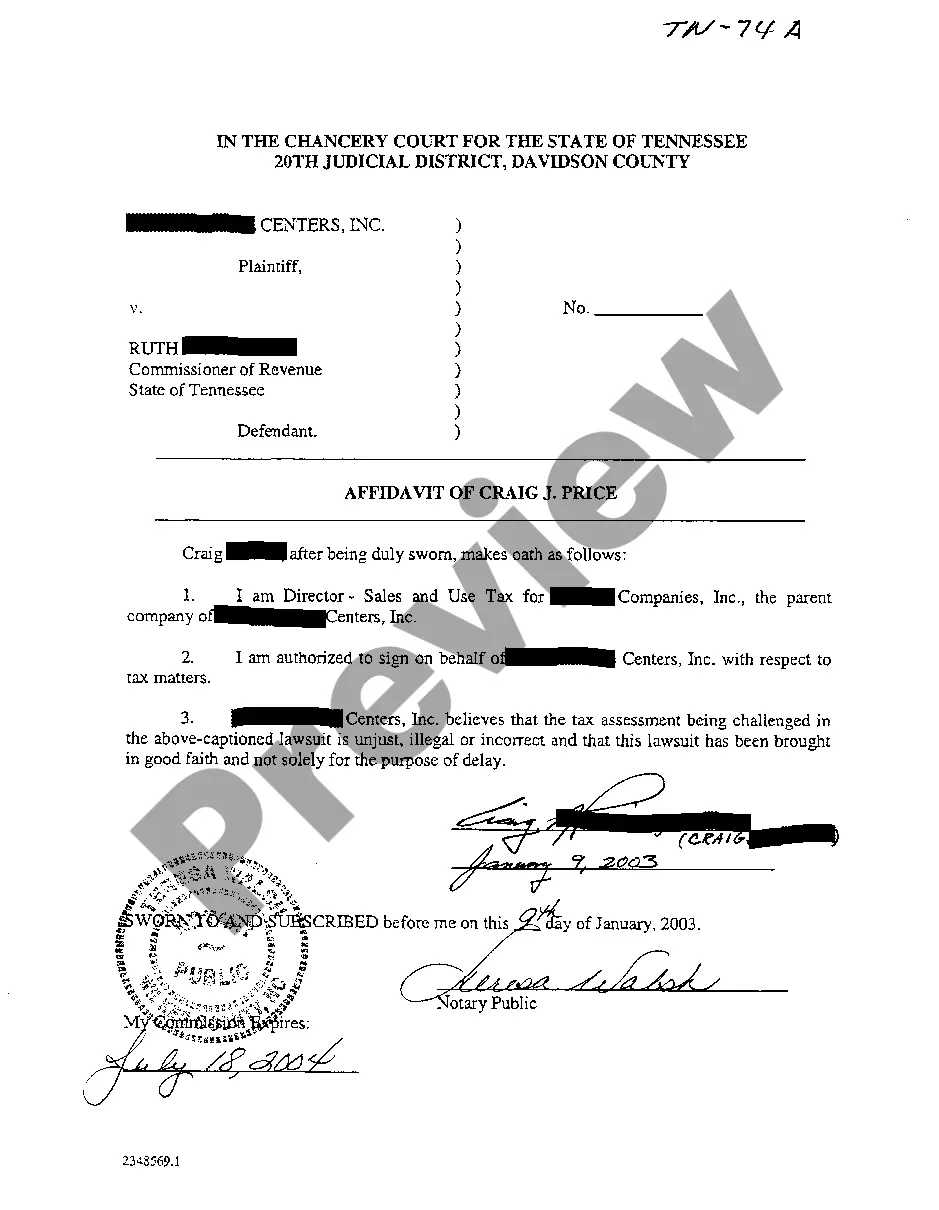

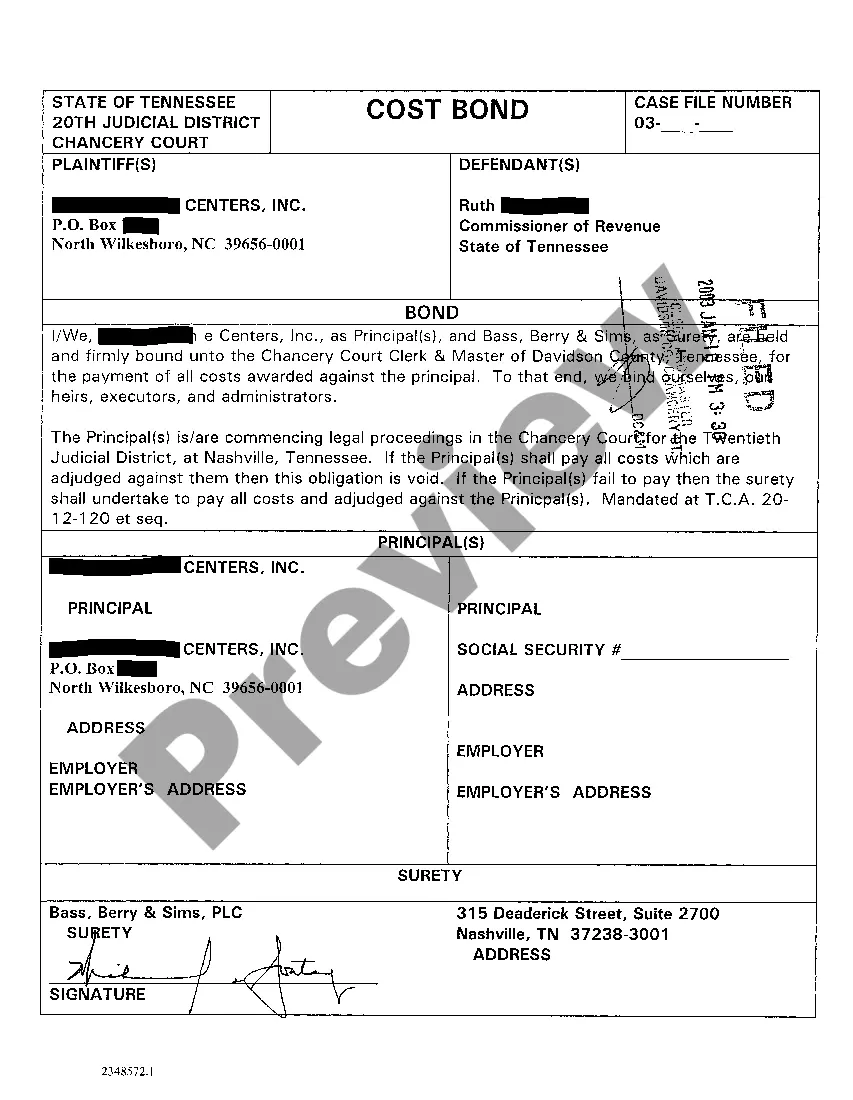

The Memphis Tennessee Affidavit of Plaintiff's Representative regarding tax assessment is a legal document that is used in the context of a lawsuit involving a tax assessment issue. This affidavit is typically filed by the representative of the plaintiff, who is responsible for presenting evidence and arguing the case on behalf of the plaintiff. The purpose of this affidavit is to provide detailed information about the tax assessment dispute, including the specific issues being contested and the grounds on which the plaintiff is challenging the assessment. It is a sworn statement that asserts the representative's knowledge and understanding of the case and their authority to act on behalf of the plaintiff. This document includes several key sections to ensure that all relevant information is properly conveyed to the court. The affidavit usually begins with an introduction, identifying the plaintiff and the representative, and stating their relationship to one another. It may also mention the specific court or administrative agency where the lawsuit is being heard. Next, the affidavit describes the relevant facts of the case in detail. This includes providing a summary of the tax assessment in question, such as the specific tax years or periods being disputed, the assessed value of the property or income, and any relevant calculations or formulas used by the taxing authority. Additionally, the affidavit may address the plaintiff's objections or challenges to the tax assessment. This can involve identifying any errors or inconsistencies in the assessment process, such as incorrect calculations or failure to consider certain exemptions or deductions. The representative may also state any legal or constitutional arguments that support the plaintiff's position. Furthermore, the affidavit may include a section on the efforts that have been made to resolve the dispute outside of court. This could involve detailing any communication or negotiation attempts with the taxing authority or its representatives, as well as any previous legal actions or administrative proceedings related to the issue. It is important to note that the specific content and structure of the Memphis Tennessee Affidavit of Plaintiff's Representative regarding tax assessment may vary depending on the nature of the case and the requirements of the court. Different types or variations of this affidavit may exist, depending on the particular circumstances or specific legal framework under which the tax assessment dispute falls. It is advisable to consult the relevant laws and regulations or seek legal counsel to determine the appropriate format and content for a specific case.

Memphis Tennessee Affidavit of Plaintiff's Representative regarding tax assessment

Description

How to fill out Memphis Tennessee Affidavit Of Plaintiff's Representative Regarding Tax Assessment?

We always want to reduce or prevent legal damage when dealing with nuanced legal or financial matters. To accomplish this, we apply for attorney solutions that, as a rule, are extremely costly. Nevertheless, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without turning to an attorney. We provide access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Memphis Tennessee Affidavit of Plaintiff's Representative regarding tax assessment or any other form quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it in the My Forms tab.

The process is equally straightforward if you’re new to the website! You can register your account in a matter of minutes.

- Make sure to check if the Memphis Tennessee Affidavit of Plaintiff's Representative regarding tax assessment adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Memphis Tennessee Affidavit of Plaintiff's Representative regarding tax assessment would work for your case, you can select the subscription plan and proceed to payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!