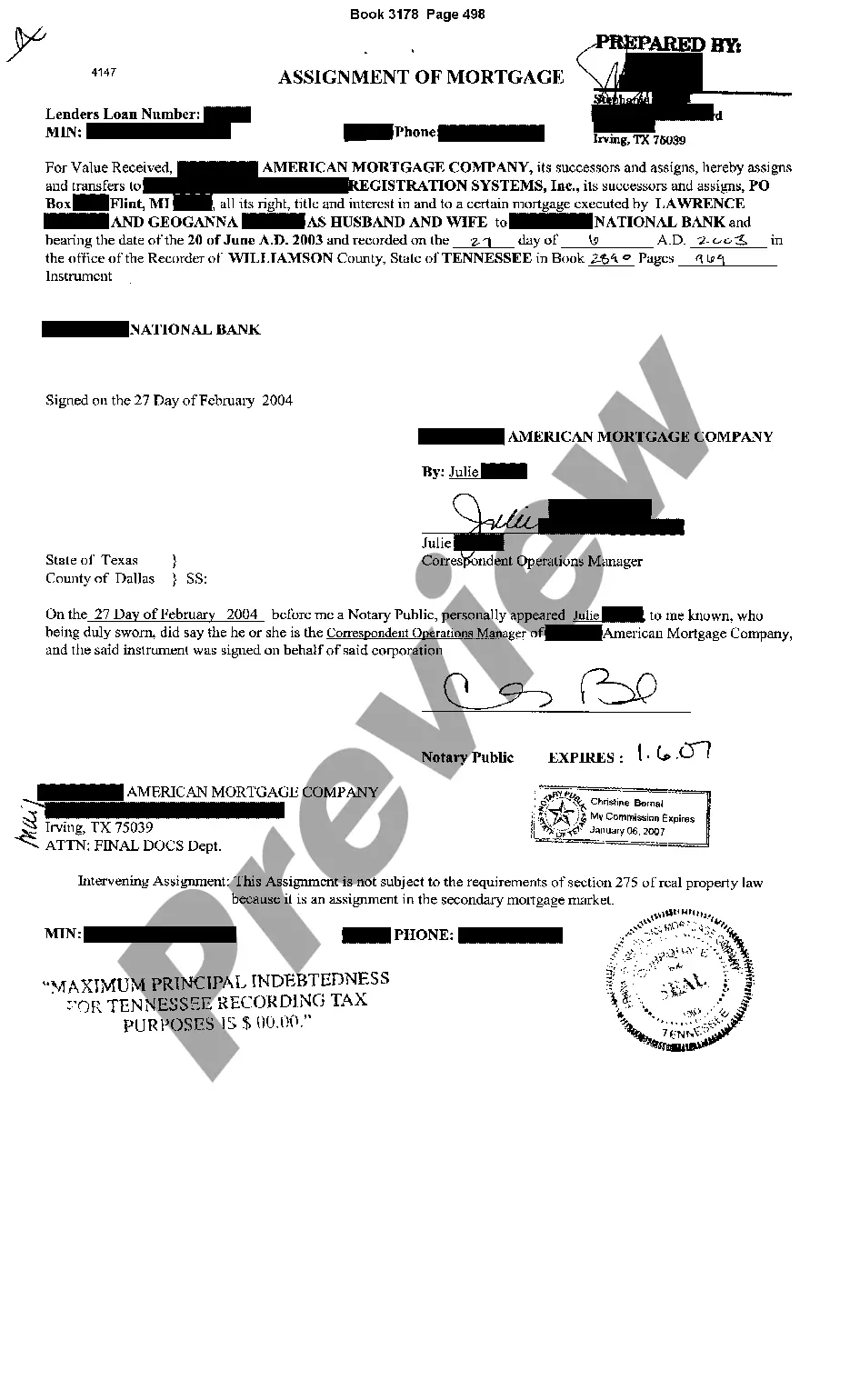

Murfreesboro, Tennessee Assignment of Mortgage is a legal document that transfers the rights and responsibilities of a mortgage from one party to another. This assignment typically occurs when a mortgage lender or investor sells the mortgage loan to another entity, such as another financial institution or an investor. In the context of Murfreesboro, Tennessee, the Assignment of Mortgage plays a crucial role in real estate transactions. When a homeowner in Murfreesboro chooses to sell their property or refinance their mortgage, the existing mortgage needs to be assigned to the new lender or buyer. This assignment ensures that the new party assumes all rights and obligations associated with the mortgage, including receiving payments and managing the loan. The Murfreesboro, Tennessee Assignment of Mortgage involves several key elements. First, it specifies the original lender or mortgage holder, the borrower, and the property address. It also outlines the terms and conditions of the mortgage, including the loan amount, interest rate, and repayment period. Additionally, it states the specific rights being transferred, such as the right to receive payments and proceed with foreclosure if necessary. There are no specific different types of Assignment of Mortgage documents exclusive to Murfreesboro, Tennessee. However, the assignment can vary based on the type of mortgage being transferred. For instance, Murfreesboro Assignment of Mortgage documents may differ for conventional mortgages, adjustable-rate mortgages (ARM), or government-insured mortgages like those offered by the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA). Keywords: Murfreesboro, Tennessee; Assignment of Mortgage; legal document; transfer rights; transfer responsibilities; mortgage lender; mortgage loan; financial institution; real estate transactions; homeowner; sell property; refinance mortgage; new lender; new buyer; assume rights; assume obligations; mortgage holder; borrower; property address; terms and conditions; loan amount; interest rate; repayment period; transfer rights; receive payments; foreclosure; conventional mortgage; adjustable-rate mortgage; ARM; government-insured mortgage; Federal Housing Administration; FHA; Department of Veterans Affairs; VA.

Murfreesboro, Tennessee Assignment of Mortgage is a legal document that transfers the rights and responsibilities of a mortgage from one party to another. This assignment typically occurs when a mortgage lender or investor sells the mortgage loan to another entity, such as another financial institution or an investor. In the context of Murfreesboro, Tennessee, the Assignment of Mortgage plays a crucial role in real estate transactions. When a homeowner in Murfreesboro chooses to sell their property or refinance their mortgage, the existing mortgage needs to be assigned to the new lender or buyer. This assignment ensures that the new party assumes all rights and obligations associated with the mortgage, including receiving payments and managing the loan. The Murfreesboro, Tennessee Assignment of Mortgage involves several key elements. First, it specifies the original lender or mortgage holder, the borrower, and the property address. It also outlines the terms and conditions of the mortgage, including the loan amount, interest rate, and repayment period. Additionally, it states the specific rights being transferred, such as the right to receive payments and proceed with foreclosure if necessary. There are no specific different types of Assignment of Mortgage documents exclusive to Murfreesboro, Tennessee. However, the assignment can vary based on the type of mortgage being transferred. For instance, Murfreesboro Assignment of Mortgage documents may differ for conventional mortgages, adjustable-rate mortgages (ARM), or government-insured mortgages like those offered by the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA). Keywords: Murfreesboro, Tennessee; Assignment of Mortgage; legal document; transfer rights; transfer responsibilities; mortgage lender; mortgage loan; financial institution; real estate transactions; homeowner; sell property; refinance mortgage; new lender; new buyer; assume rights; assume obligations; mortgage holder; borrower; property address; terms and conditions; loan amount; interest rate; repayment period; transfer rights; receive payments; foreclosure; conventional mortgage; adjustable-rate mortgage; ARM; government-insured mortgage; Federal Housing Administration; FHA; Department of Veterans Affairs; VA.