A Chattanooga Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principle is a type of bond issued by a surety company to guarantee the payment of costs that may be awarded against the principle in a legal proceeding. This bond serves as a financial assurance that the principal will fulfill their obligation to pay any costs that are required by a court or other authorized entity. The Chattanooga Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principle is important in various legal matters. For instance, it can be required in civil cases where one party is seeking compensation for damages or seeking reimbursement for legal expenses. It ensures that if the principal is found liable for the costs, they will be able to cover these expenses. There are different types of Chattanooga Tennessee Cost Bonds available based on the specific requirements of the situation. Some of the most common variations include: 1. Appeal Bond: This type of bond may be required if the principal wishes to appeal a court's decision. It guarantees that if the appeal is unsuccessful, the principal will cover any costs resulting from the appeal process. 2. Indemnity Bond: In certain situations, a court may require the principal to provide an indemnity bond. This bond ensures that the principal will reimburse any costs incurred by the opposing party if they prevail in the legal action. 3. Fiduciary Bond: A fiduciary bond may be necessary when the principal is acting in a fiduciary capacity, such as a trustee or executor. It guarantees that the principal will properly manage and distribute assets, and it covers potential costs if any errors or mismanagement occur. 4. Court Cost Bond: This type of bond ensures that the principal will pay any court costs associated with the legal proceeding, including filing fees, expert witness fees, or other expenses required by the court. Obtaining a Chattanooga Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principle may involve working with a reputable surety company licensed to operate in Tennessee. The principal will typically have to provide financial information and complete an application process. The surety company will then evaluate the principal's credibility and financial stability before issuing the bond. Once issued, the bond remains in effect until the legal matter is resolved, and all costs are paid in full. It is important to note that the specific requirements for a Chattanooga Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principle may vary based on the jurisdiction and the nature of the legal proceeding. It is recommended to consult with a legal professional or surety bond expert to ensure compliance with all necessary regulations and requirements.

Chattanooga Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal

Description

How to fill out Chattanooga Tennessee Cost Bond To Act As Surety For Payments Of Costs Awarded Against The Principal?

Regardless of social or occupational rank, completing legal papers is a regrettable requirement in the current professional landscape.

Frequently, it’s virtually unfeasible for an individual without legal education to draft such documents from the beginning, primarily due to the intricate terminology and legal nuances they involve.

This is where US Legal Forms can be incredibly helpful.

Make sure the document you have located is tailored to your area since the laws of one state or region do not apply to another.

Review the document and examine a brief summary (if available) of contexts in which the document can be utilized. If the selected one does not fulfill your requirements, you can start anew and look for the appropriate document.

- Our platform boasts an extensive collection of over 85,000 state-specific forms that are applicable for nearly every legal circumstance.

- US Legal Forms also serves as a valuable resource for associates or legal advisors who wish to save time using our DIY forms.

- Whether you require the Chattanooga Tennessee Cost Bond to Function as Surety for Payments of Costs Awarded Against the Principal or any other document that is valid in your region, US Legal Forms has everything readily available.

- Here’s how to obtain the Chattanooga Tennessee Cost Bond to Serve as Surety for Payments of Costs Awarded Against the Principal swiftly through our reliable platform.

- If you are already a current user, you can proceed to Log In to your account to download the required form.

- However, if you are new to our library, ensure to follow these instructions before downloading the Chattanooga Tennessee Cost Bond to Function as Surety for Payments of Costs Awarded Against the Principal.

Form popularity

FAQ

Tennessee Supersedeas Bond (Appeal Bond ~ Tennessee) A judicial bond is a type of financial assurance filed with the court that guarantees that should the appellant NOT prevail that he or she will comply with the original judgment and with any other orders issued by the court pertaining to the same.

You only have 60 days to appeal after you find out that there is a problem. You can ask someone to help you file an appeal. Usually, your appeal is decided within 90 days after you file it.

An appeal bond, sometimes called a supersedeas bond, is required when a defendant wants to appeal an adverse judgment or order. The bond guarantees that if the defendant (principal) loses the appeal, the amount of the judgment and, in some cases, accrued interest, expenses and legal fees, will be paid.

- The appeal to the Court of Appeals in cases decided by the Regional Trial Court in the exercise of its original jurisdiction shall be taken by filing a notice of appeal with the court which rendered the judgment or final order appealed from and serving a copy thereof upon the adverse party.

To get a Tennessee surety bond, people generally go to a surety bonding company. You are able to get a surety bond through a general insurance company, but choosing a surety bond company often means you can get better quotes.

An appeal is the legal process to ask a higher court to review a decision by a judge in a lower court (trial court) because you believe the judge made a mistake. A litigant who files an appeal is called an appellant. A litigant against whom the appeal is filed is called an appellee.

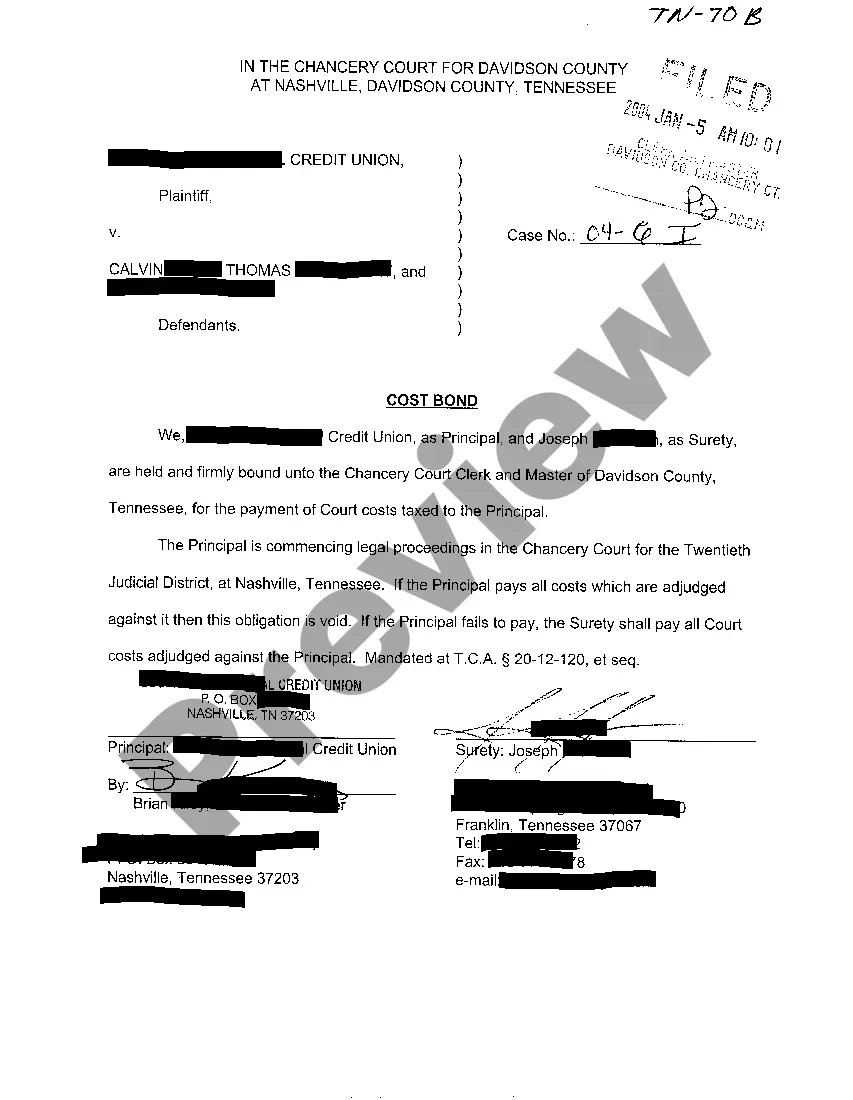

COST BOND. as Surety, are held and firmly bound unto the Circuit Court Clerk of Davidson County, Tennessee, for the payment of all costs awarded against the Principal(s). To that end, we bind ourselves, our heirs, executors, and administrators.

A cost bond is a kind of surety bond that guarantees payment of court expenses. Generally speaking, surety bonds form a legally binding contract, involving three parties: the principal, the obligee, and the surety. The party requesting the bond is the obligee. The party obligated to buy the bond is the principal.

Interesting Questions

More info

The court awarded all attorneys' fees in favor of the City of St. Paul. The appeal was taken to the Minnesota Supreme Court. The Court ruled that the Court Act does not authorize fees in the absence of “a case presenting the question of a violation of the ordinance and the prevailing party is a municipality.” The Court Act requires fees to be awarded for any court proceedings that do not result in a “final judgment on the merits.” A “final judgment on the merits” is a final decision. If the trial court's “final victory” was an award of attorney's fees, the Supreme Court concluded that it must be considered when evaluating whether a municipality has violated any of the requirements set forth in the Act. The Court held that the Court Act does not authorize fees in the absence of a “final judgment on the merits.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.