Knoxville, Tennessee Assignment of Mortgage: A Comprehensive Guide Introduction: In Knoxville, Tennessee, the Assignment of Mortgage is a legal document that transfers the ownership rights of a mortgage from one party to another. It serves as a vital instrument in facilitating the transfer of property interests and is an integral part of real estate transactions. This article aims to provide a detailed explanation of what the Knoxville Tennessee Assignment of Mortgage entails, its significance, and potential types associated with it. By incorporating relevant keywords, we aim to offer a comprehensive understanding of this essential legal document. Key Concepts: 1. Assignment of Mortgage: The Assignment of Mortgage is a written agreement that enables the transfer of rights and interests in a mortgage from the original lender (assignor) to a new party (assignee). It typically includes the borrower's name, loan amount, property information, and transfer details. 2. Assignor: The assignor refers to the original lender or mortgage holder who transfers the mortgage rights to the assignee. The assignor relinquishes all claims and obligations associated with the mortgage upon assignment. 3. Assignee: The assignee is the recipient of the mortgage rights. They assume all rights and responsibilities established under the original mortgage, including the right to collect payments, enforce default provisions, and foreclose if necessary. Types of Knoxville Tennessee Assignment of Mortgage: 1. Absolute Assignment: An absolute assignment involves a complete transfer of mortgage rights from the assignor to the assignee. The assignee becomes the new legal holder of the mortgage and has full rights to enforce it. 2. Collateral Assignment: A collateral assignment allows the assignor to transfer the mortgage as security for collateral against a specific debt or obligation. It grants the assignee limited rights, primarily confined to foreclosure or collection proceedings if the assignor fails to fulfill their obligations. 3. Assignment in Blank: An assignment in blank occurs when the assignor transfers the mortgage to the assignee without specifying the latter's identity. This type of assignment provides flexibility to the assignor, allowing them to transfer the mortgage to any party they choose in the future. Significance of Knoxville Tennessee Assignment of Mortgage: 1. Legal Validity: The Assignment of Mortgage ensures the legality and enforceability of property transfers and mortgage rights in Knoxville, Tennessee. It must comply with state laws and requirements to be considered legally valid. 2. Property Transfer: Assigning a mortgage allows homeowners to sell their property to potential buyers. The assignee assumes the mortgage along with the property, ensuring a smooth transfer of ownership. 3. Loan Modifications and Mortgage Servicing: Mortgage lenders often sell or transfer their mortgage loans to other financial institutions. The Assignment of Mortgage facilitates this process, enabling loan modifications and changes in mortgage servicing rights. Conclusion: Understanding the Knoxville Tennessee Assignment of Mortgage is crucial when engaging in real estate transactions. Whether it is an absolute, collateral, or assignment in blank, this legal document bridges the gap between mortgage holders, facilitating property transfer and loan modifications. By adhering to relevant keywords and concepts, this detailed description provides valuable insights into the various aspects of the Knoxville Tennessee Assignment of Mortgage.

Knoxville Tennessee Assignment of Mortgage

State:

Tennessee

City:

Knoxville

Control #:

TN-E010

Format:

PDF

Instant download

This form is available by subscription

Description

Assignment of Mortgage

Knoxville, Tennessee Assignment of Mortgage: A Comprehensive Guide Introduction: In Knoxville, Tennessee, the Assignment of Mortgage is a legal document that transfers the ownership rights of a mortgage from one party to another. It serves as a vital instrument in facilitating the transfer of property interests and is an integral part of real estate transactions. This article aims to provide a detailed explanation of what the Knoxville Tennessee Assignment of Mortgage entails, its significance, and potential types associated with it. By incorporating relevant keywords, we aim to offer a comprehensive understanding of this essential legal document. Key Concepts: 1. Assignment of Mortgage: The Assignment of Mortgage is a written agreement that enables the transfer of rights and interests in a mortgage from the original lender (assignor) to a new party (assignee). It typically includes the borrower's name, loan amount, property information, and transfer details. 2. Assignor: The assignor refers to the original lender or mortgage holder who transfers the mortgage rights to the assignee. The assignor relinquishes all claims and obligations associated with the mortgage upon assignment. 3. Assignee: The assignee is the recipient of the mortgage rights. They assume all rights and responsibilities established under the original mortgage, including the right to collect payments, enforce default provisions, and foreclose if necessary. Types of Knoxville Tennessee Assignment of Mortgage: 1. Absolute Assignment: An absolute assignment involves a complete transfer of mortgage rights from the assignor to the assignee. The assignee becomes the new legal holder of the mortgage and has full rights to enforce it. 2. Collateral Assignment: A collateral assignment allows the assignor to transfer the mortgage as security for collateral against a specific debt or obligation. It grants the assignee limited rights, primarily confined to foreclosure or collection proceedings if the assignor fails to fulfill their obligations. 3. Assignment in Blank: An assignment in blank occurs when the assignor transfers the mortgage to the assignee without specifying the latter's identity. This type of assignment provides flexibility to the assignor, allowing them to transfer the mortgage to any party they choose in the future. Significance of Knoxville Tennessee Assignment of Mortgage: 1. Legal Validity: The Assignment of Mortgage ensures the legality and enforceability of property transfers and mortgage rights in Knoxville, Tennessee. It must comply with state laws and requirements to be considered legally valid. 2. Property Transfer: Assigning a mortgage allows homeowners to sell their property to potential buyers. The assignee assumes the mortgage along with the property, ensuring a smooth transfer of ownership. 3. Loan Modifications and Mortgage Servicing: Mortgage lenders often sell or transfer their mortgage loans to other financial institutions. The Assignment of Mortgage facilitates this process, enabling loan modifications and changes in mortgage servicing rights. Conclusion: Understanding the Knoxville Tennessee Assignment of Mortgage is crucial when engaging in real estate transactions. Whether it is an absolute, collateral, or assignment in blank, this legal document bridges the gap between mortgage holders, facilitating property transfer and loan modifications. By adhering to relevant keywords and concepts, this detailed description provides valuable insights into the various aspects of the Knoxville Tennessee Assignment of Mortgage.

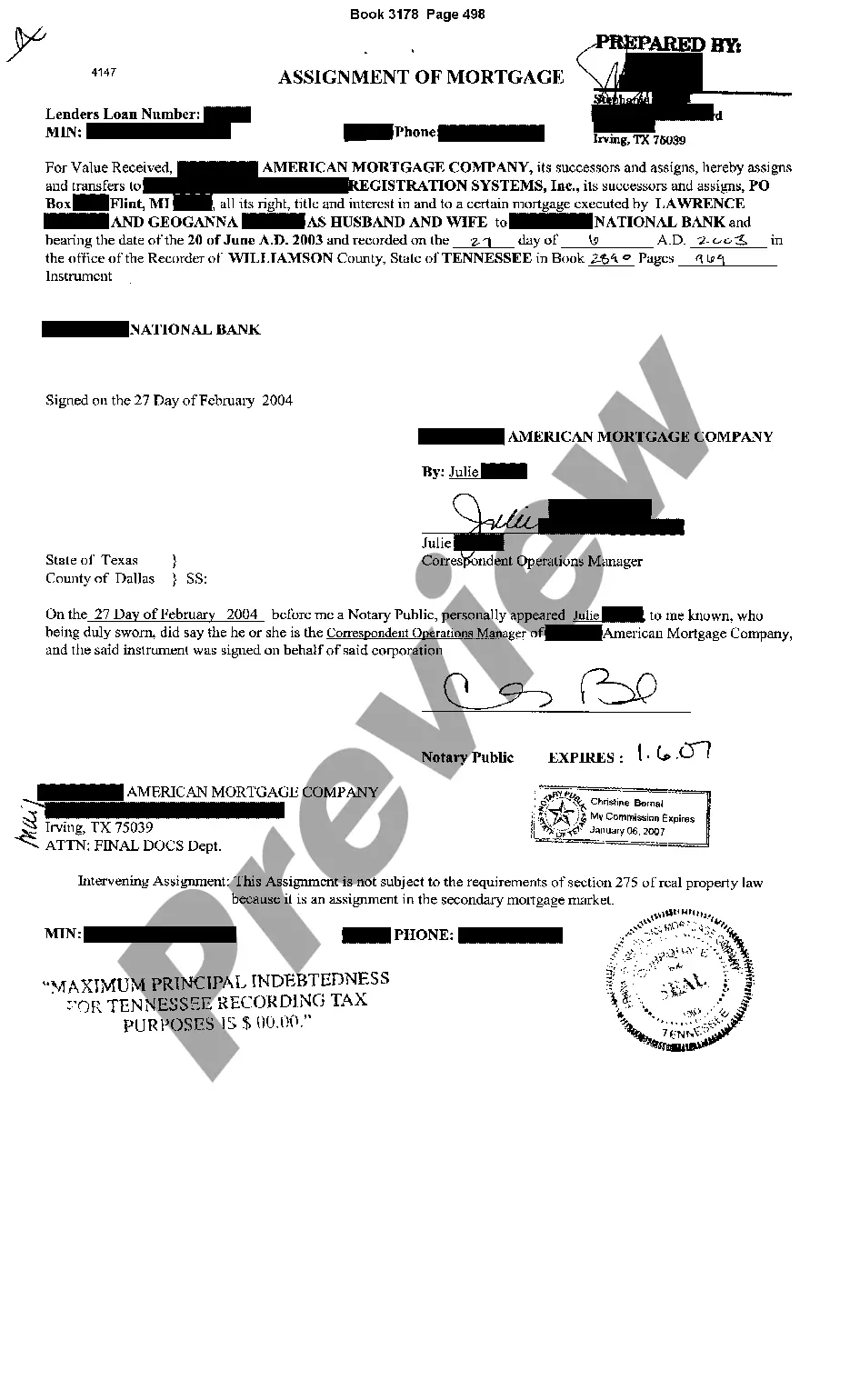

Free preview

How to fill out Knoxville Tennessee Assignment Of Mortgage?

If you’ve already used our service before, log in to your account and download the Knoxville Tennessee Assignment of Mortgage on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your file:

- Make sure you’ve located a suitable document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Knoxville Tennessee Assignment of Mortgage. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!