legal documents is an unfortunate necessity in today’s world. Too often, it’s almost impossible for someone without any law background to draft this sort of papers from scratch, mainly because of the convoluted terminology and legal subtleties they entail. This is where US Legal Forms comes to the rescue. Our service offers a massive catalog with over 85,000 ready-to-use state-specific documents that work for pretty much any legal situation. US Legal Forms also is an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

No matter if you want the Murfreesboro Tennessee Loan And Security Agreement or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Murfreesboro Tennessee Loan And Security Agreement quickly using our reliable service. In case you are already an existing customer, you can proceed to log in to your account to download the needed form.

Nevertheless, if you are a novice to our platform, ensure that you follow these steps prior to downloading the Murfreesboro Tennessee Loan And Security Agreement:

- Ensure the form you have chosen is specific to your location since the rules of one state or county do not work for another state or county.

- Preview the form and read a short description (if available) of cases the document can be used for.

- In case the form you picked doesn’t meet your requirements, you can start over and search for the necessary form.

- Click Buy now and pick the subscription option you prefer the best.

- Log in to your account credentials or register for one from scratch.

- Choose the payment method and proceed to download the Murfreesboro Tennessee Loan And Security Agreement once the payment is through.

You’re good to go! Now you can proceed to print the form or fill it out online. In case you have any problems locating your purchased documents, you can easily find them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.