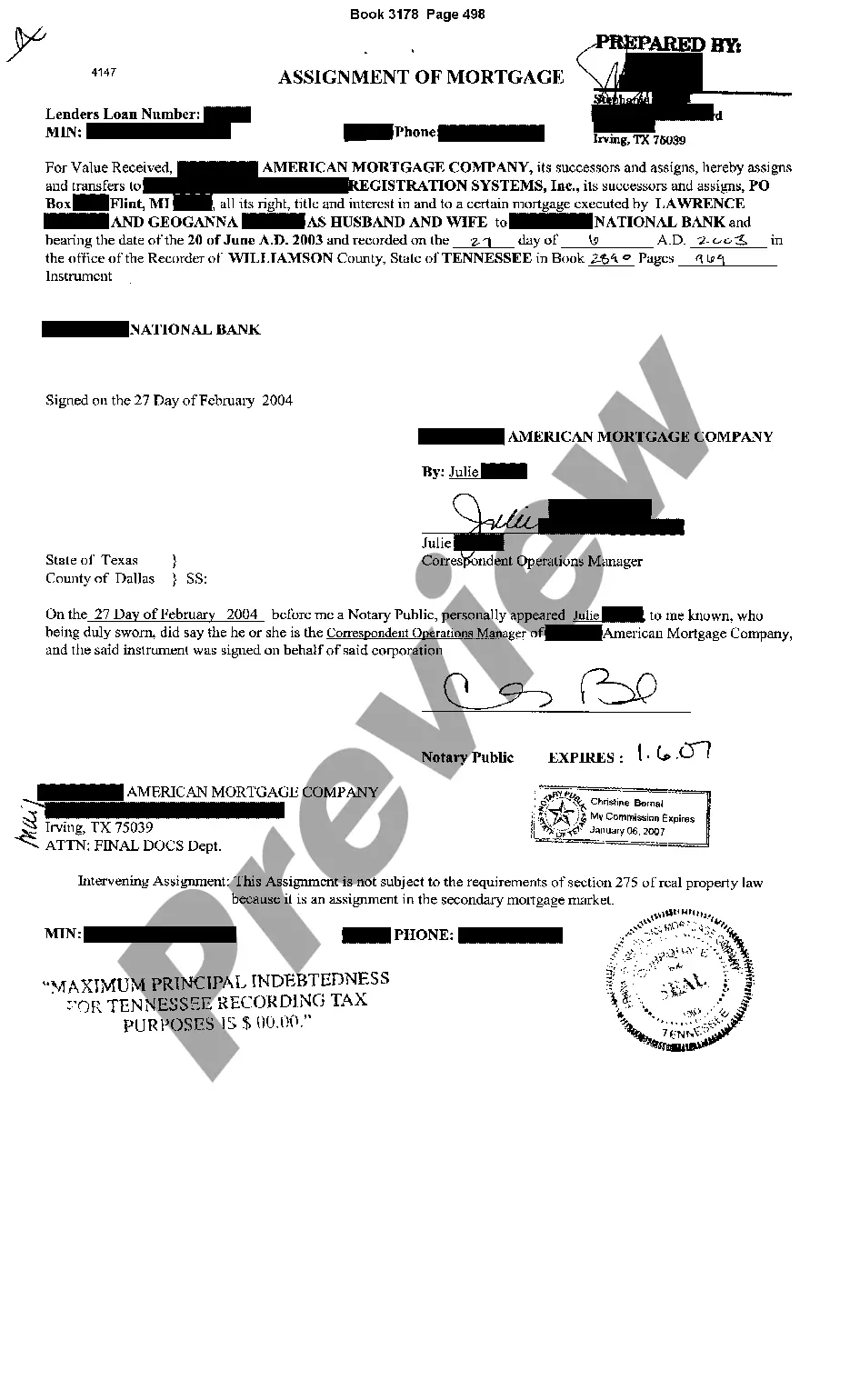

Chattanooga Tennessee Assignment of Mortgage is a legal document that transfers the ownership of a mortgage from one party to another. This document is commonly used when a mortgage loan is sold or transferred to a new lender or investor. The Assignment of Mortgage serves as official evidence of the transfer and ensures that the new party has the legal right to enforce the terms of the mortgage. It includes important details such as the names of the original lender, the new mortgage holder, the property address, and the outstanding balance on the loan. There are different types of Assignment of Mortgage in Chattanooga, Tennessee, including: 1. Full Assignment: This type of assignment transfers the complete ownership of the mortgage, including all rights, interests, and obligations, to the new party. The original lender is completely released from any future claims or responsibilities regarding the mortgage. 2. Partial Assignment: In some cases, only a portion of the mortgage is assigned to a new party. This can happen when a portion of the loan is sold to another lender or investor, while the original lender retains ownership of the remaining portion. 3. Assignment in Blank: This type of assignment is typically used when the mortgage loan is sold to a secondary market investor or entity such as a mortgage-backed securities trust. The assignment is made in blank, meaning the specific new owner's name is left blank or is assigned to a trustee who holds the mortgage on behalf of the investors. Chattanooga Tennessee Assignment of Mortgage plays a crucial role in the mortgage industry as it facilitates the transfer of mortgage loans between lenders and investors. It ensures that the legal rights and obligations associated with the loan are properly transferred and recorded. Whether it is a full, partial, or assignment in blank, this document provides transparency and certainty in the mortgage market of Chattanooga, Tennessee.

Chattanooga Tennessee Assignment of Mortgage

Description

How to fill out Chattanooga Tennessee Assignment Of Mortgage?

Regardless of one's social or professional rank, completing legal documents is an unfortunate requirement in the modern world.

Too frequently, it’s nearly unfeasible for individuals without legal training to create such documents from scratch, primarily due to the complicated terminology and legal nuances they involve.

This is where US Legal Forms proves to be useful.

Make sure the form you have located is tailored to your area, as the laws of one state do not apply to another.

Preview the form and read a short description (if provided) of the situations the document can be used for.

- Our service offers a vast array of over 85,000 state-specific forms that cater to virtually any legal situation.

- US Legal Forms is also a fantastic resource for associates or legal advisors looking to save time by utilizing our DIY forms.

- No matter if you need the Chattanooga Tennessee Assignment of Mortgage or any other document that is valid in your region, with US Legal Forms, everything is readily available.

- Here’s how to quickly acquire the Chattanooga Tennessee Assignment of Mortgage using our reliable service.

- If you are already a member, you can go ahead and Log In to your account to obtain the required form.

- However, if you are new to our platform, make sure to follow these steps before downloading the Chattanooga Tennessee Assignment of Mortgage.

Form popularity

FAQ

To file a quitclaim deed in Tennessee, start by creating the deed with all relevant details, including the property description and involved parties. Ensure both the grantor and grantee sign the document in the presence of a notary public. Next, submit the signed deed to the county register’s office for recording. This process is a critical step in managing the Chattanooga Tennessee Assignment of Mortgage and securing property rights.

Filing a quit claim deed in Tennessee involves drafting the document that outlines the relinquishment of any property claims. You will need to gather necessary information such as the property description and the names of grantor and grantee. After signing the quit claim deed in front of a notary, submit it to your local county register’s office. Following these steps will facilitate your Chattanooga Tennessee Assignment of Mortgage process.

To transfer a house deed to a family member in Tennessee, you need to create a new deed that clearly details the transfer of ownership. Using a warranty deed or quitclaim deed is common, but it’s essential to ensure it meets state requirements. After completing the deed, both parties must sign it before a notary public. Finally, record the deed with the local county clerk to complete the Chattanooga Tennessee Assignment of Mortgage process.

To obtain a copy of a deed in Tennessee, visit the local county register of deeds' office where the property is located. You may need to provide the property address or parcel number to facilitate the search. Many counties also offer online access to land records, making it easier to retrieve this information. The Chattanooga Tennessee Assignment of Mortgage resources can provide additional insights on accessing property records.

In Tennessee, a deed can be prepared by anyone who understands the legal requirements, though it’s often best handled by a qualified attorney or real estate professional. This ensures that the document meets all legal standards and accurately reflects your intentions. It’s critical to get it right, as mistakes can lead to future complications. For assistance, tools related to the Chattanooga Tennessee Assignment of Mortgage can simplify the process.

Transferring a property deed in Tennessee involves drafting a new deed, which outlines the property's address, legal description, and details of the grantor and grantee. Once the new deed is completed and notarized, you must submit it to the local county's register of deeds for recording. This ensures that the transfer is legally documented. For a seamless experience, consider using resources related to the Chattanooga Tennessee Assignment of Mortgage.

To transfer a property deed in Tennessee, you need to prepare a new deed that includes the necessary details about the property and the new owner. After completing the deed, you must sign it in front of a notary public. Finally, file the deed with the local county register to officially record the transfer. If you're looking for guidance on this process, the Chattanooga Tennessee Assignment of Mortgage may also help clarify your options.

A quit claim deed transfers whatever interest the grantor has in the property to the grantee. Importantly, it does not guarantee that the grantor holds clear title, meaning the buyer assumes risk regarding any existing claims. When considering this option in your Chattanooga Tennessee Assignment of Mortgage, it’s wise to conduct thorough research.

The primary beneficiaries of a quitclaim deed are those looking to transfer property ownership without the hassle of traditional processes. Individuals involved in divorce settlements or transferring property between family members often use this type of deed. It can make the Chattanooga Tennessee Assignment of Mortgage process more straightforward by quickly transferring rights.

Yes, a quit claim deed must be notarized in Tennessee for it to be legally effective. The notary public verifies the identity of the individuals signing the deed, which adds a layer of protection against fraud. This notarization is crucial, particularly when dealing with property transfers related to a Chattanooga Tennessee Assignment of Mortgage.