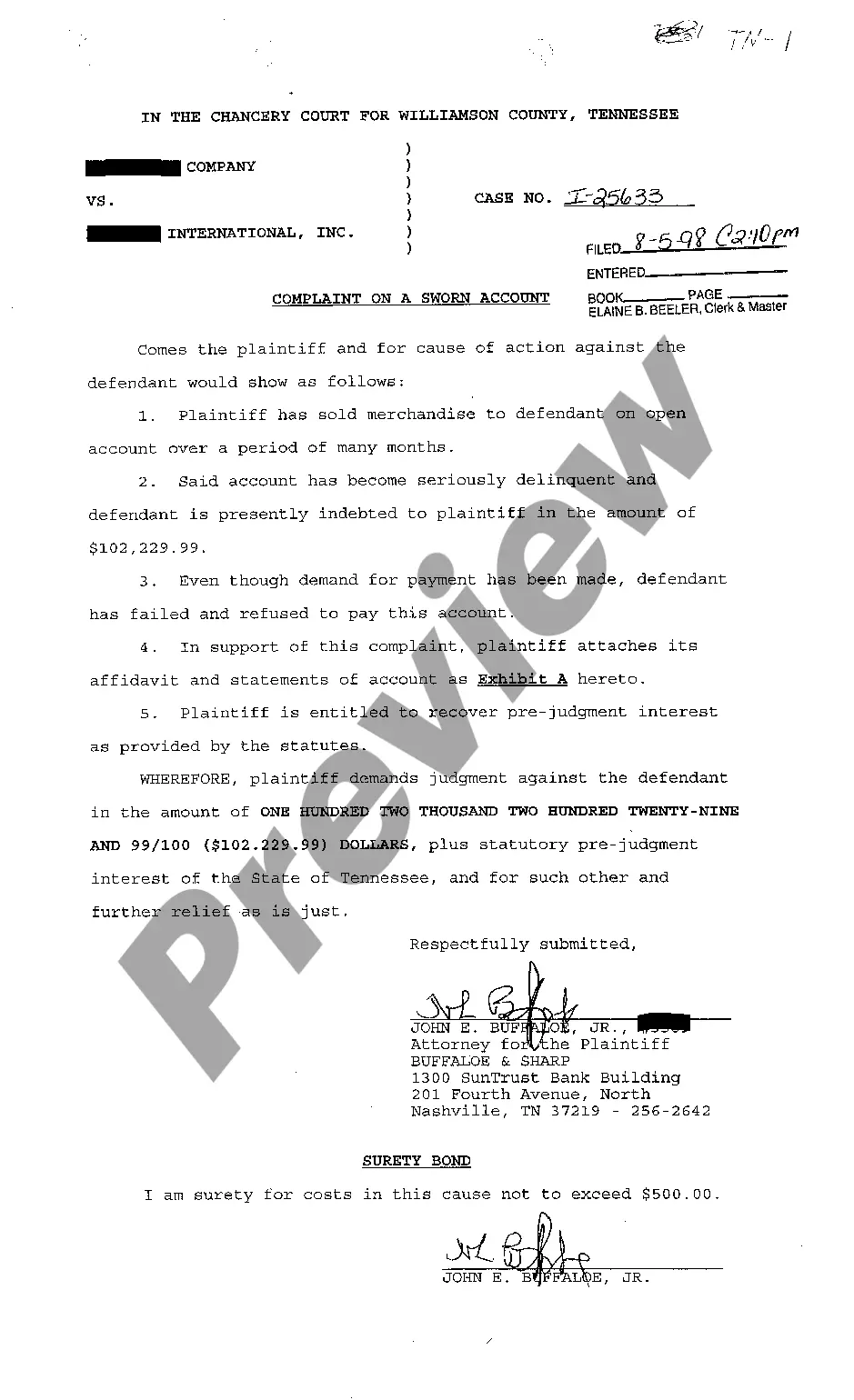

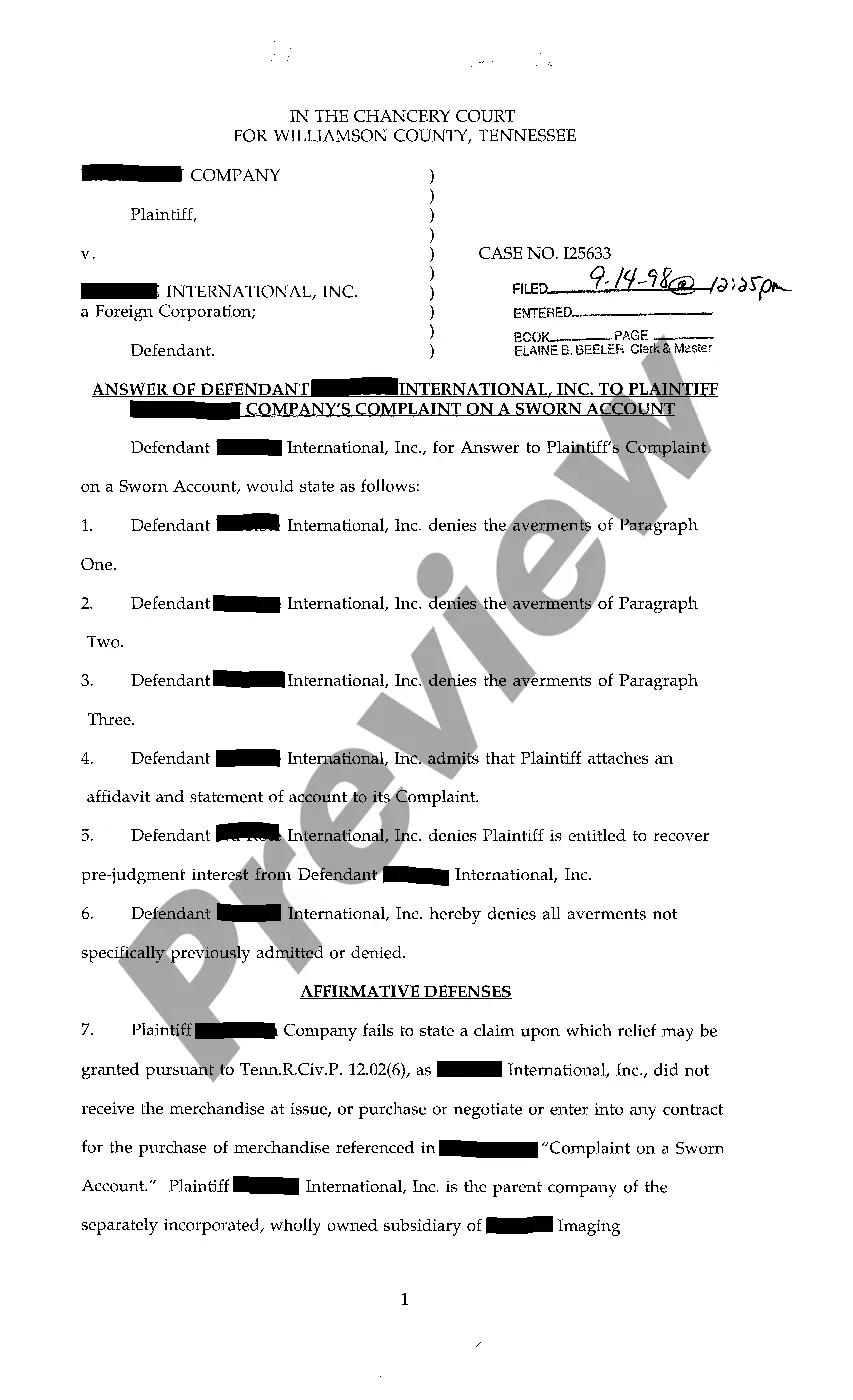

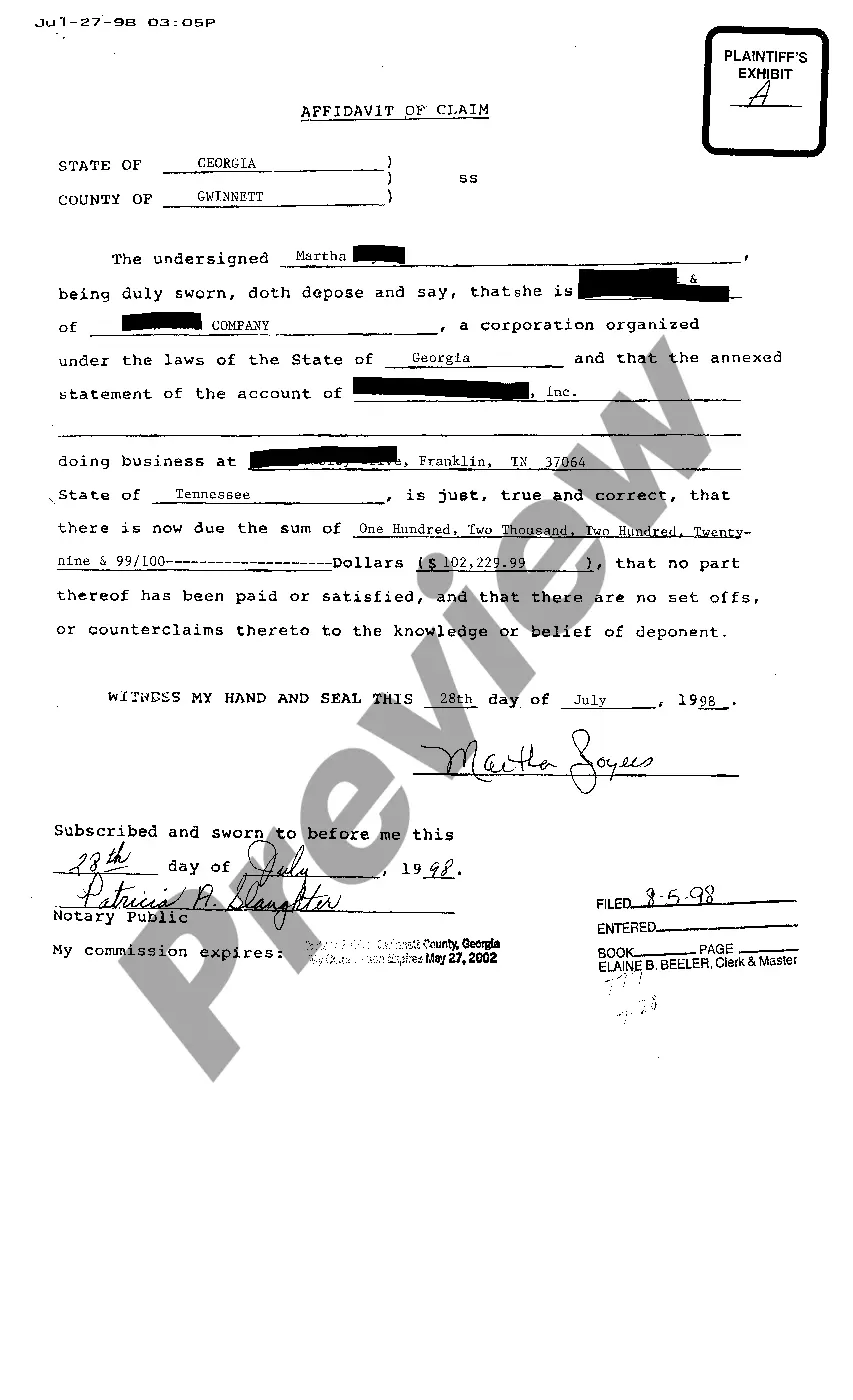

Title: Understanding Murfreesboro Tennessee Complaint On A Sworn Account for Delinquency and Refusal to Pay Keywords: Murfreesboro Tennessee Complaint, Sworn Account, Delinquency, Refusal to Pay Introduction: A Murfreesboro Tennessee Complaint on a Sworn Account for Delinquency and Refusal to Pay is a legal mechanism used in Murfreesboro, Tennessee, to address issues related to unpaid debts. This comprehensive guide aims to explain the intricacies of such complaints, providing a detailed description of their purpose, process, and potential outcomes. It also covers different types of complaints that may arise in Murfreesboro, Tennessee. 1. Overview of Murfreesboro Tennessee Complaint on a Sworn Account: A Murfreesboro Tennessee Complaint on a Sworn Account for Delinquency and Refusal to Pay refers to a legal action filed by a creditor against a debtor who has failed to make payment for goods, services, or debts owed. This complaint asserts that the debt is valid, overdue, and that the debtor has refused to fulfill their financial obligations. 2. Purpose of the Complaint The primary purpose of a Murfreesboro Tennessee Complaint on a Sworn Account is to seek judicial intervention to resolve financial disputes between a creditor and a debtor. It provides a legal framework for creditors to pursue the collection of unpaid debts while giving debtors the opportunity to present any defenses or counterclaims they may have. 3. Filing Process: To initiate a Murfreesboro Tennessee Complaint on a Sworn Account, the creditor must file a formal complaint at the appropriate court. The complaint must provide detailed information about the debt, including the amount owed, the nature of the goods/services, and evidence of the debtor's refusal to pay. Sworn statements or affidavits may be required to authenticate the debt. 4. Types of Complaints: a) Consumer-related Complaints: These complaints involve unpaid debts for consumer purchases, such as credit card bills, personal loans, or retail store accounts. b) Business-related Complaints: These complaints involve unpaid debts arising from business transactions such as unpaid invoices, outstanding loans, or services rendered. 5. Legal Proceedings and Outcomes: After filing the complaint, the debtor is officially served with a copy, providing them a designated period to respond or raise any defenses. The court may then schedule a hearing to evaluate the evidence presented by both parties. If the debt is proven valid, the court may issue a judgment in favor of the creditor, requiring payment from the debtor. Enforcement actions, including wage garnishment, property liens, or bank account levies, may be pursued based on the court's decision. Conclusion: A Murfreesboro Tennessee Complaint on a Sworn Account for Delinquency and Refusal to Pay is a legal recourse available to creditors in Murfreesboro, Tennessee, to seek resolution for unpaid debts. By understanding the purpose, process, and potential outcomes of such complaints, both creditors and debtors can navigate the legal system with clarity, enabling fair and just resolution of financial disputes.

Murfreesboro Tennessee Complaint On A Sworn Account for Delinquency and Refusal to Pay

Description

How to fill out Murfreesboro Tennessee Complaint On A Sworn Account For Delinquency And Refusal To Pay?

No matter what social or professional status, completing law-related documents is an unfortunate necessity in today’s professional environment. Very often, it’s practically impossible for someone with no law education to create this sort of paperwork cfrom the ground up, mainly because of the convoluted jargon and legal subtleties they entail. This is where US Legal Forms comes to the rescue. Our service offers a massive library with more than 85,000 ready-to-use state-specific documents that work for practically any legal scenario. US Legal Forms also serves as a great asset for associates or legal counsels who want to save time using our DYI tpapers.

Whether you want the Murfreesboro Tennessee Complaint On A Sworn Account for Delinquency and Refusal to Pay or any other document that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Murfreesboro Tennessee Complaint On A Sworn Account for Delinquency and Refusal to Pay in minutes using our reliable service. In case you are already a subscriber, you can go on and log in to your account to download the appropriate form.

However, if you are a novice to our platform, ensure that you follow these steps prior to downloading the Murfreesboro Tennessee Complaint On A Sworn Account for Delinquency and Refusal to Pay:

- Ensure the form you have chosen is suitable for your area because the rules of one state or county do not work for another state or county.

- Review the document and go through a short outline (if available) of scenarios the document can be used for.

- If the one you picked doesn’t meet your needs, you can start again and search for the necessary form.

- Click Buy now and pick the subscription plan you prefer the best.

- utilizing your login information or register for one from scratch.

- Pick the payment method and proceed to download the Murfreesboro Tennessee Complaint On A Sworn Account for Delinquency and Refusal to Pay as soon as the payment is done.

You’re good to go! Now you can go on and print the document or fill it out online. Should you have any issues locating your purchased documents, you can easily access them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.