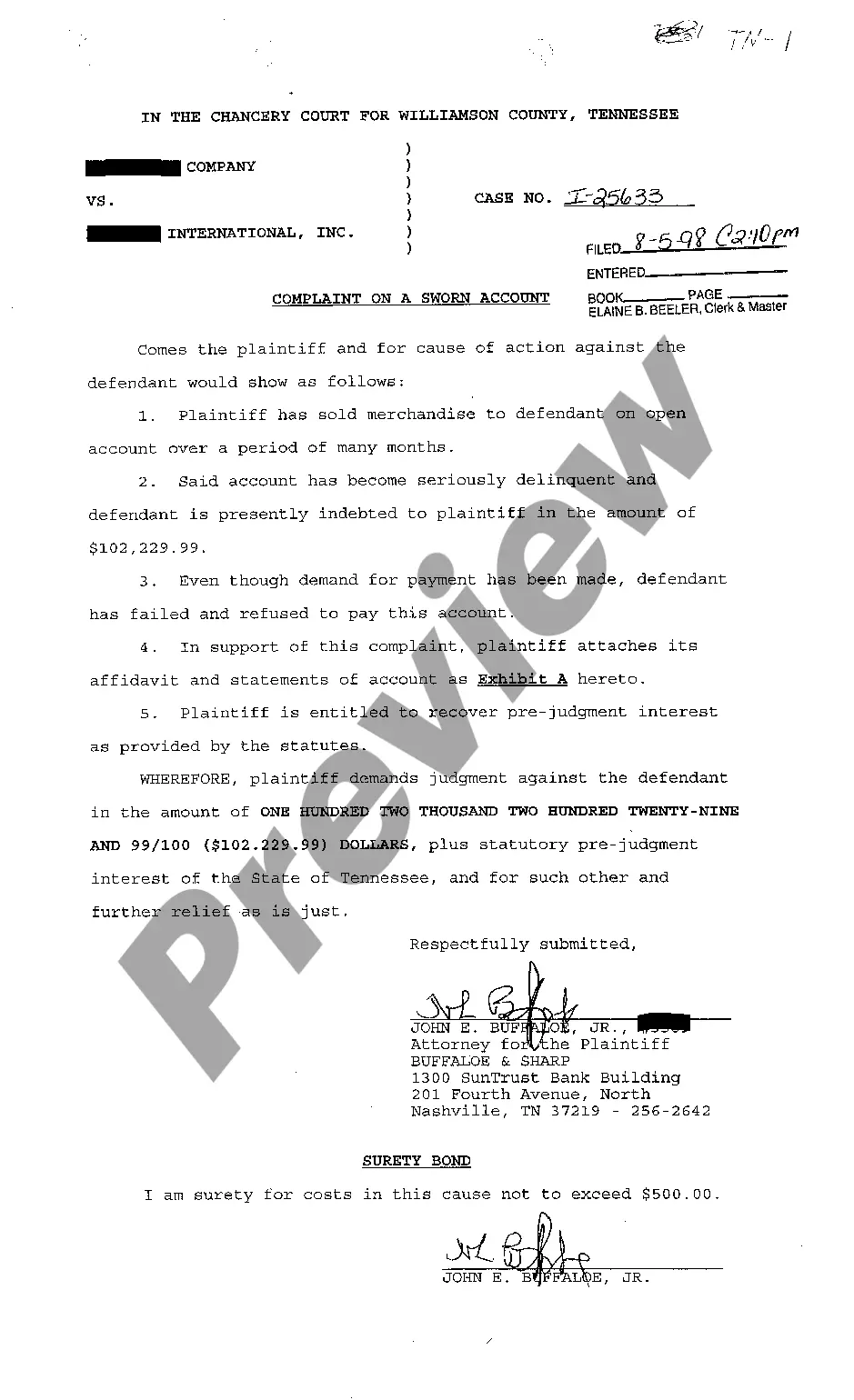

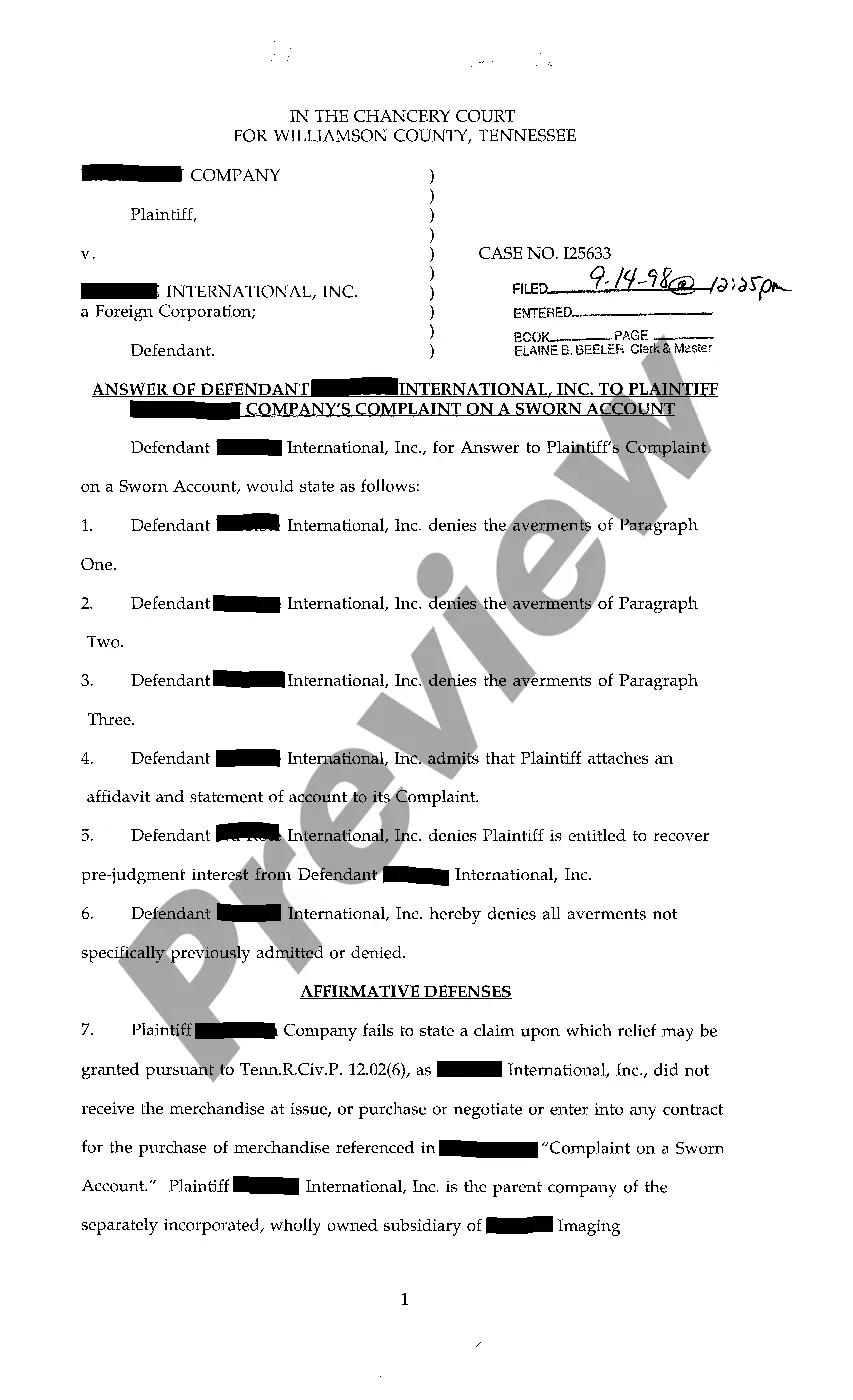

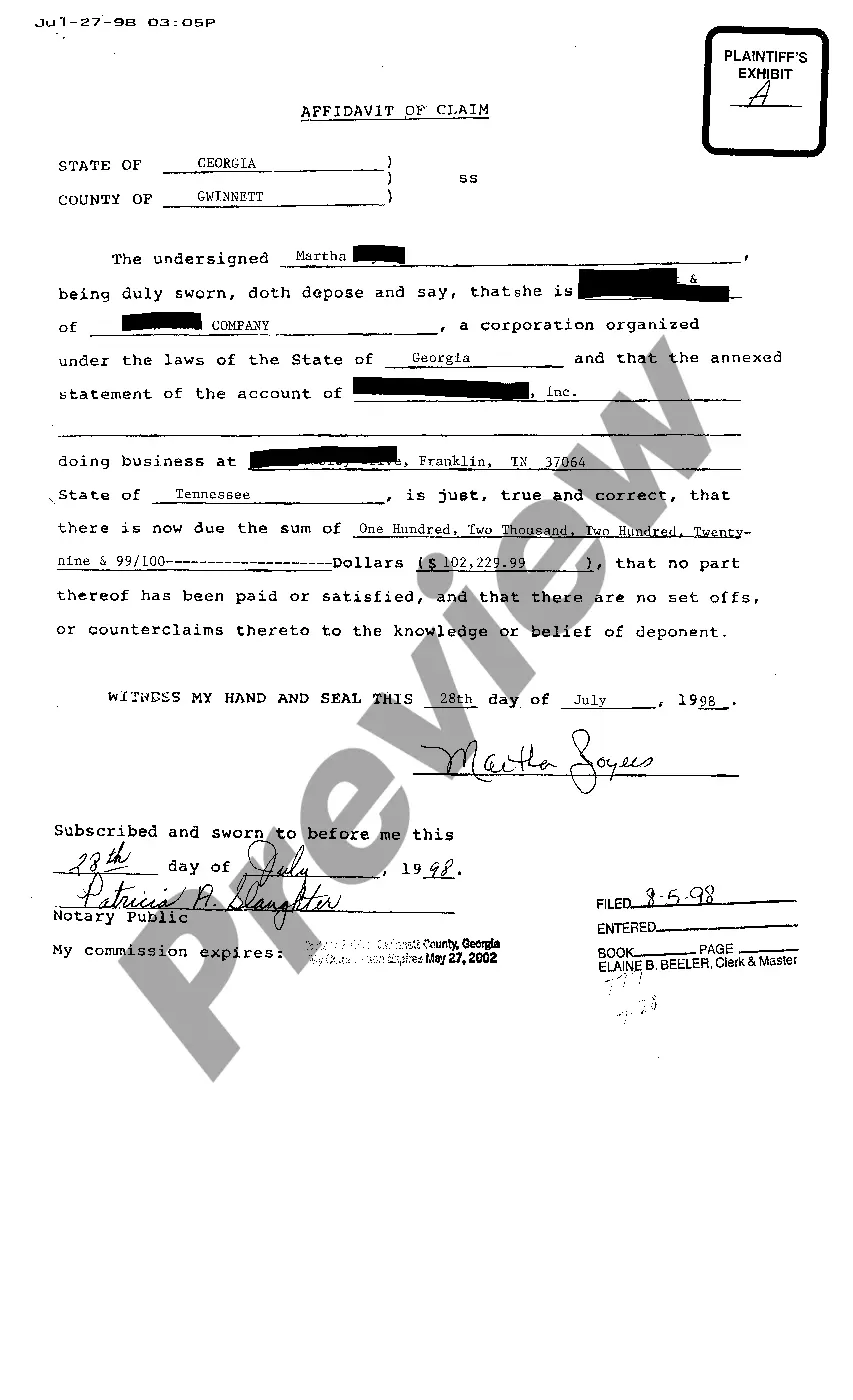

Title: Understanding Knoxville Tennessee Complaint on a Sworn Account for Delinquency and Refusal to Pay Keywords: Knoxville Tennessee complaint, sworn account, delinquency, refusal to pay, legal action, debt collection, consequences, resolution Introduction: A Knoxville Tennessee Complaint on a Sworn Account for Delinquency and Refusal to Pay refers to the legal action initiated by a creditor against a debtor who has failed to fulfill their financial obligations. This situation typically arises when an individual or business owes money to another entity but neglects to clear the debt despite numerous attempts to collect payment. In such cases, the creditor may choose to file a complaint against the debtor to seek resolution for the unpaid amount. Types of Knoxville Tennessee Complaint On A Sworn Account for Delinquency and Refusal to Pay: 1. Individual Debt: — This type of complaint generally occurs when an individual debtor fails to repay a personal loan, credit card debt, or medical bills. — The creditor files a sworn account complaint to initiate legal proceedings and recover the outstanding debt. 2. Business Debt: — When a business entity has overdue payments for goods or services supplied by another business, the creditor can file a sworn account complaint. — This complaint can be used to seek legal remedies and potentially obtain a judgment against the delinquent business for non-payment. Details of a Sworn Account Complaint: 1. Legal Action: — A sworn account complaint initiates legal action against the debtor in a Tennessee court. — The complaint must include the details of the outstanding debt, including the exact amount, due dates, and any relevant contracts or agreements. 2. Affidavit: — The complaint is accompanied by an affidavit signed by the creditor. — This affidavit attests to the accuracy and validity of the owed amount. 3. Service of Complaint: — Once the complaint is filed, it must be served to the debtor through a legally accepted method. — This ensures that the debtor is made aware of the complaint and has an opportunity to respond. Potential Consequences: 1. Legal Judgment: — If the court finds in favor of the creditor, a judgment may be issued against the debtor. — The judgment may include an order to pay the outstanding debt, interest, collection costs, and possibly attorney fees. 2. Wage Garnishment: — In some cases, the court may allow the creditor to garnish the debtor's wages to recover the owed amount directly from their income. 3. Asset Seizure: — If the debt remains unpaid, the creditor may seek permission from the court to seize a debtor's assets, such as real estate or vehicles, to satisfy the debt. Resolving a Sworn Account Complaint: 1. Negotiated Settlement: — Debtors can often negotiate a settlement agreement with the creditor to repay the debt in installments or for a reduced amount. 2. Payment Plan: — If the debtor cannot pay the full amount immediately, the court may agree to a payment plan, allowing the debtor to pay the debt over time. 3. Mediation: — Mediation can be pursued to resolve the dispute outside of court, where a neutral third-party facilitates negotiations between the creditor and debtor. In conclusion, a Knoxville Tennessee Complaint on a Sworn Account for Delinquency and Refusal to Pay is a legal remedy initiated by a creditor against a debtor who has failed to pay a debt. This complaint can result in various consequences for the debtor, including legal judgments and potential asset seizure. However, resolution alternatives such as negotiation, payment plans, or mediation may exist to alleviate the situation before it reaches a courtroom.

Knoxville Tennessee Complaint On A Sworn Account for Delinquency and Refusal to Pay

Description

How to fill out Knoxville Tennessee Complaint On A Sworn Account For Delinquency And Refusal To Pay?

Getting verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Knoxville Tennessee Complaint On A Sworn Account for Delinquency and Refusal to Pay becomes as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, obtaining the Knoxville Tennessee Complaint On A Sworn Account for Delinquency and Refusal to Pay takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. The process will take just a couple of more steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make sure you’ve picked the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to find the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Knoxville Tennessee Complaint On A Sworn Account for Delinquency and Refusal to Pay. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!