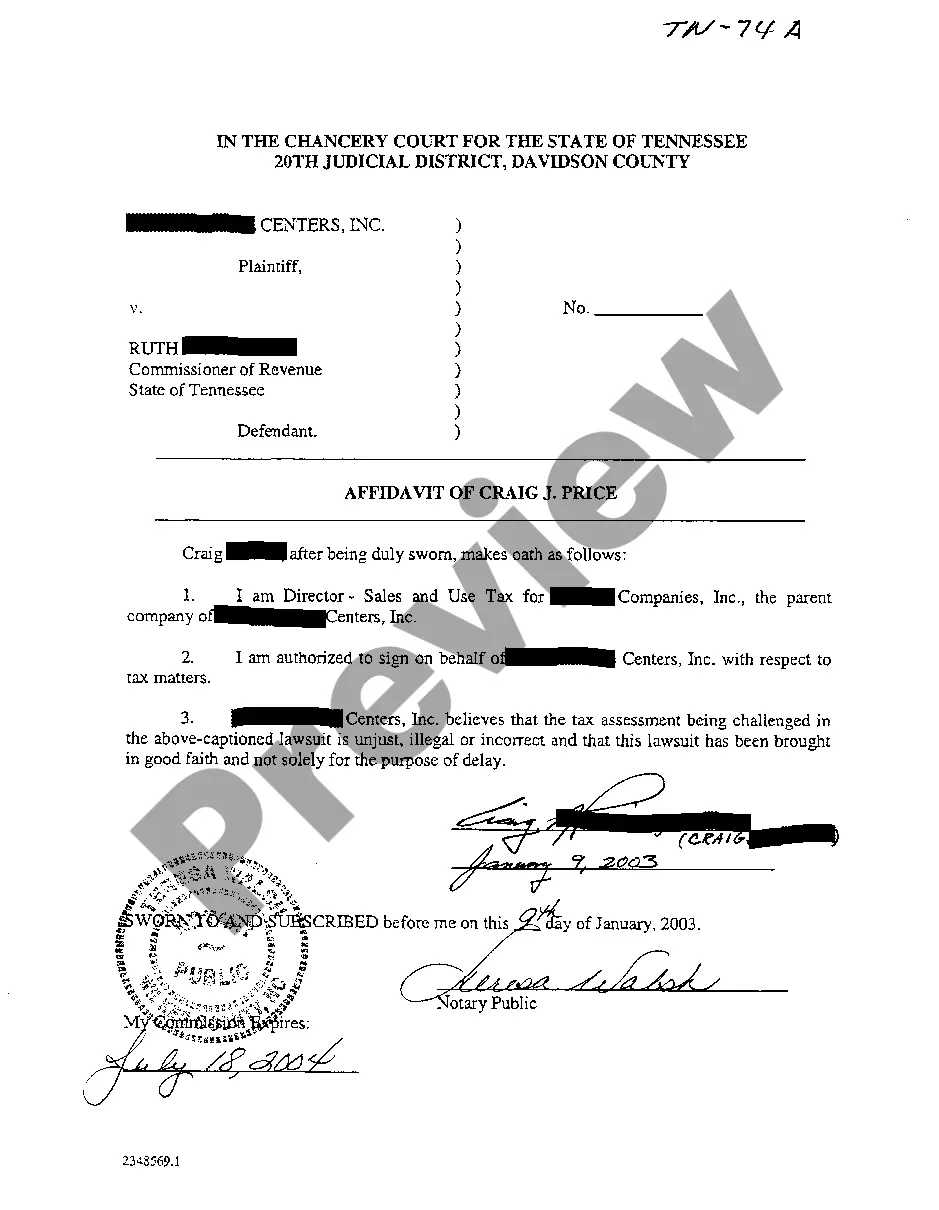

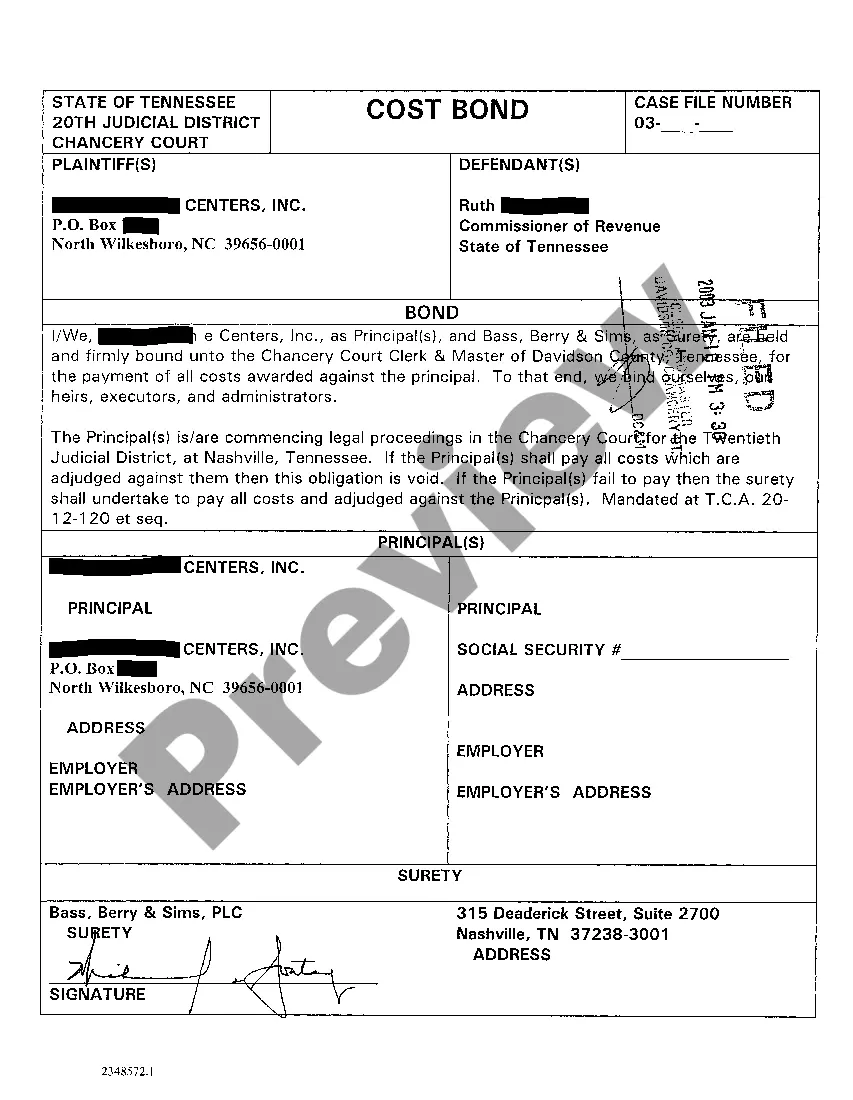

The Knoxville Tennessee Affidavit of Plaintiff's Representative regarding tax assessment is an important legal document used in the city of Knoxville, Tennessee. This affidavit is typically filed by the plaintiff's representative in a lawsuit related to tax assessment issues. It serves as a sworn statement affirming specific details and facts related to the case. Keywords: Knoxville Tennessee, Affidavit, Plaintiff's Representative, tax assessment, legal document, lawsuit, sworn statement, facts, details. Different types of Knoxville Tennessee Affidavits of Plaintiff's Representative regarding tax assessment may include: 1. Affidavit of Plaintiff's Representative in Property Tax Dispute: This type of affidavit is specific to property tax disputes. It is filed by the representative of the plaintiff, who alleges that the tax assessment on a particular property is inaccurate or unfair. The affidavit will outline the reasons for disputing the assessment, provide evidence supporting the claim, and state the relief sought by the plaintiff. 2. Affidavit of Plaintiff's Representative in Business Tax Assessment Lawsuit: In cases where the plaintiff is a business entity, this affidavit is filed to challenge the tax assessment imposed on their business. The affidavit will include details about the plaintiff's business operations, the tax assessment in question, and any evidence supporting the claim that the assessment is incorrect or unjust. 3. Affidavit of Plaintiff's Representative in Personal Income Tax Dispute: When an individual taxpayer contests their personal income tax assessment, the representative may file this type of affidavit. It will state the grounds for disputing the assessment, such as incorrect reporting, miscalculations, or discrepancies in the tax return. The affidavit will also provide supporting documents, such as financial records or tax forms, to substantiate the plaintiff's position. 4. Affidavit of Plaintiff's Representative in Sales Tax Assessment Lawsuit: For cases involving disputes over sales tax assessments, this specific affidavit is used. The affidavit will outline the transactions in question, the amount of sales tax assessed, and the reasons for challenging the assessment. It may also include statements from relevant parties, such as customers or employees, supporting the plaintiff's claim. In conclusion, the Knoxville Tennessee Affidavit of Plaintiff's Representative regarding tax assessment encompasses several types, each tailored to the specific nature of the tax dispute. These affidavits play a vital role in presenting the plaintiff's case by providing essential facts, evidence, and assertions necessary for a successful legal challenge.

Knoxville Tennessee Affidavit of Plaintiff's Representative regarding tax assessment

Description

How to fill out Knoxville Tennessee Affidavit Of Plaintiff's Representative Regarding Tax Assessment?

We always strive to minimize or prevent legal issues when dealing with nuanced law-related or financial matters. To do so, we apply for attorney solutions that, usually, are extremely expensive. Nevertheless, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based library of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without turning to an attorney. We offer access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Knoxville Tennessee Affidavit of Plaintiff's Representative regarding tax assessment or any other form quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it from within the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the website! You can register your account within minutes.

- Make sure to check if the Knoxville Tennessee Affidavit of Plaintiff's Representative regarding tax assessment adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Knoxville Tennessee Affidavit of Plaintiff's Representative regarding tax assessment would work for your case, you can choose the subscription plan and make a payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!