Knoxville Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal

Description

How to fill out Tennessee Cost Bond To Act As Surety For Payments Of Costs Awarded Against The Principal?

Utilize the US Legal Forms and gain immediate access to any template you desire.

Our user-friendly site with a vast array of templates eases the process of locating and acquiring nearly any document sample you need.

You can export, complete, and authenticate the Knoxville Tennessee Cost Bond to Serve as Surety for Payments of Costs Awarded Against the Principal in just a few minutes instead of browsing the internet for hours trying to find a suitable template.

Using our collection is a fantastic method to enhance the security of your form submission.

If you do not yet have an account, follow the steps outlined below.

Access the page containing the template you need. Confirm that it is the template you were looking for: check its title and description, and utilize the Preview option when it is available. If not, use the Search field to locate the required one.

- Our knowledgeable attorneys frequently review all documents to ensure that the forms are suitable for a specific area and compliant with current laws and regulations.

- How can you obtain the Knoxville Tennessee Cost Bond to Serve as Surety for Payments of Costs Awarded Against the Principal.

- If you already own an account, simply Log In to your account.

- The Download button will be active for all the samples you view.

- Additionally, you can access all the previously saved documents in the My documents menu.

Form popularity

FAQ

Tennessee Supersedeas Bond (Appeal Bond ~ Tennessee) A judicial bond is a type of financial assurance filed with the court that guarantees that should the appellant NOT prevail that he or she will comply with the original judgment and with any other orders issued by the court pertaining to the same.

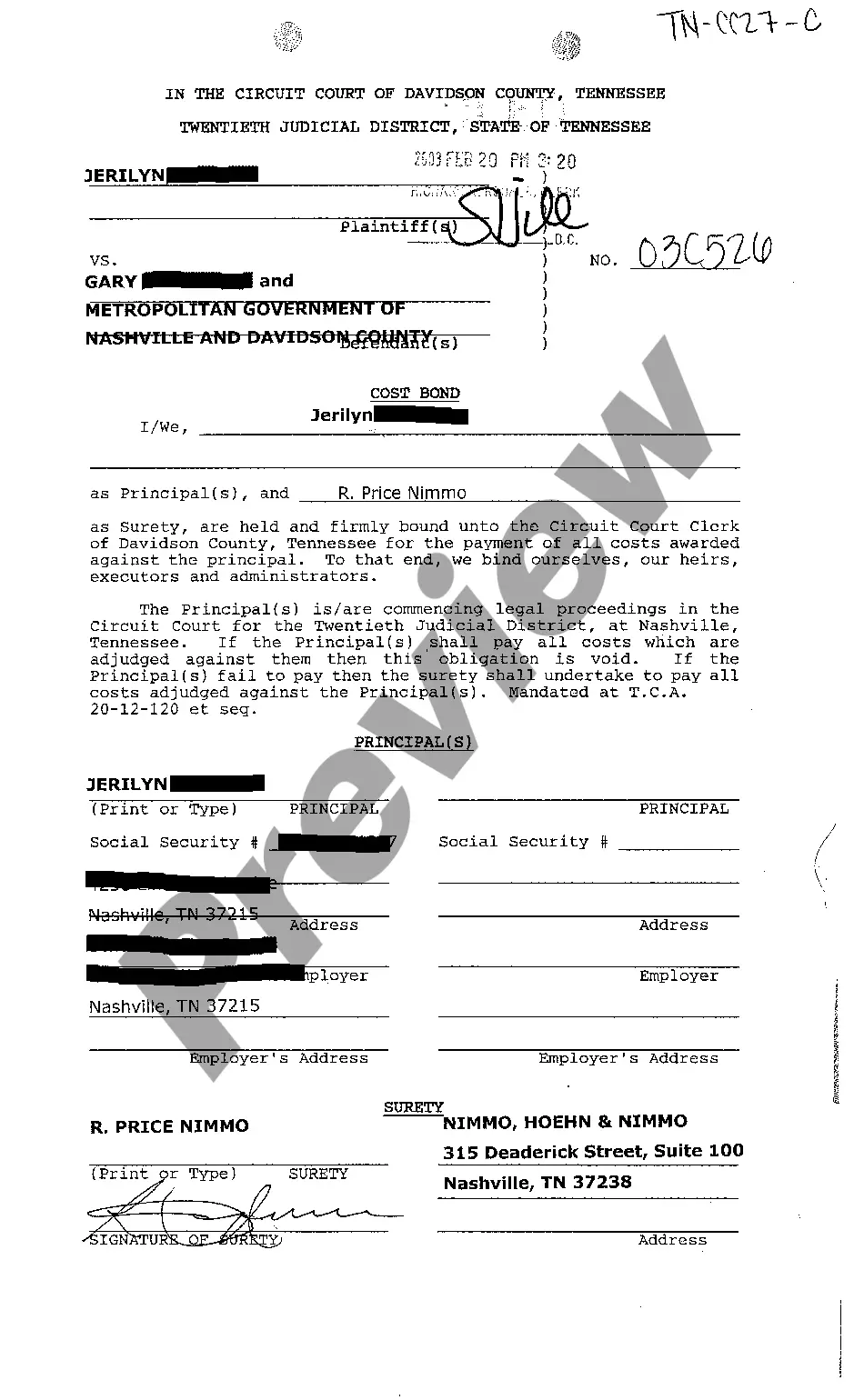

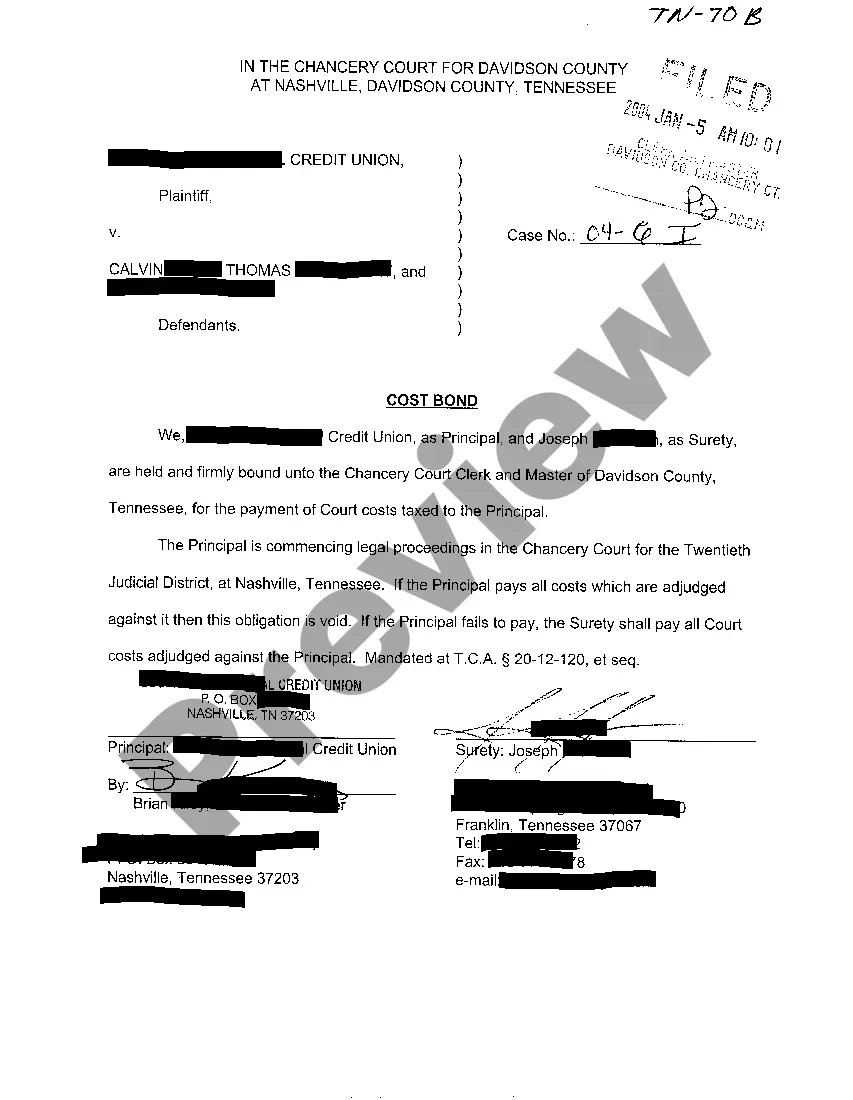

COST BOND. as Surety, are held and firmly bound unto the Circuit Court Clerk of Davidson County, Tennessee, for the payment of all costs awarded against the Principal(s). To that end, we bind ourselves, our heirs, executors, and administrators.