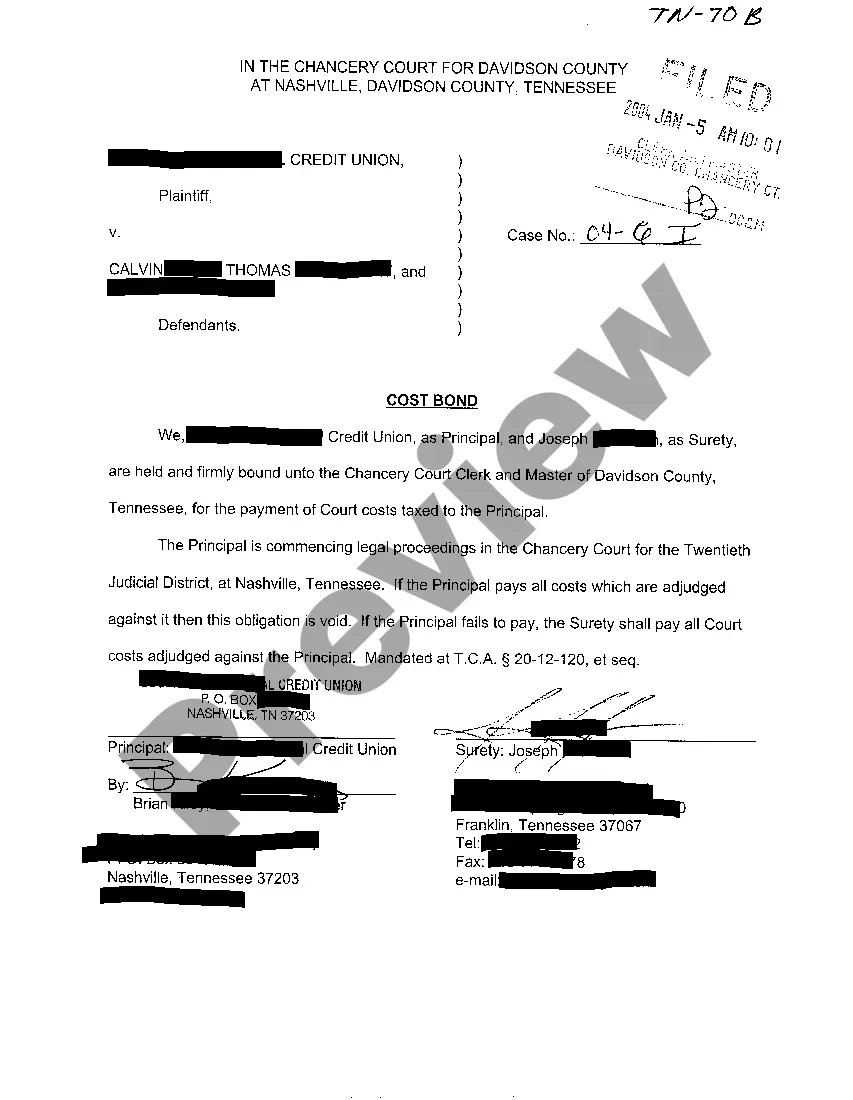

A Murfreesboro Tennessee Cost Bond, also known as a Surety Bond, is a legally binding contract that acts as a financial guarantee for the payment of costs awarded against a principle in legal proceedings. This type of bond can provide assurance to the court or other parties that the responsible party will fulfill their financial obligations. The Murfreesboro Tennessee Cost Bond is specifically designed to protect the interests of parties involved in legal cases, ensuring that costs, expenses, and other financial obligations are met by the principal. In certain cases, the court may require the principal to obtain a cost bond before proceeding with the litigation. This bond serves as a promise to pay the court-awarded costs once the legal proceedings are concluded. There are different types of Murfreesboro Tennessee Cost Bonds available, depending on the specific circumstances of the case. Some common variations include: 1. Plaintiff's Cost Bond: This type of bond is required when the principal is the plaintiff in a case and is responsible for covering the potential costs and expenses if they are unsuccessful in the legal proceedings. 2. Defendant's Cost Bond: In cases where the principal is the defendant, this bond guarantees the payment of costs if they lose the case and are ordered to reimburse the opposing party for their expenses. 3. Appeal Cost Bond: If the principal wishes to appeal a court decision, an appeal cost bond may be required. This bond ensures that the principal will pay any additional costs that may arise from the appeal process. 4. Enforcement Cost Bond: When a judgment or court order needs to be enforced, the court may require the principal to obtain an enforcement cost bond. This bond guarantees payment of costs associated with the enforcement process. Overall, a Murfreesboro Tennessee Cost Bond acts as a safeguard for the financial interests of parties involved in legal proceedings. It ensures that costs awarded against the principle will be paid, providing peace of mind to all parties involved.

Murfreesboro Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal

State:

Tennessee

City:

Murfreesboro

Control #:

TN-CN-70-02

Format:

PDF

Instant download

This form is available by subscription

Description

A04 Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal

A Murfreesboro Tennessee Cost Bond, also known as a Surety Bond, is a legally binding contract that acts as a financial guarantee for the payment of costs awarded against a principle in legal proceedings. This type of bond can provide assurance to the court or other parties that the responsible party will fulfill their financial obligations. The Murfreesboro Tennessee Cost Bond is specifically designed to protect the interests of parties involved in legal cases, ensuring that costs, expenses, and other financial obligations are met by the principal. In certain cases, the court may require the principal to obtain a cost bond before proceeding with the litigation. This bond serves as a promise to pay the court-awarded costs once the legal proceedings are concluded. There are different types of Murfreesboro Tennessee Cost Bonds available, depending on the specific circumstances of the case. Some common variations include: 1. Plaintiff's Cost Bond: This type of bond is required when the principal is the plaintiff in a case and is responsible for covering the potential costs and expenses if they are unsuccessful in the legal proceedings. 2. Defendant's Cost Bond: In cases where the principal is the defendant, this bond guarantees the payment of costs if they lose the case and are ordered to reimburse the opposing party for their expenses. 3. Appeal Cost Bond: If the principal wishes to appeal a court decision, an appeal cost bond may be required. This bond ensures that the principal will pay any additional costs that may arise from the appeal process. 4. Enforcement Cost Bond: When a judgment or court order needs to be enforced, the court may require the principal to obtain an enforcement cost bond. This bond guarantees payment of costs associated with the enforcement process. Overall, a Murfreesboro Tennessee Cost Bond acts as a safeguard for the financial interests of parties involved in legal proceedings. It ensures that costs awarded against the principle will be paid, providing peace of mind to all parties involved.

How to fill out Murfreesboro Tennessee Cost Bond To Act As Surety For Payments Of Costs Awarded Against The Principal?

If you’ve already utilized our service before, log in to your account and save the Murfreesboro Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Make certain you’ve found the right document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to find the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Murfreesboro Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!