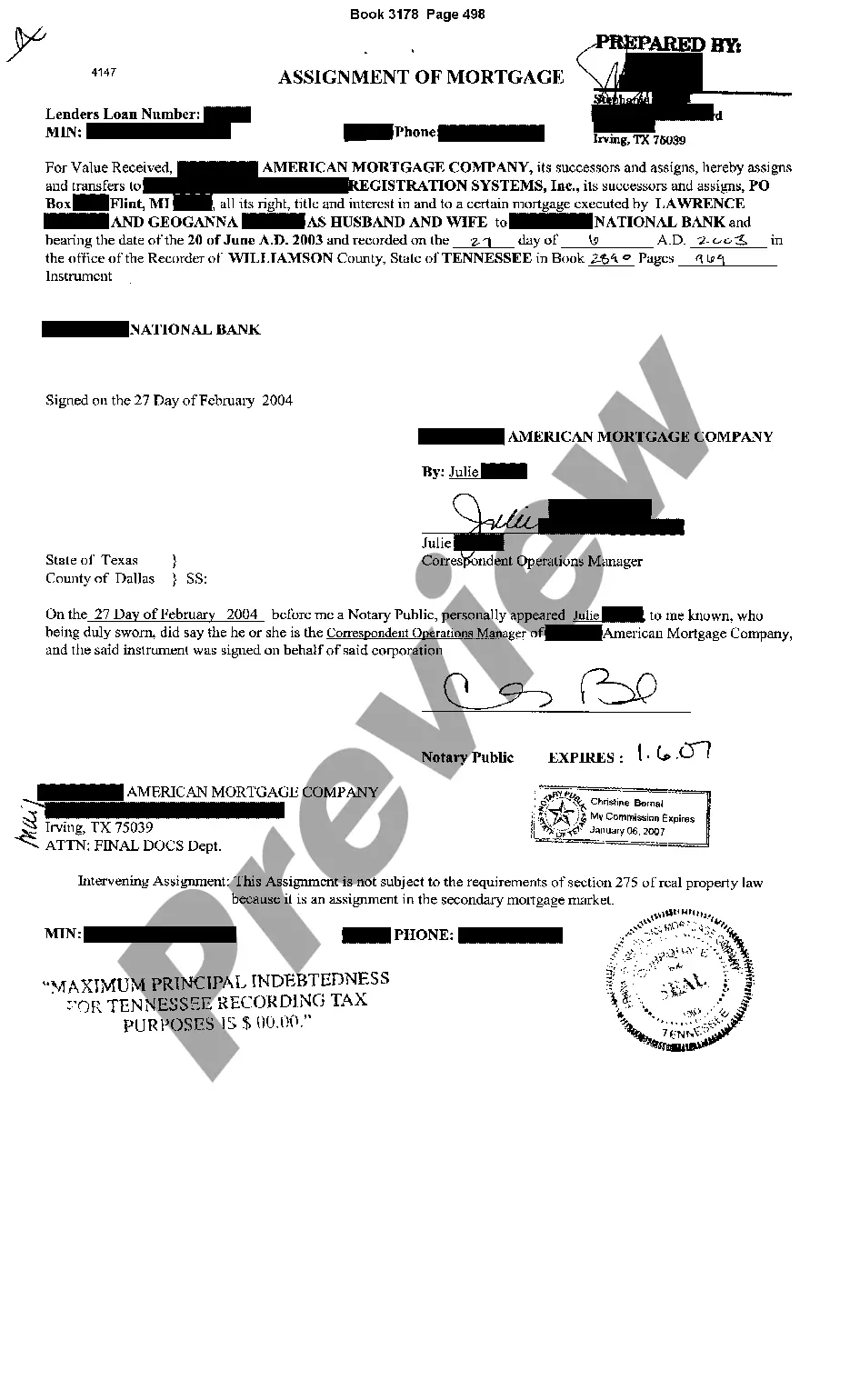

Clarksville Tennessee Assignment of Mortgage is a legal document that transfers the rights and responsibilities of a mortgage loan from the original lender to another party. This assignment allows the new party, known as the assignee, to assume the role of the lender and collect payments from the borrower. In Clarksville, Tennessee, there are primarily two types of Assignment of Mortgage commonly used: 1. Full Assignment of Mortgage: This type involves the complete transfer of the mortgage, including all rights and obligations, from the original lender to the assignee. The assignee becomes the new mortgagee and gains the authority to enforce loan terms, collect payments, and foreclose in case of default. 2. Partial Assignment of Mortgage: In certain cases, only a portion of the mortgage loan is assigned to another party. This can occur when the original lender wants to mitigate risk or when the loan is being sold in parts to different investors. In a partial assignment, specific rights or portions of the mortgage, such as the interest payments or servicing rights, are assigned to the assignee. The Clarksville Tennessee Assignment of Mortgage process typically involves several steps. Firstly, the assignor, usually the original lender, drafts the assignment document with all necessary details, including the names of the parties involved, loan details, and legal descriptions of the property. Once prepared, both the assignor and assignee must sign the assignment in the presence of a notary public for it to be considered valid. After the assignment is executed, the assignee becomes responsible for managing the mortgage loan. This includes collecting and processing payments, providing account statements, and communicating with the borrower regarding any changes or inquiries related to the loan. If the borrower defaults on the loan, the assignee has the right to initiate foreclosure proceedings and take legal action to recover the debt. Clarksville Tennessee Assignment of Mortgage is an essential legal document that facilitates the transfer of mortgage loans in the real estate market. It ensures the smooth transition of ownership and responsibility, while also protecting the rights and interests of both lenders and borrowers. The assignment process must comply with the applicable state laws and regulations to ensure its validity and enforceability.

Clarksville Tennessee Assignment of Mortgage

Description

How to fill out Clarksville Tennessee Assignment Of Mortgage?

If you are searching for a valid form template, it’s extremely hard to find a more convenient platform than the US Legal Forms website – probably the most comprehensive libraries on the internet. Here you can get thousands of templates for company and personal purposes by types and states, or keywords. With the high-quality search function, getting the latest Clarksville Tennessee Assignment of Mortgage is as easy as 1-2-3. In addition, the relevance of every record is confirmed by a team of skilled lawyers that on a regular basis check the templates on our platform and update them according to the latest state and county demands.

If you already know about our platform and have a registered account, all you need to receive the Clarksville Tennessee Assignment of Mortgage is to log in to your user profile and click the Download button.

If you utilize US Legal Forms for the first time, just follow the instructions below:

- Make sure you have chosen the form you want. Look at its information and utilize the Preview function to explore its content. If it doesn’t suit your needs, use the Search field near the top of the screen to find the appropriate file.

- Confirm your decision. Choose the Buy now button. Next, select your preferred subscription plan and provide credentials to sign up for an account.

- Process the financial transaction. Utilize your credit card or PayPal account to complete the registration procedure.

- Obtain the form. Select the format and download it on your device.

- Make modifications. Fill out, edit, print, and sign the received Clarksville Tennessee Assignment of Mortgage.

Each and every form you save in your user profile has no expiration date and is yours permanently. You can easily gain access to them via the My Forms menu, so if you want to get an extra copy for modifying or creating a hard copy, you may return and download it once more at any time.

Take advantage of the US Legal Forms extensive collection to gain access to the Clarksville Tennessee Assignment of Mortgage you were looking for and thousands of other professional and state-specific samples in one place!