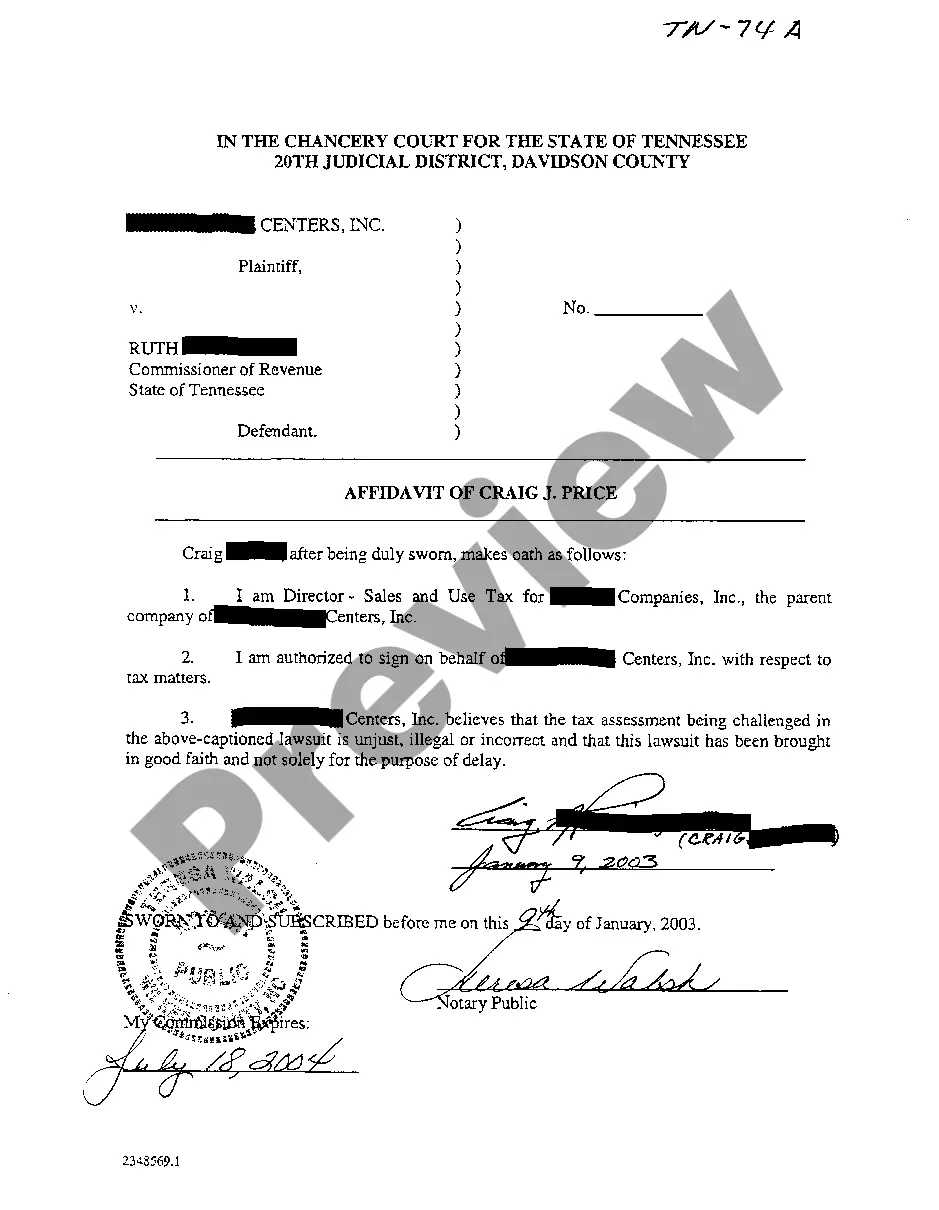

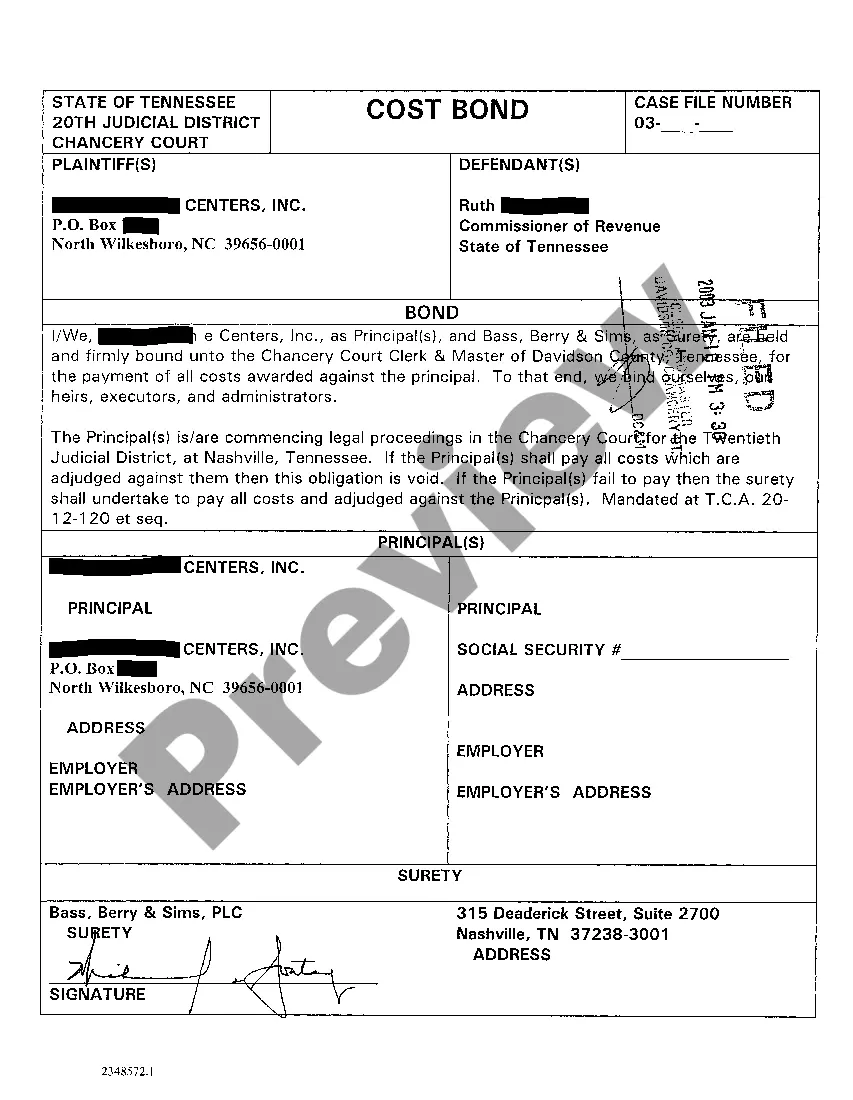

The Clarksville Tennessee Affidavit of Plaintiff's Representative regarding tax assessment is a legal document that outlines the details and facts related to a tax assessment dispute in the city of Clarksville, Tennessee. It is used by a representative of the plaintiff, who is seeking to challenge or contest a tax assessment made by the tax authorities. This affidavit plays a vital role in presenting evidence and supporting the plaintiff's claims during legal proceedings. The affidavit typically includes the following relevant information: 1. Introduction: The affidavit begins with general information, stating the name of the representative and their relationship to the plaintiff. 2. Plaintiff's Details: The affidavit should include the complete name, address, and contact information of the plaintiff involved in the tax assessment dispute. 3. Explanation of Tax Assessment Dispute: This section details the reasons for contesting the tax assessment, highlighting any inaccurate or unfair assessment made by the tax authorities. The affidavit may also mention any relevant legislation or legal precedents that support the plaintiff's position. 4. Supporting Documents: The representative attaches relevant supporting documents such as tax returns, property appraisals, financial statements, and any correspondence with the tax authorities. These documents strengthen the plaintiff's case and provide evidence for the claims made in the affidavit. 5. Witness Statements: If applicable, the affidavit may include witness statements from individuals with direct knowledge or expertise related to the tax assessment. These statements further support the plaintiff's claims and provide credibility to their position. 6. Declaration: The affidavit concludes with a declaration by the plaintiff's representative attesting to the accuracy of the information provided. This declaration is made under oath and warns of potential penalties for providing false or misleading information. Different types or variations of the Clarksville Tennessee Affidavit of Plaintiff's Representative regarding tax assessment may exist, such as: 1. Affidavit of Plaintiff's Representative for Residential Property Tax Assessment: This type of affidavit is specifically designed for residential property owners who are disputing their tax assessment. 2. Affidavit of Plaintiff's Representative for Commercial Property Tax Assessment: This variant is intended for commercial property owners challenging tax assessments on their properties. 3. Affidavit of Plaintiff's Representative for Personal Income Tax Assessment: This type of affidavit is relevant when the plaintiff is contesting a tax assessment related to their personal income. 4. Affidavit of Plaintiff's Representative for Business Tax Assessment: This specific affidavit is used by business owners who are challenging their tax assessments for their commercial operations. In conclusion, the Clarksville Tennessee Affidavit of Plaintiff's Representative regarding tax assessment is a comprehensive legal document that presents the plaintiff's case against a tax assessment dispute. It is essential for outlining the facts, providing evidence, and supporting the plaintiff's claims during legal proceedings.

Clarksville Tennessee Affidavit of Plaintiff's Representative regarding tax assessment

Description

How to fill out Clarksville Tennessee Affidavit Of Plaintiff's Representative Regarding Tax Assessment?

Locating verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Clarksville Tennessee Affidavit of Plaintiff's Representative regarding tax assessment gets as quick and easy as ABC.

For everyone already familiar with our library and has used it before, getting the Clarksville Tennessee Affidavit of Plaintiff's Representative regarding tax assessment takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a couple of more actions to make for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make certain you’ve selected the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to get the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Clarksville Tennessee Affidavit of Plaintiff's Representative regarding tax assessment. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!